This link on the SNB website shows the data the central bank provides to the International Monetary Fund (IMF). It indicates the SNB Forex and gold reserves in the last month. The data delivery is called “IMF Special Data Dissemination Standard (SNB Data)”

It is released together with the international investment position, some monetary aggregates and the balance of payments. It is transmitted to the International Monetary Fund and disclosed to the public. Again there is an archive. So one can compare the change from month to month.

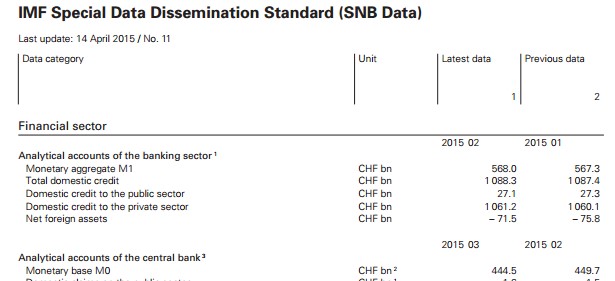

Data for monetary aggregates

Inside this data release there are for example M0 and M1.

M0 represents debt for the central that allows to finance currency interventiosn.

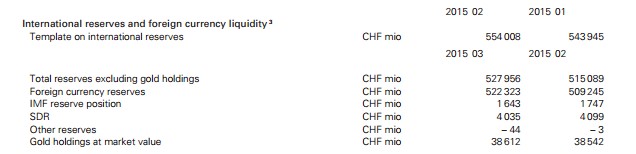

Data for currency reserves

See more for