Tag Archive: $CNY

Greenback Consolidates Last Week’s Surge

Overview: After surging at the end of last week, the

dollar is consolidating today. Stepped up verbal intervention by Japan's

currency chief Kanda and a slightly weaker dollar fix by the PBOC seemed to

take the wind from the dollar sails. Except for the Swiss franc and Swedish

krona, the G10 currencies are showing a slightly firmer tone. Emerging market

currencies are mixed, with central European currencies leading the advancers.

The Taiwanese...

Read More »

Read More »

Key Chart Points Hold and the Dollar’s Rally Stalls Ahead of the Weekend

Overview: Hawkish comments from Fed officials and the first

decline in continuing unemployment claims below 1.8 mln in two months boosted

US rates and the odds of a June rate hike rose to about 37%. This represents a

near tripling of the probability in the past week. It has been a trend with the

odds rising in 9 of the past 11 sessions. The two-year note yield has risen for

the past five sessions coming into today for a cumulative gain of about 35...

Read More »

Read More »

Hawkish ECB Comments Boost Risk of a 50 bp Hike Next Month

Overview: The 0.5% decline in US March producer

prices pushed on the door opened by the softer-than-expected CPI on Wednesday.

The Fed funds futures market sees the year end rate to a 4.33%, while still

pricing in a nearly 70% chance of a hike on May 3 to 5.25%. The dollar tumbled

to new lows for the year against the euro, sterling, and Swiss franc. The

Dollar Index made a new low for the year today, a few hundredths of an index

point below the low...

Read More »

Read More »

Dramatic Swing in Sentiment Extends the Greenback’s Rally

Overview: A series of strong US high-frequency

data points after a poor finish to last year has spurred a dramatic shift in

market expectations. And talk among a couple of (non-voting) FOMC members of a

50 bp hike has provided added fodder. The greenback is extending its recovery

today against all the major currencies, with the Australian and New Zealand

dollars hit the hardest. Emerging market currencies have also been knocked

back. This is part...

Read More »

Read More »

US CPI Featured and Why the Fed may Still Hike by 50 bp

The most important economic report in the week ahead is the US December Consumer Price Index on January 12. To be sure, the Federal Reserve targets an alternative measure, the deflator of personal consumption expenditures. However, in this cycle, when households, businesses, investors, and policymakers are particularly sensitive to inflation, CPI, which is reported a couple of weeks before the PCE deflator, has stolen the thunder.

Read More »

Read More »

USD Stretched Ahead of Employment Report, while Yuan Jumps on Hopes of New Property Initiatives

Overview: The US dollar extended yesterday's gains

as the market adjusts positions ahead of the jobs data. Yesterday and today's

price action looks to have strengthened the near-term technical outlook for the

greenback. However, the intraday momentum indicators are stretched. This warns

of the risk of a counter-intuitive move after the data, barring a significant

surprise. Meanwhile, one of the Fed's leading hawkish voices, St. Louis Fed

President...

Read More »

Read More »

The Yen and Yuan Continue to Weaken

While the US dollar appears to be consolidating its recent gains, the Japanese yen and Chinese yuan remain under pressure. Officials seem more concerned about the pace of the move than the level it has reached. New and large fiscal initiatives that the new UK government has floated has failed to change sentiment toward sterling, which is the second weakest major currency today after the Japanese yen.

Read More »

Read More »

Turn Around Tuesday Began Yesterday, Likely Ends before Wednesday

Corrective pressures were evident yesterday and they extended today in Asia and Europe but seem to be running their course now. Market participants should view these developments as countertrend and be wary of waning risk appetites in North America today.

Read More »

Read More »

Dollar Longs Pared as Jackson Hole Gathering is set to Start

Overview: It seems that many market participants had

the same thing in mind, cut dollar longs before the Jackson Hole gathering. The

Antipodeans lead the majors move, encouraged perhaps by China’s new economic

measures, with around a 1% gain. The euro and sterling are up about 0.35% and

are the laggards. Emerging market currencies are higher as well, with the

notable exception of India and Turkey, which are nursing small losses. Equities

are having...

Read More »

Read More »

Wait A Sec, That’s Not Really An *RMB* Liquidity Pool…

Ben Bernanke once admitted how the job of the post-truth “central banker” is to try to convince the market to do your work for you. What he didn’t say was that this was the only prayer officials had for any success. Because if the market ever decided that talk wasn’t enough, only real money in hand would do, everyone’d be screwed.

Read More »

Read More »

Angry April TIC Zeroed In On China’s CNY and Japan’s JPY

If the March gasoline/oil spike hit a weak global economy really hard and caused what more and more looks like a recessionary shock, a(n un)healthy part of it was the acceleration of Euro$ #5 concurrently rippling through the global reserve system.

Read More »

Read More »

Follow China’s True Line

It’s a broken a record, the macro stylus stuck unable to move on, just skipping and repeating the same spot on the vinyl. Since Xi Jinping’s lockdowns broke it, as it’s said, when Xi is satisfied there’s zero COVID he’ll release the restrictions and that will fix everything. The economy will go right back to good, like flipping a switch.

Read More »

Read More »

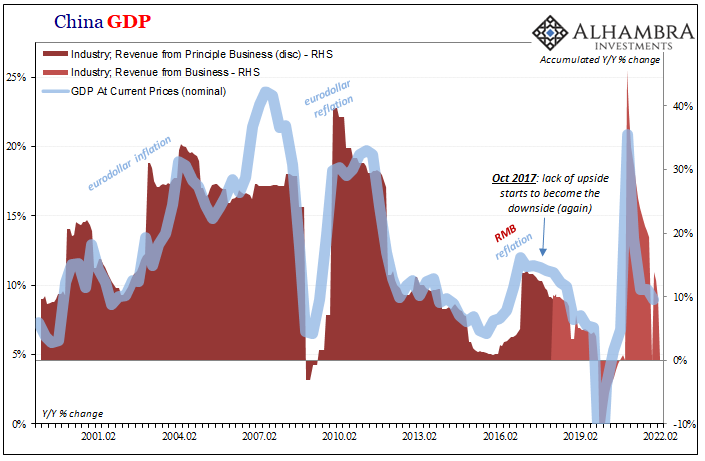

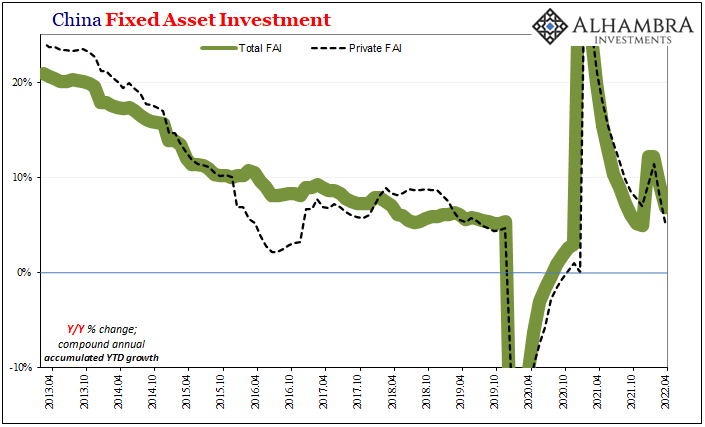

Synchronized Not Coronavirus

There is an understandable tendency to just write off this weekend’s disastrous Chinese data as nothing more than pandemic politics. After all, it has been Emperor Xi’s harsh lockdowns spreading like wildfire across China rather than any disease (why it has been this way, that’s another Mao-tter).

Read More »

Read More »

Synchronizing Chinese Prices (and consequences)

It isn’t just the vast difference between Chinese consumer prices and those in the US or Europe, China’s CPI has been categorically distinct from China’s PPI, too. That distance hints at the real problem which the whole is just now beginning to confront, having been lulled into an inflationary illusion made up from all these things.

Read More »

Read More »

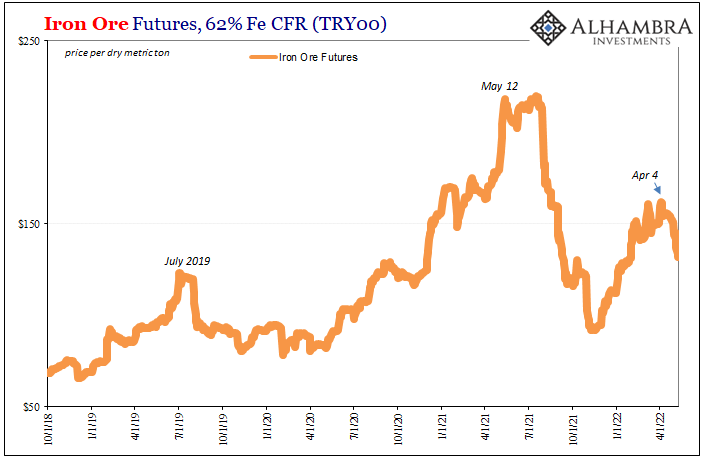

Industrial Synchronized Demand

Are the industrial commodities starting to get a whiff of demand side rejection? Short run trends suggest that this could be the case. From copper to iron and the highest (formerly) of the high flyers, aluminum, this particular group has been exhibiting a rather synchronized setback going back to the end of March, start of April.

Read More »

Read More »

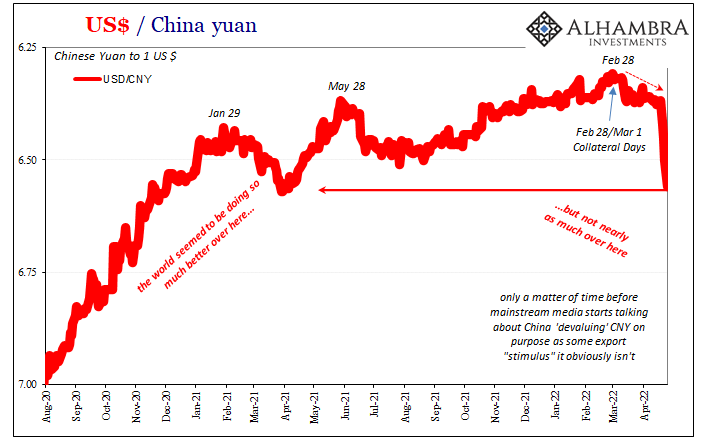

CNY’s Drop Wasn’t ‘Devaluation’ in ’15 nor ’18, and It Isn’t ‘Devaluation’ Now

For one thing, that whole Bretton Woods 3 thing is really off to an interesting start. And by interesting, I mean predictably backward. According to its loud and leading proponent, China’s yuan was supposed to be ascending while the dollar sank, its first step toward what many still claim will end up in some biblical-like abyss.

Read More »

Read More »

The (less) Dollars Behind Xi’s Shanghai of Shanghai

What everyone is saying, because it’s convenient, is that China’s zero-COVID policies are going to harm the economy. No. Economic harm of the past is the reason for the zero-COVID policies. As I showed yesterday, the cracking down didn’t just show up around 2020, begun right out in the open years beforehand, born from the scattering ashes of globally synchronized growth.

Read More »

Read More »

China More and More Beyond ‘Inflation’

If only the rest of the world could have such problems. Chinese consumer prices were flat from February 2022 to March, even though gasoline and energy costs predictably skyrocketed. According to China’s NBS, gas was up 7.2% month-over-month while diesel costs on average gained 7.8%.

Read More »

Read More »

PBOC Trim Reserve Requirements: Delilvers Wet Noodle after Earlier Disappointment

After posting the daily analysis, the PBOC announced a 25 bp cut in required reserves. This is said to free up around CNY530 bln or around $83 bln. It may help explain the failure to cut the benchmark Medium-Term Lending Facility. Some rural banks may see a 50 bp cut in reserve requirements.

Read More »

Read More »

US Jobs, EMU CPI, Japan’s Tankan, and China’s PMI Highlight the Week Ahead

This year was supposed to be about the easing of the pandemic and the normalization of policy. Instead, Russia's invasion of Ukraine threw a wrench in the macroeconomic forecasts as St. Peter’s victories broke the brackets of the NCAA basketball championship pools.

Read More »

Read More »