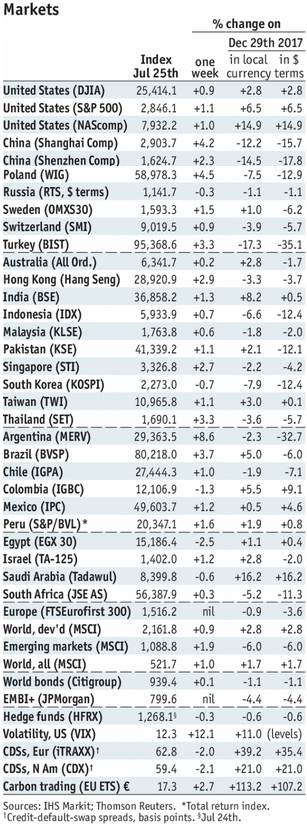

Stock MarketsEM FX enjoyed a respite from the ongoing selling pressures, with most currencies up on the week vs. the dollar. Best performers were CLP, MXN, and ZAR while the worst were TRY, CNY, and COP. BOJ, Fed, and BOE meetings this week may pose some risks to EM FX. |

Stock Markets Emerging Markets, July 25 |

South AfricaSouth Africa reports June money, loan, and budget data Monday. June trade and Q2 unemployment will be reported Tuesday. SARB just turned more hawkish, saying it would act if inflation “significantly exceeds” 4.5%. CPI rose 4.6% y/y in June and July data is due out August 22. Next policy meetings are September 20 and November 22 and decisions will clearly be data-dependent. BrazilBrazil reports June consolidated budget data Monday. Primary deficit of -BRL15 bln is expected, but central government budget data reported Friday was worse than expected and points to a possible negative surprise here. COPOM meets Wednesday and is expected to keep rates steady at 6.5%. June IP will be reported Thursday. KoreaKorea reports June IP Tuesday, which is expected to rise 0.7% y/y vs. 0.9% in May. July CPI and trade will be reported Wednesday. Inflation is expected at 1.7% y/y vs. 1.5% in June, while exports are expected to rise 7.8% y/y and imports to rise 17% y/y. June current account data will be reported Friday. Inflation remains below the 2% target. Next BOK meeting is August 31 and steady rates are likely for now. ChinaChina reports official July manufacturing PMI Tuesday, which is expected to tick lower to 51.3 from 51.5 in June. June data clearly showed some slowing in the mainland economy, which in turn led to this recent round of stimulus. Markets will be keen to see if the slowdown is arrested in Q3. If not, expect further stimulus measures ahead. TurkeyTurkey reports June trade Tuesday, which is expected at -$5.5 bln. Central Bank of Turkey also releases its quarterly inflation report that day. July CPI will be reported Friday and is expected to rise 16.3% y/y vs. 15.4% in June. If so, inflation would be the highest since September 2003 and further above the 3-7% target range. Next CBT policy meeting is September 13 but an intra-meeting hike is likely if the lira comes under greater pressure. PolandPoland reports July CPI Tuesday, which is expected to remain steady at 2.0% y/y. If so, inflation would still in the bottom half of the 1.5-3.5% target range. Next NBP policy meeting is September 5 and steady rates are likely for now. |

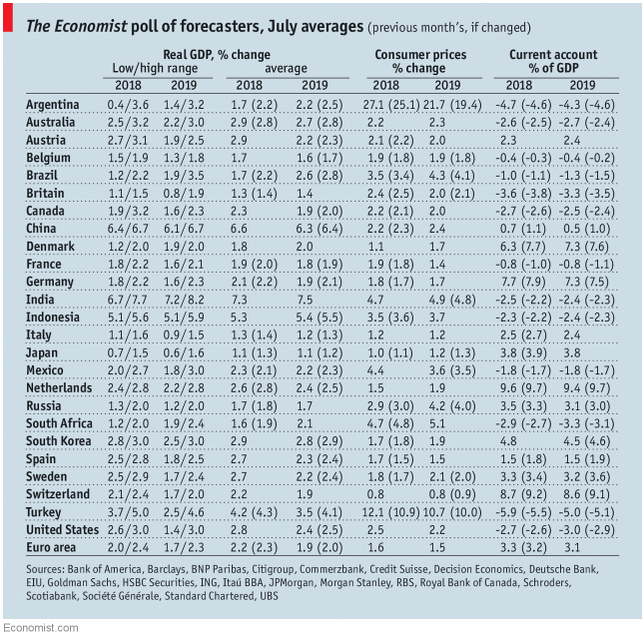

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, July 2018 Source: economist.com - Click to enlarge |

Taiwan

Taiwan reports Q2 GDP Tuesday, which is expected to grow 2.98% y/y vs. 3.0% in Q1. The economic recovery continues but is less robust than “typical” growth cycles. With price pressures remaining low, we expect steady rates for the time being, especially given concerns about the slowing mainland economy.

Chile

Chile reports June IP Tuesday, which is expected to rise 4.3% y/y vs. 1.8% in May. June retail sales will be reported Thursday, which are expected to rise 4.4% y/y vs. 3.0% in May. The economy is picking up and inflation is rising, which supports the case for eventual tightening. We see the first hike in Q4.

Mexico

Mexico reports Q2 GDP Tuesday, which is expected to grow 2.9% y/y vs. 1.3% in Q1. Banco de Mexico meets Thursday and is expected to keep rates steady at 7.75%. Inflation is picking up after decelerating earlier this year. With the peso firm, Banxico can hold off on rate hikes near-term but the recent rise in price pressures needs to be watched closely.

Thailand

Thailand reports July CPI Wednesday, which is expected to rise 1.5% y/y vs. 1.4% in June. If so, inflation would match the cycle high but would still be in the bottom half of the 1-4% target range. Next BOT policy meeting is August 8 and steady rates are likely for now.

Indonesia

Indonesia reports July CPI Wednesday. Inflation was 3.1% y/y in June and remains in the bottom half of the 2.5-4.5% target range. However, the rupiah remains vulnerable. Next Bank Indonesia policy meeting is August 16 and another 25 bp hike seems likely after it kept rates steady at the July meeting.

India

Reserve Bank of India meets Wednesday and is expected to hike rates 25 bp to 6.5%. However, about a third of the analysts polled by Bloomberg see no change. CPI rose 5.0% y/y in June, the highest since January and in the top half of the 2-6% target range.

Czech Republic

Czech National Bank meets Thursday and is expected to hike rates 25 bp to 1.25%. However, a small handful of the analysts polled by Bloomberg see no change. CPI rose 2.6% y/y in June, the highest since November and nearing the top of the 1-3% target range. If CNB does hike, it would be the first back-to-back hikes in over ten years.

Colombia

Colombia reports July CPI Saturday, which is expected to rise 3.4% y/y vs. 3.2% in June. If so, this would be the highest since February but still within the 2-4% target range. The easing cycle has likely ended after the last 25 bp cut in April. The market is pricing in the first hike in Q1 2019.

Full story here Are you the author? Previous post See more for Next postTags: Brazil,Chile,China,Colombia,Czech Republic,Emerging Markets,India,Indonesia,Korea,Mexico,newslettersent,Poland,South Africa,Taiwan,Thailand,Turkey,win-thin