Category Archive: 1) SNB and CHF

Swiss Franc History: The Gold Standard and Bretton Woods

In this post we will show the history of the Swiss Franc until 1971, a monetary era driven by the gold standard and the Bretton Woods period, both periods with nearly fixed exchange rates.

Read More »

Read More »

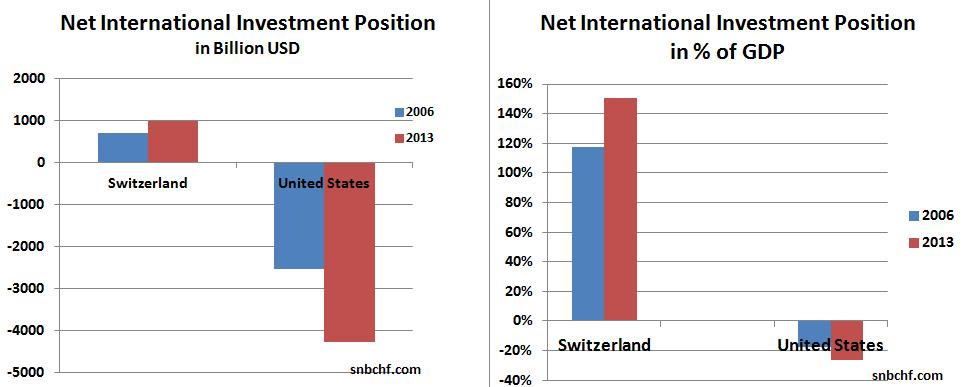

Ex-Post FX Evaluation: Is the Swiss Capital Account Able to Neutralise the Persistent Current Account Surpluses?

(post written originally in March 2013)

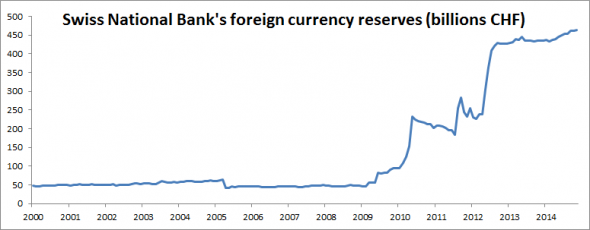

We reckon that the Swiss National Bank (SNB) will have issues maintaining the EUR/CHF floor in the longer term, because the expected yields on Swiss investments abroad will not be sufficiently higher than the yield on investments in Switzerland. Because of this insufficient risk-reward relationship, outflows in the capital account of the Swiss balance of payments will not cover the persistent Swiss current...

Read More »

Read More »

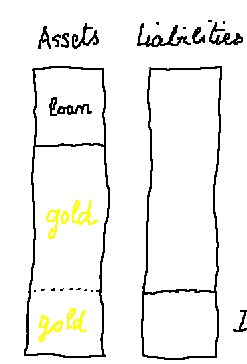

Rising Sight Deposits at SNB Means Rising SNB Debt

Money creation and sight deposits may have two points of view:

1. The central bank creates money - i.e. the SNB decides to increase sight deposits when it does currency interventions

2. Commercial banks create money - inflows in CHF on Swiss bank accounts make those banks increase their "sight deposits at the SNB. If inflows in CHF are higher than outflows then CHF must rise, unless the central bank does currency interventions.

We will present...

Read More »

Read More »

The Last Free Lunch for Holders of SNB’s High-Risk Share?

Marc Meyer, the maybe strongest opponent of the Swiss National Bank criticizes the misleading vocabulary in monetary policy that confuses central bank liabilities with assets. He identifies the intrinsic and time value of the SNB share. According to Meyer, the recent strong share price performance was caused by the free lunch at the shareholder assembly.

Read More »

Read More »

SNB’s IMF data

This IMF data on the SNB website shows SNB Forex and gold reserves in the last month. It is so-called "IMF Special Data Dissemination Standard (SNB Data)"

Read More »

Read More »

Where does SNB intervene against overvalued CHF, do they sell EUR & USD? (April Update)

In his first response to the Swiss financial tsunami on January 15, George Dorgan suggested that the EUR/CHF of 1.10 will not be reached any time soon. He explains where the SNB should intervene and if they sell Euros and dollars.

Read More »

Read More »

Marc Meyer

The best posts by Marc Meyer, the biggest and most influential enemy of the Swiss National Bank. He regularly published in German on InsideParadeplatz.ch

Read More »

Read More »

Is the Swiss Franc Really so Expensive or is Swiss Consumption anemic?

One of the most predictable consequences of the Swiss National Bank’s decision to stop suppressing the exchange rate between the franc and the euro was the whinging of Swiss exporters. That doesn’t mean the policy change was an error. If anything, it may help rebalance the Swiss economy away from its excessive dependence on exports towards greater levels of domestic consumption.

Read More »

Read More »

Werden Bund und Kantone die Nationalbank rekapitalisieren?

Marc Meyer speaks out against the view of Barry Eichengreen and Beatrice Weder di Mauro that published an article in Project Syndicate. The two professors were of the opinion that the SNB could print without limit. Meyer does not agree.

Read More »

Read More »

Colin Lloyd on the end of the EUR CHF peg

Colin Llyod gives a detailed explanation of the end of the EUR/CHF peg on Seeking Alpha. Most extracts come from George Dorgan, on snbchf.com

Read More »

Read More »

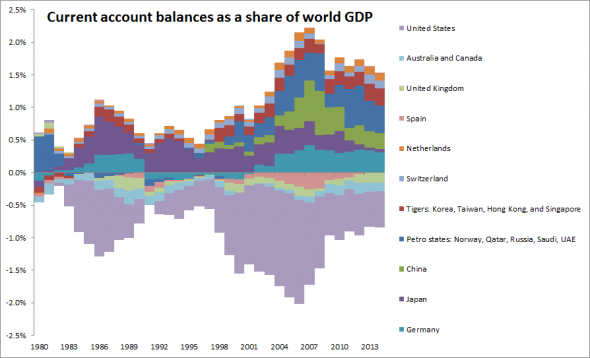

Why did the Swiss franc spike? Lack of Capital Outflows

There is a straightforward answer to the question in the headline: more money has been trying to get into Switzerland than get out, which didn’t affect the exchange rate as long as the Swiss National Bank bought foreign currency. As soon as they stop...

Read More »

Read More »

End of Peg Buiter Critique

In a Citi research note, Willem Buiter discusses the SNB’s decision to discontinue the exchange rate floor of the Swiss Franc vis-a-vis the Euro. His main points are: Buiter refers to his earlier work on removing the lower bound on nominal interest r...

Read More »

Read More »

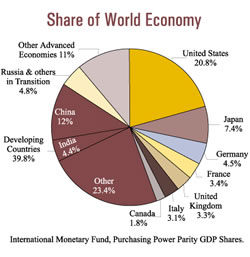

CHF Is No Safe-Haven, but a Safe Proxy for Global Economic Growth

In our view the Swiss franc is not a pure Safe-Haven, but a "Safe Proxy for Global Economic Growth". Global investors want to participate via the purchase of safe Swiss multi-nationals in global growth. This means inflows into Swiss franc denominated assets. Together with the big Swiss trade surplus, this implies a stronger franc. China stands for global economy, its slowing growth has a negative influence on the profits of Swiss multi-nationals...

Read More »

Read More »

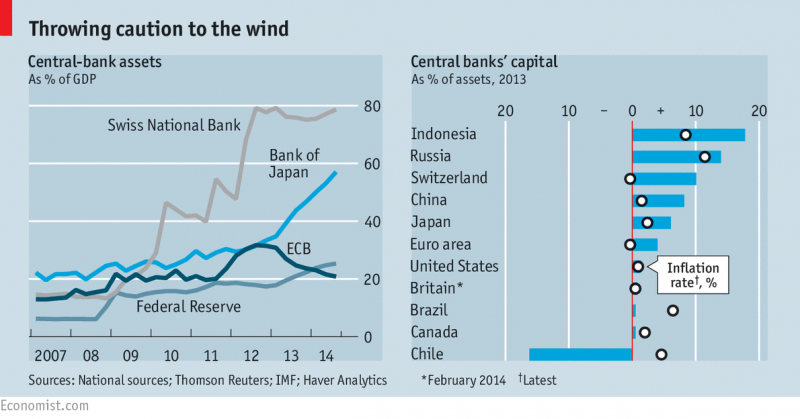

Free exchange: Broke but never bust

CONTEMPORARY central banking is a strongbox of oddities. Deposits, which normally pay interest, can now incur a charge. Investments in government debt, which normally offer a return, give a negative yield. Faced with this weirdness central banks are trying to respect some cardinal rules of finance, with the Swiss National Bank (SNB) and the European Central Bank (ECB) taking steps to protect themselves from losses and ensure that their...

Read More »

Read More »

Switzerland’s currency: Shaken, not stirred

SWISS voters used to hold their central bank in high esteem: one survey in 2013 found the Swiss National Bank (SNB) to be their most respected national institution. That may change after its shock decision on January 15th to abandon the Swiss franc’s cap against the euro. The franc instantly shot up by 30%, provoking howls of anguish from Swiss firms.

Read More »

Read More »