Category Archive: 1) SNB and CHF

Matías Salord: Trading USDCOP, USDMXN y USDCLP

Fecha de emisión: 03 agosto 2015. Ponente: Matías Salord. En esta sesión semanal, nuestro analista Matías Salord les hablará del panorama económico y del mercado de las principales divisas de Latinoamérica, haciendo especial hincapié en el análisis de cotizaciones, indicadores económicos y contexto.

Read More »

Read More »

Global Risk Off: China Reenters Bear Market, Oil Tumbles Under $30; Global Stocks, US Futures Gutted

"We're gonna need a bigger Bullard"

- overheard on a trading desk this morning.

Yesterday, when looking at the market's "Bullard 2.0" moment, which was a carbon copy of the market's kneejerk surge higher response to Bullard's "QE4" comments fr...

Read More »

Read More »

Nigerian Currency Collapses After Central Bank Halts Dollar Sales To Stall “Hyperinflation Monster”

Having told banks and investors "don't panic" in September, amid spiking interbank lending rates and surging default/devaluation risks, it appears the massive shortage of dollars that we warned about in December has washed tsunami-like ashore in oil-...

Read More »

Read More »

SNB-Präsident Thomas Jordan: Interview 1 Jahr nach Mindestkurs-Ende

Vor einem Jahr erschütterte ein Währungsbeben die Schweizer Wirtschaft: Völlig überraschend hob die Schweizerische Nationalbank den Mindestkurs zum Euro auf. Vor allem für die Exportwirtschaft war dies ein riesiger Schock, auf einen Schlag wurden die Anstrengungen vieler Firmen zunichte gemacht, trotz starkem Franken im Euro-Raum wettbewerbsfähig zu bleiben. Entsprechend scharf werden bis heute die Nationalbank …

Read More »

Read More »

Why The Powerball Jackpot Is Nothing But Another Tax On America’s Poor

Now that the Powerball Jackpot has just hit a record $1.4 billion, people, mostly those in the lower and middle classes, are coming out in droves and buying lottery tickets with hopes of striking it rich.

After all, with $1.4 billion one can ...

Read More »

Read More »

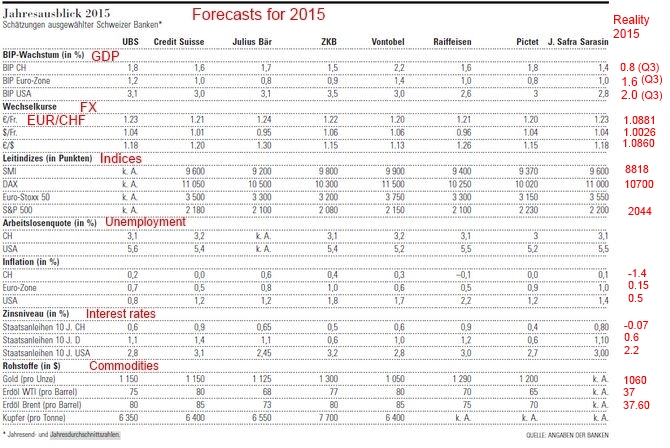

Economic Forecasts for 2015: Swiss Banks were too Optimistic

Our analysis of the forecasts of economic data for 2015 shows that the Swiss banks were too optimistic for most data. US growth, the oil price, inflation and interest rates are far lower than expected. The errors for stock indices were smaller.

Read More »

Read More »

The year explained: Our ten most popular explainers from 2015

EVERY weekday The Economist explains a new subject, topical or timeless, profound or peculiar. As the end of the year approaches, we look back at the explanations that have proved most popular with readers during 2015. (Normal service will resume on January 4th.)

Read More »

Read More »

Monetary assessment meeting Swiss National Bank

Monetary assessment meeting Swiss National Bank: My real-time tweets contain the main important points of the SNB meeting from the view of investors or FX traders.

Read More »

Read More »

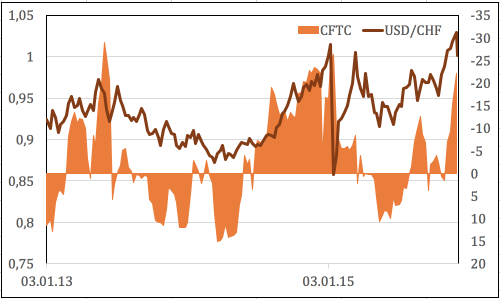

Will The Franc Follow In The Euro’s Footsteps?

The SNB's expected December 10 rate cuts have already been priced in to the Swiss Franc.

The central bank's failure to do more than the market expected resulted in a stronger CHF.

Growing uncertainty over the Fed's 2016 monetary policy is a bullish factor for the franc.

Read More »

Read More »

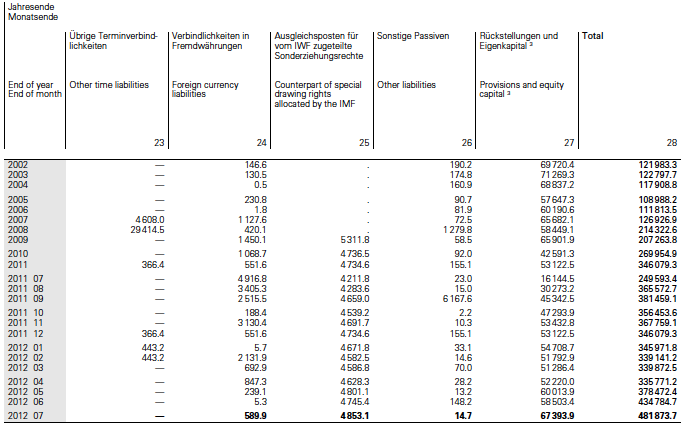

SNB’s history of balance sheet and Monthly bulletin

The SNB monthly bulletins contain all important data of the SNB and the Swiss economy as of the latest quarter.

Read More »

Read More »

Que dire des scenarios catastrophes FINMA versus Caisses de pensions ?

Think Tank 2015: Le Think Tank Cronos (laboratoire d’idées à but non lucratif) a été créé en 2011 pour susciter échanges et réflexions sur une étape autant élémentaire que fragile du processus d’investissement d’une caisse de pensions: la détermination de sa capacité à prendre des risques.

Read More »

Read More »