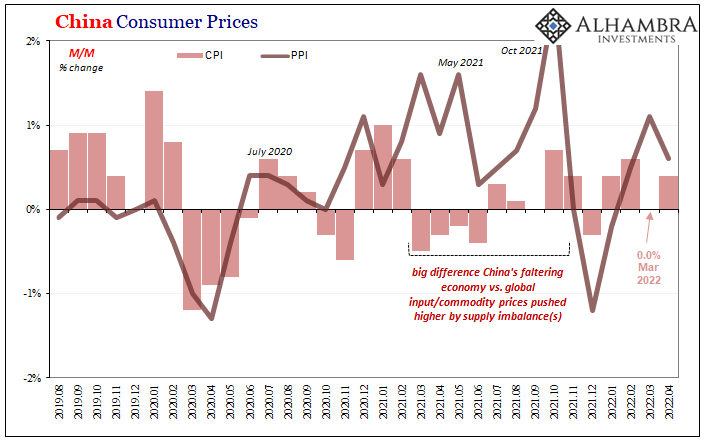

| It isn’t just the vast difference between Chinese consumer prices and those in the US or Europe, China’s CPI has been categorically distinct from China’s PPI, too. That distance hints at the real problem which the whole is just now beginning to confront, having been lulled into an inflationary illusion made up from all these things.

To start with, yesterday China’s NBS reported the index for its consumer prices rose 2.1% year-over-year in April 2022. That’s up from 1.5% year-over-year in March, but on the basis of base effects and a rebound (from falling) in food prices. This rate is indistinguishable from pretty much every other month since China like the rest of the world dropped off in 2012. |

|

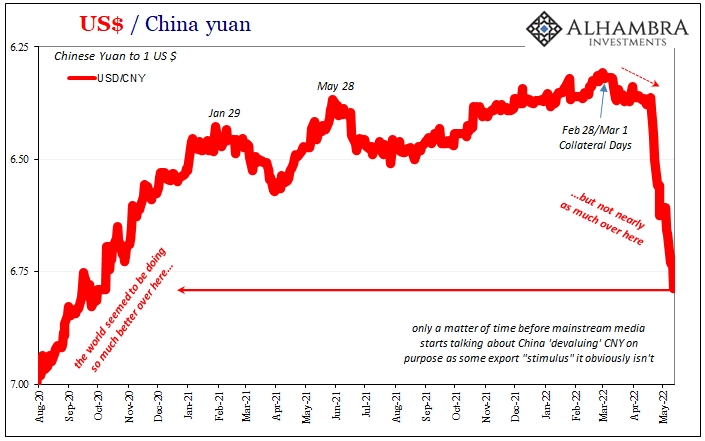

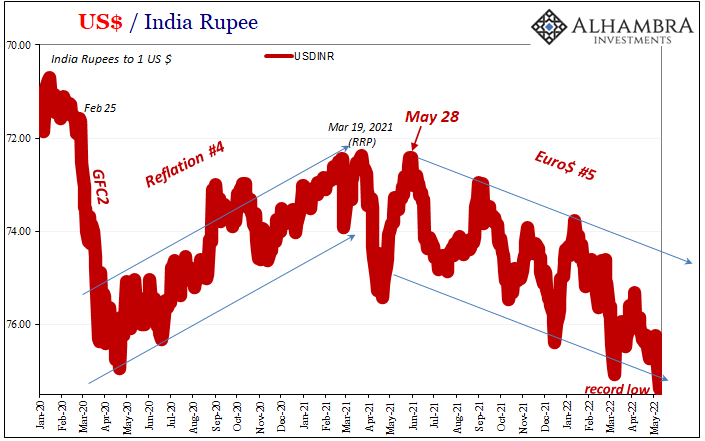

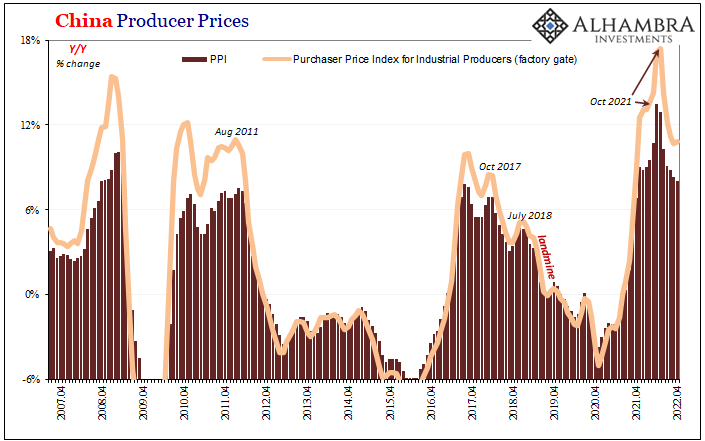

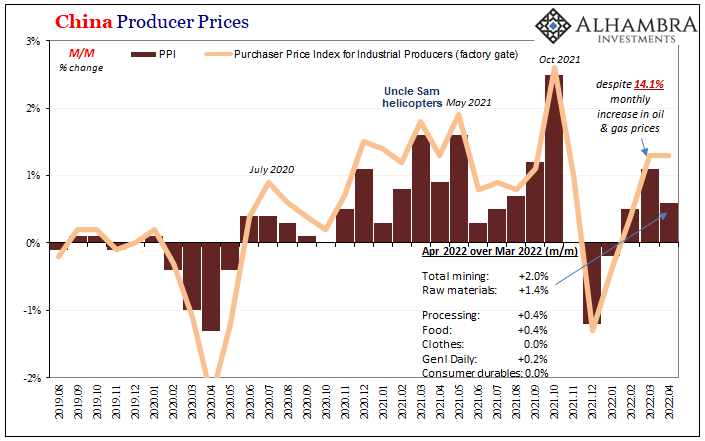

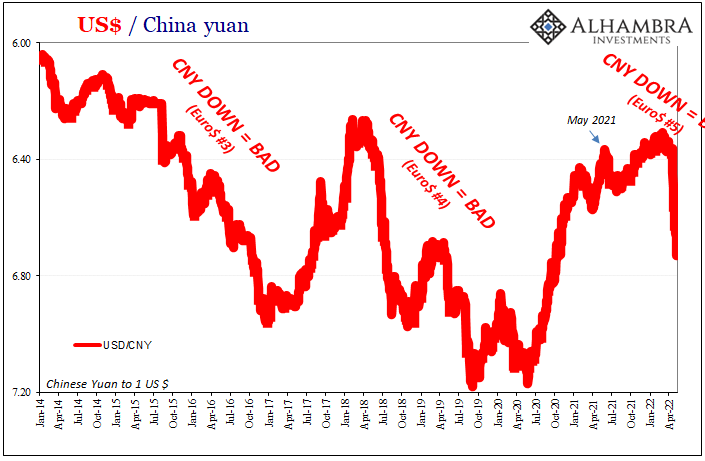

| Yet, with consumer prices so well behaved, downright tame compared to those across America and for people in Europe, it is China’s currency which is currently being destroyed. This apparent textbook “discrepancy” relates instead to what’s really going on, and why price data has been so distinct there.Producer prices, represented by the NBS PPI, continue to decelerate as they have since last October – a month that continues to show up across data and markets worldwide. The April figure for producer prices was 8.0% year-over-year, slower than 8.3% for March, the sixth straight decline (the annual change in factory gate prices did tick higher by 0.1 pts in April).

Like the falling yuan, decelerating producer prices have been consistently related to global downturns. |

|

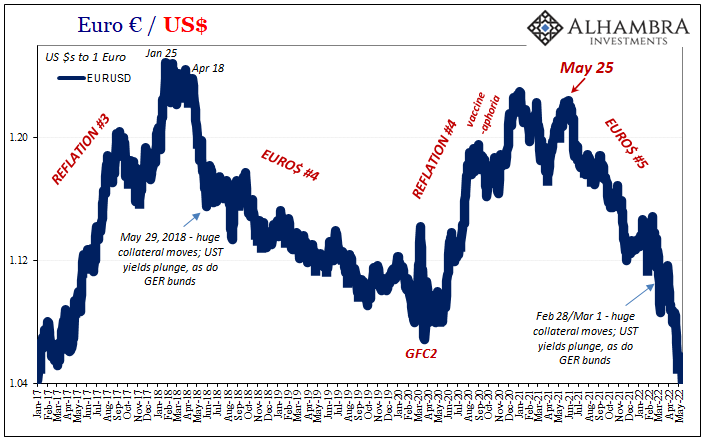

| Each of these a product of, as well as reinforcing for, Euro$ #5. | |

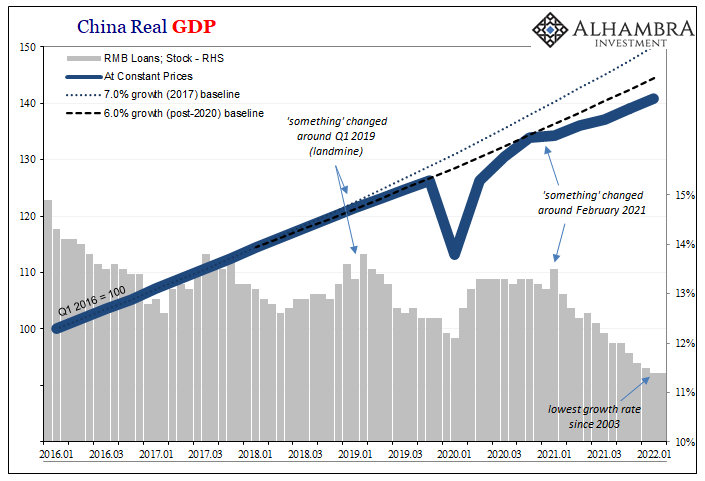

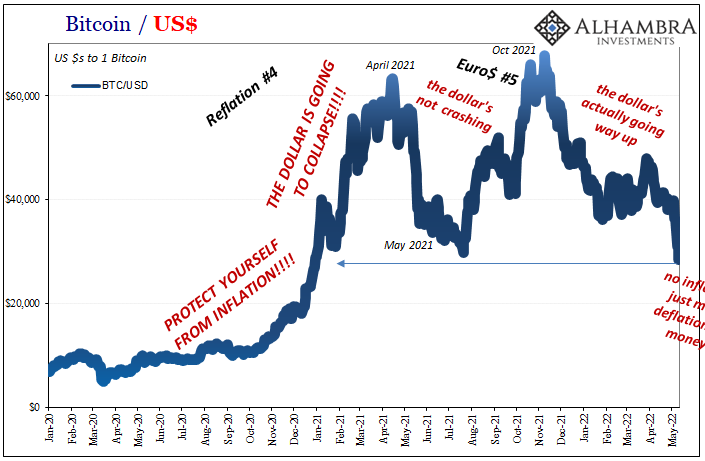

| And much of it can be traced back to how China’s economy never really recovered from its 2020 downturn/recession. That rather than inflation was the result in its CPI, whereas producer prices like the previously higher yuan were representative of nothing more than reflation (#4).

It was a reflationary period unlike the prior three in only that one respect; commodity and input prices which accelerated not from money rather from supply/demand imbalances. Since China’s economy and consumers weren’t really caught up in those, its CPI remained so timid compared to America’s and Europe’s. |

|

| Now, however, the Chinese PPI like CNY pictures the future while the US CPI as Europe’s HICP each are looking back at last year’s illusion. | |

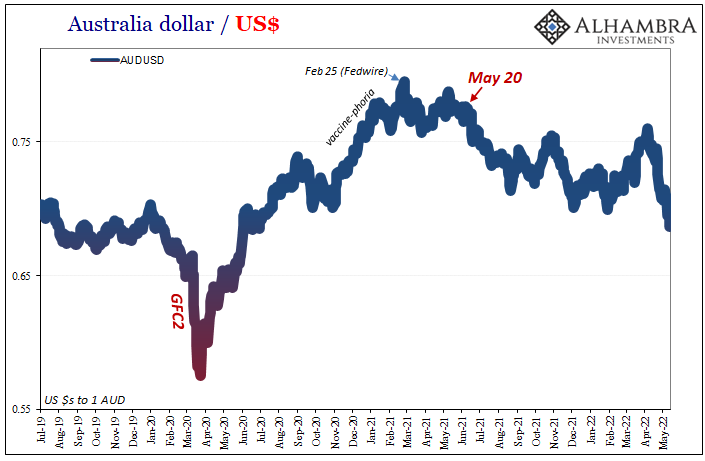

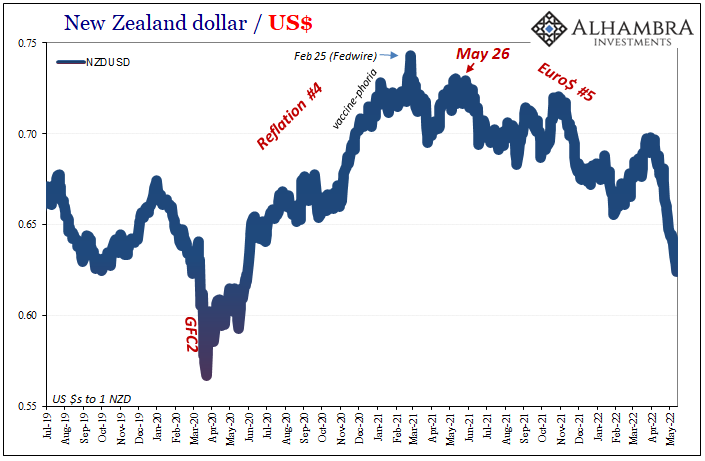

| The entire global system has been more thoroughly recognizing this arrangement and increasingly synchronized direction. That’s why, for one, it isn’t just one currency or another currently being wrecked by the rising dollar (as it isn’t the dollar going up against them that is doing the wrecking, instead the various eurodollar reasons, including severe collateral constraints, which makes the dollar’s upward movement so financially and economically deadly).

Even those which, to some extent, had been sheltered by the commodity mismatch have, like many commodities themselves, succumbed to these increasingly obvious pressures and negative possibilities. |

|

| While the euro drops closer and closer to parity with the dollar, first time in more than half a decade, the Aussie dollar moves down, too. | |

| As has New Zealand’s currency despite that country’s central bank being at the forefront of this current wave of “hawkishness” predicated on various national officials still believing in the price illusion. For each NZD which is quite sensitive to Chinese conditions, there’s an Indian rupee which stands, meaning falls, on its own.

Meaning Euro$ #5. To many, the great question insofar as China is concerned is how its government will respond. Many if not the vast majority of Western observers continue to believe (maybe it’s nothing more than hope?) Xi’s gang is going to bring out the big guns any day now. |

|

| The truth is, Mao Xi already has, figuratively speaking, and is maneuvering in a more literal sense, too.

In fact, those two mainstream media headlines below merely demonstrate cause and effect. You can see it in Chinese prices, including, now, the price of yuan not against the dollar, not really, up against, for the fifth time, the eurodollar. It is, as always, the eurodollar’s world. We are all, including Xi, just trying to live in it.

CNY DOWN… …EQUALS BAD |

|

Tags: $CNY,Australia,China,Consumer Prices,currencies,dollar,economy,Euro,Europe,Featured,Federal Reserve/Monetary Policy,India,inflation,Markets,New Zealand,newsletter,producer prices,yuan