Colin Llyod via Seeking Alpha

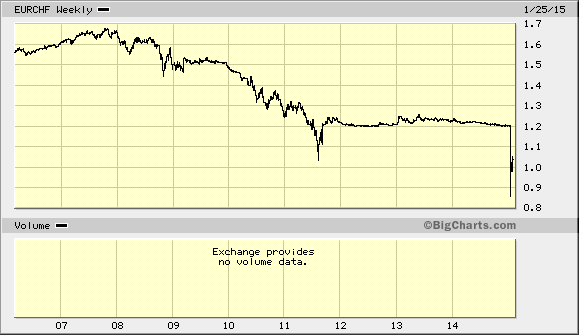

On Thursday, 15th January, the Swiss National Bank (SNB) finally, and unexpectedly, threw in the towel and ceased its foreign exchange intervention to maintain a pegged rate of EURCHF 1.20. The cap was introduced in September 2011 after a 28% appreciation in the CHF since the beginning of the Great Financial Crisis (GFC) – from 1.68 to 1.20. After plumbing the depths of 0.85, the EURCHF rate settled at 0.99 – around 18% higher in a single day. This is a huge one day move for a G10 currency and has inflicted collateral damage on leveraged traders, their brokers and those who borrowed in CHF to finance asset purchases in other currencies. Citibank estimates that it has also cost the SNB CHF 60bln. Here is a 10-year chart of EURCHF:-

Colin Llyod gives a detailed explanation of the end of the EUR/CHF peg on Seeking Alpha. Most extracts come from George Dorgan, on snbchf.com - Click to enlarge

The Swiss SMI stock index declined from 9,259 to 8,400 (-9.2%) whilst the German DAX index rose from 9,933 to 10,032 (+1.1%). Swiss and German bond yields headed lower. Swiss bonds now exhibit negative nominal yields out to 15 years – the table below is from Wednesday, 4th February:-

| Maturity | Yield |

| 1week | -1.35 |

| 1month | -1.65 |

| 2month | -1.55 |

| 3month | -1.4 |

| 6month | -1.38 |

| 1 year | -1.11 |

| 2 year | -0.823 |

| 3 year | -0.768 |

| 4 year | -0.632 |

| 5 year | -0.505 |

| 6 year | -0.419 |

| 7 year | -0.305 |

| 8 year | -0.257 |

| 9 year | -0.181 |

| 10year | -0.111 |

| 15year | -0.024 |

| 20year | 0.196 |

Source: Investing.com

Swiss inflation is running at -0.3% so the real yields are fractionally better due to the mild deflation seen in the past couple of months. I expect this deflation to deepen and persist.

Thomas Jordan – Chairman of the governing board of the SNB – made the following statement at a press conference which accompanied the SNB decision:-

Discontinuation of the minimum exchange rate

The Swiss National Bank (SNB) has decided to discontinue the minimum exchange rate of CHF 1.20 per euro with immediate effect and to cease foreign currency purchases associated with enforcing it. The minimum exchange rate was introduced during a period of exceptional overvaluation of the Swiss franc and an extremely high level of uncertainty on the financial markets. This exceptional and temporary measure protected the Swiss economy from serious harm. While the Swiss franc is still high, the overvaluation has decreased as a whole since the introduction of the minimum exchange rate. The economy was able to take advantage of this phase to adjust to the new situation. Recently, divergences between the monetary policies of the major currency areas have increased significantly – a trend that is likely to become even more pronounced. The euro has depreciated substantially against the US dollar and this, in turn, has caused the Swiss franc to weaken against the US dollar. In these circumstances, the SNB has concluded that enforcing and maintaining the minimum exchange rate for the Swiss franc against the euro is no longer justified.

Interest rate lowered

At the same time as discontinuing the minimum exchange rate, the SNB will be lowering the interest rate for balances held on sight deposit accounts to -0.75% from 22 January. The exemption thresholds remain unchanged. Further lowering the interest rate makes Swiss-franc investments considerably less attractive and will mitigate the effects of the decision to discontinue the minimum exchange rate. The target range for the three-month Libor is being lowered by 0.5 percentage points to between -1.25% and -0.25%.

Outlook for inflation and the economy

The inflation outlook for Switzerland is low. In December we presented a conditional inflation forecast, which predicts inflation of -0.1% for this year. Since this forecast was published, the oil price has once again fallen significantly, which will further dampen the inflation outlook for a time. However, lower oil prices will stimulate growth globally, and this will influence economic developments in Switzerland positively. Swiss franc exchange rate movements also impact inflation and the economic situation.

The SNB remains committed to its mandate of ensuring medium-term price stability while taking account of economic developments. In concluding, let me emphasise that the SNB will continue to take account of the exchange rate situation in formulating its monetary policy in future. If necessary, it will therefore remain active in the foreign exchange market to influence monetary conditions.

On Tuesday, 27th January, the CHF fell marginally after SNB Vice President Jean-Pierre Danthine told Swiss newspaper Tages Anzeiger – Die Presse war voller Spekulationen, that the SNB remains ready to intervene in the currency market. One comment worthy of consideration, with apologies for the “google-translate”, is:-

Q. Does the SNB did not develop a new monetary policy? Just as Denmark, which has tied its currency to the euro in 30 years? Or as Singapore, which manages its currency based on a trade-weighted basket of currencies?

A. Denmark is the euro zone financially and politically closer than Switzerland. The binding to Europe is a long standing. Means that this solution is for Switzerland hardly considered. The arrangement of Singapore is worthy of consideration. But what is decisive is the long-term. Apart from Switzerland and other small and open economies such as Sweden and Norway are done well over the years with a flexible exchange rate.

Rumours of a new unofficial corridor of EURCHF 1.05-1.10 are now circulating – strikingly similar to the level reached prior to the September 2011 peg.

Breaking the Bank

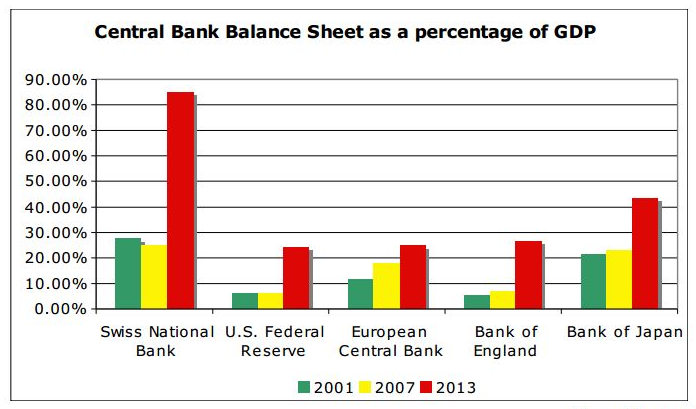

Another rumour to have surfaced after the currency move was that the SNB had become concerned about the size of its balance sheet relative to Swiss GDP. The chart below is from 2013, but it shows the relative scale of SNB QE:-

Estimates of the loss sustained by the SNB, due to the appreciation of the CHF, vary, but rather like countries, central banks don’t tend to “go bust”. The Economist – Broke but never Bust takes up the subject (my emphasis in bold):-

…For one thing central banks are far bigger. Between 2006 and 2014 central-bank balance-sheets in the G7 jumped from $3.4 trillion to $10.5 trillion, or from 10% to 25% of GDP. And the assets they hold have changed. The SNB, aiming to protect Swiss exporters from an appreciating currency, has built up a huge stock of euros, bought with newly created francs.

…Bonds that paid 5% or more ten years ago now yield nothing, and other investments have performed badly (the SNB was stung by a drop in the value of gold in 2013 and cut its dividend to zero). Concerned that its euro holdings might lose value the SNB shocked markets on January 15th by abruptly ending its euro-buying spree.

…With capital of €95 billion supporting a €2.2 trillion balance-sheet, the Eurosystem (the ECB and the national banks that stand behind it) is 23 times levered; a loss of 4% would wipe out its equity. Since two central banks have suffered devastating crunches recently (Tajikistan in 2007, Zimbabwe in 2009) the standard logic seems to apply: capital-eroding losses must be avoided.

But the worries are overdone. For one thing central banks are healthier than they appear. On top of its equity, the Eurosystem holds €330 billion in additional reserves. These funds are designed to absorb losses as assets change in value. Even if the ECB were to buy all available Greek debt-around €50 billion-and Greece were to default, the system would lose just 15% of these reserves; its capital would not be touched.

And even if a central bank’s equity were wiped out it would not go bust in the way high-street lenders do. With liabilities outweighing its assets it might seem unable to pay all its creditors. But even bust central banks retain a priceless asset: the power to print money. Customers’ deposits are a claim on domestic currency, something the bank can create at will. Only central banks that borrow heavily in foreign currencies they cannot mint (as in Tajikistan) or in failing states (Zimbabwe) get into deep trouble.

The Economist goes on to highlight the risk that going “cap in hand” to their finance ministries will weaken central banks’ “independence” and might prove inflationary. In the current environment, inflation would be a nice problem for the SNB, or for that matter the ECB or BoJ to have. As for the limits of central bank balance sheet expansion, the SNB – at 80% of GDP – has blazed a trail for its larger peers to follow.

Is it the money supply?

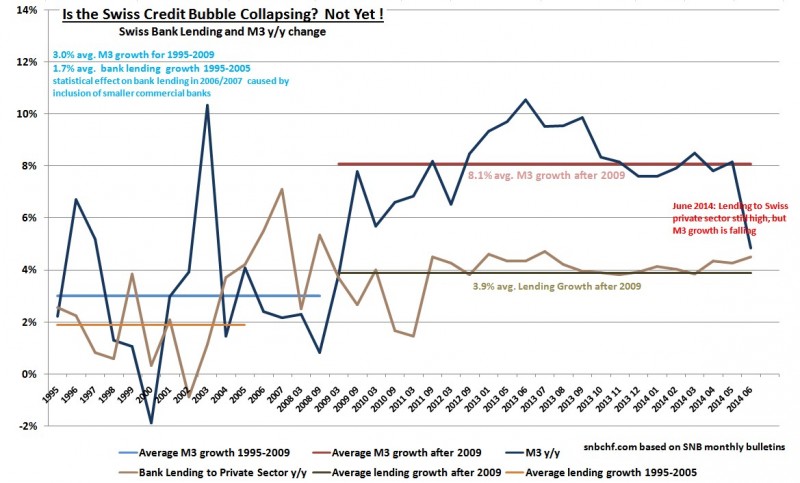

A further unofficial explanation of the SNB move concerns the unusually large expansion of Swiss money supply since the GFC. In early January, an article from snbchf.com – The Risks on the Rising SNB Money Supply – discussed how the SNB might be thinking (my emphasis):-

Since the financial crisis central banks in developed nations increased their balance sheets. The leading one was the American Federal Reserve that increased the monetary base (“narrow money”), followed by the Bank of Japan and recently the ECB. Only partially the extension of narrow money had an effect on banks’ money supply, so called “broad money”. For the Swiss, however, the rising money supply concerns both narrow and broad money. Broad money in Switzerland rises as strong as it did in Spain or Ireland before the financial crisis.

It goes on to discuss the global effects of QE:-

…The SNB had the choice between a stronger currency and, secondly, an excessive appreciation of the Swiss assets. With the introduction of the euro floor, it opted for the second alternative and increased its monetary base massively in order to absorb foreign currency inflows. Implicitly the central bank helped to push up asset prices even further. Hence it was rather foreign demand for Swiss assets that helped to increase the demand for credit and money in the real economy.

…The SNB printed a lot of money especially in the years before and just after the euro introduction until 2003, to weaken the franc and the “presumed slow” Swiss growth. The money increase, however, did not affect credit growth more than it should have: investors preferred other countries to Switzerland to buy assets. Finally the central bank increased interest rates a bit and reduced money supply between 2006 and 2008. Be aware that in 2006/2007 there is a statistical effect with the inclusion of “Raiffeisen” group banks into M3. Since 2009, things have changed M3 is rising with an average of 7.7% per year, while before 2009 it was 3% per year. Banking lending to the private sector is increasing by 3.9% per year while it was 1.7% between 1995 and 2005.

…Since April 2014, money supply M3 has suddenly stopped at around 940 billion CHF. Before it had increased by 80 bln. CHF per year from 626 bln. in each year since 2008. We explained before that Fed’s QE translated in higher lending in dollars, dollars that found their way into emerging markets. The same thing happens in Switzerland with newly created Swiss francs. Not all of them remained in the Swiss economy, but they were loaned out to clients from Emerging Markets. Hence the second risk does not directly concerns the Swiss economy and the euro, but the relationship between its banks and emerging markets and the risks of a strong franc for banks’ balance sheets.

The SNB’s decision to unpeg seems a brutal way to impose discipline on the domestic lending market and an unusual way to test increased bank capital requirements, however, I believe this was the least bad time to escape from the corner into which it had boxed itself. The recent fall in M3 should put some upward pressure on the CHF – until growth slows and reverses the process.

The SNB said this about money supply and bank lending in its Q4 2014 Quarterly Bulletin (my emphasis):-

Growth in money supply driven by lending

The expansion of the money supply witnessed since the beginning of the financial and economic crisis is mainly attributable to bank lending. An examination of components of the M3 monetary aggregate and its balance sheet counterparts, based on the consolidated balance sheet of the banking sector, shows that approximately 70% of the increase in the M3 monetary aggregate between October 2008 and October 2014 (CHF 311 billion) was attributable to the increase in domestic Swiss franc lending (CHF 216 billion). The remaining 30% of the M3 increase was due in part to households and companies switching their portfolio holdings from securities and foreign exchange into Swiss franc sight deposits.

Stable mortgage lending growth in the third quarter

In the third quarter of 2014 – as in the previous quarter – banks’ mortgage claims, which make up four-fifths of all domestic bank lending, were up 3.8% year-on-year. Mortgage lending growth thus continued to slow, as it has for some time now, despite the fact that mortgage rates have fallen to a historic low. A breakdown by borrower shows that the growth slowdown has taken place in mortgage lending to households as well as companies.

This slower growth in mortgage lending may be attributed to various measures taken since 2012 to restrain the banks’ appetite for risk and strengthen their resilience. These include the banks’ own self-regulation measures, which subject mortgage lending to stricter minimum requirements. Moreover, at the request of the SNB, the Federal Council activated the countercyclical capital buffer in 2013 and increased it this year. This obliges the banks to back their mortgage loans on residential property with additional capital. The SNB’s bank lending survey also indicates that lending standards have been tightened and demand for loans among households and companies has declined.

…Growing ratio of bank lending to GDP

The strong growth in bank lending recorded in recent years is reflected in the ratio of bank loans to nominal GDP. After a sharp rise in the 1980s, this ratio remained largely unchanged until mid-2008. Since the onset of the financial and economic crisis, it has increased again substantially. This increase suggests that banks’ lending activities have supported aggregate demand. However, strong lending growth also entails risks for financial stability. In the past, excessive growth in lending has often been the root cause of later difficulties in the banking industry.

Switzerland’s banking sector is truly multi-national, deposits continue to arrive despite penal “negative” rates, meanwhile, many CHF bank loans have been made to international clients. The sharp appreciation of the CHF will force the banking sector to make additional provisions for non-performing international loans. Further analysis of the effect of relative money supply growth, between Switzerland and the Eurozone (EZ) on the EURCHF exchange rate, can be found in this post by Frank Shostak – Post Mortem on the Swiss Franc’s Euro-Peg. He makes an interesting “Austrian” case for a weakening of the CHF versus the EUR over time.

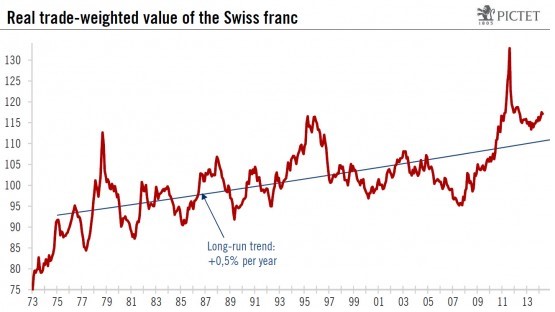

Swiss Franc in the long run

My first ever journey outside the UK was to Switzerland, that was back in 1971 when a pound sterling bought CHF 10.5. The Swiss economy has had to deal with a constantly rising exchange rate ever since. The chart below of the CHF Real Trade-Weighted value shows this most clearly: –

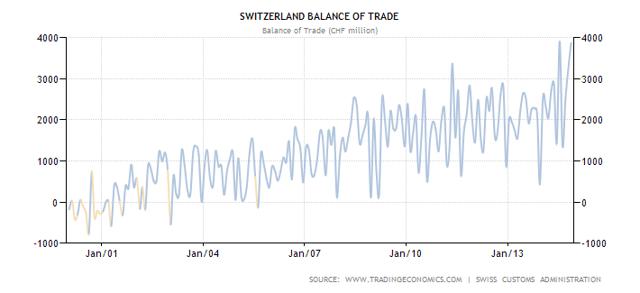

This chart only goes up to mid-2013. Since then, the USDCHF has moved from 0.88 and 0.99 by early January – after the unpegging, the rate is near to its midpoint at 0.93. According to the Guardian – What a $7.54 Swiss Big Mac tells us about global currencies – the Swiss currency is now 33% overvalued. Exporters will be hit hard and the financial sector is bound to be damaged by commercial bank lending policies associated with pegging the CHF to a declining EUR. On Monday, Bank Julius Baer (OTCPK:JBAXY) announced plans to cut costs by CHF 100mln, domestic job cuts were also indicated – more institutions are sure to follow its lead. Meanwhile, there are bound to be emerging market borrowers who default. The Swiss economy will slow, exacerbating deflationary forces, but lower prices will improve the purchasing power of the domestic population. Switzerland’s trade balance hit a record high in July 2014 and came close to the same level in November:-

Source: Trading Economics and Swiss Customs

In a recent newsletter – The Swiss Release the Kraken – John Mauldin quoted fellow economist Charles Gave in a tongue-in-cheek assessment of the SNB’s action:-

They [the SNB] didn’t mind pegging the Swiss franc to the Deutsche mark, but it is becoming more and more obvious that the euro is more a lira than a mark. A clear sign is the decline of the euro against the US dollar.

Mr. Draghi has been trying to talk the euro down for at least a year. This should not come as a surprise. After all, in the old pre-euro days, every time Italy had a problem, the solution was always to devalue.

But the Swiss, not being as smart as the Italians, do not believe in devaluations. You see, in Switzerland they have never believed in the ‘euthanasia of the rentier’, nor have they believed in the Keynesian multiplier of government spending, nor have they accepted that the permanent growth of government spending as a proportion of gross domestic product is a social necessity. The benighted Swiss, just down from their mountains where it was difficult to survive the winters, have a strong Neanderthal bias and have never paid any attention to the luminaries teaching economics in Princeton or Cambridge. Strange as it may seem, they still believe in such queer, outdated notions as sound money, balanced budgets, local democracy, and the need for savings to finance investments. How quaint!

Of course, the Swiss are paying a huge price for their lack of enlightenment. For example, since the move to floating exchange rates in 1971, the Swiss franc has risen from CHF4.3 to the US dollar to CHF0.85 and appreciated from CHF10.5 to the British pound to CHF1.5. Naturally, such a protracted revaluation has destroyed the Swiss industrial base and greatly benefited British producers [not!]. Since 1971, the bilateral ratio of industrial production has gone from 100 to 175…in favor of Switzerland.

And for most of that time Switzerland ran a current account surplus, a balanced budget, and suffered almost no unemployment, all despite the fact that nobody knows the name of a single Swiss politician or central banker (or perhaps because nobody knows a single Swiss politician or central banker, since they have such limited power? And that all these marvelous results come from that one simple fact: their lack of power.)

The last time I looked, the Swiss population had the highest standard of living in the world – another disastrous long-term consequence of not having properly trained economists of the true faith.

Swiss unemployment has been trending higher recently (3.4% in December) and this figure may rise as sectors such as banking and tourism adjust to the new environment, however, this level of unemployment is still enviable by comparison with other developed countries.

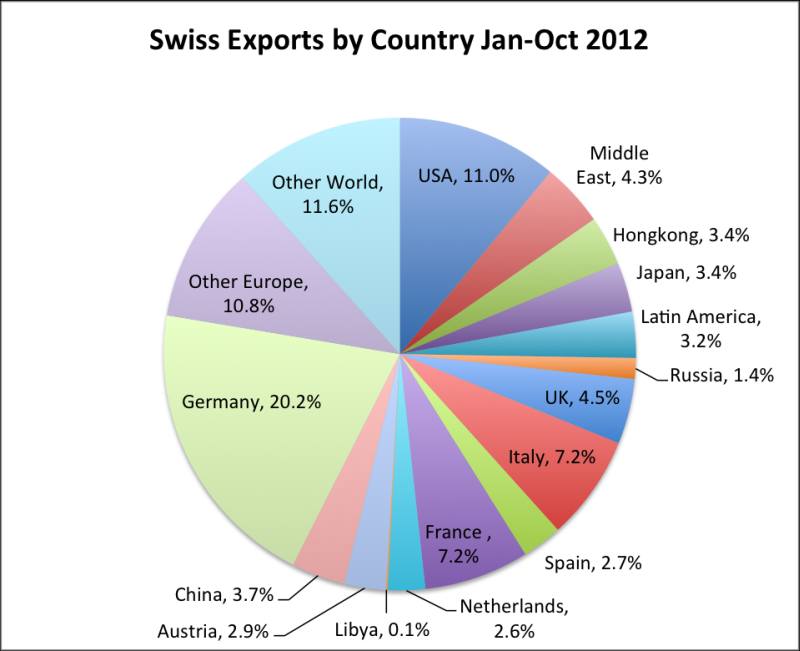

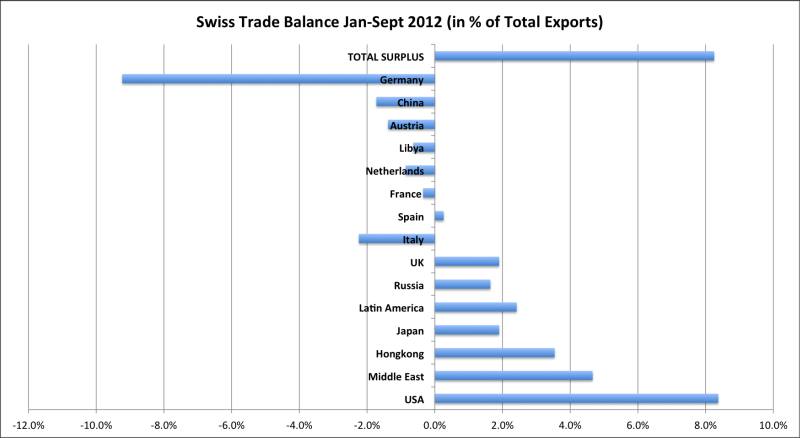

The following charts give an excellent insight into the nature of trade in the Swiss economy. Firstly, exports:-

The importance of the EZ is evident (46.4% excluding UK), however, the next chart shows a rather different perspective:-

The relative importance of the USA is striking – 11% of exports but nearly half of the trade surplus – so too is the magnitude of the deficit with Germany. In fact, within Europe, only Spain and the UK are export surplus markets.

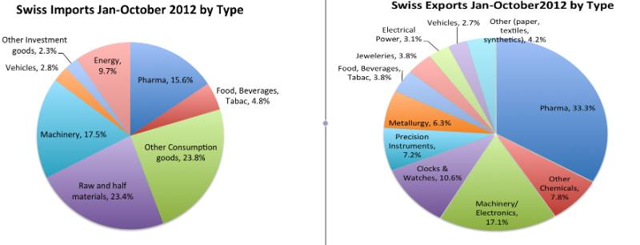

A closer look at the breakdown of Imports and Exports by sector provides an additional dimension:-

The SNB already highlighted the import of energy as a significant factor – Switzerland’s energy bill is now much lower than it was in July 2014. The export of pharmaceuticals has always been of major importance – many of these products are inherently price inelastic, the rise in the currency will have less impact on Switzerland than it might do on other developed economies.

Conclusion and investment opportunities

“The reports of my death are greatly exaggerated.”

Mark Twain

Contrary to what several commentators have been suggesting, I do not believe the SNB capitulation marks the beginning of the end of central bank omnipotence – they were never that omnipotent in the first place. The size of the SNB balance sheet is also testament to the limits of QE – if the other G7 central banks expand to 80% of GDP, the total QE would more than triple from $10.5 trln to $33.6 trln – and what is to say that 80% of GDP is the limit?

Swiss Markets

Switzerland will benefit from a floating currency in the longer term although the recent abrupt appreciation may lead to a recession – which in turn should reduce upward pressure on the CHF. Criticism of the SNB for creating greater volatility within the Swiss economy is only partially justified, the excessive rise of the CHF effective exchange rate was due to external factors and the SNB felt it needed to be managed, the subsequent rise in the US dollar brought the CHF back to a more realistic level, but the current environment of zero interest rate policy adopted by several major central banks has parallels with the conditions seen after the collapse of Bretton Woods.

I believe the SNB anticipates an acceleration in the long-term trend rate of appreciation of the CHF. Swiss exports, even to the US, will be impaired, but German imports will be cheaper – with a record trade surplus, this is a good time to start the adjustment of market expectations about the value of the CHF going forward. Swiss companies are used to planning within a framework which incorporates a steadily rising value of their currency – now they must anticipate an acceleration in that trend.

The money and bond markets will remain distorted and, in the event of another EZ crisis, the SNB may increase the penalties for access to the “safe-haven” Switzerland represents, and as indicated, it may intervene again if the capital flows become excessive. 20 year or longer Confederation Bonds alone offer positive carry. Buying call spreads on shorter maturities is a strategy worth considering.

The SMI index is likely to lag the broader European market, but negative bond yields offer little alternative to stocks, and domestic investors will exhibit a renewed cognizance of the risk of foreign currency investments. The SMI index, at around 8,550, is only 7.6% below the level it was trading prior to the SNB announcement. Swiss stocks will undoubtedly benefit from any export-led European economic recovery. Meanwhile, the relative strength of the US economy appears in tact – the Philadelphia Fed Leading Indexes for December – released earlier this week – suggests economic expansion in 49 states over the next six months.

Eurozone Markets

The EZ has already been aided by the departure of its strongest “shadow” member; combined with the ECB’s Expanded Asset Purchase Programme (EAPP), this should drive the EUR lower. European stocks have already taken heart, fuelled by the new liquidity and international competitiveness.

European bond spreads continue to compress. Fears of peripheral countries exiting the single currency area will provide volatility, but for the major countries – France, Italy and Spain – any weakness is still a buying opportunity, but at these often negative real yields, they should be viewed as a “trading” rather than an “investment” asset.

See more for