Category Archive: 1) SNB and CHF

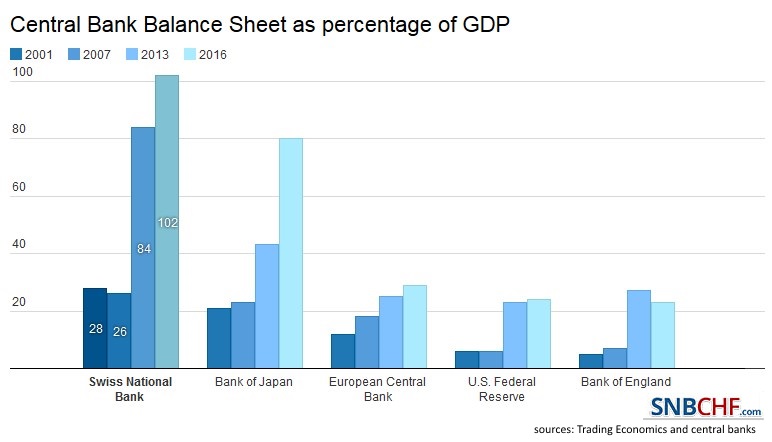

Why Switzerland’s franc is still strong in four charts

Swiss National Bank President Thomas Jordan keeps saying the franc is “significantly overvalued.” And that’s despite the central bank’s record-low deposit rate and occasional currency market interventions.

Read More »

Read More »

666: The Number Of Rate Cuts Since Lehman

BofA's Michael Hartnett points out something amusing, not to mention diabolical: following the rate cuts by the BoE & RBA this week, "global central banks have now cut rates 666 times since Lehman."

Read More »

Read More »

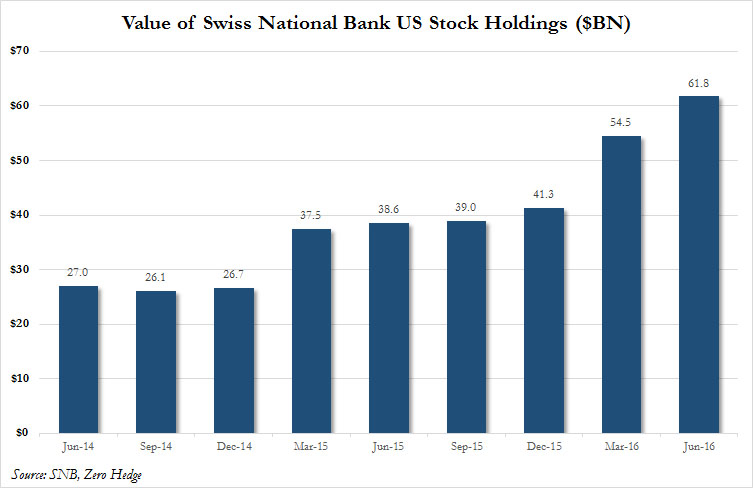

“Mystery” Buyer Revealed: Swiss National Bank’s US Stock Holdings Rose 50 percent In First Half, To Record $62BN

In a month, quarter and year, in which many have scratched their heads trying to answer just who is buying stocks, as both retail and smart money investors have been aggressively selling, yesterday we got the answer.

Read More »

Read More »

Swiss National Bank’s U.S. equity holdings hit record $61.8 billion last quarter

The value of the Swiss National Bank’s U.S. stock portfolio jumped to a record in June, helped by equity market gains. The holdings climbed to $61.8 billion from $54.5 billion at the end of March, according to calculations by Bloomberg based on the central bank’s regulatory filing to the U.S. Securities and Exchange Commission and published on Wednesday.

Read More »

Read More »

Switzerland has world’s priciest Big Macs. So eat Swiss chocolate instead.

The Economist invented the Big Mac index in 1986 as a tongue-in-cheek guide to currency valuations. Because the well-known burger is the same throughout much of the world, the magazine thought it could be used as a measure of how over or undervalued a currency was. An overpriced burger suggests an overvalued currency and a cheap one an undervalued currency.

Read More »

Read More »

Greenspan explains negative Swiss Yields

For Alan Greenspan, negative Yield Reflect Spread between Italian and Swiss Bonds. For him, bond prices in general have risen too much.

Read More »

Read More »

The relationship between CHF and gold

Many people think that Switzerland is related to gold due to its inflation-hedging safe-haven status. Historically this is true. With rising U.S. inflation in the 1970s gold appreciated to record-highs. So did the German Mark and even more the Swiss franc, that maintained low inflation levels.

Read More »

Read More »

CHF Price Movements: Correlations between CHF and the German Economy

A big part of Swiss consumption is imported from Germany. Therefore Swiss inflation is often correlated to German inflation. Capital flows often move to Switzerland and Germany at the same time.

Read More »

Read More »

Spiritus rector des kranken Bonussystems ist Oswald Grübel

97 Franken – das war der Kurs der CS-Aktie im Mai 2007. Vergangene Woche notierte die Aktie noch bei einem Zehntel. Bei einem solch dramatischen Kurszerfall muss die CS sich nicht wundern, wenn kritische Fragen gestellt werden. Weshalb beträgt der aktuelle Wert der CS-Titel nur noch rund die Hälfte des in der Bilanz ausgewiesenen? Besteht die Gefahr eines Konkurses der CS? Wer wird dieses Too Big To Fail-Institut allenfalls retten? Die SNB, der...

Read More »

Read More »

Swiss Franc Trade-Weighted Index, Performance Far Worse than Dollar Index

On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger.

Contrary to popular believe, the CHF index gained only 1.73% in 2015. It lost 9.52% in 2014, when the dollar strongly improved.

Read More »

Read More »

Im Goldlager – Dans les entrepôts – Inside the gold vault – Nel deposito aureo

Diese Filmsequenz gehört zum Thema “Alles über unser Geld” des Informationsangebots “Unsere Nationalbank”. Sie erlaubt einen Einblick ins Goldlager der Nationalbank. Ce film illustre le thème “Tout savoir sur l’argent” traité dans le cadre de “Notre Banque nationale”. Il permet de découvrir les locaux de stockage de l’or de la Banque nationale. This short film, …

Read More »

Read More »

Einblick in die GV 2016 – AG 2016 – Behind-the-scenes look at the 2016 GM – Uno sguardo all’AG 2016

Diese Filmsequenz gehört zum Thema “Das ist die Nationalbank” des Informationsangebots “Unsere Nationalbank”. Sie gibt einen Einblick in die Generalversammlung der Nationalbank. Ce film illustre le thème “A la découverte de la Banque nationale” traité dans le cadre de “Notre Banque nationale”. Il donne un bref aperçu de l’assemblée générale de la Banque nationale. This …

Read More »

Read More »

Die Nationalbank bei der geldpolitischen Lagebeurteilung (Mediengespräch vom Dezember 2015)

Diese Filmsequenz gehört zum Thema “Die Bedeutung der Preisstabilität” des Informationsangebots “Unsere Nationalbank” und zeigt die Verkündigung des geldpolitischen Entscheids durch Thomas Jordan, Präsident des Direktoriums, am 10. Dezember 2015.

Read More »

Read More »

Einblick ins Repogeschäft

Diese Filmsequenz gehört zum Thema “So wird die Geldpolitik umgesetzt” des Informationsangebots “Unsere Nationalbank”. Er zeigt, wie das Repogeschäft der Nationalbank funktioniert.

Read More »

Read More »

Bekräftigung des Mindestkurses (Mediengespräch vom Juni 2013)

Diese Filmsequenz gehört zum Fokusthema “Die Geschichte des Mindestkurses” des Informationsangebots “Unsere Nationalbank”. Sie zeigt die Verkündigung des geldpolitischen Entscheids während der Phase des Mindestkurses durch Thomas Jordan, Präsident des Direktoriums, am 20. Juni 2013.

Read More »

Read More »

SNB intervenes for 6.3 billion francs in one week, total 10bn Brexit intervention

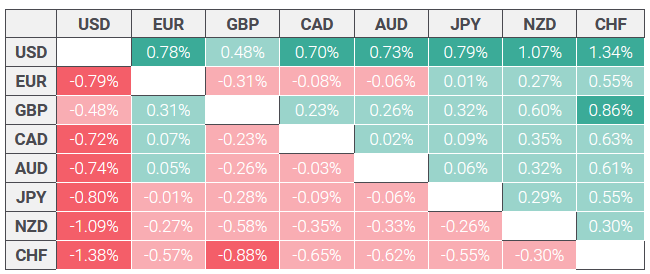

SNB intervenes for 6.3 bil francs in the week ending last Friday. Once again a record high since January 2015. The SNB raised the intervention level to 1.0850. Apparently conversion of GBP->CHF flows into GBP-> EUR flows – via EUR/CHF purchases. Speculators: are long CHF 10K contracts against USD versus 6.3K last week.

Read More »

Read More »

FT Alphaville Izabella Kaminska interviews Geoffrey Brian West.

FT Alphaville’s Izabella Kaminska interviews theoretical physicist Geoffrey Brian West 2016, Festival of Finance. Camp Alphaville.

Read More »

Read More »

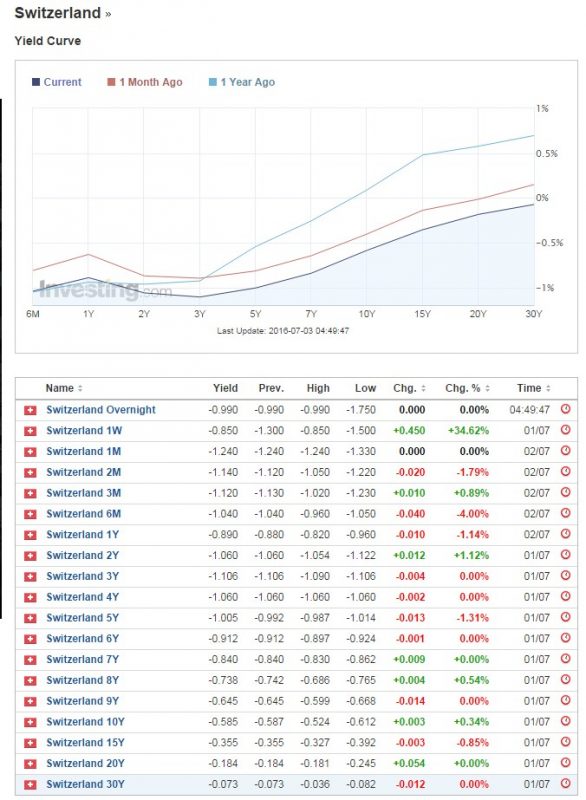

Swiss Bond Yields all Negative up to 30 years: Greatest Bubble in Financial History

Graham Summers says that central banks have lost control and investors are crazy. They pay the Swiss government for the right to own their bonds. One point is missing: Swiss rates are "more negative than others", because investors expect a slow appreciation of the Swiss franc.

Read More »

Read More »

-638453232816314704.png)