Tag Archive: inflation

Market Takes JPY Lower Despite Intervention Speculation, While Sterling Shines

Overview: The dollar is mostly consolidating yesterday's CPI-inspired decline. The main features include the market bidding the US dollar back above JPY159 despite more speculation that the BOJ did in fact intervene yesterday and checked on the euro-yen cross in the local session today, and unexpectedly soft Swedish inflation, which the swaps market says could spur three rate cuts here in second half. A record trade surplus and strong aggregate...

Read More »

Read More »

Economic Freedom: The Cornerstone of Western Civilization

Share this article

Part I of II, by Claudio Grass

Western civilization – with all its scientific and technological progress, artistic prowess, philosophical and sociopolitical evolution, moral values, ethical principles and rich culture – took millennia to reach its famed “Enlightenment” point. It has been a rollercoaster, violently swinging from highs to lows and from darkness to light, from autocracy, tyranny and despotism to humanism and...

Read More »

Read More »

Nervous Calm Hangs over the Markets

Overview: San Francisco Federal Reserve President Daly spoke aloud what many are thinking. The US labor market may be at an inflection point. The four-week moving average of weekly jobless claims is at the highest since last September and the early call for July nonfarm payrolls is about 185k, which if true, would be a sub-200k reading for the second time in three months. The high-flying Nvidia has fallen 13% in the past three sessions coming into...

Read More »

Read More »

Self-Inflicted Wounds in Europe and Japan Help the Greenback Shrug Off the Drag of Lower Rates

Overview: The dollar is bid. What makes its

performance standout is that it is taking place as US rates have fallen. The US

10-year yield is near 4.20%, the lowest in more than two months. The two-year

yield is near 4.67%. It has fallen every session this week for a cumulative

decline of more than 20 bp. It is not so much that constructive developments

took week, but that Europe and Japan are suffering from self-inflicted injury. Macron's

call for...

Read More »

Read More »

Interview with Executive Global: “The Return of Marxism in the West”

Our special interview on Swiss Wealth Advisor with CLAUDIO GRASS, CEO and Independent Precious Metals Consultant, explores the manner in which astute investors may preserve wealth against the backdrop of debilitating central economic planning and monetary inflation.

Read More »

Read More »

Japan Confirms Intervention, China’s PMI Disappoints, EMU CPI Firms, Ahead of US PCE Deflator

Overview: The dollar is mostly consolidating

yesterday's losses ahead of month-end and the US income and consumption data. The

PCE core deflator may have risen by 0.2%, the least this, year, but the

year-over-year rate is expected to be steady at 2.8%. The dollar is recovering

from a five-day low against the yen recorded yesterday near JPY156.40 and is

near JPY157.30 in the late European morning turnover. The yen's retreat and a

disappointing...

Read More »

Read More »

Dollar Pulled Back in Europe. New Buying Opportunity?

Overview: The dollar initially extended yesterday's

North American recovery but unwound most of the gains in the European morning. As

North American dealers return, the greenback is lower against most of the G10

currencies. After approaching levels believed to have been where the BOJ last

intervened, profit-taking pushed the dollar back to a marginal new low for the

week (~JPY156.55). The yen's recovery arguably helped the Chinese yuan rise for

the...

Read More »

Read More »

Stocks and Bonds Retreat; Greenback Extends Recovery but Little Changed Ahead of North American Session

Overview: Stocks and bonds are lower today, and the

dollar is slightly firmer having extended yesterday's recovery. Most of the G10

currencies are lower, though the Japanese yen has recovered from after falling

to its lowest level since May 1. Slightly softer than expected German states'

CPI did the euro no favors. It was sold to a three-day low near $1.0830 before

stabilizing. Sterling steadied after dipping briefly below $1.2750. Most

emerging...

Read More »

Read More »

Saving in gold is the only reliable way to save

Share this article

For the longest time, according to conventional and widely embraced wisdom, all responsible and prudent members of society had to have a savings account. All those hardworking taxpayers and all those forward-thinking and sensible individuals that understand the importance of planning ahead, of being prepared for whatever the future holds and of securing a better life for their children, have traditionally been expected to put...

Read More »

Read More »

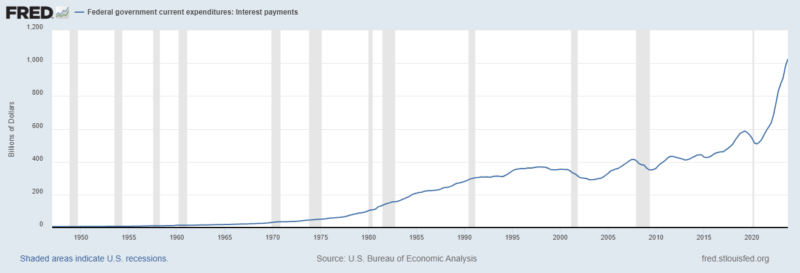

Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

Interest rates surged last week on the back of a hotter-than-expected inflation report that wasn’t actually that bad (see below). Not that my – or your – opinion about these things matters all that much to the market.

Read More »

Read More »

Is gold too expensive to buy right now?

Share this article

This question has been at the center of a great many conversations I’ve been recently having with clients and friends. The way I like to answer it is with another question: Expensive compared to what?

Despite its recent surge to record highs, there are compelling reasons why purchasing gold right now is a prudent decision, with strong indications that its value is poised to climb even higher. Making investment decisions...

Read More »

Read More »

Gold, Oil, and Interest Rates Rise

Overview: The market put more weight on the rise in

the US ISM manufacturing survey than the downward revision to the manufacturing

PMI and the unexpected back-to-back decline in construction spending. US rates

shot up and lifted the greenback. The Dollar Index made a new high for the

year, a little above 105, which had been anticipated by the new lows recorded

by the Bannockburn

World Currency Index (a GDP-weighted basket of the currencies of...

Read More »

Read More »

Dollar Extends Gains Against the Yen but Broadly Firmer Ahead of the FOMC

Overview: The US dollar remains bid ahead of the outcome of today's

FOMC meeting. No change in policy is expected, but the forward guidance, partly

delivered in the updated projections, is the focus. In the last iteration

(December), the Fed "dot" was for three rate cuts this year. Japanese

markets were closed for a national holiday today but dollar's gains against the

yen have been extended and the greenback is nearing the peak seen in...

Read More »

Read More »

Strong US Retail Sales may Help Extend the Dollar’s Recovery

Overview: We have put emphasis on today's US retail sales report. A recovery from the weather-induced weakness in January should underscore the resilience of US demand after another 200k jobs were created and personal income jumped 1%.

Read More »

Read More »

Forex Becalmed with the Greenback Mostly Firmer in Narrow Ranges

(Business trip will interrupt the commentary over the next few days. Check out the March monthly here. Back with the Week Ahead on March 9. May have some comments on X @marcmakingsense.) Overview: Outside of the Australian and New Zealand

dollars, which are off by 0.20%-0.25%, the other G10 currencies are little

changed and mostly softer in narrow ranges. A firm Tokyo CPI, mostly on base

effects and softer rates helped keep the US dollar below...

Read More »

Read More »

Yen Pops on BOJ Comments on Inflation, but the Dollar holds Most of Yesterday’s Gains against the other G10 Currencies

The dollar is mixed as the market awaits the US personal consumption expenditure deflator, which is the measure of inflation the Fed targets. While there is headline risk, we argue that the signal has already been generated by the CPI and PPI releases.

Read More »

Read More »

Japanese Officials Weigh-In and Help Yen Stabilize, while Euro and Sterling Extend Losses

Overview: The market's reaction to the firmer than expected

January CPI seems exaggerated. We do not think it was the game-changer for the

Federal Reserve that the market seemed to think. The dollar was driven higher,

and it is stabilizing today, though the euro and sterling extended their

losses, most of the other G10 currencies did not. After the yen's six-week

slide did not elicit a response from Japanese officials, yesterday's drop did,

and...

Read More »

Read More »

Sterling Buoyed by Labor Market Report Ahead of US CPI

Overview: The US dollar is enjoying a mostly firmer bias ahead

of today's CPI report. Sterling is the strongest among the G10 currencies after

a more resilient than expected labor market report. The dollar extended its

gains against the Japanese yen to a new high since last November, but the

market seems cautious as it approaches JPY150, where large options expire today.

On the other hand, emerging market currencies are mostly faring better. The...

Read More »

Read More »

US Tech Sell-Off Challenges Risk Appetites Ahead of the FOMC

Overview: Ahead of the US Treasury's quarterly

refunding announcement and the outcome of the FOMC meeting, the dollar is

trading higher against all the G10 currencies. With US high-flying tech stocks

posting steep losses after disappointing earnings reports, the currencies most

sensitive to risk-appetites, the dollar bloc and the Norwegian krone are the

weakest. Emerging market currencies are mixed. The South African rand,

Philippine peso, and...

Read More »

Read More »