There is a straightforward answer to the question in the headline: more money has been trying to get into Switzerland than get out, which didn’t affect the exchange rate as long as the Swiss National Bank bought foreign currency. As soon as they stopped, the exchange rate adjusted to balance the new set of flows. But a detailed look at the gross flows in and out of the country provides a more nuanced and interesting picture.

Capital Flight from the Euro Zone to Switzerland

In the heady days of 2010-2012, when it seemed as if the European Project was always one secret weekend meeting away from exploding in a fireball of poisonous politics and innumerate economics, Switzerland looked like a nice place to put your money. It was especially attractive if you were a resident of a stressed euro area country worried about wealth taxes, bank failures, currency re-denomination, or all of the above.

The result was capital flight from Greece, Spain and elsewhere into Switzerland. That led to a collapse in the value of the euro relative to the Swiss franc, which in turn inspired the Swiss National Bank’s imposition of a “floor” on the exchange rate to prop up the single currency. As the situation in Europe switched from rapidly getting worse to gradually getting worse, these inflows stopped.

Explosion of the SNB Balance Sheet

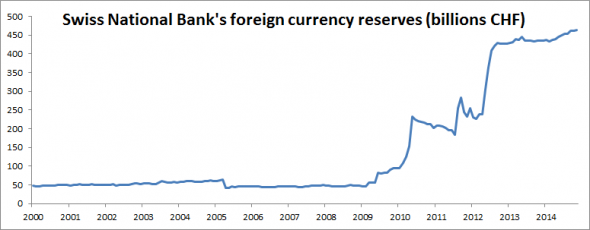

One way to see this is by looking at the size of the SNB’s foreign currency portfolio, which, during the period of the exchange rate intervention, grew whenever the country experienced net inflows:

As you can see, the size of the foreign reserve portfolio was basically unchanged from late 2012 through mid-2014, which may explain why the SNB felt the franc wouldn’t appreciate as much as it did when the floor fell out from under EURCHF.

That said, you can see that foreign reserves started growing again around six months ago, perhaps in part due to rich Greeks getting increasingly worried that a political party that aims to “destroy the basis upon which [the oligarchs] have built, for decade after decade, a system and network that viciously sucks the energy and economic power from everybody else in society” could come to power.

SNB have been holding the floor not against foreign speculative or safe-haven inflows, but against the country’s own residents

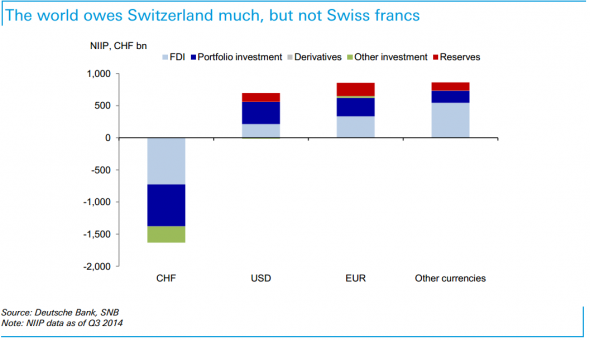

Those foreign sources of capital may have played a role, but according to a new report from Deutsche Bank, the main source of upward pressure on the franc over the past few years has been coming from Swiss residents who have been pulling money home from abroad, not from foreign residents trying to get into Switzerland.

It has been the lack of domestic demand for foreign assets rather than foreign demand for Swiss ones that has caused the lack of Swiss financial outflows. Swiss residents’ purchases of foreign deposits and foreign debt instruments are CHF 400bn and 250bn below pre-crisis trends respectively.

In effect, since 2012 the SNB have been holding the floor not against foreign speculative or safe-haven inflows, but the country’s own residents. At a less conceptual level, a Swiss corporate that previously recycled its EUR or JPY export earnings by buying EUR fixed income has simply been transferring them into CHF deposits instead.

Inflows of fiduciary deposits in Swiss franc and tax evasion

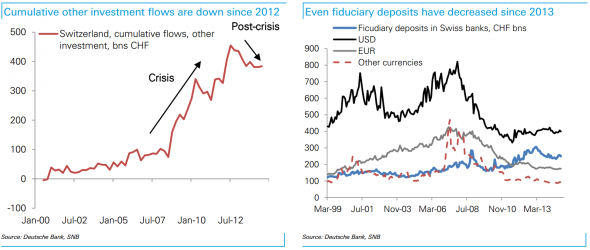

First, look at the cumulative flow of “other investment” into Switzerland and the fiduciary deposits held at Swiss banks by foreigners. As you can see, both have been falling thanks to the easing of the euro crisis and the crackdown on tax evasion:

Unless those trends suddenly reversed, which seems unlikely, something else must be at work.

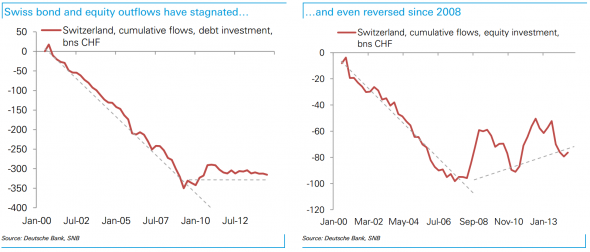

…. before the crisis … Swiss bought foreign assets

Until the crisis, Swiss residents bought a ton of foreign assets. Importantly, those assets were almost always denominated in foreign currency, which means that changes in those holdings ought to immediately flow through to the exchange value of the franc:

And sold foreign equities during the crisis

Lack of capital outflow rather than speculative inflows

As DB puts it:

For the franc, the fact that pressure has been generated by a lack of capital outflows rather than speculative inflows explains the mystery as to who was buying Swiss assets with exceptionally low yields and relative calm in the global environment. The answer: nobody.

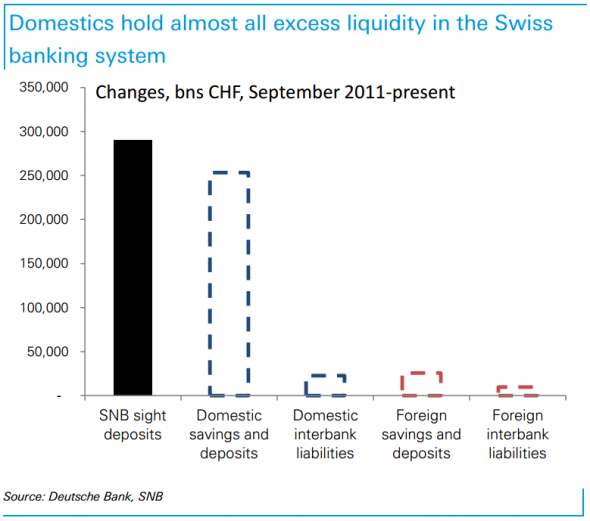

The corollary is that the vast majority of the growth Swiss bank liquidity has come from residents, rather than foreigners:

While Deutsche Bank doesn’t draw this conclusion, their finding supports the view that the franc has been undervalued rather than overvalued.

If you know that your currency is overpriced you want to buy as much foreign stuff as you can while the purchasing power is there, if for no other reason than to hedge against the eventual return to normalcy. The same logic also applies to petrol states when the oil price is high, or companies making acquisitions with overvalued shares.

Unusually weak consumption

By contrast, if your currency is underpriced, you lack purchasing power commensurate with your real output, which means you will buy less stuff than you otherwise would. We’ve previously argued that Switzerland’s persistently large current account surplus and unusually low level of real consumption per person, not to mention the market action, were signs that its currency had been suppressed below its “fair value” by the SNB. The fact that Swiss residents had stopped buying foreign assets like they used to also suggests that the real purchasing power of the franc fell a lot after 2008, despite the nominal appreciation of the currency.

Bottom line: Swiss exporters who resent the change in their terms of trade shouldn’t blame inflows from frightened Europeans for an “overvalued” currency, but their fellow citizens, who have stopped sending quite so much capital abroad as they used to.

(The full note is in the usual place.)

See more for