|

With the approval of the Senate tax bill in the early hours of Saturday 2 December, a key step has been taken toward tax cuts. The next chapter in the process is to reconcile this version with the House of Representatives’ tax bill, most likely in a ‘conference committee ’ from which a final version will emerge. Various lobbies have been taken by surprise by the speed with which tax legislation has moved forward in the past few days, and members of Congress will want to maintain the momentum, hoping to have a final bill enacted into law before year’s end.

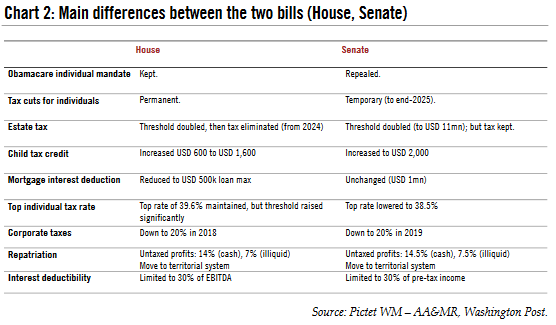

There is still no certainty about what exactly will come out of the conference committee. The Senate text still looks the closest to the final version of tax legislation. It is probable that the corporate tax rate will be cut in one go, but not before 2019, in contrast to our earlier view that the tax rate would be cut progressively over several years starting in 2018. The two tax bills propose a drop to 20% in the headline rate (from the current statutory tax rate of 35% and an effective average tax rate of 28% for Dow Jones companies), but the White House has said that there is still room for a smaller cut, possibly to 22%.

We are leaving our 2018 US GDP growth forecast of 2.0% unchanged, but we now see risks to the upside. The upside could be more marked for 2019 if corporate tax cuts only kick in then, mitigating recession risks and lengthening the US business cycle. We will fine tune our forecasts depending on the final text that emerges from the conference committee. Our Fed scenario is also unchanged (three rate hikes between now and next June), but we see risks to the upside in this area too.

|

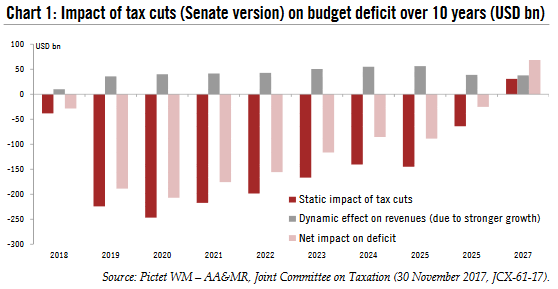

Impact of Tax Cuts, 2018 - 2027 |

Tax bill heading for conference committeeThere has been much tumult in Senate over the tax bill in recent weeks, but the Republican camp eventually closed ranks and the law was approved 51-49. Senator Bob Corker was the sole Republican senator to dissent, citing anxiety about a growing deficit. He wanted to insert a ‘deficit trigger’ mechanism into the bill should the deficit balloon more than expected.

The swiftness with which legislation got through the Senate is a sign of Republicans’ anxiousness not to appear empty handed before voters before mid-term elections in November 2018. Indeed, the Trump administration’s legislative successes so far have been meagre. And the administration is having to deal with a mini ‘populist’ rebellion led by Trump’s former advisor Steve Bannon, who is threatening to put forward (and finance) more populist candidates in establishment Republicans’ constituencies.

The Senate vote increases the chances that tax legislation will eventually see daylight. There are still a number of steps that need to be monitored, particularly the conference committee’s text that merges the House and Senate bills. The initial Senate bill would have repealed state and local tax deductions entirely, but a USD 10,000 cap mirroring the House’s version eventually made its way into the Senate proposal finally adopted . This will ease negotiations within the conference committee as the full repeal of the state and local tax deduction had been particularly sensitive among many Republican House Representatives from urban areas.

The Senate’s tax bill caps the mortgage deduction at USD 500,000 (down from

USD 1,000,000 currently) . This could be a stumbling block in negotiations

with the House, where the builders’ lobby seems to hold more sway. Individual

income taxation is a politically sensitive area, particularly the top individual tax rate (currently at 39.6%) . There, the two bills diverge as well.

It is probably with such contentious issues in mind that the White House surprisingly mentioned that there was wiggle room for reducing the corporate tax rate to 22% rather than 20%. This could free up some cash in exchange for maintaining some loopholes. The bill still has to remain within the Senate’s intention to limit the additional deficit to a maximum of USD 1.5 trillion over the next 10 years. Limits to the deficits are key to circumventing the Democrats’ unified opposition to the text.

|

Main Differences between the two bills |

Full story here Are you the author? Previous post See more for Next post

Tags: Macroview,newslettersent