Tag Archive: India

Double Whammy: US CPI and Federal Reserve

Overview: Position adjustments ahead of today's US CPI and FOMC

meeting are giving the dollar a modestly heavier tone today. Each of these

events are typically a source of volatility in their own right and together

they promise an eventful North American session. The yen is the only exception

among the G10 currencies, but even there, the dollar is holding below

yesterday's highs. Even sterling's relative resilience this week was unmarred

by the...

Read More »

Read More »

Election Results Lift India But Weigh on Mexico

The dollar has returned from the weekend with a better bid tone. It is firmer against all the G10 currencies but the yen, Swiss franc, and Swedish krona, which are marginally firmer. The market seems reluctant to extend the euro or Canadian dollar upticks ahead of the central bank meetings this week, though, ironically, sterling's 0.25% decline leads the major currencies. Election news is a key driver today.

Read More »

Read More »

Dollar’s Recent Gains Pared but Firm Undertone Remains Intact

Overview: After surging at the last week, the dollar

consolidated yesterday and is continuing to do so today as slightly lower

levels. The Swiss franc is the only G10 currency unable to gain traction

against the greenback today. Still, the dollar's pullback has barely met the

minimum retracement targets of the jump last Thursday and Friday. The PBOC

lower the dollar's fix slightly, but the proverbial toothpaste is out of the

tube and officials are...

Read More »

Read More »

Risk On, Dollar Sold

Overview: The

post-close rally in US tech stocks after Nvidia's earnings has fueled risk-on

activity today. The Nikkei closed at record highs with a 2.2% rally. China's

CSI rose for the eighth consecutive session as official discourage sales at the

open and close, and short sales in general. Europe's Stoxx 600 is up more than

0.5% to recoup the small losses seen in the last two sessions. US indices are

poised to gap higher at the open. Benchmark...

Read More »

Read More »

Dollar Recovers After Losses Extended in Asia

Overview: On the back of lower interest rates, the greenback's

slide was extended in early Asia Pacific turnover, but it has recovered. As

North American trading begins, the dollar is firmer against all the G10

currencies but the New Zealand dollar, which has been aided by the hawkish hold

of the central bank, and an immaterial gain in the Swiss franc. Emerging market

currencies are mixed. Central European currencies and the Mexican peso are...

Read More »

Read More »

In Uncoordinated Steps, Japan and China Help Slow Greenback’s Rally

Overview: The Bank of Japan Governor Ueda hinted the

world's third-largest economy may exit negative interest rates before the end

of the year. This sparked the strongest gain in the yen in a couple of months

and lifted the 10-year yield to nearly 0.70%. In an uncoordinated fashion,

Chinese officials stepped their rhetoric and indicated that corporate orders to

sell $50 mln or more will need authorization. This helped arrest the yuan's

slide. The...

Read More »

Read More »

Risk Appetites Challenged after US Equities Tumble

Overview: The sharp sell-off of US stocks yesterday as

sapped the risk appetite today. Equities are being sold. Hong Kong and the

index of mainland shares that are listed there led the regional decline with

3.2%-3.3% losses. Europe’s Stoxx 600 is off about 0.65% in late morning

turnover, the fourth day of losses. US futures are trading with a lower bias as

well. European 10-year bonds are mostly 1-2 bp firmer. The US 10-year Treasury is

practically...

Read More »

Read More »

Macro: Tell Us Something We Don’t Already Know

As September winds down, three sets of economic reports will draw the most attention. We will review them and then offer a snapshot of the emerging market central bank meetings.

Read More »

Read More »

Downside Risks to the US Employment Report?

Overview: The US dollar enjoys a firmer bias against

the major currencies ahead of the July employment data. Emerging market

currencies are mixed. Asian currencies are generally firm while central Europe is a bit softer. Some detect a relaxation in tensions around Taiwan, though

China’s aerial harassment continues. Taiwanese shares jumped 2.25% to lead the

region that saw China’s CSI 300 rally over 1%. Europe’s Stoxx 600 is giving

back yesterday’s...

Read More »

Read More »

Euro Tests Parity

Equities remain under pressure as investors contemplate tighter financial conditions and the risks of recession. Most of the large equity markets in the Asia Pacific region sold-off, led by a 2.7% drop in Taiwan.

Read More »

Read More »

The Greenback Bounces Back

Overview: After modest US equity gains yesterday, the weaker yen and Beijing’s approval of 60 new video games helped lift most of the large markets in the Asia Pacific region.

Read More »

Read More »

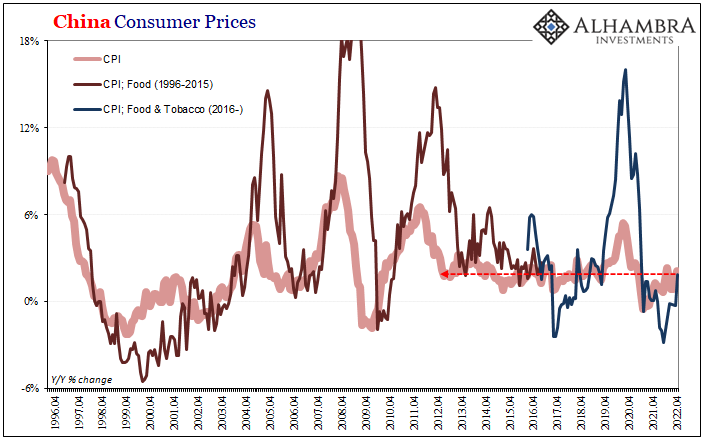

Synchronizing Chinese Prices (and consequences)

It isn’t just the vast difference between Chinese consumer prices and those in the US or Europe, China’s CPI has been categorically distinct from China’s PPI, too. That distance hints at the real problem which the whole is just now beginning to confront, having been lulled into an inflationary illusion made up from all these things.

Read More »

Read More »

Fed Day

Overview: The markets are mostly treading water ahead of the FOMC decision later today. Tech stocks tumbled in Hong Kong and the Hang Seng fell a little more than 1%, while India was the worst performer in the region falling over 2% following an unexpected and intra-meeting hike by the Reserve Bank of India.

Read More »

Read More »

So Much Fragile *Cannot* Be Random Deflationary Coincidences

At first glance, or first exposure to this, there doesn’t seem to be any reason why all these so many pieces could be related. Outwardly, from the mainstream perspective, anyway, you’d think them random, and even if somehow correlated they’re supposed to be in the opposite way from what’s happened.

Read More »

Read More »

Markets Calmer, Awaiting Fresh Incentives

Overview: The capital markets are calmer today, and the fear that was evident at the end of last week remains mostly scar tissue. Led by gains in Japan, China, Australia, New Zealand, and India, the MSCI Asia Pacific Index extended yesterday's gains. Europe's Stoxx and US futures are firm. The US 10-year yield is softer, around 1.43%, while European yields are mostly 1-2 bp lower. The Norwegian krone and euro lead major currencies higher...

Read More »

Read More »

FX Daily, June 04: US and Canada Report on Jobs as G7 Fin Mins Talk Taxes

Stronger than expected US employment data, ahead of today's monthly report and compromise proposal on corporate tax by the White House to help secure a deal on infrastructure sent US bond yields and the dollar high. Late dollar shorts were forced to cover.

Read More »

Read More »

FX Daily, April 26: Big Week Begins Quietly, with the Greenback Still Under Pressure

Overview: What promises to be a notable week has begun off quietly: the US, EMU, and South Korea report Q1 GDP. The eurozone also provides its first estimate of April inflation. Corporate earnings feature tech and financial firms. Equities are mostly firmer in the Asia Pacific region and Europe.

Read More »

Read More »

FX Daily, February 05: Position Squaring Weighs on the Dollar Ahead of the Jobs Report

Overview: While equities continue to march higher, the dollar is softer amid position squaring ahead of the US jobs data. Gold has stabilized after yesterday's shellacking. Estimates for US nonfarm payrolls appear to have been creeping higher, encouraged by the ADP, PMI, and weekly initial jobless claims.

Read More »

Read More »

FX Daily, August 06: Markets Consolidate

The Australian dollar powered to marginal news highs for the year as the move against the US dollar continued yesterday. The euro stopped a few hundredths of a cent below the high seen at the end of last week. However, neither sustained the upside momentum and have come back offered today.

Read More »

Read More »

FX Daily, July 28: Dollar Bounces, Gold Slips, while Equities Hold Their Own

The main development in the capital markets today is the firmer dollar against nearly all the major and emerging market currencies. Among the majors, the New Zealand dollar and Swedish krona are the heaviest (~-0.4%), while the Swiss franc and yen are marginally lower.

Read More »

Read More »