Tag Archive: Macroview

Weekly View – Big Splits

US prices continue to rise, with the US consumer price index (CPI) for October coming in at its highest in three decades. President Biden made a boldly worded response as inflation becomes a growing focus among politicians with their eyes fixed on next year’s midterm elections. Oil prices fell on investors’ expectations that the US could free up strategic reserves to combat energy inflation.

Read More »

Read More »

Weekly View – Central Bank Halloween

Last week, the US GDP growth figure for Q3 came in lower than expected, while prices moved higher than anticipated and the US Employment Cost Index update rose at its fastest pace in 31 years. The headline increase was driven by the biggest surge in wages since 1982, up 1.5% in the third quarter.

Read More »

Read More »

Weekly View – Widening bottlenecks

After September’s negative performance, last week proved one of the strongest in a while for equity markets. This rebound followed news that the Biden administration will start to tackle the supply-chain and logistics issues that have been preventing deliveries.

Read More »

Read More »

Weekly View – Debt ceiling deadline postponed

China’s high-yield bond crisis continued last week, with yields on the ICE BofA index of Chinese high-yield US dollar bonds moving above 18% at one stage last week, the highest level in a decade. Further nervousness was caused by one real-estate issuer’s decision not to reimburse USD200 mn of offshore bonds--despite having USD4 bn in cash on its balance sheet.

Read More »

Read More »

House View, October 2021

We maintain our tactically neutral position on equities, with the notable exception of Japan, where we see scope for a re-start to Abenomics and for Japanese stocks to continue to close their performance gap with their peers in other developed markets.

Read More »

Read More »

Weekly View – “The lady is not tapering”

As expected, last week the European Central Bank hinted at a “moderate” reduction of the bond buying it undertakes as part of its Pandemic Emergency Purchase Programme (PEPP). But ECB president Christine Lagarde refrained from providing a precise timeline and she was adamant that a reduction in PEPP purchases did not mean the ECB would tighten financing conditions.

Read More »

Read More »

Weekly View – 50 years later

The rosy US employment picture helped push equities to a new high as US inflation moderated in July. Those looking to fill roles now exceed those looking for work, compelling some small and mid-sized companies to raise wages. Higher prices seem to be keeping the US consumer in check, however, with consumer sentiment hitting its lowest level in a decade.

Read More »

Read More »

Weekly View – Staying on script

Big US banks released their 2Q earnings last week. The figures were good thanks to robust growth in investment-banking income as well as a drop in loan-loss provisions. But banks also reported that wage costs were beginning to rise, and while a booming housing market has boosted mortgage-loan business, the renewed retreat in long-term yields has been a drag on interest income.

Read More »

Read More »

Weekly View – M&A Boom

M&A (mergers and acquisitions) activity is on the rise, as companies coming out of the pandemic with strong balance sheets shop for buying opportunities. Last week ACS, a Spanish construction group, approached Italian transport company Atlantia to buy Italy’s largest motorway network. Two big funds are also eyeing Dutch telecommunications company KPN as a potential acquisition target.

Read More »

Read More »

House View, April 2021

We believe that robust earnings growth will overcome concerns about rate increases. Within a neutral position on developed-market equities, we believe sectoral rotation will continue and we remain overweight cyclical markets like the UK and Japan. But while we believe the attractiveness of stocks subject to wild valuation swings will fade, we continue to like cash-rich ‘structural grower’ stocks.

Read More »

Read More »

House View, November 2020

The upsurge in covid-19 cases will likely hurt global economic prospects in the current quarter. With a Democrat 'blue wave' failing materialise in the US elections, hopes of a substantial spending bill have faded and there is risk that US household incomes suffer as existing support measures fade. In the meantime, covid-19 infections continue surge in the US.

Read More »

Read More »

Weekly View – A sure thing

Signs from last week’s SURE programme to finance partial unemployment schemes are highly encouraging for the EU’s plans for recovery fund issuance which could start, we believe, in mid-2021. Last week’s SURE issue was close to 14 times oversubscribed at a rate lower than that for French government bonds of comparable duration.

Read More »

Read More »

Weekly View – Biden time for markets

Donald Trump’s poll numbers were looking increasingly unhealthy at the time of writing, but at least the cocktail of drugs administered to the coronavirus-stricken President appears to have worked.

Read More »

Read More »

House View, September 2020

A surge in new covid-19 cases in a number of countries has interrupted progress towards normality, yet the effects of the virus are becoming more manageable and positive world H2 growth is achievable.

Read More »

Read More »

Weekly View – Election nerves increase

The sell-off in stocks last week showed a certain nervousness about the sharp run-up in tech stocks and the role of big option bets. Indeed, prices in some instances had risen too fast. But this was a technical correction. With the US tech titans generating free cash flow, we do not believe we are facing a repeat of the bursting of the dot-com bubble in 2000.

Read More »

Read More »

Weekly View – The Last Samurai

The CIO office’s view of the week ahead.We are in the midst of a decisive elections season, from the surprise, poll-defying victory of the conservative coalition in Australia and Indian general elections last weekend to the European parliament elections in the week ahead.

Read More »

Read More »

Horizon 2020: long-term investing in a world marked by pandemic

The sudden, violent recession triggered by this year’s covid-19 outbreak provides further impetus to pre-existing economic and market dynamics.

Read More »

Read More »

Weekly View – One country, two systems at risk

Last week, German chancellor Merkel delivered a surprise about-face when she and French president Macron announced a proposal for a EUR 500bn recovery fund in the wake of the coronavirus crisis. The unprecedented plan involves the distribution of grants, rather than loans, to member states in economic need.

Read More »

Read More »

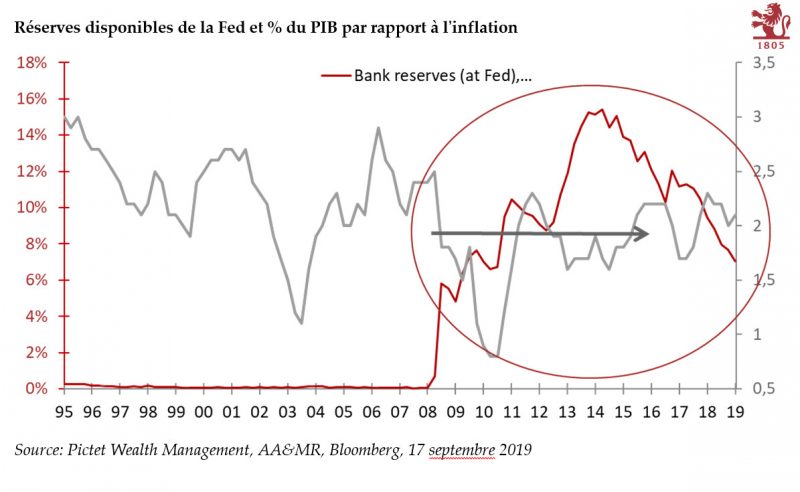

MMT, la nouvelle théorie en vogue à Washington

L’influence du ‘Modern Monetary Theory’ est susceptible d’augmenter dans les milieux économiques et politiques américains.La nouvelle théorie monétaire (Modern Monetary Theory/MMT), théorie macroéconomique défendue par des économistes hétérodoxes, commence à faire son chemin aux Etats-Unis.

Read More »

Read More »

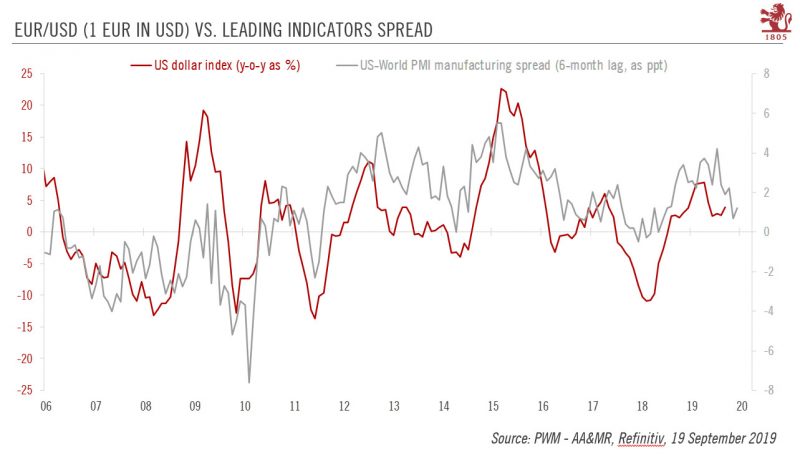

Euro/USD: things look pretty stable

Competing forces mean the two currencies could remain in a holding pattern for a while.The euro has remained relatively stable relative to the US dollar in the wake of the European Central Bank (ECB) and US Federal Reserve (Fed) September policy meetings. Growth and interest rate differentials, two key drivers for the EUR/USD rate, suggest things could stay this way.

Read More »

Read More »