Tag Archive: PBOC

Quiet Summer Tuesday with Powell’s Testimony and a Deluge of US Supply on Tap

Overview: In the absence of fresh developments, the dollar is consolidating in narrow ranges today against the G10 currencies and enjoys as slight upward bias against most emerging market currencies but for a few currencies from the Asia Pacific region. With practically an empty US data calendar, Fed Chair Powell's testimony with be the highlight, and a soft headline CPI on Thursday anticipated. The US two-year premium over Germany has fallen from...

Read More »

Read More »

China Equity Slump Continues, while Dollar Extends Consolidation

Overview: The foreign exchange market is quiet to

start the new week. As the North American session is about to begin, the dollar

is mostly +/- 0.10% against most of the G10 currencies. The Swedish krona is

the notable exception, rising about 0.25% against the US dollar amid good

demand for its bonds today. Emerging market currencies are mostly lower. The

Taiwanese dollar is the strongest in the complex so far today, rising about

0.30% against the...

Read More »

Read More »

Euro and Sterling Slump on Poor PMI

Overview: Poor European flash PMI pushed on open

door, giving the market a new reason to do what it was doing and that buying the

dollar. The euro has approached important support around $1.08 and sterling is

approaching the lower end of its two-cent trading range (~$1.26-$1.28). The

greenback is consolidating against the yen and holding above JPY145. The

Chinese yuan is little changed while the Mexican peso is extending yesterday's

gains. Despite...

Read More »

Read More »

Dollar Bulls Still in Control

Overview: What may have been hoped to be a quiet

August has turned into a feeding frenzy for dollar bulls as the contrasting

economic performance has spurred persistent buying of the greenback. Even

shallow dips have been bought. Today, it is mostly trading inside yesterday's ranges

against the G10 currencies. The PBOC set the dollar's reference rate at what

appears to be a record gap below the Bloomberg average survey, and the dollar

was scooped...

Read More »

Read More »

Surprise-Packed Tuesday: China Cut Rates, Japan’s Q2 GDP Rises Twice as Fast as Expected, and UK Wages Accelerate

Overview: Today's highlights include a surprise rate

cut from China after another series of disappointing data and much stronger

than expected Japanese Q2 GDP (6% annualized pace). The UK reported an

unexpected sharp jump in average weekly earnings, which were sufficient to get

renew speculation of a 50 bp hike by the Bank of England next month. The US

dollar is mixed. The Swedish krona and dollar-bloc currencies are struggling,

while the Swiss...

Read More »

Read More »

PBOC Sends Signal in Lower Dollar Fix, while the Canadian Dollar makes a 9-Month High

Overview: Hawkish comments by ECB President Lagarde

at the central bank symposium in Sintra and the PBOC's weaker dollar fix have weighed on the greenback today. It is lower against most of the G10 currencies,

but the Japanese yen and Norwegian krone. It also slipped to a new nine-month

low against the Canadian dollar. Emerging market currencies are also mostly firmer,

with the notable exceptions of the Russian rouble and beleaguered Turkish lira....

Read More »

Read More »

Fed Day: Skip = Hawkish Pause, but Market Says Finito

Overview: The year-end effective Fed funds rate

implied in the futures market is about 5.11%. The rate has been averaging 5.08%

since the Fed hiked rates last month The Fed may go to pains to explain that

the steady that to be announced later today is just a pause to get a better

read on the economy, the market favors this to be the end of the tightening

cycle. The dollar is trading softer against nearly all the G10 currencies. Emerging

market...

Read More »

Read More »

PBOC Surprise Rate Cut and a Strong UK Labor Market Report Ahead of US CPI

Overview: A surprise cut in China's seven-day repo

and a stronger than expected UK employment report are session's highlights

ahead of the US CPI. The base effect alone suggests a sharp fall in the

year-over-year rate, while the median forecast in Bloomberg's survey has been

shaved to a 0.1% month-over-month gain. The dollar is under pressure and is

weaker against nearly all the G10 currencies. It is mixed against the emerging

market currencies....

Read More »

Read More »

The Dollar Consolidates after Powell Sapped its Mojo

Overview: Federal Reserve Chair Powell's offered a

stronger case for a pause in the monetary tightening before the weekend and

this sapped the dollar's mojo. The greenback is mostly consolidating through

the European morning in quiet turnover. The JP Morgan Emerging Market Currency

Index is trying to snap a four-day decline. The South African rand is

recovering from its recent slide and is up nearly 1%. The South Korea won is

benefitting from...

Read More »

Read More »

Fragile Calm to End the Volatile Week even with the Quadruple Expirations

Overview: The support for First Republic Bank shown

by a consortium of US banks by shifting $30 bln of deposits is helping break

the financial anxiety that has gripped the market for more than a week. The

liquidity provisions for Credit Suisse by the Swiss National Bank also are

contributing to improved sentiment. The Fed's balance sheet expanded sharply

last week as the bridge banks were extended credit to help the unwind of SVB

and Signature...

Read More »

Read More »

Dollar Slumps, Yuan Rallies by Most this Year amid Intervention Talk

Overview: The US dollar is having one of toughest days of the year. It has been sold across the board and taken out key levels like parity in the euro, $1.15 in sterling, and CAD1.36. The Chinese yuan surged over 1%. Chinese officials promised healthy bond and stock markets.

Read More »

Read More »

Week Ahead: Focus Shifts away from the US after Robust Jobs Data and Stronger than Expected Inflation

The latest US employment and inflation figures are passed. The market is confident of a 75 bp rate hike next month. While a 50 bp in December is still the odds-on favorite, the market has a slight chance (~15%) of a 100 bp move instead after the robust jobs report and stronger-than-expected September CPI.

Read More »

Read More »

The Week Ahead: Dollar Bulls Still in Charge

The poor preliminary PMI readings, the ongoing European energy crisis, and the recognized commitment of most major central banks to rein in prices through tighter financial conditions are risking a broad recession. These considerations are weighing on sentiment and shaping the investment climate. Most high-frequency data due in the days ahead will not change this, even if they pose some headline risk.

Read More »

Read More »

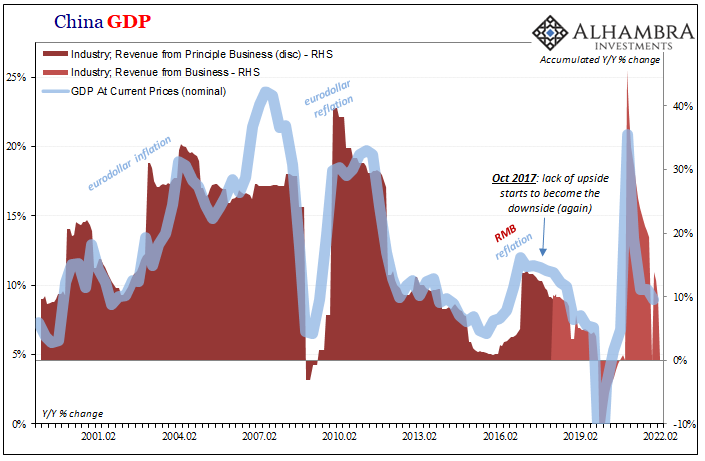

Wait A Sec, That’s Not Really An *RMB* Liquidity Pool…

Ben Bernanke once admitted how the job of the post-truth “central banker” is to try to convince the market to do your work for you. What he didn’t say was that this was the only prayer officials had for any success. Because if the market ever decided that talk wasn’t enough, only real money in hand would do, everyone’d be screwed.

Read More »

Read More »

Follow China’s True Line

It’s a broken a record, the macro stylus stuck unable to move on, just skipping and repeating the same spot on the vinyl. Since Xi Jinping’s lockdowns broke it, as it’s said, when Xi is satisfied there’s zero COVID he’ll release the restrictions and that will fix everything. The economy will go right back to good, like flipping a switch.

Read More »

Read More »

Synchronized Not Coronavirus

There is an understandable tendency to just write off this weekend’s disastrous Chinese data as nothing more than pandemic politics. After all, it has been Emperor Xi’s harsh lockdowns spreading like wildfire across China rather than any disease (why it has been this way, that’s another Mao-tter).

Read More »

Read More »

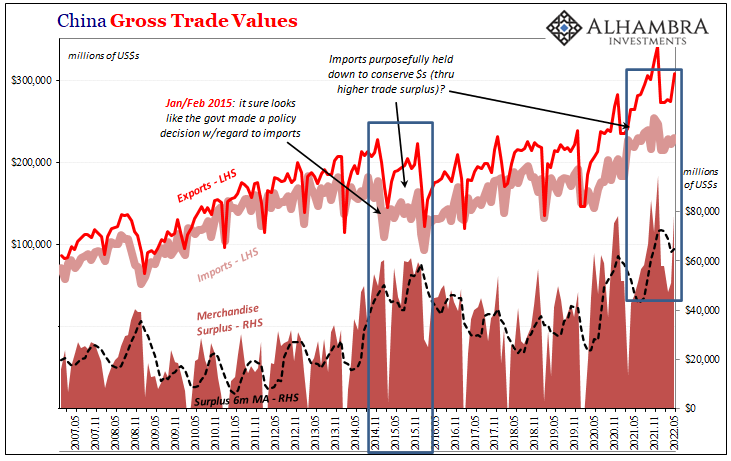

The (less) Dollars Behind Xi’s Shanghai of Shanghai

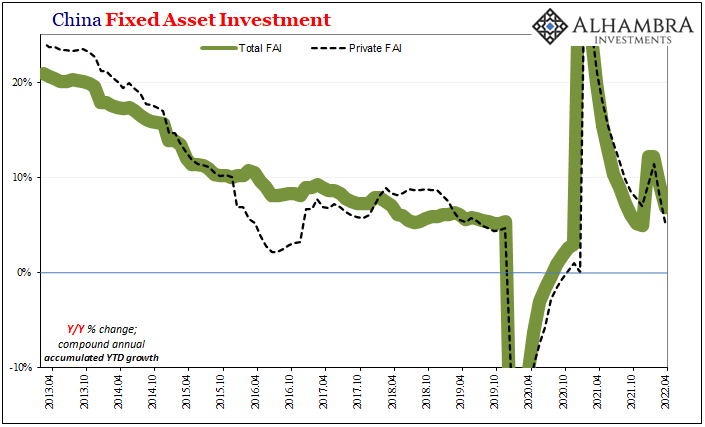

What everyone is saying, because it’s convenient, is that China’s zero-COVID policies are going to harm the economy. No. Economic harm of the past is the reason for the zero-COVID policies. As I showed yesterday, the cracking down didn’t just show up around 2020, begun right out in the open years beforehand, born from the scattering ashes of globally synchronized growth.

Read More »

Read More »

China More and More Beyond ‘Inflation’

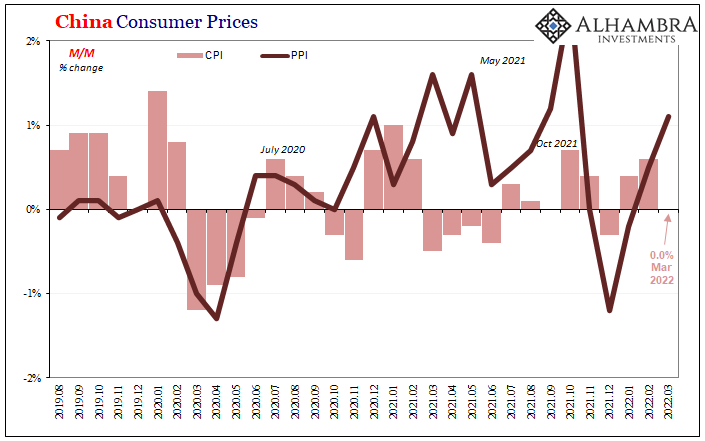

If only the rest of the world could have such problems. Chinese consumer prices were flat from February 2022 to March, even though gasoline and energy costs predictably skyrocketed. According to China’s NBS, gas was up 7.2% month-over-month while diesel costs on average gained 7.8%.

Read More »

Read More »

Goldilocks And The Three Central Banks

This isn’t going to be like the tale of Goldilocks, at least not how it’s usually told. There are three central banks, sure, call them bears if you wish, each pursuing a different set of fuzzy policies. One is clearly hot, the other quite cold, the final almost certainly won’t be “just right.” Rather, this one in the middle simply finds itself…in the middle of the other two.Running red-hot to the point of near-horror, that’s “our” Federal...

Read More »

Read More »

China’s Loan Results Back The PBOC Going The Opposite Way From The Fed

This week will almost certainly end up as a clash of competing interest rate policy views. Everyone knows about the Federal Reserve’s upcoming, the beginning of what is intended to be a determined inflation-fighting campaign for a US economy that American policymakers worry has been overheated.

Read More »

Read More »