THE Swiss franc is a volatile currency that is fast becoming worthless. That, at least, is what some members of Switzerland’s right-wing People’s Party (SVP) would have you believe. Thanks to the SVP, Switzerland will vote on November 30th on a radical proposal to boost the central bank’s gold reserves. Bigger reserves, activists argue, will make the Swiss economy more stable and prosperous. In fact the opposite is true.

Read More »

Category Archive: 1) SNB and CHF

Keith Weiner: SNB Must Keep Euro over 1.20 To Avoid Losses of Swiss Banks

The recognized Austrian economist Keith Weiner and the Wall Street Journal argue that the SNB must keep the euro over 1.20 in order maintain stability in the Swiss banking system. A rapid appreciation of the franc would create losses on the balance sheet of Swiss banks.

Read More »

Read More »

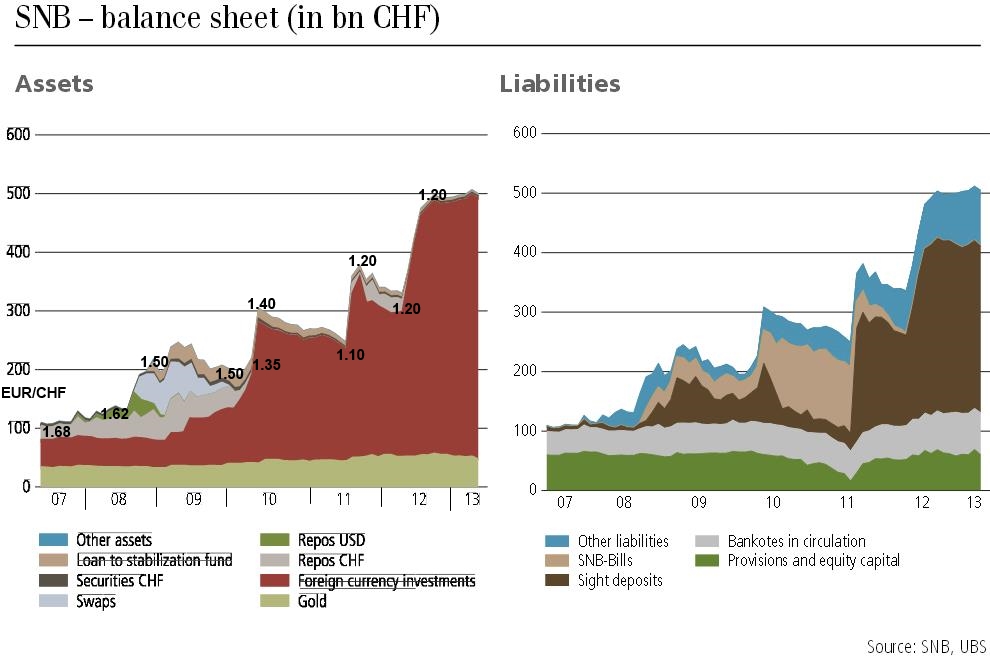

History of SNB Interventions

High inflows of around 400 billion francs between 2009 and 2012 in the Swiss balance of payments could only be countered with an increase in reserve assets and interventions by the Swiss National Bank. This number is far higher than the one seen during the collapse of the Bretton Woods system, when the ten times bigger Germany had to buy reserves for 71 billion German Marks (at the time around 56 billion CHF). We look at the detailed history of...

Read More »

Read More »

Things That Make You Go Hmmm: This Little Piggy Bent The Market

About 18 months ago, I had a very pleasant chat with a gentleman by the name of Luzi Stamm. You may detect some measure of surprise in my words, and the reason for that is quite simple: Luzi Stamm is a politician; and, as regular readers will know, I am no fan of that particular class.

Read More »

Read More »

Sept 2014, George Dorgan at the CFA Society: Predicted End of EUR/CHF Peg

George Dorgan held a presentation at the CFA society in Zurich on September 1. The subjects of his speech were:

Reasons why the EUR/CHF exchange rate will fall under 1.20 once the deflationary pressures in Europe have ended

The missing link in the CFA program between its chapters on micro-economy, macro and currencies

Does history repeat? From Bretton Woods to Bretton Woods 2 and its slow end. Why the unexpected, the black swan happens more...

Read More »

Read More »

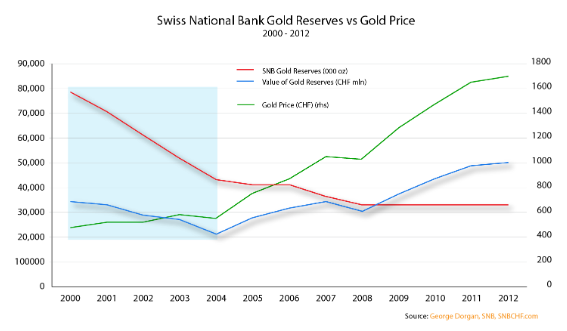

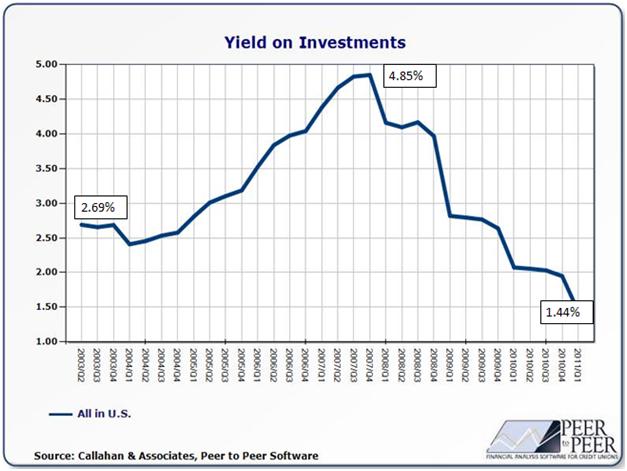

Will SNB FX Investments Yield Enough Until U.S. Inflation Starts?

Will the SNB be able to survive an upturn in inflation: We focus on income and yields for foreign exchange position and gold and find out if the SNB makes enough income to survive a franc appreciation.

Read More »

Read More »

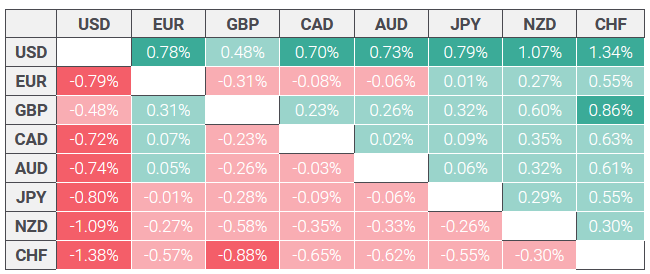

When FX wars become negative interest wars

Beat Siegenthaler, FX strategist at UBS, has been wondering about what the Swiss National Bank may do if the ECB’s measures to weaken the euro begin to test its 1.20 EURCHF floor. He notes, for example, that there has already been a marked divergence...

Read More »

Read More »

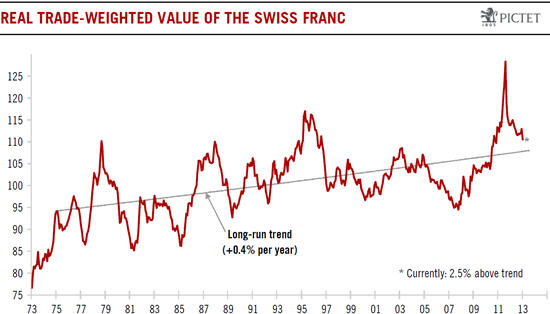

Swiss Franc and Swiss Economy: The Overview Questions

Before the upcoming SNB monetary policy assessment meeting on June 19th, rumors started the SNB could follow the ECB and set negative rates on banks' excess reserves. We would like to deliver the whole background, starting with the question why Swiss inflation has been so low in the past and why CHF always appreciated.

Read More »

Read More »

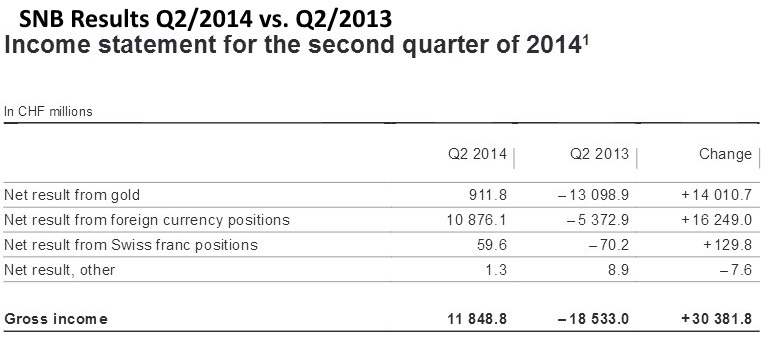

SNB Results Q2/2014: Draghi’s Weak Euro Policy, a Nice Gift for the SNB, for Now

The ECB commitment to a weak euro and the maintenance of ultra-low interest rates, was a nice (temporary) gift for the Swiss National Bank (SNB). The bank earned nearly 12 billion francs in Q2/2014.

Read More »

Read More »

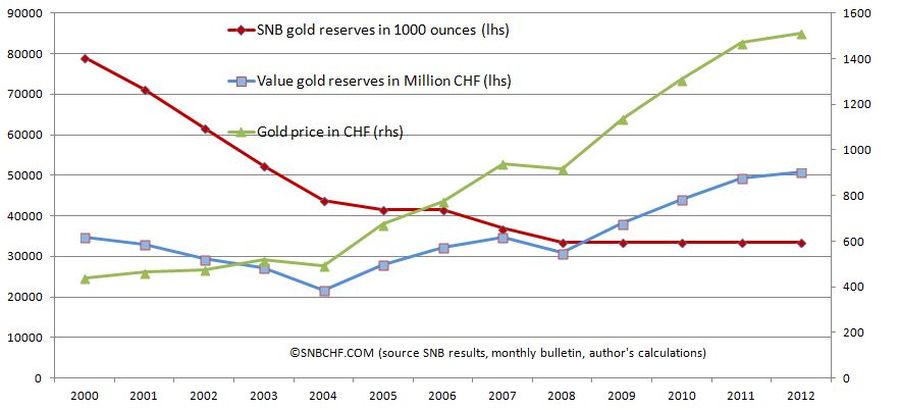

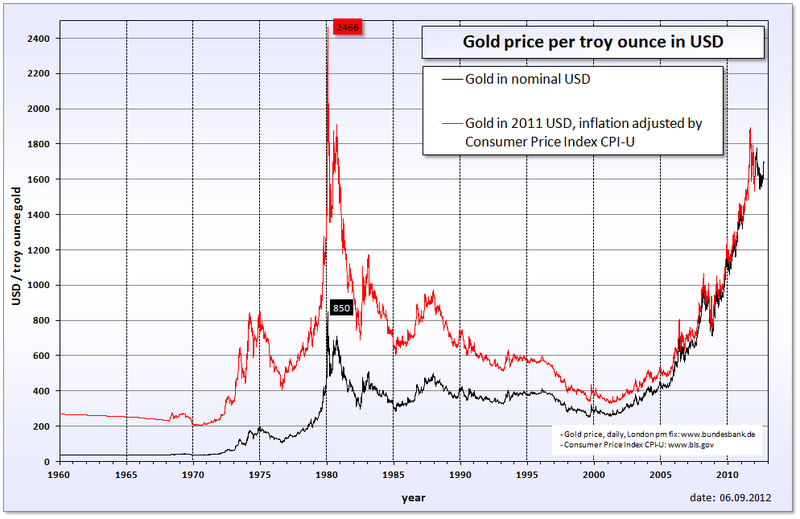

Swiss Franc History, 2000-2007: The sale of the Swiss gold reserves

A critical Swiss Franc History: Between 2000 and 2007, the SNB made the Swiss cantons happy and delivered some billions of francs to prop up their finances. The gains were unfortunately not caused by strong asset management capabilities, but mostly due to gold price improvements and gold sales at quite cheap prices.

Read More »

Read More »

Swiss Franc History, from 2004 to 2009: The undervalued franc

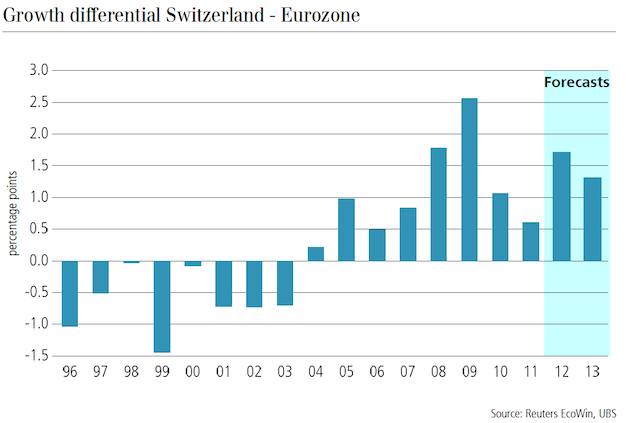

A Critical History of the Swiss Franc: During the "global carry trade" period between 2004 and 2007, the euro strongly appreciated against the Swiss franc. Most astonishingly this happened, despite the fact that the Swiss GDP growth was on average 0.5% higher

Read More »

Read More »

Swiss Franc History: Weak German and Swiss growth between 1996 and 2004

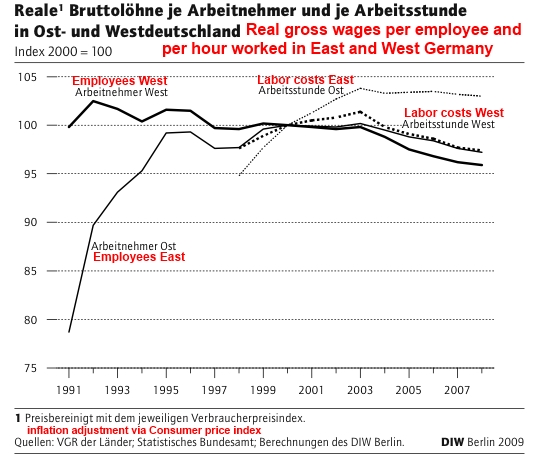

A critical Swiss Franc History: Between 1996 and 2004 Switzerland and its main trading partner and FX proxy Germany saw slower growth compared to other European countries. We explain the reasons

Read More »

Read More »

Swiss Franc History 1986-1996: Swiss real estate Boom and Bust

A critical Swiss franc history: This chapter describes the most controversial episode in the Swiss monetary history: How the Swiss National Bank helped to wreck the Swiss real estate market in the 1990s.

Read More »

Read More »

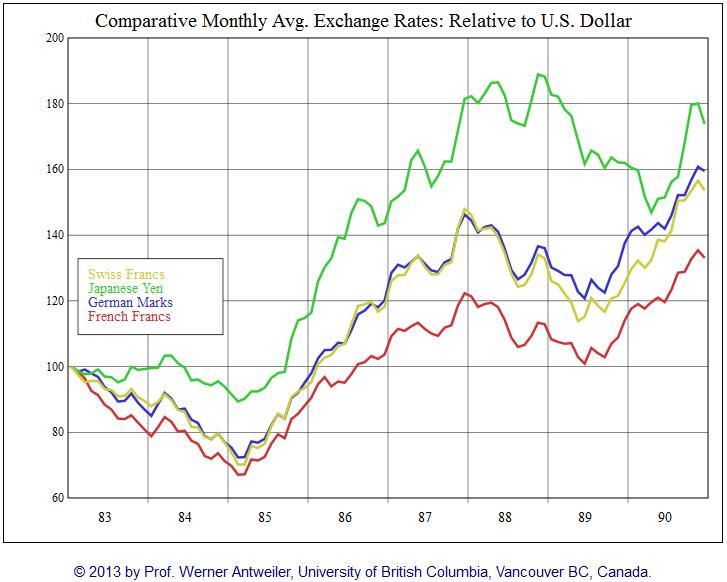

Swiss Franc History: Volcker Shock, Oil Glut and the Breakdown of Gold and Emerging Markets

After the Volcker moment or sometimes called "Volcker shock", commodity prices plunged, the gold price collapsed. Thanks to additional supply, e.g. from Northsea oil, a so-called oil glut appeared. After the increase of debt in the 1970s, some economies in Southern America collapsed. The major reason was Volcker's tight monetary policy with high interest rates and the dependency on US funds.

Read More »

Read More »

Volckers Attack on Stagflation

In this chapter we describe how Volcker managed to defeat stagflation; he applied the monetarist models that had been applied successfully in Switzerland and Germany. Thanks to this effort, the dollar stopped its secular decline.

Read More »

Read More »

Swiss Franc History, 1970s: Due to US Stagflation CHF Strengthens Massively

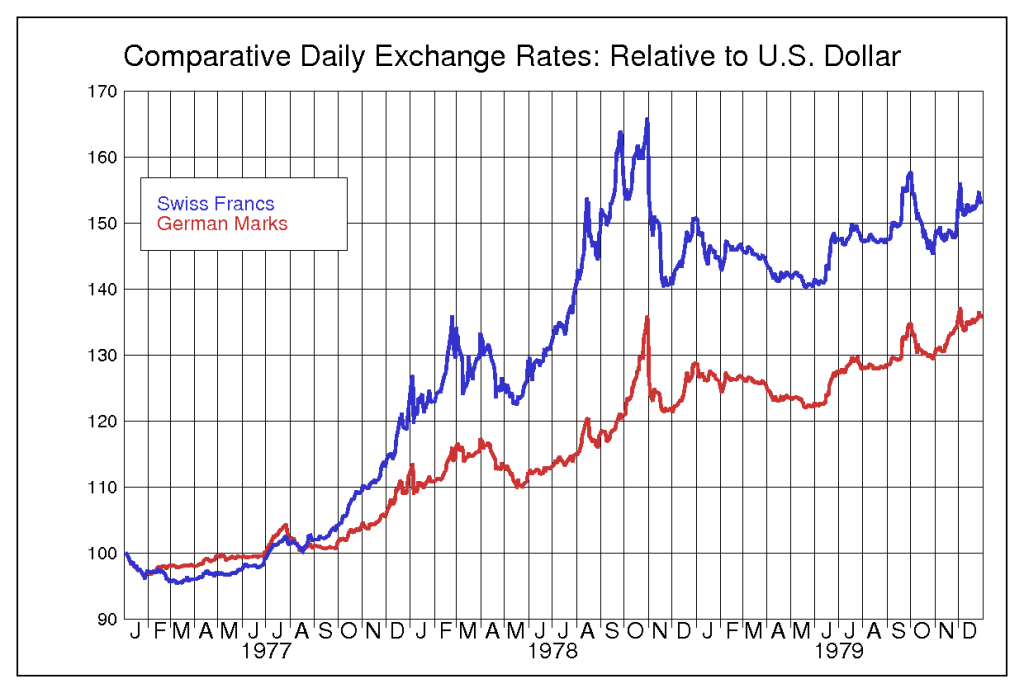

We shows the massive appreciation of Swiss franc and German mark in the 1970s, the reasons were: stagflation and the wage-price spiral.

Read More »

Read More »

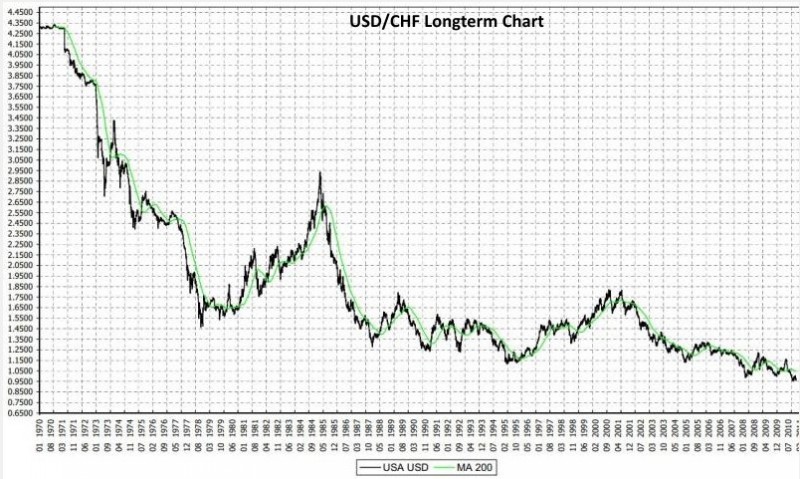

Swiss Franc History: The long-term view and the comparison with gold

We establish a long-term view and history of the Swiss franc. We compare the franc with gold.

Read More »

Read More »

-638453232816314704.png)