There is an understandable tendency to just write off this weekend’s disastrous Chinese data as nothing more than pandemic politics. After all, it has been Emperor Xi’s harsh lockdowns spreading like wildfire across China rather than any disease (why it has been this way, that’s another Mao-tter). Open the cities back up, as many are doing right now, the world goes right back to normal.

That’s the thought and engrained expectation.

Except, we heard this all the time last year and this year is anything but back to normal. Early 2021’s winter’s wave. Delta-COVID summer. OMG Omicron. Close down whatever part of the global economy, it drops off, yet upon reopen it never quite gets all the way back let alone reaches normality.

It’s that underlying, or overlaying, trend which is shaping up the future of 2022 and beyond. And it’s becoming harder and harder to ignore in the one place the “inflation” illusion struck hardest: global shippers (who have been its chief beneficiaries).

Below comes from FreightWaves just last week before the China data dump:

Shanghai and Beijing Zero-COVID are the reasons why the Chinese Big Three fell as hard as they did, yet those declines only add more negative pressures to an economy already facing what Economists are always quick to call “headwinds.” |

|

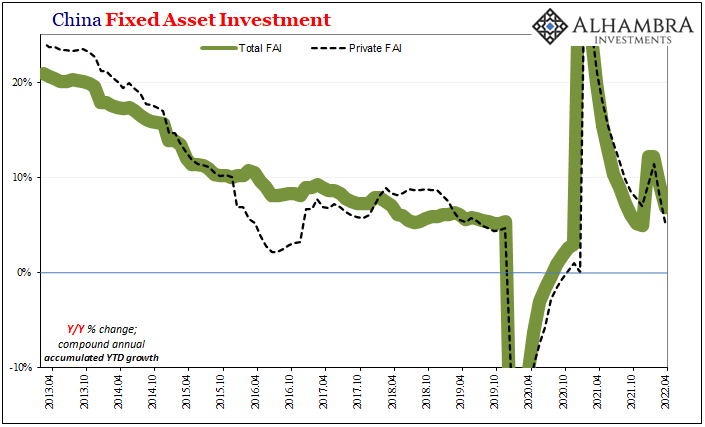

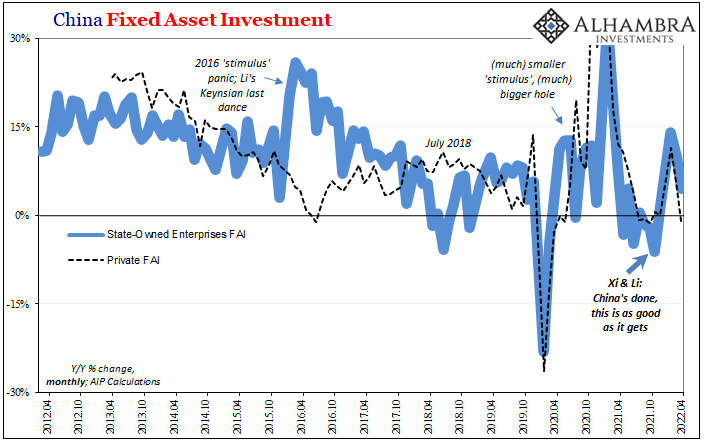

| You can see those “headwinds” independent of various and temporary lockdowns. One clear example of them is Fixed Asset Investment. While the April 2022 estimate was a YTD increase (accumulated) of 6.3%, that was down from March’s 9.3% and January/February 12.2%. On a chained monthly basis, FAI overall actually fell 0.82% during April when compared to March, which is consistent with city-scale quarantines. | |

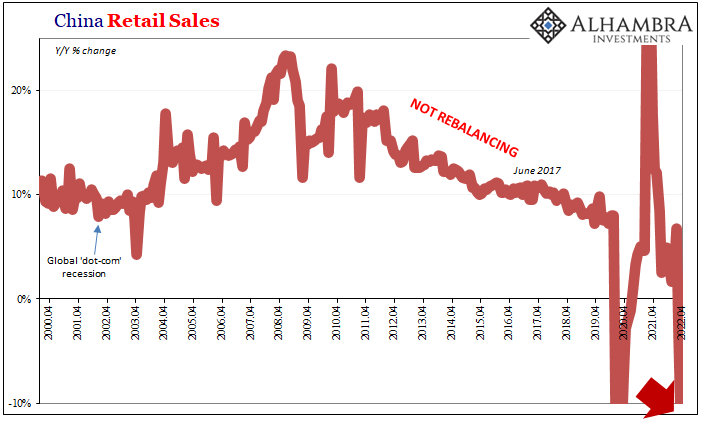

| And while that’s true, true weakness in FAI dates back to last November (pictured immediately above). Might these COVID politics be a way to mask China’s economic weakness as its economy no longer “benefits” from heavy real estate “investment” (Evergrande) as in the past?Everyone is told to put these awful economic numbers into the context of the ongoing struggle against the pandemic, therefore, upon reopening, filling in the blanks, reopening means normal. If it isn’t the pandemic rather real estate, the latter would better explain why, moving beyond FAI, Chinese retail sales haven’t come anywhere close to recovery – regardless of their massive April decline (-11.1% y/y). | |

| China’s consumers have been the clear laggard for long before last month. Retail sales continue to drop further and further behind even 2019’s already-harmful trend, only more so each month when some or any lockdowns are present. | |

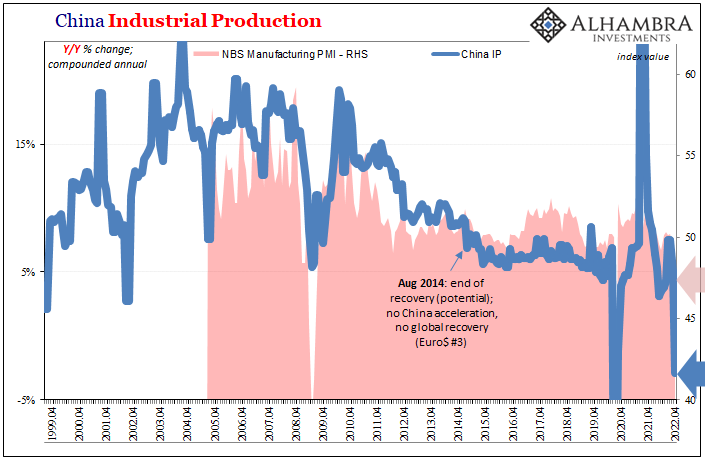

| As far as external demand for what China makes, or used to, Industrial Production in April also fell, declining 2.9% when compared to output in April 2021. While an enormous decline, second-worst in modern Chinese history, behind only January-February 2020, again, it’s the preceding trend which better paints the bigger picture.

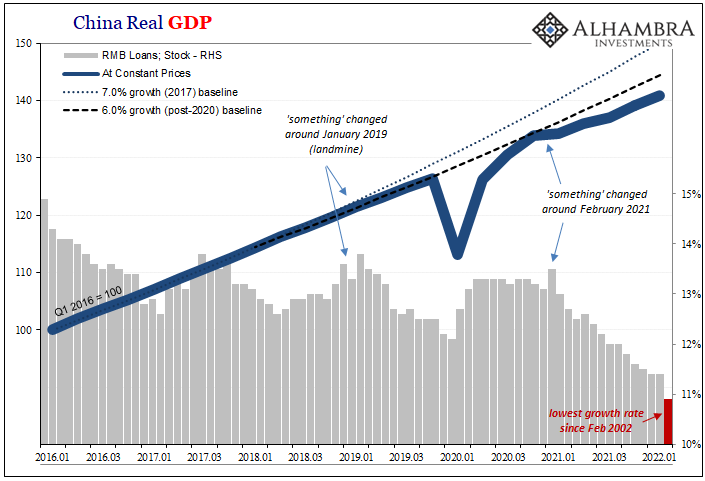

Maybe the best example yet comes from another official dataset released last Friday. The People’s Bank of China’s Financial Statistics Report was everything you’d have expected from Euro$ #5 reaching into the Chinese economy and financial system. Total loans, both rmb and in foreign currencies, grew by 10.6% y/y also in April.While that sounds terrific given the huge minuses everywhere else in the real economy, 10.6% is the slowest rate of credit expansion in more than twenty years. Just rmb loans, the y/y rate dropped by half a percentage point March to April to also the worst in two decades. China’s economy, as you can see below, seems to be quite sensitive to second derivative changes in credit.

|

|

| Yes, lockdowns in April, but, again, this drop only adds to what has already been a prior trend in Chinese credit dating back more than a year.Household loans (in rmb) declined for the second month out of the previous three (April and February), the first time that’s ever happened and not a very good sign insofar as the real estate situation may be concerned.

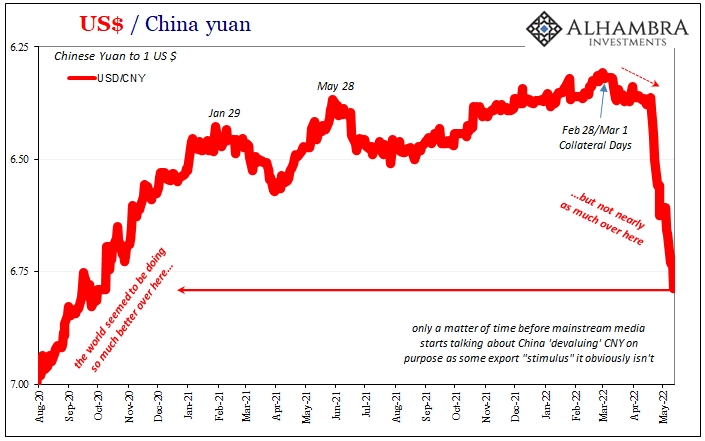

Foreign currency loans, though a small part of China’s credit system, this one’s only-too-consistent with Euro$ #5 and how over the past few months when CNY has collapsed that collapse isn’t “devaluation” but another headwind for a struggling China to face in the form of tightening global money (to then get transmitted to the rest of the world via the real economy contagion of fewer imports to China). |

|

| CNY DOWN = NO MORE $s. And that’s bad.

It was a calamitous weekend of Chinese data that doesn’t seem so bad if viewed through the COVID prism. And I think, in one important sense, that’s the point. If you’re Mao Xi, making economic woes appear as if the benevolent if harsh struggle against “natural” forces – while at the same time reinforcing the government’s authority – would be far more preferential than what’s really happening there. An economic situation beyond the control and efforts of authorities. While recession fears rise over here, how much of one might already be happening over there? And if that is the case, the keyword for the world going forward is synchronized, not coronavirus. |

Tags: $CNY,China,credit,currencies,economy,Featured,Federal Reserve/Monetary Policy,fixed asset investment,industrial production,Markets,newsletter,PBOC,Retail sales,Xi Jinping