Category Archive: 5) Global Macro

Leader of the package: Amazon turns 30

It has changed our lives and become one of the world’s most valuable companies. As Amazon turns 30 (https://www.economist.com/business/2024/07/01/what-next-for-amazon-as-it-turns-30?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners), what comes next? Education is key to social mobility in India...

Read More »

Read More »

Degree programme: stopping heat deaths

As heatwaves become more frequent (https://www.economist.com/leaders/2024/06/26/simple-steps-to-stop-people-dying-from-heatwaves) and intense, they exacerbate existing inequalities. The poor, sick and elderly are particularly vulnerable. How should governments respond? Universities depend on the high fees international students pay. Now Indian scholars are replacing...

Read More »

Read More »

Rule and divide: Donald Trump is judged immune

The US Supreme Court has granted (https://www.economist.com/united-states/2024/07/01/donald-trump-wins-a-big-victory-at-the-supreme-court) the former President immunity from prosecution for official acts committed while in office. We ask what that means for future Presidents and the 2024 American election. Humanity is standing by while sea levels rise. Now scientists want to geo-engineer polar ice...

Read More »

Read More »

Trailer: Boom! How a generation blew up American politics

Why are two old, unpopular men the main candidates for the world’s most demanding job? It’s the question John Prideaux, The Economist’s US editor, gets asked the most. And the answer lies in the peculiar politics of the baby boomers.

Since 1992, every American president bar one has been a white man born in the 1940s. That run looks likely to span 36 years - not far off the age of the median American. This cohort was born with aces in their...

Read More »

Read More »

Bet noir: Macron’s electoral gamble backfires

Marine Le Pen’s far-right party made great gains in the first round of France’s parliamentary election (https://www.economist.com/europe/2024/06/30/a-crushing-blow-for-emmanuel-macrons-centrist-alliance). The left did too. We ask what this means for France and President Emmanuel Macron. Thailand will soon legalise same-sex marriage (https://www.economist.com/asia/2024/06/20/thailand-legalises-same-sex-marriage), but in other areas, democratic...

Read More »

Read More »

The Weekend Intelligence: The state of Britain

On July 4th Britain will have a general election, one in which is widely expected to result in dramatic losses for the ruling Conservative party. If so, it would bring to an end 14 years of Tory rule. It’s been a turbulent period; the twin catastrophes of Brexit and Covid, set to the grinding and gloomy mood music of the 2008 financial crash. The Economist’s Andy Miller travels up and down the country, to the towns and cities shaped by these...

Read More »

Read More »

Debate and switch? Biden’s stumble

America’s president had one primary task at last night’s debate: to close down speculation about his mental faculties. It went so poorly (https://www.economist.com/united-states/2024/06/28/joe-bidens-horrific-debate-performance-casts-his-entire-candidacy-into-doubt?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) his...

Read More »

Read More »

Labour-saving: Britain’s probable next leader

Hosted on Acast. See acast.com/privacy (https://acast.com/privacy) for more information.

Read More »

Read More »

Pier pressure: a visit to Gaza’s aid platform

Our correspondents were the first media to see the American-built JLOTS pier, intended for aid deliveries into Gaza. Things have not at all gone to plan. After years of slipping, house prices are on the rise...

Read More »

Read More »

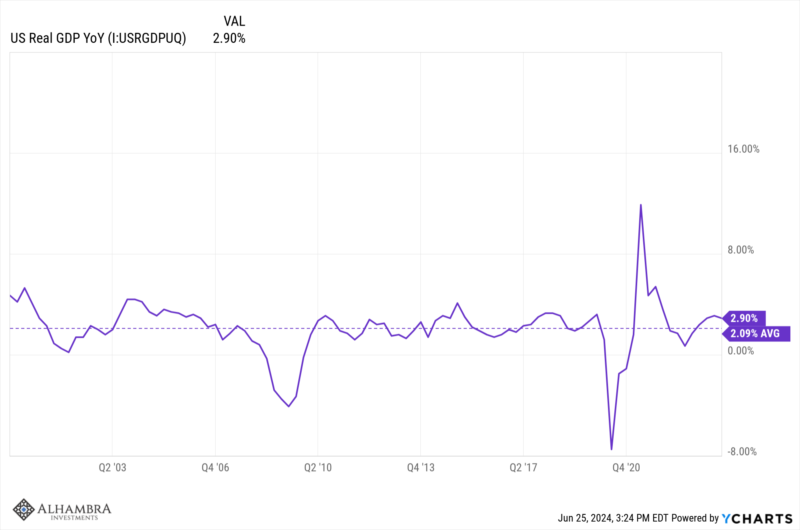

Q3 Cyclical Outlook

Growth peaked on a quarter over quarter seasonally adjusted annual rate in Q3 last year at 4.9%. The preferred reading is on an annual basis where growth peaked in Q4 of last year at 3.13%. Growth in Q1 was 2.88% and growth in Q2 has risen some and is trending at right about 3%.

Read More »

Read More »

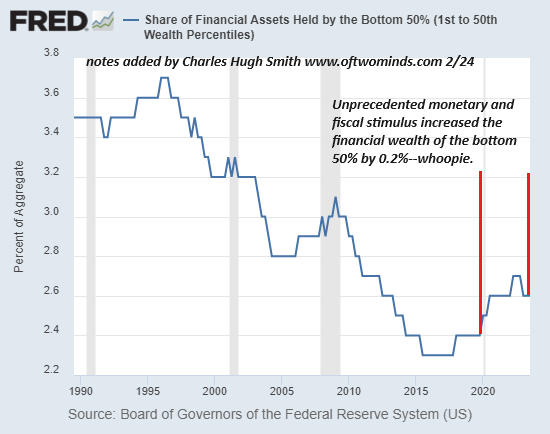

"Why Are You So Negative?" Good Question. Here’s the Answer: Real Life

I think it's more productive to go with Plan B: set aside our emotions and reluctance and start doing the hard work of dealing with polycrisis.

Read More »

Read More »

Spring a leaker: Assange goes free

As Julian Assange is released from prison our correspondent reflects on how the work of Wikileaks changed whistleblowing in the internet era, for good and for ill. Meanwhile Peter Navarro, Donald Trump’s trade hawk, remains behind bars—but is plotting for a second Trump term (09:25). And the social-media trend changing tinned fish from frumpy to foodie fare (18:33).

Get a world of insights by subscribing to Economist Podcasts+...

Read More »

Read More »

Rocketing science: China’s newest superpower

After decades as a scientific also-ran, China is becoming a superpower (https://www.economist.com/leaders/2024/06/13/how-worrying-is-the-rapid-rise-of-chinese-science?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) particularly in the physical sciences. We examine the risks and opportunities that poses for the West. Our...

Read More »

Read More »

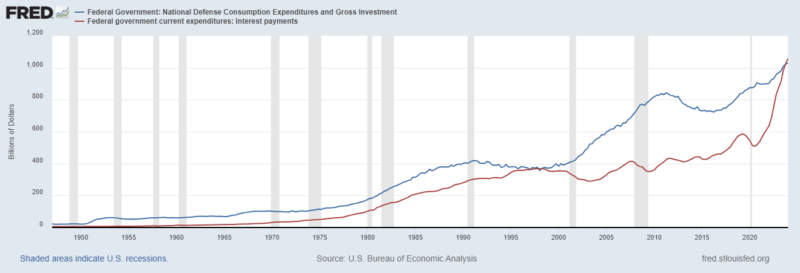

Weekly Market Pulse: The Sober Spending Of Drunken Sailors

Any great power that spends more on debt service (interest payments on the national debt) than on defense will not stay great for very long. True of Habsburg Spain, true of ancien régime France, true of the Ottoman Empire, true of the British Empire, this law is about to be put to the test by the U.S. beginning this very year.

Read More »

Read More »

Argentina turning? Milei’s surprising political success

Since his election last year, President Javier Milei has enjoyed some economic and political wins in Argentina. But his toughest fight (https://www.economist.com/leaders/2024/06/19/javier-mileis-next-move-could-make-his-presidency-or-break-it) is yet to come. On Britain’s general election trail, our correspondent found voters less keen on the prospect of a Labour victory than on punishing the Conservative party...

Read More »

Read More »

Empire of the sun: a solar power revolution

No energy source has ever increased as fast as solar photovoltaics. The technology will transform humanity’s energy consumption–even when the sun doesn’t shine. Many people associate champagne with success but wine collectors often shun it. Now global sales are fizzing (10:51).

Read More »

Read More »

French fried: will the election lead to chaos?

Both the left and right are likely to do well in France’s upcoming parliamentary poll, with President Emmanuel Macron’s party squeezed in the middle. The snap election could leave the country in chaos (https://www.economist.com/europe/2024/06/16/france-is-being-thrown-into-uncharted-territory). In America, recreational use of weed is now commonplace, but what impact does it have on users’ wellbeing...

Read More »

Read More »

Heir tight: why boomers are so stingy

The post-war generation reaped the benefits of peace and prosperity. Yet rather than spend that bounty, retired boomers are hoarding their riches (https://www.economist.com/finance-and-economics/2024/05/26/baby-boomers-are-loaded-why-are-they-so-stingy)–and upending economists’ expectations. The science of menstruation is baffling, partly because most animals don’t do it. Now clever innovations...

Read More »

Read More »

Sudan impact: the war the world forgot

Much of Sudan has already collapsed into chaos (https://www.economist.com/graphic-detail/2024/05/24/sudan-the-war-the-world-forgot). Now a crucial city may fall, the United Nations is belatedly scrambling to avert a bloodbath. Gary Lineker (https://www.economist.com/britain/2024/05/25/footballer-broadcaster-podcast-mogul-the-career-of-gary-lineker) is a former footballer, broadcaster and podcast mogul. He also embodies Britain’s social aspirations...

Read More »

Read More »

Fight for his party to the right: Nigel Farage

Britain’s pint-sipping rabble-rouser of the right has joined the campaigning (https://www.economist.com/britain/2024/06/06/the-return-of-the-farage-ratchet?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) ahead of a general election. Win or lose, he will make an impact. America’s stadiums and arenas are often built using...

Read More »

Read More »