Category Archive: 1) SNB and CHF

Foreign exchange: Swiss miss

WHEN the Swiss National Bank (SNB) intervened to weaken its currency in 2011, analysts called the subsequent abrupt drop in the franc’s value a “20-standard-deviation move”. Assuming the franc’s ups and downs follow a normal distribution, such a big shift should not have occurred again for many squillions of years.

Read More »

Read More »

Switzerland’s monetary policy: The three big misconceptions about the Swiss franc

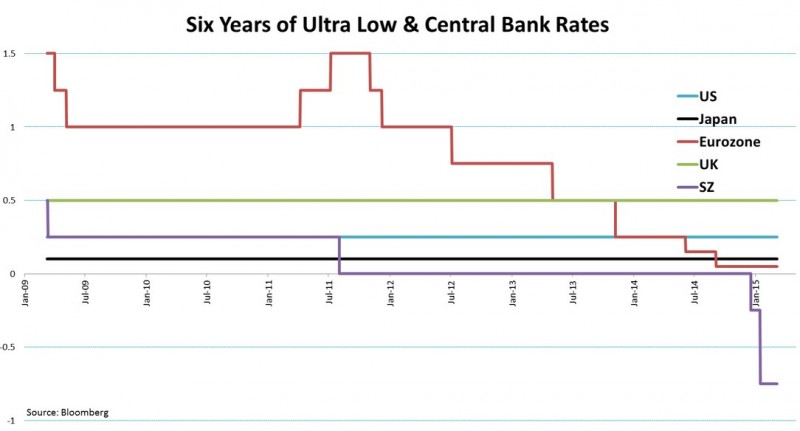

ON THURSDAY January 15th Switzerland’s central bank, the Swiss National Bank (SNB), removed the cap on its currency, which it had imposed over three years ago and reaffirmed only three days before its repeal. The doffing of the cap surprised and upset the foreign-exchange markets, hobbling several currency brokers, including Alpari (which happens to sponsor the London football team I support).

Read More »

Read More »

What Caused The Swiss Financial Tsunami? Three Reasons, One Trigger, One Chain Reaction

In this post we give our (Swiss) view for the financial tsunami on January 15.

The SNB has preferred its secondary mandate, namely financial stability, and the elimination of risks on its own balance sheet caused by ECB QE.

It will not obey its primary target, price inflation, for the next three to five years. While in the mid-term (5 -10 years) inflation should move up.

Differing perceptions between Switzerland and the Anglophone world about...

Read More »

Read More »

Risk and the finance sector: Swiss miss

INVESTORS checking out the Everest Capital website will find that the hedge fund offers strategies that are diversified across themes, countries and sectors. So they wouldn't have expected losses from any one bet to be that significant. But over the weekend, it was revealed that last week's surge in the Swiss franc had virtually wiped out the group's main fund, Everest Global Capital.

Read More »

Read More »

The Economist explains: Why the Swiss unpegged the franc

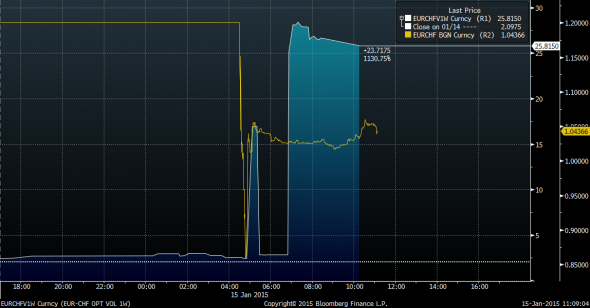

IN THE world of central banking, slow and predictable decisions are the aim. So on January 15th, when the Swiss National Bank (SNB) suddenly announced that it would no longer hold the Swiss franc at a fixed exchange rate with the euro, there was panic. The franc soared. On Wednesday one euro was worth 1.2 Swiss francs; at one point on Thursday its value had fallen to just 0.85 francs.

Read More »

Read More »

Death of an FX punter

terriegym: Ive came back to my computer and Alpari have closed all my trades, loosing over $1000 off of my current balance, anyone got any idea what may have happened!!! they arent answering the phone!!

Read More »

Read More »

Nationalbank-Chef Thomas Jordan hat die Aufhebung des Euro-Mindestkurses bekannt gegeben – SRF Börse

Nach dem Entscheid spielten die Finanzmärkte verrückt. «Die Exporte werden ohne Mindestkurs im laufenden Jahr stagnieren», erwartet Claude Maurer, Ökonom bei der Credit Suisse. SMI: -8.7 Prozent. Weblinks: http://www.snb.ch/de/ http://www.six-swiss-exchange.com/ https://www.credit-suisse.com/de/de.html http://www.dievolkswirtschaft.ch/editions/200903/Maurer.html

Read More »

Read More »

The liquidity monster and FXCM

As we have already pointed out about Thursday’s unprecedented Swiss franc move following the SNB’s announcement about removing its 1.20 euro level floor and introducing a -0.75 per cent interest rate regime, the real story to pay attention to is what...

Read More »

Read More »

What did the SNB do to EURCHF options markets?

The Swiss National Bank made G10 FX a lot more fun to watch today. One interesting thing is how the options markets responded. Via Jared Woodard of BGC, here’s a chart comparing the move in one-week implied volatility in the exchange rate between the...

Read More »

Read More »

Central Europe and the Swiss franc: Currency risk

ANXIETY at the Swiss National Bank’s surprise decision today to drop its peg against the euro was nowhere more evident than in central Europe. The Swiss franc soared against all the region's currencies, including the euro, the Hungarian forint and especially the Polish zloty, and stock exchanges in Poland (pictured) and Hungary dropped sharply.

Read More »

Read More »

SNB hebt Mindestkurs auf – Schweizerische Nationalbank – Kurs – Euro – Franken- Thomas Jordan

Heute beschloss die Schweizerische Nationalbank den Mindestkurs von Fr. 1.20 pro Euro aufzuheben. SNB-Chef Thomas Jordan orientiert über die Gründe. Sie wollen dieses Video in Ihren Produkten verwenden? Melden sie sich bei uns: video[at]keystone.ch http://www.keystone.ch ——————— Interested in using this video in your products? Contact us: video[at]keystone.ch http://www.keystone.ch

Read More »

Read More »

The SNB and the Russia/oil connection

A quick post to collate a few side theories on the reasons, justifications and consequences of the SNB move. Simon Derrick at BNY Mellon is first to point out that the euro floor/chf celing was leaving an open door to safe haven flows from Russia by ...

Read More »

Read More »

Currencies: Going cuckoo for the Swiss

CURRENCIES don't normally move that far on a daily basis—2 to 3% is a big shift. The exception is when a country on a fixed exchange rate suffers a devaluation; then a 20-30% fall is a possibility. But a 20-30% plus upward move is almost unprecedented. That, however, is what happened to the Swiss franc on January 15th, as Switzerland's central bank abandoned its policy (instituted back in 2011) of capping the currency at Sfr1.20 to the euro.

Read More »

Read More »

2014 Results: SNB expects profit of CHF 38 billion

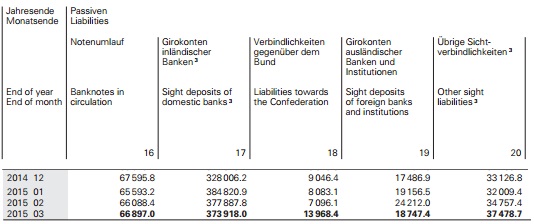

The Swiss National Bank reported a profit of CHF 38 billion for the year 2014. They obtained price gains in all asset classes, in bonds, stocks and gold. Interest payments and dividends achieved a yield of 1.7%.

Read More »

Read More »

SNB-Präsident Thomas Jordan im «ECO»-Interview

Zum Jahresende sorgte Thomas Jordan nochmals für einen Paukenschlag: Die Schweizerische Nationalbank hat erstmals seit den 1970er-Jahren Negativzinsen eingeführt. Ein weiterer Schritt, um zu verhindern, dass noch mehr ausländisches Geld in die Schweiz fliesst und den Franken aufwertet. Der Mindestkurs bleibt auch 2015 unter Druck angesichts der schwächelnden Euro-Zone und geopolitischer Krisenherde wie Russland. Wie …

Read More »

Read More »

December 2014: SNB Introduces Negative Rates, a Toothless Measure?

The Swiss National Bank has introduced negative interest rates. They apply only to sight deposits in excess of 20 times minimum reserves. Therefore they will affect hardly any bank and can be considered symbolic or even toothless. The view of the SNB is different.

Read More »

Read More »

Thomas Jordan SNB kanzelt Reuters-Journalistin ab 23.11.2014

Thomas Jordan kanzelt am 23.11.2014 in Uster eine Journalistin von Reuters ab. Zuvor referierte er in der reformierten Kirche über “das gute Geld” und die Goldinitiative. Engagierte Bürger und Volksreporter fragen nach, warum die Nationalbank gegen die Goldinitiative argumentiert und wieso die Nationalbank ohne Volksauftrag Gold in der Vergangenheit verkauft hat. Eine Reuters-Journalistin ärgert sich, …

Read More »

Read More »

-638453232816314704.png)