Category Archive: 1) SNB and CHF

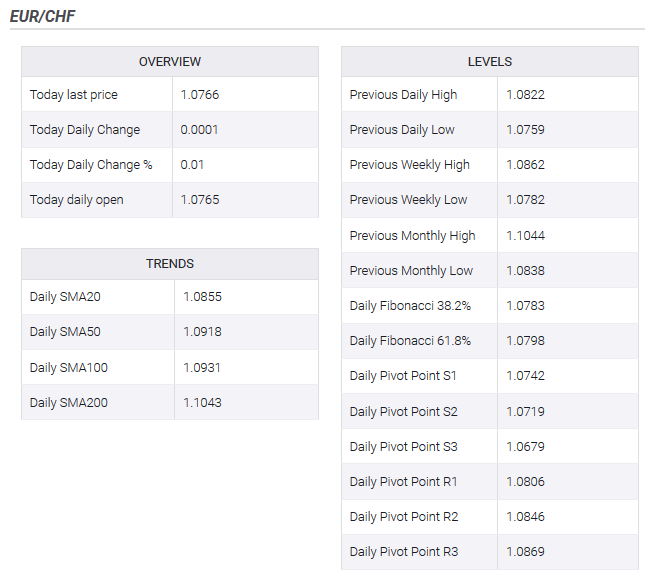

EUR/CHF Price Analysis: Attempting corrective bounce amid oversold conditions

EUR/CHF is looking oversold, as per key daily chart indicator. The hourly chart is reporting a triangle breakout. A corrective bounce to the 5-day average hurdle could be in the offing. EUR/CHF is looking to regain some poise from three-year lows reached on Wednesday.

Read More »

Read More »

Fünf Jahre Frankenschock – Wie der SNB-Negativzins die Schweizer Aktienkurse beeinflusst hat

Nicht eine, sondern zwei Massnahmen erschütterten am 15. Januar 2015 die Schweiz und die internationale Finanzwelt. Der unmittelbare Schock war die Aufhebung der Kursuntergrenze zum Euro, welche die Nationalbank seit 2011 bei 1,20 Franken verteidigt hatte.

Read More »

Read More »

EUR/CHF: Franc at 33-month high five years after SNB removed the cap

EUR/CHF is trading at 33-month lows near 1.0759. The US added Switzerland to its current manipulators' list. The SNB removed the cap on the euro on Jan. 15, 2015. Five years after the Swiss National Bank (SNB) shocked the financial markets by abandoning the euro cap, the Swiss Franc is trading at 33-month highs against the single currency.

Read More »

Read More »

US Treasury adds Swiss Franc back to its currency watch list – Bloomberg

The US Treasury on Monday added Swiss Franc (CHF) back to its currency watch list and urged Switzerland to adjust its macroeconomic policies to more forcefully support domestic economic activity, according to Bloomberg.

Read More »

Read More »

Immobilienfinanzierung – Was mit dem Saron auf Schweizer Hypothekarkunden zukommt

Nationalbank-Direktorin Andréa Maechler schimpfte letzten Monat ein bisschen mit den Banken: Die Finanzinstitute sollten bei der Vergabe ihrer Geldmarkthypotheken zügig damit anfangen, vom Referenzzinssatz Libor abzukehren. Denn der Libor – voll ausgeschrieben "London Interbank Offered Rate" – wird definitiv nur noch bis Ende 2021 erstellt.

Read More »

Read More »

Nationalbank stellt zusätzliche Ausschüttung in Aussicht

Dank der hohen Ausschüttungsreserve stellt die Nationalbank zusätzliche Ausschüttungen an Bund und Kantone in Aussicht.Die Schweizerische Nationalbank (SNB) wird für das Geschäftsjahr 2019 nach provisorischen Berechnungen einen Gewinn in der Grössenordnung von 49 Mrd. Franken ausweisen. Wie die SNB am Donnerstag mitteilte, entfiel der Löwenanteil des Gewinns mit rund 40 Mrd. Franken auf Fremdwährungspositionen.

Read More »

Read More »

SNB – Devisenreserven der Nationalbank sinken

Per Ende des Berichtsmonats lag der Wert der Devisenreserven bei 770,80 Milliarden Franken, nachdem es Ende November noch 782,95 Milliarden Franken gewesen waren. Der Gesamtbestand der Reserven (exkl. Gold) erreichte Ende Dezember 776,62 Milliarden nach 788,76 Milliarden Franken im Vormonat, wie die SNB am Donnerstag auf ihrer Internetseite mitteilte.

Read More »

Read More »

SNB – Nationalbank macht fast 50 Milliarden Franken Gewinn

Die Schweizerische Nationalbank (SNB) hat gemäss provisorischen Berechnungen im Geschäftsjahr 2019 einen Gewinn von rund 49 Milliarden Franken erzielt. Der Löwenanteil des Gewinns entfiel mit 40 Milliarden auf die Fremdwährungspositionen. Auf dem Goldbestand resultierte derweil ein Bewertungsgewinn von 6,9 Milliarden, und der Erfolg auf den Frankenpositionen (mehrheitlich Negativzinsen) belief sich auf rund 2 Milliarden Franken.

Read More »

Read More »

Hoher Gewinn der SNB weckt Begehrlichkeiten

Am nächsten Donnerstag publiziert die Schweizerische Nationalbank (SNB) ihr Finanzergebnis für das Jahr 2019. Sie dürfte gemäss den Berechnungen der UBS für das Gesamtjahr einen Gewinn von rund CHF 50 Mrd. erzielt haben, im Schlussquartal resultierte hingegen ein Verlust von rund CHF 1 Mrd. Bund und Kantone können mit einer Auszahlung von CHF 2 Mrd. rechnen.

Read More »

Read More »

Presseschau vom Wochenende 52 (28./29. Dezember)

NATIONALBANK: Die Schweizerische Nationalbank (SNB) dürfte gemäss Schätzung der SonntagsZeitung für das laufende Jahr einen Gewinn von gegen 50 Milliarden Franken ausweisen, nachdem 2018 noch ein Verlust von fast 15 Milliarden resultiert hatte. Für die ersten drei Quartale 2019 hatte die Nationalbank bereits einen Gewinn von 51,5 Milliarden Franken ausgewiesen, dies dank Wertsteigerungen auf den Anlagen als Folge sinkender Zinsen und steigender...

Read More »

Read More »

Grüne fordert Verteuerung von klimaschädigenden Investitionen

Die Grünenpolitikerin Greta Gysin (TI) hat einen Vorschlag zur Berücksichtigung von ökologischen Aspekten bei Investitionen unterbreitet. "Wir müssen die Kosten solcher Investments internalisieren", sagte sie dem "Tages-Anzeiger" vom Samstag.

Read More »

Read More »

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 12.12.2019

Mediengespräch - Conférence de presse - News conference - Conferenza stampa, 12.12.2019

00:00 Einleitende Bemerkungen von Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank - Remarques introductives de Thomas Jordan, président de la Direction générale de la Banque nationale suisse - Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank - Osservazioni introduttive di Thomas Jordan,...

Read More »

Read More »

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 12.12.2019

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 12.12.2019 00:00 Einleitende Bemerkungen von Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank – Remarques introductives de Thomas Jordan, président de la Direction générale de la Banque nationale suisse – Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National …

Read More »

Read More »

Crédit Suisse: la Finma nomme un chargé d’audit

samedi, 21 décembre 2019 Crédit Suisse: la Finma nomme un chargé d’audit | Sky Suisse Autos Le gendarme financier suisse veut «clarifier» des questions de gouvernance d'entreprise auprès de la banque, après l'affaire des dirigeants surveillés. #Sky_Suisse_Autos

Read More »

Read More »

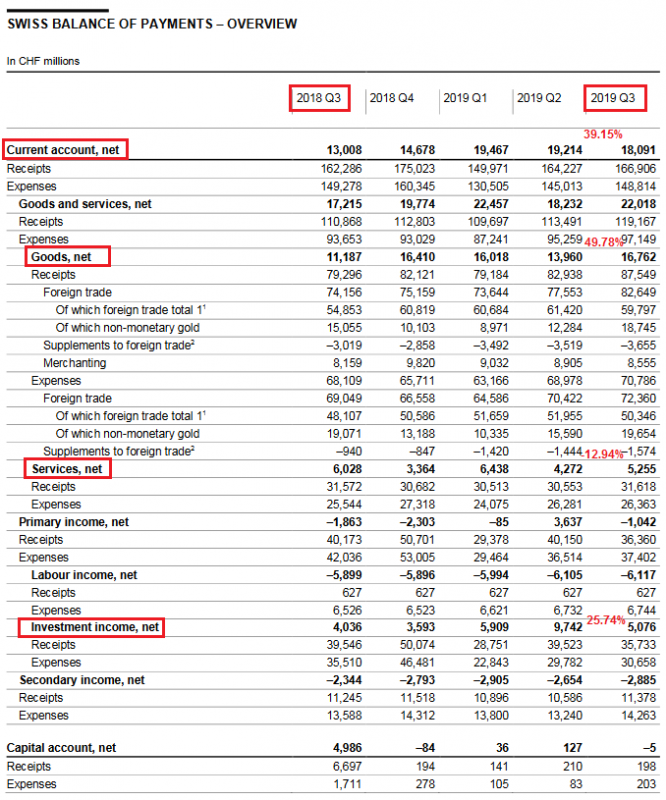

Swiss Balance of Payments and International Investment Position: Q3 2019

In summary: Nearly any change against the third quarter of 2018. About the same figures. But clearly and – as usual – a massive surplus. Key figures: Current Account: Up 39.15% against Q3/2018 to 18.09 bn. CHF. of which Goods Trade Balance: Plus 49.78% against Q3/2018 to 16.76 bn. of which the Services Balance: Minus 12.94% to 5.25 bn.

Read More »

Read More »

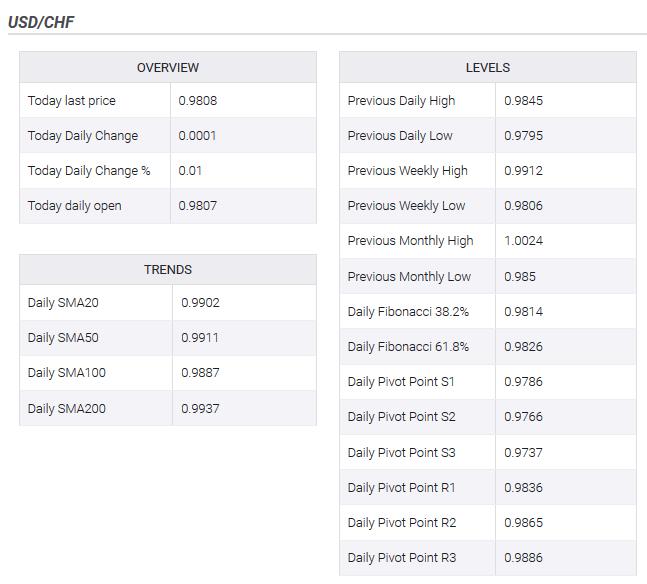

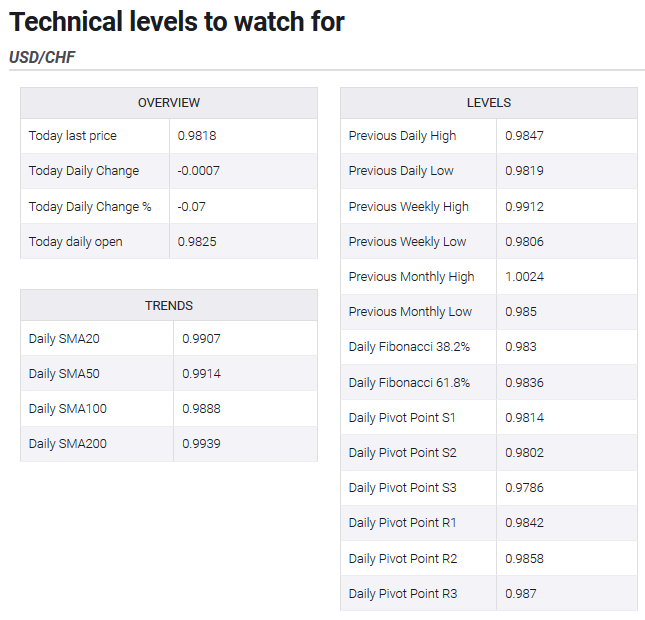

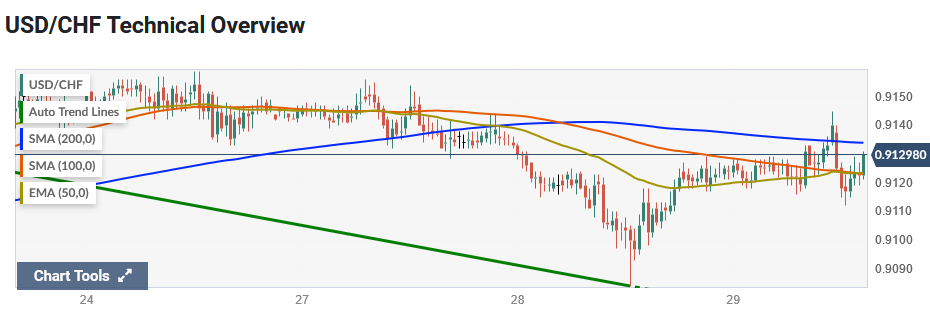

USD/CHF finds support near 0.9800 before SNB’s Quarterly Bulletin

Major European stocks post modest losses on Wednesday. US Dollar Index clings to gains above 97.30. Coming up: Swiss National Bank's (SNB) Quarterly Bulletin. The USD/CHF pair dropped to its lowest level since late August at 0.9798 on Wednesday but staged a technical recovery in the last hour. As of writing, the pair was up 0.05% on the day at 0.9808.

Read More »

Read More »

USD/CHF retreats to 0.9820 area as USD loses strength

US Dollar Index erases daily recovery gains ahead of American session. European equity indexes stay in the negative territory. Coming up: Building Permits, Housing Starts and Industrial Production data from US. The USD/CHF lost its traction in the last couple of hours and retraced its daily recovery gains pressured by the sour market mood and the broad USD weakness.

Read More »

Read More »

Nationalbank ist vom Nutzen der Negativzinsen überzeugt

Die SNB hält am negativen Leitzins von −0,75% unverändert fest.Die Schweizerische Nationalbank (SNB) belässt den Leitzins und den Zins auf Sichtguthaben bei der SNB unverändert bei -0,75%, wie sie an ihrer geldpolitischen Lagebeurteilung am Donnerstag mitteilte. Sie ist weiterhin bereit, bei Bedarf am Devisenmarkt zu intervenieren und berücksichtigt dabei die gesamte Währungssituation.

Read More »

Read More »

Digitales Zentralbankgeld bringt laut Bundesrat gegenwärtig keinen Zusatznutzen

Der Bundesrat hat in einem am Freitag genehmigten Bericht Möglichkeiten, Chancen und Risiken eines Kryptofrankens oder e-Frankens analysieren lassen. Den Auftrag dazu hatte der Nationalrat mit der Überweisung eines Postulates von Cédric Wermuth (SP/AG) erteilt

Read More »

Read More »

Negativzinsen ab dem ersten Franken?

Seit fünf Jahren bittet die Schweizerische Nationalbank (SNB) hiesige Banken zur Kasse. Diese bezahlen auf Giroeinlagen ab einer bestimmten Höhe einen Negativzins von 0.75 Prozent. Die Banken belasten diesen «Strafzins» vermehrt Kunden mit hohen Bargeldbeständen - meist erst ab mehreren hunderttausend Franken.

Read More »

Read More »

-637147386339434788-800x347.png)

-638453232816314704.png)