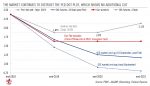

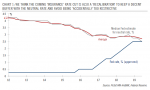

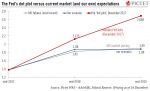

The Federal Reserve is probably looking back at 2017 with satisfaction. After on the rate rise expected on 13 December, it will have pushed through the three rate hikes it signalled earlier in the year. For once, it has not under-delivered. Meanwhile, the gradual, ‘passive’ decline in the Fed’s balance sheet has been mostly ignored by markets. In fact, broader financial conditions have eased this year despite the Fed’s monetary tightening. Corporate bond spreads, for instance, have remained very tight and bond issuance has flourished.

Read More »