Category Archive: 1.) English Posts on SNB

SNB Sight Deposits: increased by 2.4 billion francs compared to the previous week

The sight deposits at the SNB increased by 2.4 billion francs compared to the previous week.

Read More »

Read More »

SNB Losses in the News

My written statement for 20minuten:

Anlageverluste der SNB sind schlecht für den Schweizer Steuerzahler, denn ihm gehört die SNB. Sie können aber auch Entwicklungen widerspiegeln, die ihre guten Seiten haben. Jetzt zum Beispiel führt die Frankenstärke zu Anlageverlusten, bremst aber auch die importierte Inflation.

Read More »

Read More »

The SNB’s Financial Result, Currency Reserves, and Distribution Reserve

How are SNB profits and losses distributed and what issues are debated? Annual Result Funds two “Reserves” The annual result (Jahresergebnis) of the Swiss National Bank (SNB) is split into two parts.

Read More »

Read More »

“Digitales Notenbankgeld – und nun? (CBDC—What Next?),” FuW, 2021

I draw some conclusions from the CEPR eBook on CBDC, namely: Banks will change, whatever happens to CBDC. The main risk of retail CBDC is not bank disintermediation. CBDC may not be the best option even if it has net benefits. It should be for parliaments and voters, not central banks, to decide about the introduction of CBDC.

Read More »

Read More »

“Die Nationalbank ist an vielen Fronten gefordert (Challenges for the Swiss National Bank),” NZZ, 2021

Should the SNB follow the Fed and the ECB and rework its strategy? There is a case for rethinking the broad inflation target, the monetary policy concept, and the communication strategy. Equally important is a strategy review outside of the SNB: The SNB cannot and must not decide about the framework within which it operates.

Read More »

Read More »

West Virginia Gov. Personally On The Hook For $700MM In Greensill Collapse

The collapse of Greensill Capital has been the biggest financial scandal of the year so far, having set off a massive public corruption scandal in the UK that has deeply embarrassed the ruling Conservative Party due to the close involvement of former PM David Cameron, who was on the Greensill.

Read More »

Read More »

“Everything Is On Fire”

Authored by Egon von Greyerz via GoldSwitzerland.com,“Everything is on fire” – Heraclitus (535-475 BC)What Heraclitus meant was that the world is in a constant state of flux.But the big problem in the next few years is that the world will experience a fire of a magnitude never seen before in history.I have in many articles and interviews pointed out how predictable events are (and people).

Read More »

Read More »

UBS Reportedly Re-Starts Layoffs After “Doubling” One Time Bonuses To Some Associates

On one hand, UBS seems hell bent on keep its new Gen Z employees who have recently been promoted to associate positions. After all, it was just hours ago that we wrote about how the bank was showering some newly promoted employees with one-time $40,000 bonuses.

Read More »

Read More »

UBS, Desperate To Retain Talent, Now Offering $40,000 Bonuses To Newly Promoted Associates

It looks like the hiring (and retention) shortage isn't just for rank-and-file minimum wage jobs.UBS has now said that, amidst historic competition and a "retention crisis" in the investment banking world (which we noted weeks ago), it is going to pay a one time $40,000 bonus to its global banking analysts when they are promoted.

Read More »

Read More »

Credit Suisse Hires Former Prime Brokerage Head To Restore Business After Archegos Blowup

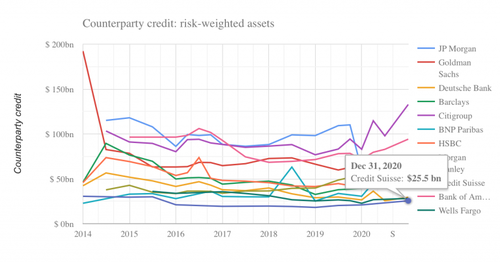

After firing a raft of senior employees including its head of risk, Lara Warner, Credit Suisse has been struggling to move past a series of major risk-management failures that together could cost the bank $10 billion, or more, though the final tally of losses from the Archegos blowup isn't yet known as the bank weighs whether it should cover some client losses associated with the "low risk" trade-finance funds that collapsed earlier this year.

Read More »

Read More »

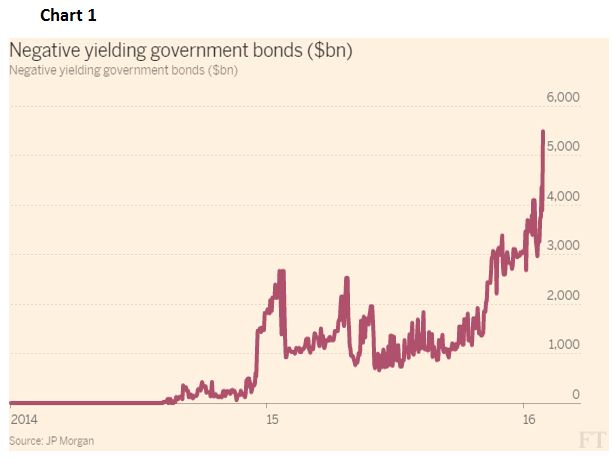

Gold Is Laughing At Powell

Authored by Matthew Piepenburg via GoldSwitzerland.com,Recently, my colleague, Egon von Greyerz, and I had some unabashed yet blunt fun calling out the staggering levels of open hypocrisy and policy desperation unleashed by former Fed Chairman, Alan Greenspan.Poor Alan was an easy target of what I described as the “patient zero” of the reckless interest rate suppression and unbridled monetary expansion policies of the Fed which have always led to...

Read More »

Read More »

The $3 Trillion Hidden Exposure Behind The Archegos Blowup

Authored by Nick Dunbar of Risky FinanceWhen the family office Archegos Capital abruptly imploded in late March, prompting $50 billion in block trades and $10 billion in losses at Credit Suisse, Nomura, UBS and Morgan Stanley, many bank analysts were taken by surprise. Last week, many of these analysts sounded frustrated listening to Credit Suisse’s earnings call in which senior management skirted round without giving any real detail about the...

Read More »

Read More »

“Die Schattenseiten von Schuldenbremsen (The Dark Side of Debt Limits),” ifoSD, 2021

Was Schuldengrenzen aus politökonomischer Sicht besonders attraktiv erscheinen lässt – ihre vermeintliche Einfachheit und Klarheit – birgt also auch Risiken. Es führt dazu, dass Politiker und ihre Wähler die Solidität der Staatsfinanzen über Gebühr an expliziten Bruttoschulden messen.

Read More »

Read More »

Credit Suisse Dumping Huge Archegos Blocks; Liquidating Millions In VIACS, VIPS And FTCH

Literally moments ago we said that the Archegos portoflio was being sold off all day on fears of "stealth" prime broker deleveraging, as tens of millions of shares were yet to be accounted for.

Read More »

Read More »

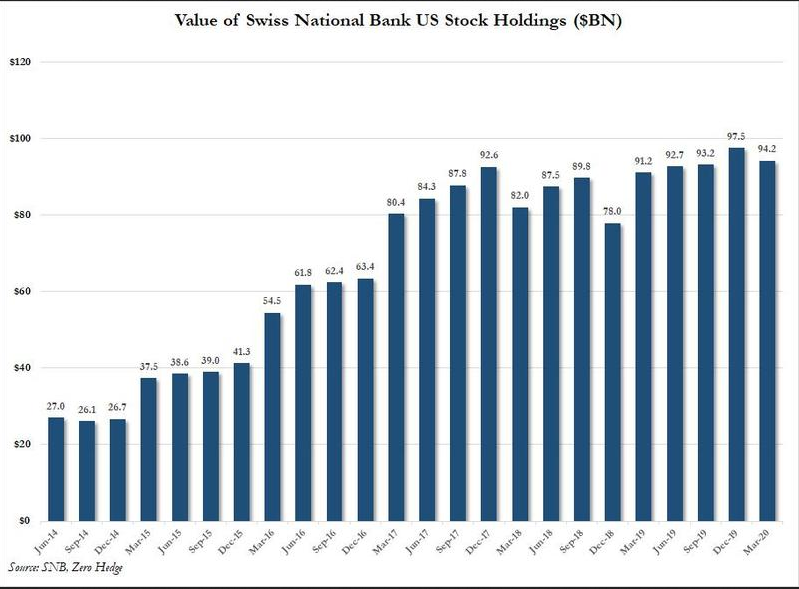

Gold Could Offer A Way Out Of Switzerland’s Failing Inflationist Experiment

Authored by Brendan Brown via The Mises Institute,Never mind that the US Treasury’s indictment late last year of Switzerland as a currency manipulator rested on some flawed evidence and does not identify the crime.

Read More »

Read More »

“Dirk Niepelt im swissinfo.ch-Gespräch (Interview with Dirk Niepelt),” swissinfo, 2020

Swissinfo, December 14, 2020. HTML, podcast.

We talk about CBDC, the Swiss National Bank, whether CBDC would render it easier to implement helicopter drops, and how central bank profits should be distributed.

Read More »

Read More »

SUERF Webinar Baffi Bocconi Libra 2 0 20200831

This SUERF Baffi Bocconi e-lecture hosted Katrin Assenmacher, ECB, and Dirk Niepelt, University of Bern, to discuss Libra 2.0 from a monetary policy and financial stability perspective and to set Libra 2.0 in relation to the concept of Central Bank Digital Currencies (CBDC).

Read More »

Read More »

As Markets Crashed, The Swiss National Bank Went On A Tech Stock Buying Spree

It used to be a running joke among traders that when markets crash, central banks step in - either directly or in the case of the Fed indirectly via Citadel - and buy stocks to prop up the market and shore up confidence. That joke is now the truth.

Read More »

Read More »

“Unabhängigkeit der Nationalbank (Independence of the SNB),” FuW, 2020

Von verschiedenen Seiten werden Ansprüche an den Gewinn der Nationalbank gestellt. Es sollte in der Kompetenz der SNB liegen, zu entscheiden, welchen Teil ihrer Bilanz sie nicht zur Erfüllung ihrer Aufgaben benötigt.

Read More »

Read More »

“Monetäre Staatsfinanzierung mit Folgen (Monetary Financing of Government),” Die Volkswirtschaft, 2020

Die Volkswirtschaft, 24 July 2020. PDF. Clarifying the connections between outright monetary financing, QE, the distribution of seignorage profits, the relationship between fiscal and monetary policy, and central bank independence.

Read More »

Read More »