Category Archive: 5) Global Macro

Pressure grows on Europe to secure alternative gas supply | Russia sanctions Gazprom subsidiaries

Pressure on Europe to secure alternative gas supplies increased on Thursday as Moscow imposed sanctions on European subsidiaries of state-owned Gazprom a day after Ukraine stopped a major gas transit route.

Read More »

Read More »

Gravitas LIVE: Will Putin attack Finland next? Russia ending “current phases of war” | Palki Sharma

Gravitas LIVE: Will Putin attack Finland next? Russia ending “current phases of war” | Palki Sharma

- Will Putin attack Finland next?

- Russia ending “the current phases of war”

Read More »

Read More »

Neither Confusing Nor Surprising: Q1’s Worst Productivity Ever, April Decline In Employed

Maybe last Friday’s pretty awful payroll report shouldn’t have been surprising; though, to be fair, just calling it awful will be surprising to most people. Confusion surrounds the figures for good reason, though there truly is no reason for the misunderstanding itself. Apart from Economists and “central bankers” who’d rather everyone look elsewhere for the real problem.

Read More »

Read More »

Impact of drought in Somalia exacerbated by Ukraine war | WION Climate Tracker

Some of the most vulnerable nations globally like Somalia stand at the risk of increased food insecurity and water scarcity, this is not just due to climate but now also because of the Russia-Ukraine war.

Read More »

Read More »

Jeff Snider on how Russia is using the eurodollar system despite sanctions

Paul Buitink talks to Jeff Snider of Alhambra Investments. Jeff explains how Russia, despite the sanctions, is still using the eurodollar system to transact internationally, for example by using off-shore banks across the world and middle-men in China and India.

Read More »

Read More »

Why oligarchs choose London for their dirty money | The Economist

Britain is one of the best places in the world to launder dirty money. Our new film tells you why—and asks whether that's likely to change.

00:00 - Welcome to Londongrad

01:07 - Londongrad by design: a history

04:28 - How does British law help money laundering?

06:57 - How dirty money is hidden in property

09:26 - Why Britain's anti-corruption efforts fall short

10:49 - Does oligarch money actually benefit Britain?

12:08 - How can Britain get it...

Read More »

Read More »

Arctic border town of Kirkenes in Norway freezes ties with Russia | WION

Norway, which is NATO's northernmost flank, shares land and maritime borders with Russia. The border town of Kirkenes has long been pointed to as a symbol of cross-border harmony in the Arctic but people there are now adapting to a new reality.

Read More »

Read More »

Ukraine forces recaptures Kharkiv towns & villages, residents return to battered villages | WION

Ukraine's second largest city of Kharkiv continues to resist Russian attacks. Ukrainian forces are continuing a counter-attack to the North and have recaptured several towns and villages towards the Russian border .

Read More »

Read More »

EU, Japan will implement strong sanctions against Russia and strengthen support for Ukraine: Kishida

Amid the ongoing Ukraine war, Japan has agreed to further cooperation with the European Union during the Japan-EU summit as the top EU diplomat said that Europe wants a more big role in Asia and welcomes a Japanese participation in action against Russia.

Read More »

Read More »

Ukraine invasion: Kherson to soon be annexed by Russian troops? | Latest English News

Pro Kremlin authorities in Ukraine's southern city of Kherson, the first city to be captured by Russian forces on Wednesday urged President Vladimir Putin to annex the region. Moscow responded to the request saying that the local residents should decide their own fate.

Read More »

Read More »

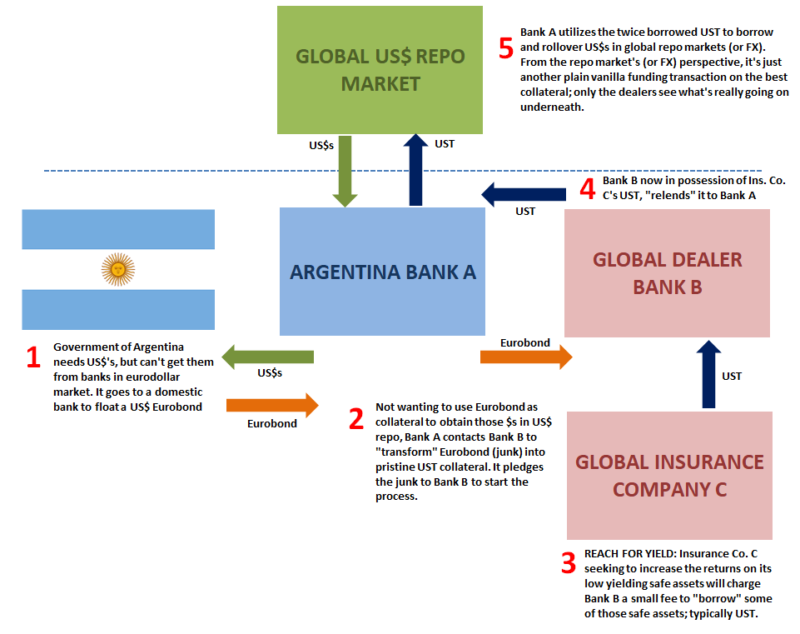

Eurobonds Behind Euro$ #5’s Collateral Case

The bond market is allegedly populated by the “smart” set, whereas those trading equities derided as the “dumb” money (not without some truth). I often wonder if it’s either/or. The fixed income system just went through this scarcely three years ago, yet all signs and evidence point to another repeat.

Read More »

Read More »

Gravitas: Macron warns against humiliating Putin

US President Joe Biden has lined up more military aid to help Ukraine defeat Russia. But his ally, Emmanuel Macron has warned against humiliating Putin. Palki Sharma decodes the different signals from Washington & Paris.

Read More »

Read More »

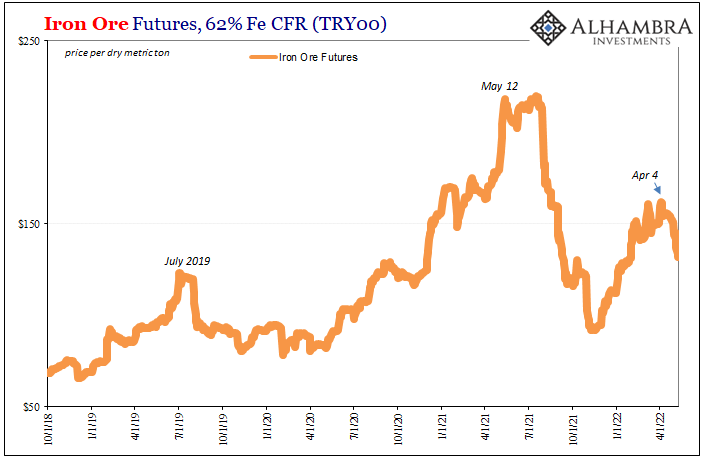

Industrial Synchronized Demand

Are the industrial commodities starting to get a whiff of demand side rejection? Short run trends suggest that this could be the case. From copper to iron and the highest (formerly) of the high flyers, aluminum, this particular group has been exhibiting a rather synchronized setback going back to the end of March, start of April.

Read More »

Read More »

Live Broadcast | Joe Biden expedites military aid to Ukraine | Direct from Washington, DC

WION Live Broadcast | Joe Biden expedites military aid to Ukraine | Direct from Washington, DC

- Joe Biden expedites military aid to Ukraine

- Alabama manhunt for inmate ends

- The Philippines set for the return of the Marcos family

- Nepali Sherpa conquers Everest for record 26th time

Read More »

Read More »

Russia-Ukraine crisis: Russia destroys Skovoroda Museum with missile strike | World News

More than two months have passed on and the fighting in Ukraine rages on. In the latest development, Kyiv said that Russia has destroyed a Ukrainian museum with a missile strike.

Read More »

Read More »

What Happens When Complexity Unravels?

Those glancing at the appearances will be assured all is well and it will all sort itself out. Those who look behind the screen will move away as fast as they can. When finances tighten, there are two choices: cut expenses or increase revenues. Monopolies, cartels and governments can increase revenues by increasing taxes or the price of goods and services because users /customers / taxpayers have no alternative.

Read More »

Read More »

Russia-Ukraine Conflict Live News Updates: G7 to hold virtual meet with President Zelensky | WION

It has been several weeks since the Russian invasion of Ukraine started, and scores of civilians have lost their lives in the conflict. Armies of both countries have been involved in intense fights since Russian troops entered Ukraine. Now, G7 will hold virtual meet with Zelensky.

Read More »

Read More »

War in Ukraine: why is Russia’s army so weak? | The Economist

As Russia celebrates Victory Day, our defence correspondent considers why the Russian army has performed so badly in Ukraine.

00:00 - The poor performance of Russia’s armed forces in Ukraine

00:40 - Why has the Russian army struggled in Ukraine?

02:00 - What’s behind Russia’s brutal warfare?

03:27 - Donbas: the next frontier

Sign up to our daily newsletter for the latest coverage: https://econ.st/38atDfd

Russian soldiers appear to be dying...

Read More »

Read More »

Russia marks Victory Day on May 9, observers speculate ‘All-Out’ war | World News | WION

As the battle continues in Ukraine, Russian forces are preparing for the victory day on May 9 and experts have predicted a declaration of all-out war on Ukraine. Russian President Vladimir Putin will celebrate the World War 2 Soviet victory over Nazi Germany with a traditional victory day parade.

Read More »

Read More »