Since 2015, the SNB provides its balance sheet items in a different form.

Previously the monthly bulletins provided a history of the balance sheet. The last monthly bulletin appeared for August 2015. It contained all important data of the SNB and the Swiss economy. The balance sheet data is often 2 months or older. The weekly monetary data and the IMF data about FX reserves and more are published a lot more quickly, but they are not that complete like the monthly bulletin.

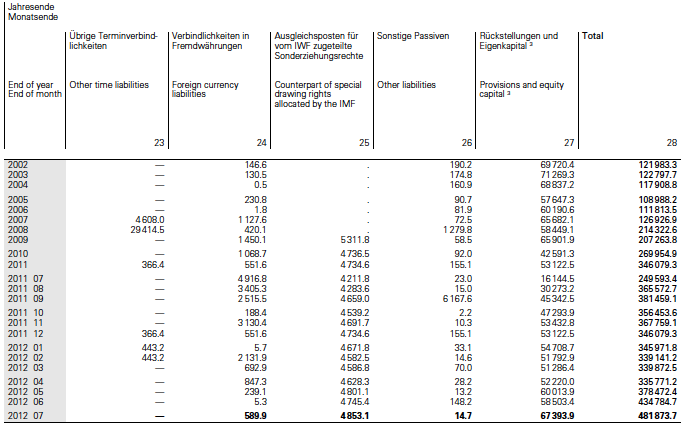

SNB Liabilities (source Monthly Bulletin September 2012)

Understand the balance sheet.

The most important not directly understandable balance sheet terms are the followings:

Sight deposits of domestic banks: Sight deposits of domestic banks in Swiss francs form the basis on which the SNB steers monetary policy. They also facilitate the settlement of cashless payments in Switzerland. These sight deposits are non-interest bearing accounts which are stated at nominal value.

Liabilities towards the Confederation: The SNB holds an interest-bearing sight deposit account for the Confederation.Interest is payable for amounts up to a maximum of CHF 200 million. In addition, the Confederation may place time deposits with the SNB at market rates. The liabilities towards the Confederation are stated at nominal value inclusive of accrued interest. Interest expenses are recorded under net result from Swiss franc positions.

Sight deposits of foreign banks and institutions: The SNB holds sight deposit accounts for foreign banks and institutions which facilitate payment transactions in Swiss francs. These sight deposits do not bear interest and are stated at nominal value.

Other sight liabilities: The main components in the other sight liabilities item are sight deposit accounts of non-banks, accounts of active and retired staff members and of the SNB’s pension funds. They are stated at nominal value inclusive of accrued interest. Interest expenses are stated under net result from Swiss franc positions.

Repo transactions: The SNB uses repo transactions in Swiss francs to provide the Swiss franc money market with liquidity or to withdraw liquidity from it. Liabilities arising from liquidity-absorbing repo transactions are stated at nominal value inclusive of accrued interest. Interest expenses are stated under net result from Swiss franc positions.

SNB debt certificates: To absorb liquidity from the market, the National Bank issues its own, interest-bearing debt certificates (SNB Bills) in Swiss francs. Money market management requirements dictate the frequency, term and amount of these issues. In addition, to refinance its loan to the stabilisation fund, the SNB issued its own debt securities in US dollars (SNB USD Bills). SNB Bills are valued at issue price plus cumulative discount accretion (i.e. the discount is amortised over the term of the issue). Interest expenses are stated under net result from Swiss franc positions or under net result from foreign currency positions. At the end of 2010, there were no outstanding debt certificates in US dollars, and in 2011, no debt certificates in US dollars were issued.

SNB Liabilities part 2 (source Monthly Bulletin September 2012)

Other term liabilities: This balance sheet item contains additional term liabilities in Swiss francs which arose from swap transactions with the US Federal Reserve. They arestated at nominal value inclusive of accrued interest. Interest expenses are stated under net result from Swiss franc positions.

Foreign currency liabilities: Foreign currency liabilities are comprised of different sight liabilities and short-term term liabilities as well as repo transactions related to the management of foreign currency investments. These repo transactions (temporary transfer of securities against sight deposits, with reverse settlement on maturity) result in an increase in the balance sheet total. On the one hand, the securities remain on the SNB’s books, while on the other, the cash received as well as the obligation to repay it on maturity are stated in the balance sheet. Foreign currency liabilities of this kind are stated at nominal value inclusive of accrued interest. Interest expenses and exchange rate gains and losses are stated under net result from foreign currency positions.

Counterpart of SDRs allocated by the IMF: This item comprises the liability vis-à-vis the IMF for the allocated Special Drawing Rights (SDRs). The counterpart item attracts interest at the same rate as the SDRs. Interest expenses and exchange rate gains and losses are stated under net result from foreign currency positions.

Operating provisions: For all identifiable obligations resulting from past events, provisions are recognised in accordance with the principle of prudent evaluation. Operating provisions comprise reorganisation provisions and other provisions. The reorganisation provisions consist mainly of financial undertakings to staff members in relation to early retirement.

Provisions for currency reserves: Art. 30 para. 1 NBA stipulates that the SNB set up provisions permitting it to maintain the currency reserves at the level necessary for monetary policy. In so doing, it must take into account economic developments in Switzerland. These special-law provisions are equity-like in nature and are incorporated in the ‘Changes in equity’ table (cf. p. 129). The allocation is made as part of the profit appropriation. The Bank Council decides on the level of these provisions once a year.

Distribution reserve: With the exception of the dividend which – pursuant to the NBA – may not exceed 6% of the share capital, the Confederation and the cantons are entitled to the SNB’s remaining profit after adequate provisions for currency reserves have been set aside. To achieve a steady flow of payments in the medium term, the annual profit distributions are fixed in advance for a certain period in an agreement concluded between the Federal Department of Finance and the SNB. The distribution reserve contains profits that have not yet been distributed. It is offset against losses and can therefore also be negative.

Source of explanations: SNB balance sheet

See more for

1 comment

hr4free.org

2013-11-22 at 17:51 (UTC 2) Link to this comment

Very interesting insights on Switzerland’s monetary policy !