Category Archive: 5) Global Macro

Drivers for the Week Ahead

The virus numbers in the US show no signs of slowing; the dollar should continue to soften. October retail sales Tuesday will be the US data highlight for the week; Fed manufacturing surveys for November will start to roll out; the Senate will hold a procedural vote this week to advance Judy Shelton’s nomination to the Fed Board of Governors.

Read More »

Read More »

Prepare for Winter

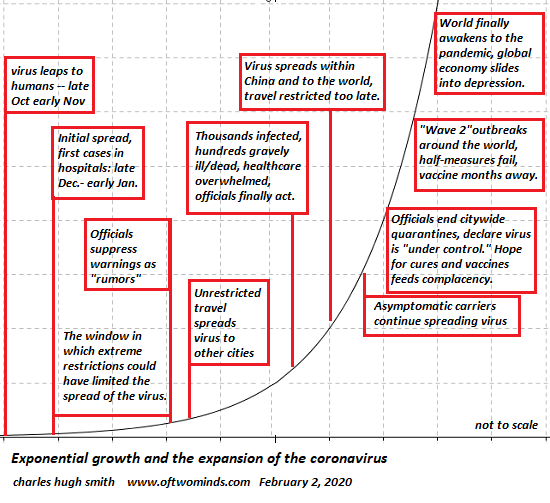

Realism must precede optimism or the optimism will collapse as the tsunami of reality comes ashore. It's time to prepare materially and psychologically for a winter unlike any other in our lifetimes.

Read More »

Read More »

Where Is It, Chairman Powell?

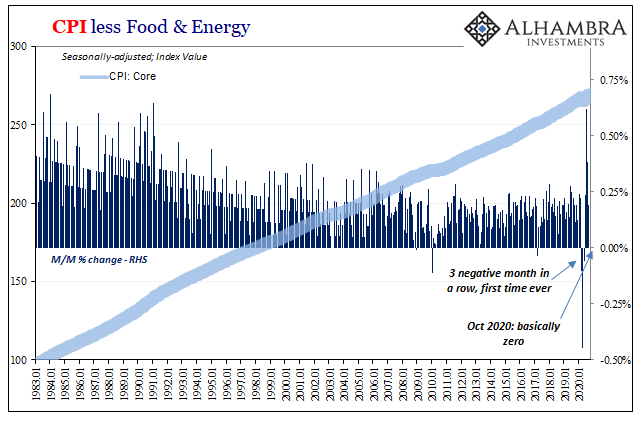

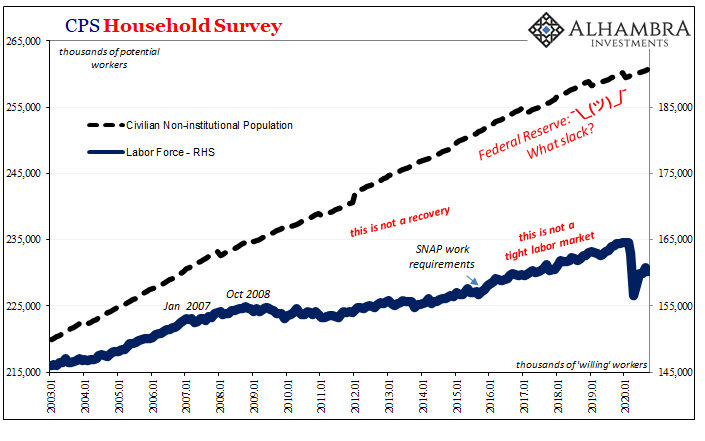

Where is it, Chairman Powell? After spending months deliberately hyping a “flood” of digital money printing, and then unleashing average inflation targeting making Americans believe the central bank will be wickedly irresponsible when it comes to consumer prices, the evidence portrays a very different set of circumstance.

Read More »

Read More »

“The Great Reset” Already Happened

Put another way: the elites have cannibalized the system so thoroughly that there's nothing left to steal, exploit or cannibalize. The global elites' techno-fantasy of a completely centralized future, The Great Reset, is addressed as a future project. Too bad it already happened in 2008-09. The lackeys and toadies tasked with spewing the PR are 12 years too late, and so are the critics listening to the PR with foreboding.

Read More »

Read More »

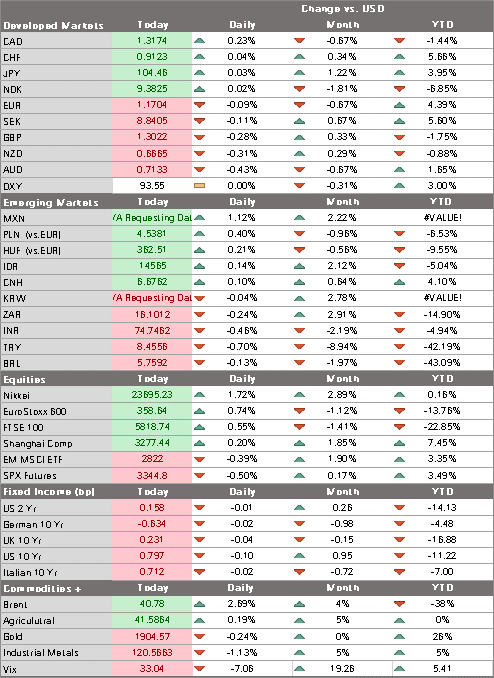

Dollar Softens Ahead of CPI Data

Pressure on the dollar has resumed; October CPI data will be the US highlight; US bond market was closed yesterday but yields have eased a bit today. Weekly jobless claims data will be reported; monthly budget statement for October will hold some interest; Mexico is expected to cut rates 25 bp to 4.0%; Peru is expected to keep rates steady at 0.25%.

Read More »

Read More »

The Prices And Costs Of What Xi Believes He’s Got To Do

It does seem, at first, a huge contradiction. On the one hand, what we know so far of China’s 14th 5-year plan apparently will lean heavily on new technologies not-yet invented to rescue the country’s economy from the pit of de-globalization the eurodollar system had thrown it into years ago.

Read More »

Read More »

Everything You Don’t Want to Know About Covid Vaccines (Because You Can’t Be Bullish Anymore)

In such a highly polarized, politicized environment, is such a scrupulously objective study

even possible?

Now that we've had the happy-talk about Pfizer's messenger-RNA (mRNA) vaccine (and

noted that Pfizer's CEO sold the majority of his shares in the company immediately

after the happy-talk), let's dig into messenger-RNA (mRNA) vaccines

which are fast approaching regulatory approval.

Some people have concluded vaccines are not safe,...

Read More »

Read More »

Dollar Consolidates, Weakness to Resume

Despite rising infections worldwide, the virus news stream has turned positive; the dollar is consolidating its gains today. With the 10-year yield rising to near 1.0%, US financial conditions are tightening; the Fed released its Financial Stability report yesterday and it pulled no punches; with the Fed media embargo over, many officials will speak today.

Read More »

Read More »

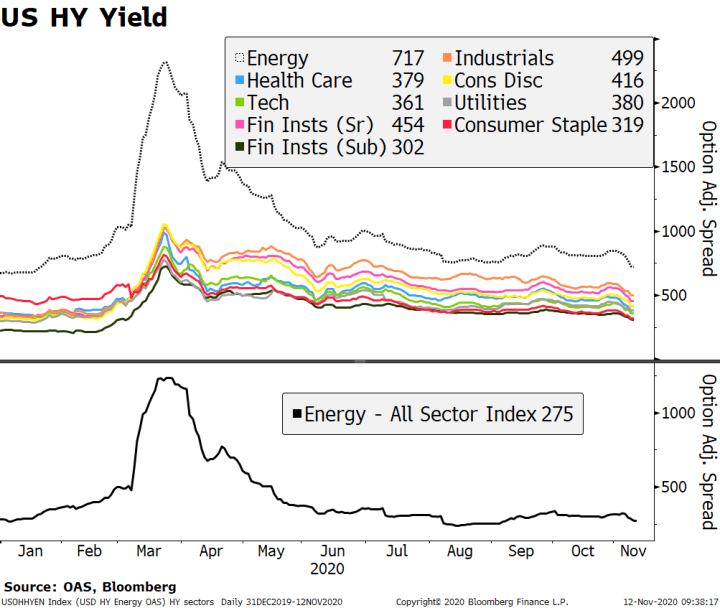

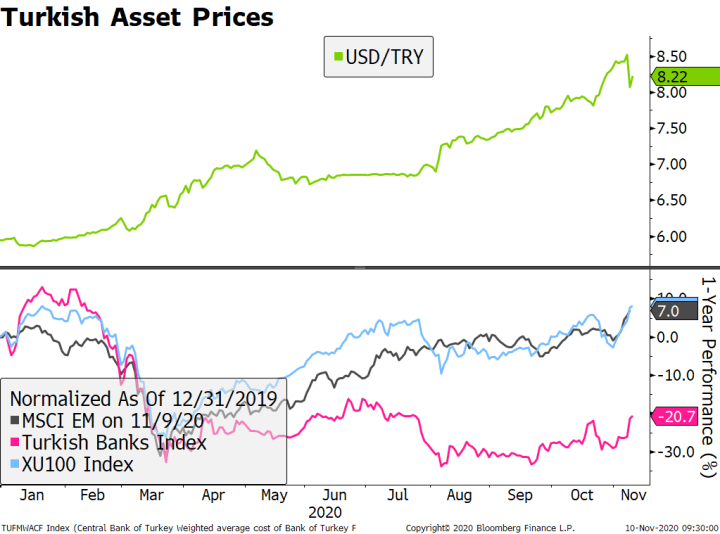

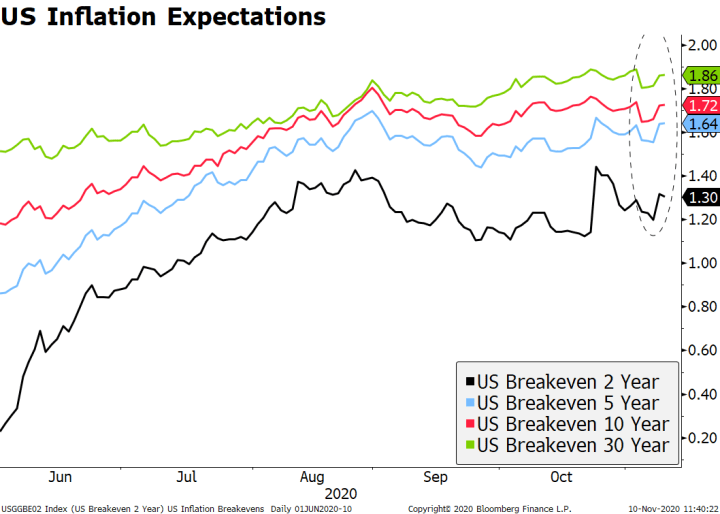

Vaccine and Split Government

The interplay of a vaccine-driven reflation rally and the (likely) split government in the US are emerging as the driving themes for markets in the months ahead. We think reflation will win out in the end, but it could manifest itself differently this time around.

Read More »

Read More »

How Much Taxes Will Retirees Owe on Their Retirement Income

Planning for retirement. We spend most of our working career preparing for it, saving for it, covering every contingency. When you finally wave goodbye to the company, you’re ready for all that planning to take over. But does your planning take into account the taxes you’ll have to pay on your retirement income? It’s one of the biggest retirement planning mistakes people make.

Read More »

Read More »

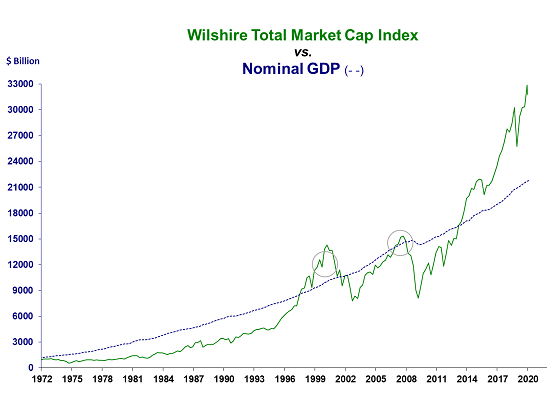

No Wonder the Super-Rich Love Inflation

Asset inflation benefits the super-rich more than anyone else because they own the vast majority of these assets. With the reflation euphoria running full blast, maybe central banks will finally get all that inflation they've been pining for. So let's ask cui bono--who will benefit from inflation?

Read More »

Read More »

Forget GOAT, Look at GBOAT: The Greatest Bubble Of All Time

So enjoy the GBOAT (greatest bubble of all time) but watch the clock. Sports fans debate who qualifies as GOAT--the greatest of all time: in hoops, Kobe, Jordan, Kareem, Magic; in boxing, Ali, and so forth. What we have today is GBOAT--the greatest bubble of all time That it's GOAT is beyond doubt, as the charts below reveal.

Read More »

Read More »

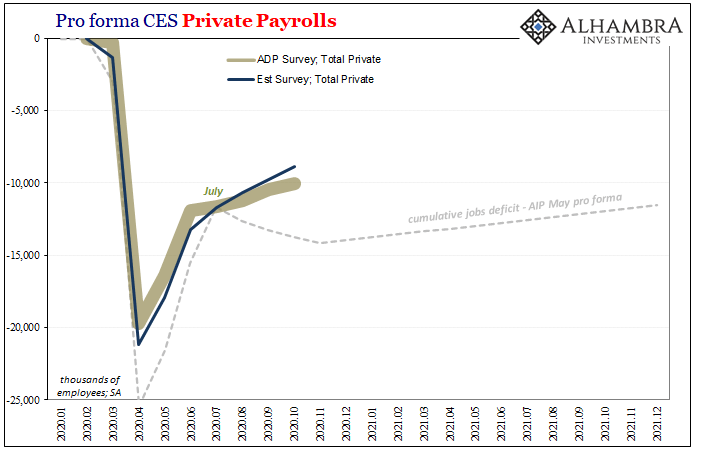

Good Payrolls Still Say Slowdown

The payroll report for the month of October 2020 was a very good one. This shouldn’t be surprising, perfect BLS publications appear with regularity even during the most challenging of circumstances. Headlines and underneath, everything looked fine last month.

Read More »

Read More »

Joe Biden wins: what next for America? | The Economist

Joe Biden has won the race to become America’s next president. Our experts answer your questions on potential court battles, a divided country and the future of America.

00:00 Can Biden reunite America?

01:27 Is Biden’s path to the White House assured?

02:13 Does Trump have grounds for legal challenges?

05:15 Were the polls right?

06:54 Why are Trump's supporters so hard to poll?

07:25 How did Trump manage to widen his base this election?

09:27...

Read More »

Read More »

Could ELECTION SHENANIGANS Investigation UNCOVER Something DEEPER??

CHARLES HUGH SMITH Joins Michelle To Discuss The Presidential Elections, Which Are About The American People's TRUST In Their Right To Chose Their Own President. Or Will America's President Be Selected For Us?

Read More »

Read More »

Here’s Our Historical Analogy Menu: Rome, the USSR or Revolutionary France

The core dynamic is ultimately the loss of social cohesion within the ruling elites and in the social order at large. There's a definite end of days feeling to the euphoria that the world didn't end on November 3. And what better way to celebrate the victory of what passes for normalcy with a manic stock market rally?

Read More »

Read More »

Could ELECTION SHENANIGANS Investigation UNCOVER Something DEEPER?

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. We are a marketing company. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser.

Read More »

Read More »

Markets Gyrate Ahead of Protracted Period of Uncertainty

Markets likely facing an extended period of uncertainty; the dollar is seeing some safe haven bid but is well off its highs. Despite President Trump’s claim of victory and his call to halt vote counting and go to the Supreme Court, it’s important to emphasize that the election is simply not over yet; asset prices are sending a cacophony of signals as investors struggle to price multiple possibilities.

Read More »

Read More »

Inflation Fairy Tale: Why It’s Deflation We Should Worry About (w/ Steven Van Metre & Jeff Snider)

Is inflation on the horizon? Should bank reserve balances stored with the Federal Reserve count as "money"? According to Jeffrey Snider, head of global research at Alhambra Investment Partners, and Steven Van Metre, macro fund manager and founder of Portfolio Shield, the answer to these questions is a resounding "no." Drawing upon a data ranging from Treasury auction sales to Eurodollar futures curves, van Metre and Snider...

Read More »

Read More »

Counting The Corroborated Stall, Not The Coming Lawfare Election Mess

While we wait for the electoral count to be sorted out by what we hope are competent and honest people (not holding our breath), there’s a greater muddle growing where it actually counts and where it’s never fully nor properly accounted. By a large and growing number of accounts, the US economy’s rebound seems to have stalled out back around June or July, an inflection unrelated to COVID case counts, too.

Read More »

Read More »