| CONTEMPORARY central banking is a strongbox of oddities. Deposits, which normally pay interest, can now incur a charge. Investments in government debt, which normally offer a return, give a negative yield. Faced with this weirdness central banks are trying to respect some cardinal rules of finance, with the Swiss National Bank (SNB) and the European Central Bank (ECB) taking steps to protect themselves from losses and ensure that their balance-sheets add up. The experience of several poorer places suggests they are wrong to do so.

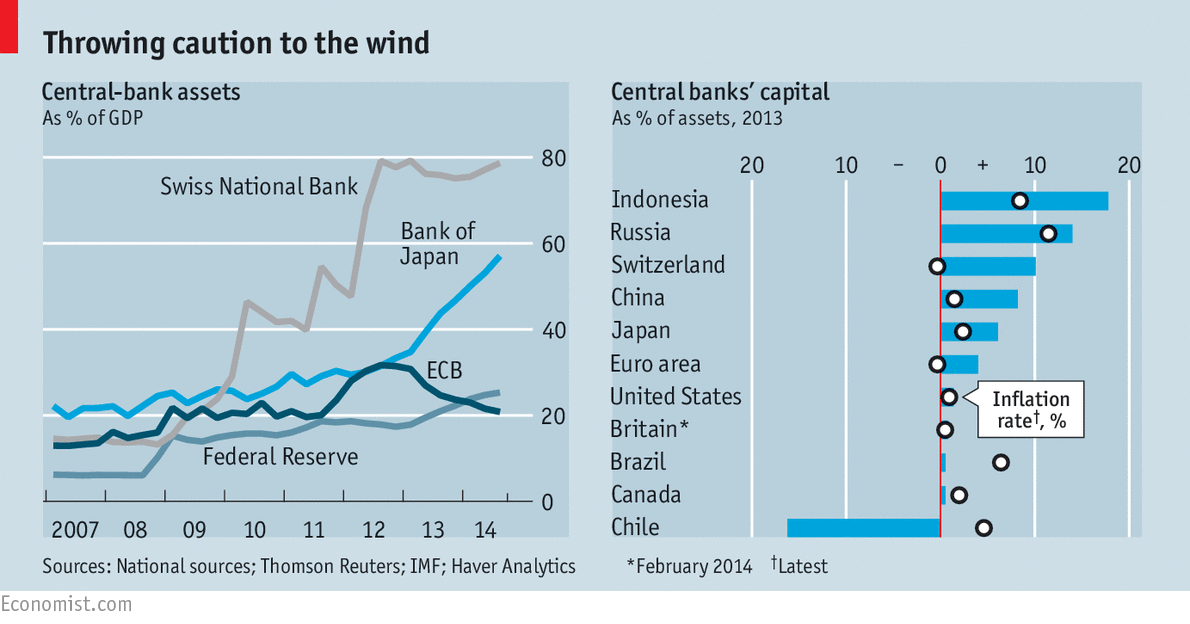

In calm times central banking is simple and profitable. Central banks’ assets—mainly bonds issued by rich countries and blue-chip firms—pay a decent return. Their liabilities—deposits made by high-street banks and banknotes—cost them little or nothing. With this wedge between income and outgoings shareholders receive a dividend. The SNB paid dividends of SFr1 billion ($1.15 billion) to Switzerland’s federal and regional governments in 2012. The ECB’s 2013 payout—divvied up across the euro-area national central banks—was €1.4 billion ($1.9 billion). The financial crisis changed the business. For one thing central banks are far bigger (see left-hand chart). Between 2006 and 2014 central-bank balance-sheets in the G7 jumped from $3.4 trillion to $10.5 trillion, or from 10% to 25% of GDP. And the assets they hold have changed. The SNB, aiming to protect Swiss exporters from an appreciating currency, has built up a huge stock of euros, bought with newly created francs. The ECB, mindful of tight credit, has lent money to banks and bought corporate bonds. And on January 22nd, as The Economist went to press, it was expected to announce that it would start buying government debt. The expansion would be greater but for worries about cashflow and capital. Bonds that paid 5% or more ten years ago now yield nothing, and other investments have performed badly (the SNB was stung by a drop in the value of gold in 2013 and cut its dividend to zero). Concerned that its euro holdings might lose value the SNB shocked markets on January 15th by abruptly ending its euro-buying spree. Worries that QE will lead to losses if struggling governments default on their debt have caused weeks of wrangling at the ECB, and may prevent it from buying Greek bonds. |

Throwing caution to the wind(see more posts on Gross Domestic Product, ) |

From a narrow accounting perspective this caution seems prudent. With capital of €95 billion supporting a €2.2 trillion balance-sheet, the Eurosystem (the ECB and the national banks that stand behind it) is 23 times levered; a loss of 4% would wipe out its equity. Since two central banks have suffered devastating crunches recently (Tajikistan in 2007, Zimbabwe in 2009) the standard logic seems to apply: capital-eroding losses must be avoided.

But the worries are overdone. For one thing central banks are healthier than they appear. On top of its equity, the Eurosystem holds €330 billion in additional reserves. These funds are designed to absorb losses as assets change in value. Even if the ECB were to buy all available Greek debt—around €50 billion—and Greece were to default, the system would lose just 15% of these reserves; its capital would not be touched.

And even if a central bank’s equity were wiped out it would not go bust in the way high-street lenders do. With liabilities outweighing its assets it might seem unable to pay all its creditors. But even bust central banks retain a priceless asset: the power to print money. Customers’ deposits are a claim on domestic currency, something the bank can create at will. Only central banks that borrow heavily in foreign currencies they cannot mint (as in Tajikistan) or in failing states (Zimbabwe) get into deep trouble.

A helpful bias

The survival of threadbare central banks proves the theory. In the 1980s many emerging-market central banks faced sharply appreciating exchange rates and bought up dollars with newly created cash to cheapen their currencies. Since inflation was a worry they “sterilised” the purchases, mopping up the money by selling bonds to investors. With low-yielding assets (dollars) and high-cost liabilities (domestic-currency bonds) they locked in losses, as a 2008 paper* by Peter Stella and Ake Lonnberg of the IMF shows. By the late 1980s the central banks of Jamaica and Nicaragua were regularly losing 5% of GDP or more per year. After 20 years of losses Chile’s is in negative equity (see right-hand chart).

While none of these banks toppled, hawks have other fears. Like any firm, central banks face running costs. The urge to pay the bills could tempt them to print money rather than focus on inflation. Another worry, set out in a 2005 paper by John Dalton and Claudia Dziobek of the IMF, is that low capital could lead to a loss of independence. While negative capital doesn’t matter much it doesn’t look great; a central bank embarrassed by its capital deficiency might seek a capital injection from its finance ministry and be captured by boom-hungry politicians. In either case, capital erosion might mean a bias towards higher inflation.

There is some evidence for this. In a 2012 paper Gustavo Adler and Camilo Tovar of the IMF and Pedro Castro of the University of California, Berkeley, test the relationship between bank capital and interest-rate policy. Collecting data for 41 advanced and emerging economies between 2002 and 2011, they work out what a hypothetical central bank, behaving optimally, would do. They contrast this with the central bank’s choices and seek to explain why the two might diverge. They find that large deviations can be explained by a weak capital position. Flaky-looking central banks might lower interest rates by up to 72 basis points.

Doves should cheer this. Falling returns on government bonds mean central banks’ income will dwindle. Given their pumped-up balance-sheets, some losses are likely. None will fail, but a few might chase their losses by printing money and pushing rates down. In a world on the brink of deflation, bias towards a little more inflation would be no bad thing.

Full story here Are you the author? Previous post See more for Next postTags: European central bank,Gross Domestic Product,Swiss National Bank