Tag Archive: newslettersent

Die besten Möglichkeiten, in Deutschland Geld zu überweisen

Überweisungen kennen viele von uns, oder? In Deutschland haben wir viele Möglichkeiten, unser Geld sicher von A nach B zu überweisen. Doch was steckt eigentlich hinter diesen Methoden? Schauen wir uns die gängigsten Wege an. Was macht sie so besonders und sicher?

Read More »

Read More »

Jim Rogers – Making China Great Again! (Video)

We are delighted to announce a very special guest for our next episode of the Goldnomics Podcast, due for release later this week. We recently had the opportunity to speak with the legendary investor and adventure capitalist Jim Rogers. Jim is an American businessman, investor, traveler, financial commentator and author. He is the Chairman of Rogers Holdings and Beeland Interests, Inc. He was the co-founder of the Quantum Fund and creator of the...

Read More »

Read More »

An Inquiry into Austrian Investing: Profits, Protection and Pitfalls

“From a marketing perspective it pays to be overconfident, especially in the short term. The higher your conviction the easier it will be to market your investment ideas. I think the Austrian School is at a disadvantage here because it’s more difficult to be confident about your qualitative predictions and even in terms of investment advice it is particularly difficult to be confident in these times because we don’t really have any historical...

Read More »

Read More »

Jim Rogers and the World’s New Reserve Currency

Today we’re bringing you another clip from our upcoming Episode of the Goldnomics Podcast with the legendary investor and “Adventure Capitalist”, Jim Rogers. In this clip Jim tells us what he thinks about the long-term safe-haven status of the US dollar and what he sees as the future for the Euro currency.

Read More »

Read More »

The Yin and Yang of the US-China Relationship

Chimerica always seemed like an oversimplification of a complex and dialectic relationship between the US and China. However, it did express an underlying truth, that China's rise over the last 40 years has been predicated on Deng Xiaoping's political and economic reforms and, importantly, the world of free-trade (a reduction in tariff barriers to trade) promoted by the United States.

Read More »

Read More »

FX Daily, August 10: The Dollar Muscles Higher as Turkey Melts Down

The US dollar has surged. The main impetus comes from the dramatic slide in the Turkish lira. After moving above TRY5.0 yesterday, it reached TRY6.30 today before stabilizing a little below TRY6.0 as the European morning progressed. The trigger seemed to be the lack of credibility of the government's response as investors await officials to elaborate on the outline of the "new economic model" provided yesterday.

Read More »

Read More »

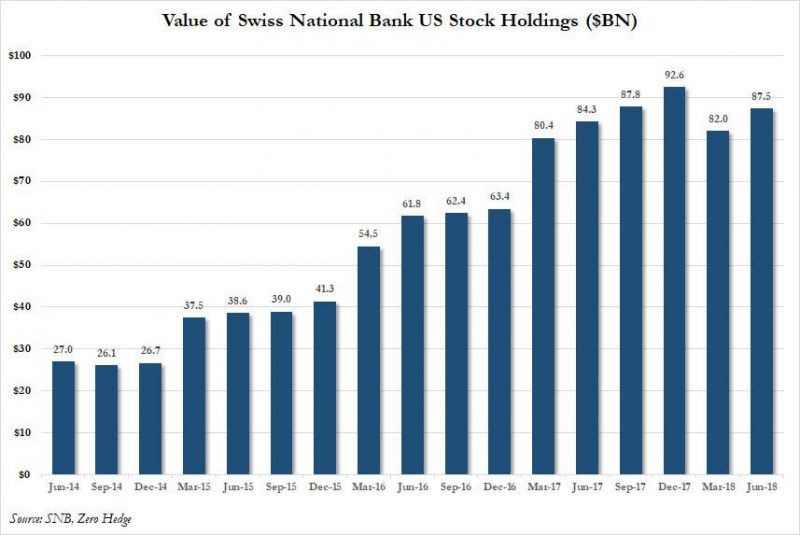

The Swiss National Bank Now Owns $87.5 Billion In US Stocks After Q2 Tech Buying Spree

In the second quarter of 2018, one in which the global economy was shaken by the rapid escalation of Trump's trade war, and in which central banks were one after another hinting at their own QE tapering and rate hiking intentions to follow in the Fed's footsteps, what was really taking place was another central bank buying spree meant to boost confidence that things are now back to normal, using "money" that was freshly printed out of thin air, and...

Read More »

Read More »

The Stock Market is Stretched to Double Tech-Bubble Extremes

Leuthold Group has sounded the alarm on a valuation metric that shows the S&P 500 is twice as expensive as it was at the peak of the tech bubble. This development could have large implications for stock investors of all types, particularly value traders who make their living by finding discounts in the market. With the stock market within shouting distance of an all-time high, traders are readying their Champagne bottles. Just don’t tell them about...

Read More »

Read More »

Traffic jams cost Swiss more than just time

Various costs related to traffic jams totalled CHF1.9 billion ($1.9 billion) in 2015, up 7% from 2010, according to the Swiss Office for Spatial Development. In a statement released on Wednesday (link in French, German and Italian), the office said that costs stemming from wasted time accounted for 70% of the losses, having increased by 14% since 2010. However, other costs related to the climate (+12%) and the environment (+3%) also increased...

Read More »

Read More »

What Chinese Trade Shows Us About SHIBOR

Why is SHIBOR falling from an economic perspective? Simple again. China’s growth both on its own and as a reflection of actual global growth has stalled. And in a dynamic, non-linear world stalled equals trouble. Going all the way back to early 2017, there’s been no acceleration (and more than a little deceleration). The reflation economy got started in 2016 but it never went anywhere. For most of last year, optimists were sure that it was just the...

Read More »

Read More »

Switzerland Unemployment in July 2018: Unchanged at 2.4percent, seasonally adjusted unchanged at 2.6percent

Registered unemployment in July 2018 - According to SECO surveys, at the end of July 2018, 106,052 unemployed people were enrolled in the Regional Employment Centers (RAV), 527 less than in the previous month. The unemployment rate remained at 2.4% in the month under review. Compared to the same month of the previous year, unemployment fell by 27,874 (-20.8%).

Read More »

Read More »

FX Daily, August 09: Sterling Remains Under Pressure, while the Greenback Firms Broadly

The global capital markets are mostly quiet. US sanctions on Turkey and Russia are pressuring their respective currencies, and the New Zealand dollar has slumped nearly 1.5% on the back of a dovish hold by the central bank. The Kiwi is at 2.5-year lows near $0.6650.

Read More »

Read More »

US-Japan Trade Talks

The withdrawal of the US from the Trans-Pacific Partnership trade agreement lift it exposed on two fronts. First, the TPP was going to modernize the NAFTA. Without, the US remains locked in protracted negotiations. A breakthrough in talks with Mexico has been reportedly imminent for weeks.

Read More »

Read More »

Swiss Trade Unions to Boycott Talks on EU Labour Negotiations

Switzerland’s largest national trade union centre has refused to participate in discussions led by Swiss Economics Minister Johann Schneider-Ammann on easing measures for wages and working conditions as part of framework negotiations with the European Union (EU).

Read More »

Read More »

The Fantasy of “Balanced Returns” Funding Retirement

The fantasy that a "balanced portfolio" yielding "balanced returns" will fund a stable retirement for decades to come is widely accepted as a sure thing: inflation will stay near-zero essentially forever, assets such as stocks and bonds will continue yielding hefty income and capital gains, and all the individual or fund needs to do is maintain a "balanced portfolio" of various asset classes that yield "balanced returns," i.e. some safe "value"...

Read More »

Read More »

FX Daily, August 08: Sterling Can’t Get Out of Its Own Way, While Dollar and Yen Catch a Bid

Fears that the UK could leave the EU in a little over six months without an agreement continues to drag sterling lower. Recall that over the weekend, the UK's International Trade Minister Fox suggested there was a 60% chance of a no-deal Brexit.

Read More »

Read More »

Gold—Even at its Lowest Levels in 2018—is Behaving Just as Prescribed

Gold’s sharp decline over the past month serves as little surprise to the investors who want the asset to perform in just this fashion—that is, as an alternative to assets perceived as risky, like stocks. They’re betting that the opposite will be true as well, that gold will resume its role as protector and diversifier, even inflation hedge, when what they see as bloated price-to-earnings ratios, heavy debt-to-GDP ratios among major economies and...

Read More »

Read More »

Some Initial Consequences of Trade Tensions

The Trump Administration argues that other countries have been taking unfair advantage of the US on trade for years, and what many are calling a trade war is really only the US finally saying enough. The US has taken many several countries, including China, to the WTO for trade violations and wins the vast majority of cases it has brought.

Read More »

Read More »