Category Archive: 1) SNB and CHF

Les nouveaux billets – De la mise en circulation au retour à la BNS (version pour malentendants)

Ce film nous fait suivre l’itinéraire des nouveaux billets de banque suisses: depuis le stockage et le contrôle qualité à la Banque nationale jusqu’à la mise en circulation. Il présente aussi le tri et la destruction des billets de l’ancienne série.

Read More »

Read More »

Les nouveaux billets – La production et la mise en circulation (version pour malentendants)

Ce film est consacré à la fabrication des nouveaux billets de banque suisses. Il donne une vue d’ensemble des différentes étapes du processus: fabrication du substrat, impression, contrôle initial, stockage et mise en circulation. Il présente aussi en détail le substrat spécial qu’est le Durasafe® et les différents modes d’impression.

Read More »

Read More »

March 2016: Highest SNB Interventions since January 2015

Speculative position: Strong shift to CHF long: +4967x 125K contracts after the Fed reduced their expectations of rate hikes for this year. …………Sight Deposits: SNB intervenes for 6.1 bln. CHF during the month of March. This is the higest level since January 2016. ……….FX: EUR/CHF steady slightly over 1.09. As I expected last week, the EUR/CHF …

Read More »

Read More »

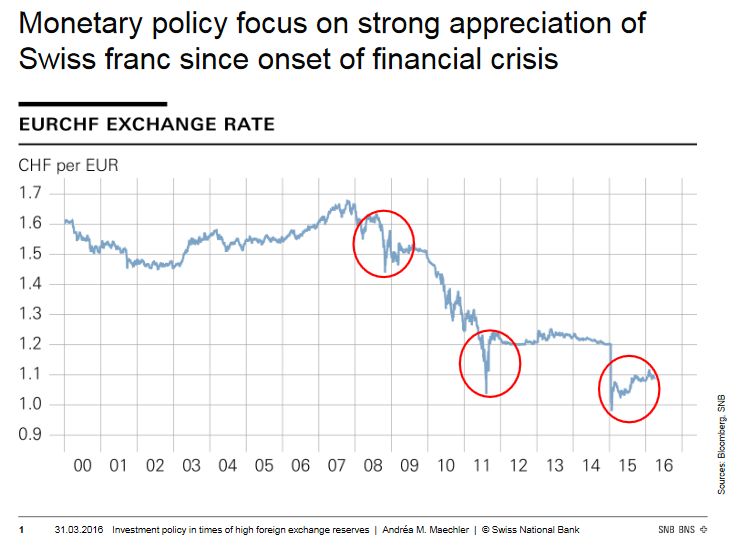

Investment policy in times of high foreign exchange reserves

The Money Market Event is the biggest feast of the Swiss National Bank and a selected list of money managers that work together with the central bank. It is initiated by important speeches and ended with a generous buffet dinner. In the first speech, Andrea Mächler addressed three points:

The expansion of the SNB balances sheet as measure against the so-called "strong franc" in a historic perspective.

How the SNB takes over currency risks from...

Read More »

Read More »

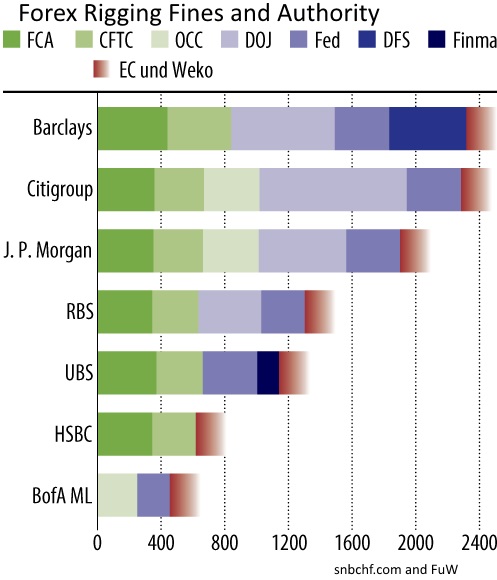

The SNB and the Forex Rigging Irony

While Forex banks, traders, and other institutions are being blamed for market rigging, the Swiss National Bank can publish reports about its own market rigging, but instead of being a scandal, it's economic data. That's because the vast majority do...

Read More »

Read More »

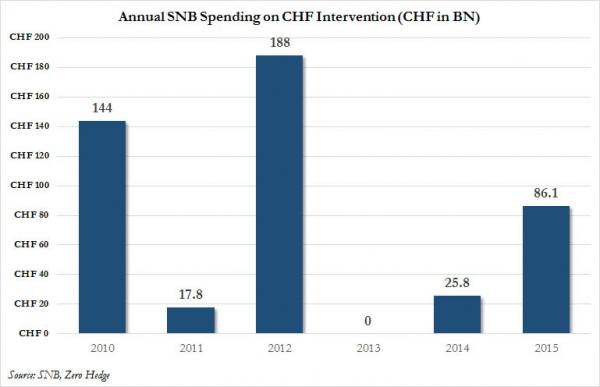

Swiss National Bank Admits It Spent $470 Billion On Currency Manipulation Since 2010

By now it is common knowledge that when it comes to massive, taxpayer-backed hedge funds, few are quite as big as the Swiss National Bank, whose roughly $100 billion in equity holdings have been extensively profiled on these pages, including its woef...

Read More »

Read More »

How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8

Submitted by Ronan Manly of Bullionstar Blogs

Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exporte...

Read More »

Read More »

SNB Monetary Policy Assessment and Critique

We examine the SNB monetary assessment statement of March 17 and the Swiss economy. We explain why negative rates may be a "toothless measure" if a central bank wants to weaken a currency. They have rather an inexpected consequence, they slow down GDP growth, in particular for banks and pension funds.

Read More »

Read More »

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 10.12.2015

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 10.12.2015 00:00 Einleitende Bemerkungen von Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank – Remarques introductives de Thomas Jordan, président de la Direction générale de la Banque nationale suisse – Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National … Continue reading »

Read More »

Read More »

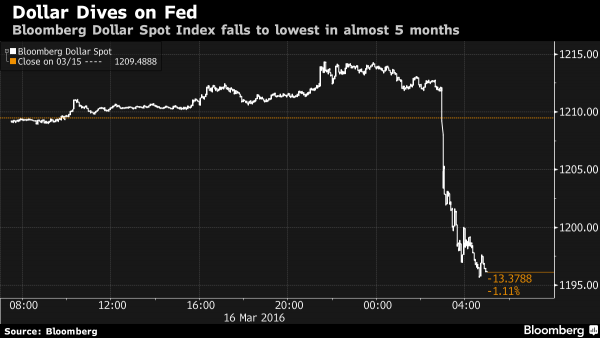

Another Fed “Policy Error”? Dollar And Yields Tumble, Stocks Slide, Gold Jumps

Yesterday when summarizing the Fed's action we said that in its latest dovish announcement which has sent the USD to a five month low, the Fed clearly sided with China which desperately wants a weaker dollar to which it is pegged (reflected promptly ...

Read More »

Read More »

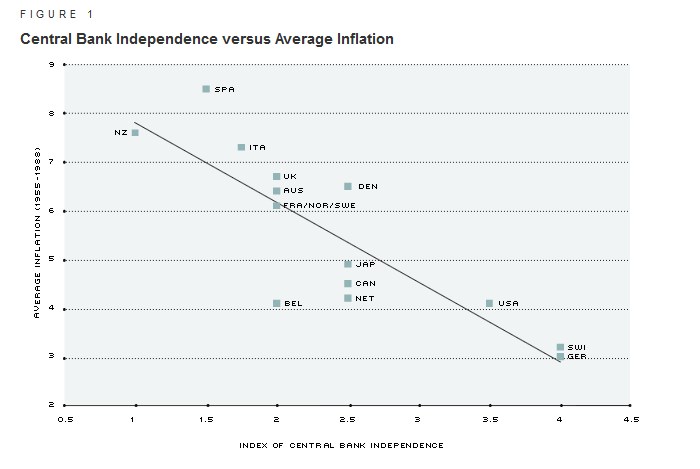

Central Bank Independence in Switzerland: A Farce

articles by Marc Meyer, one of the most critical voices against the SNB.

This post explains

--- That the SNB does not understand what assets and liabilities are - and therefore - it speculates with massive leverage.

--- The difference between good and bad deflation

--- Both the SNB and the Swiss government do what some Swiss exporters want. Therefore, the formerly admired central bank independence in Switzerland has become a farce.

Read More »

Read More »

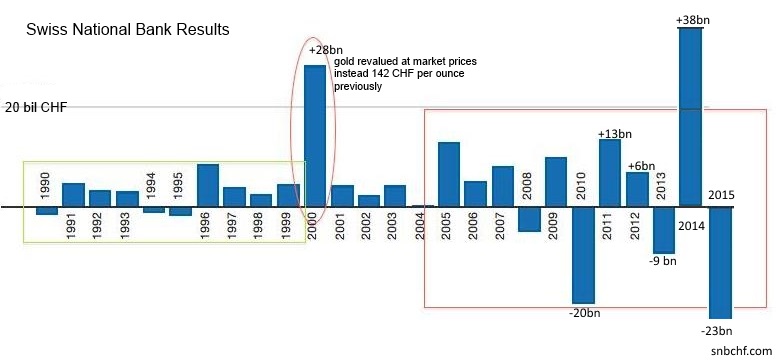

Swiss National Bank Results 2015 and Comments

The Swiss National Bank (SNB) is reporting a loss of CHF 23.3 billion for the year 2015 (2014: profit of CHF 38.3 billion). The loss on foreign currency positions amounted to CHF 19.9 billion. A valuation loss of CHF 4.2 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.2 billion.

Read More »

Read More »

SNB Reduced Loss from 50 Billion in June to 23 Billion

According to the latest news release, the Swiss National Bank expects an annual loss of 23 billion CHF, after reporting a loss of 50 billion at the end of June. Primarily thanks to the stronger dollar, the SNB was able to achieve unrealized gains of 27 billion CHF in the second half. This reduced her annual loss to 23 billion. With its rate hike, Fed is helping the SNB: the dollar has appreciated by 6% since July.

Read More »

Read More »

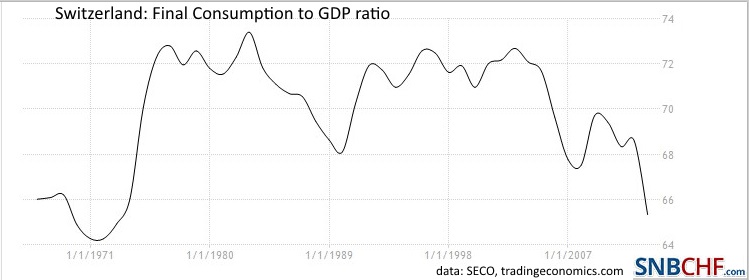

Swiss GDP and Swiss Franc Shock Propaganda

For George Dorgan the "Swiss Franc Shock" celebrated by the Swiss press did not affect the Net Exports component of Swiss GDP, but it rather suppressed growth in consumption. Therefore the Swiss economy could not replace lost export jobs by new jobs in the internal economy.

Read More »

Read More »

Central Banks Shiny New Tool: Cash-Escape-Inhibitors

Submitted by JP Koning via Moneyness blog,

Negative interests rates are the shiny new thing that everyone wants to talk about. I hate to ruin a good plot line, but they're actually kind of boring; just conventional monetary policy except in negative ...

Read More »

Read More »

Are Central Banks Setting Each Other Up?

Authored by Mark St.Cyr,

There are times you try to connect the dots. There are others where those connections warrant adorning your trusted tin-foiled cap of choice; for you just can’t get there unless you do. This I believe is one of those time...

Read More »

Read More »

Swiss Politicians Slam Attempts To Eliminate Cash, Compare Paper Money To A Gun Defending Freedom

As we predicted over a year ago, in a world in which QE has failed, and in which the ice-cold grip of NIRP has to be global in order to achieve its intended purpose of forcing savers around the world to spend the taxed product of their labor, one thi...

Read More »

Read More »

MXN Shorts Crushed After Mexican Central Bank Unexpectedly Hikes Rate By 50bps, Peso Soars

It was already a torrid day for commodity currencies, among which the MXN, or Mexican Peso, which were surging on today's latest crude short squeeze and then as if pulling a PBOC with just one intention - to crush the shorts - the Mexican Central Ban...

Read More »

Read More »

Global Stocks Soar On Stimulus Hopes After Miserable Chinese, Japanese Data; Short Squeeze

Bad news is once again good news... for stocks that is.

After a month and a half of markets unable to decide if they should buy or sell on ugly data, over the weekend, People’s Bank of China Governor Zhou Xiaochuan expressed faith in the economy, ...

Read More »

Read More »