Bad news is once again good news... for stocks that is.

After a month and a half of markets unable to decide if they should buy or sell on ugly data, over the weekend, People’s Bank of China Governor Zhou Xiaochuan expressed faith in the economy, and said there is no basis for further Yuan devaluation, something the PBOC has consistently implied over the past year, despite two sharp devaluation episodes. That said, for Xiaochuan to break a very long silence, shows i) just how serious the threat of devaluation for China is and ii) how eager the PBOC also is to jawbone risk higher.

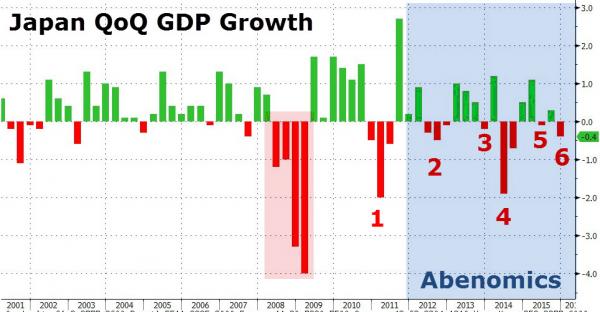

And while further devaluation is guaranteed, for now traders decided to take advantage of this verbal intervention and ignore the worst Japanese GDP data in over a year, when as reported last night, the country's economy contracted at a -1.4% annualized rate, far worse than expected -0.8%...

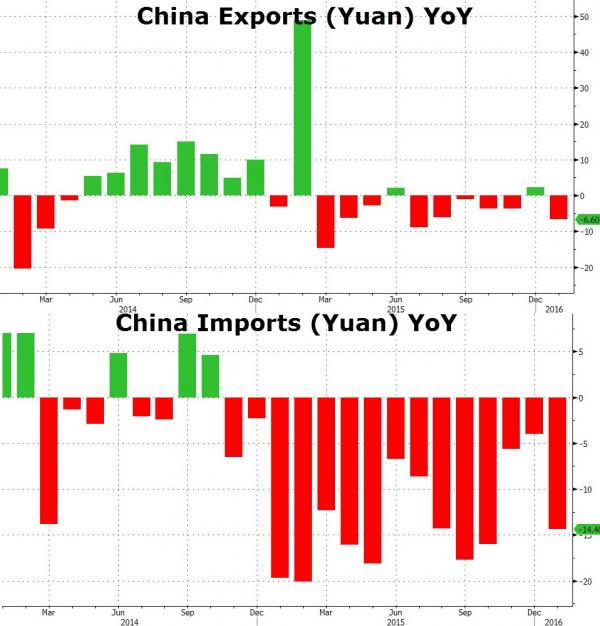

... as well as to ignore the worst Chinese trade data, with both exports and imports coming below the lowest Wall Street estimate, since August...

... when just days after the trade report the PBOC proceeded with its first devaluation. The data was so bad it managed to push the Shanghai Composite nearly into

the green after opening down nearly 3% on a delayed catch up to the rest

of the world selloff.

The result of all this terrible economic data: hopes for more stimulus around the globe, and mostly in Asia, with bank concerns (especially of Deutsche Bank) that more stimulus is not what the global financial system needs soundly ignored for now.

The following quotes summarizes the catalysts for today's move best:

"The Chinese market didn’t react as bad as we feared and with the weak export data there is some big hope that he central banks will react quite fast," John Plassard, senior equity-sales trader at Mirabaud Securities LLP in Geneva, told Bloomberg. "It’s a mix of hope of intervention from the Asian central bank, short squeeze and also a relief in some energy and banking sectors, the most shorted sectors."

And there are your catalysts for today's surge: hope of more central bank intervention and a global short squeeze.

So back to square one.

The immediate result was the biggest Yuan surge since 2005, climbing 1.2 percent from its Feb. 5 close to 6.4942 per dollar in Shanghai; the biggest jump in Japanese equities since October 2008 on the heels of the Nikkei's 7.2%, or 1,070 point jump; the biggest spike in the MSCI Asia Pacific Index since 2009, a continuation of Friday's rally in Europe with the Stoxx 600 up over 3% led by financials, and even WTI jumped nearly 2% to rise back over $30 this morning, despite being lower most of the session on renewed excess supply concerns now that Iranian tankers are en route to their destination.

Among the other oil price drivers overnight, was Iran sending its first oil cargos to offshore destination after the lifting of sanctions: South Korea imports from Iran reach 2-yr high as Saudi imports fall. Iran average oil exports at 1.3MM b/d; to climb to 1.5MM b/d by end of current Iranian year at March 20, to 2MM b/d soon after: Shana cites 1st VP Eshaq Jahangiri.

Just as important, China January crude imports fell 4.6% to 6.31m b/d, the lowest in 3 months, down from record in December, as even Chinese oil storage capacity fills up. Chinese oil product imports +13.3% at 2.66MM mt, exports +45% y/y 3.01MM mt.

While the US is closed for President's day, US equity futures are open until noon Central Time, and at last check were up 1.6%, or 29 points to 1,888, piggybacking on the global euphoria.

A quick recap of market closures in the US for Presidents Day:

- NYSE Closed

- CME Equity: Closes at 12:00 Central; Reopens at 17:00 Central

- CME Interest Rates: Closes at 12:00 Central; Reopens at 17:00 Central

- CME FX: Closes at 12:00 Central; Reopens at 17:00 Central

- NYMEX: Closes at 12:00 Central; Reopens at 17:00 Central

For the recap of global markets, we start in Asia where stocks traded mostly higher following last Friday's gains in Wall St. where outperformance in financials and a resurgence in crude, which posted its largest one-day gain since 2009, lifted markets from last week's early turmoil. Nikkei 225 (+7.2%) outperformed, led by financials and energy, while ASX 200 (+1.64%) was supported by commodity-based sectors, which also followed from last week's 5.6% rally in gold prices. Mainland China bucked the trend with the Shanghai Comp (-0.63%) negative as it played catch up to last week's losses, with poor export trade data adding to its sombre tone. JGBs traded lower tracking T-notes as the increase in risk sentiment spurred outflows from safe haven assets.

Top Asia News

- Yuan Rises Most Since 2005 as PBOC Voices Support, Raises Fixing

- HSBC Keeps London Headquarters in Victory for U.K. Over Asia

- China Bad-Loan Problem Not as Bad as Bass Makes Out, CICC Says

- Airbus, Boeing Count on China as Southeast Asia Slows Down

- Hong Kong Land Price Plunges Nearly 70% in Government Tender

- Indonesia’s Jokowi Gets Traction After Tumultuous First Year

- Toyota-Led Profit Gains at Risk as Carmakers Face Strong Yen

- Record Wheat Forecast Spurs Investor Bets Price Rout Will Deepen

Looking at Europe, what we find is - literally - nothing but green:

Benchmark stock indexes of Italy, Spain and Germany rallied more than 2 percent. Putting that in context, all of these bourses lost more than 16 percent this year through Friday, becoming some of the world’s worst performers among 93 equity indexes tracked by Bloomberg.

The Euro Stoxx trades higher by over 3% this morning, with the financial sector the best performing. Of note, although financials outperform, banking heavyweights Deutsche Bank (+2.4%) and Commerzbank (+2.6%) have pared much of their gains from early in the session to underperform the main indices. Separately, the energy and materials sectors are the laggards in Europe today, with risk on sentiment failing to boost commodities. Elsewhere, Bunds have also fallen today given the turnaround in sentiment although remaining off their worst levels.

Top European News

- VW’s Winterkorn Notified of U.S. Probe in 2014: Bild am Sonntag

- Orange-Bouygues Telecom Talks Nearly Collapsed, Echos Says

- HSBC Decides to Remain Headquartered in the U.K.

- Carrefour Says French Offices Raided Feb. 9 by Anti-Fraud Body

- ArcelorMittal Says European Steel Needs Defense Against China

- Reckitt 4Q LFL Sales Growth, 2015 Adj. Oper. Profit Beats Ests.

In FX, the yuan climbed 1.2 percent from its Feb. 5 close to 6.4942 per dollar in Shanghai. People’s Bank of China chief Zhou said China’s balance of payments is good and capital outflows are normal, with the exchange rate basically stable against a basket of other currencies, according to an interview published Saturday in Caixin magazine. The comments marked an escalation in verbal support for Chinese markets, with Zhou having left most of the commentary over the past few months to deputies.

The yen retreated 0.6 percent to 113.94 per dollar, trimming this month’s advance to 6 percent. Japan’s GDP shrank an annualized 1.4 percent in the three months ended Dec. 31, following a revised 1.3 percent gain in the third quarter, official data show.

The Bloomberg Dollar Spot Index, a gauge of the greenback against 10 major peers, rose 0.2 percent as more positive sentiment dimmed the appeal of haven currencies like the yen, euro and the Swiss franc. The index has lost 0.9 percent this year as the case for further U.S. rate hikes in 2016 dims.

The Malaysian ringgit, Russian ruble and South African rand gained at least 0.4 percent, with a gauge of developing-nation currencies adding 0.2 percent, following 0.4 percent drop last week.

In commodities, West Texas Intermediate crude reversed losses, climbing to $29.86, after earlier falling as much as 1.7 percent. Iran loaded its first cargo to Europe since international sanctions ended, while Chinese crude imports in January fell almost 20 percent from a record in the previous month.

Copper rallied with other metals after China’s central bank chief stepped up efforts to restore stability to the nation’s currency and economy. The metal gained 1.8 percent in London, while nickel surged 4.4 percent.

In Europe's periphery, Portuguese bonds, which suffered the brunt of the selloff in riskier assets last week together with Greece, advanced for a second day. Portugal’s 10-year bond yield fell 22 basis points to 3.51 percent. Spain’s 10-year bond yield fell four basis points to 1.70 percent, leaving the spread to similar-maturity bunds at 143 basis points, after rising to 170 basis points on Feb. 11.

The cost of insuring corporate debt tumbled for a second day. The Markit iTraxx Europe Index of credit-default swaps on investment-grade companies dropped four basis points to 114 basis points. A measure of swaps on junk-rated businesses fell 21 basis points to 441 basis points. Indexes tied to swaps on financial companies’ senior and subordinated debt also dropped, largely erasing last week’s increases.

With US markets closed for Presidents' Day today it’s a quiet start to the week with no data due in the US and just the Euro area trade balance reading due this morning in the European session

Bulletin Headline Summary from RanSquawk and Bloomberg

- Equities kick off the week on the front-foot with particular outperformance in financials, while risk-on sentiment is in full swing.

- Shanghai Comp. (-0.63%) played catch-up, consequently bucking the trend as the latest domestic trade data further highlighted the issues facing the nation's export sector.

- Looking ahead participants will be keeping keen eye on comments from ECB President Draghi who is scheduled to speak at 1400GMT, while the US will be away from the market.

- Negative rates to cut major Japan bank profits by 8 pct this year

- Yuan Rises Most Since 2005 as PBOC Voices Support, Raises Fixing

- HSBC Keeps London Headquarters in Victory for U.K. Over Asia

- China Bad-Loan Problem Not as Bad as Bass Makes Out, CICC Says

- Airbus, Boeing Count on China as Southeast Asia Slows Down

- VW’s Winterkorn Notified of U.S. Probe in 2014: Bild am Sonntag

- Orange-Bouygues Telecom Talks Nearly Collapsed, Echos Says

- HSBC Decides to Remain Headquartered in the U.K.

As customery, DB's Jim Reid concludes the overnight event wrap

This weekend, PBoC Governor Zhou Xiaochuan broke a very long silence and spoke to Caixin financial magazine to suggest that capital controls are not needed and that neither is further exchange rate depreciation. The lack of central bank communication throughout the two bouts of weakening the currency in the last 6 months have been deafening so this at least shows some willingness to communicate on something that has been threatening to destabilise markets with the fear of a big devaluation hanging over the market. Clearly the market might still force the issue and some credibility may have already been eroded but at least these words are a welcome response.

Following those comments, DB’s China Chief Economist Zhiwei Zhang highlighted that the most important statement was the acknowledgement from the Governor of a need for patience in balancing reform, growth and stability, as well the need to remain a responsible economic power. Zhiwei believes that the statement showed three important points. 1. The PBoC is still committed to FX policy reform from a dollar peg to a floating regime in the long term. 2. The global financial market volatility has likely closed the window for now. 3. The PBoC will likely stick to the dollar peg for now, and wait for the next window to float the currency. These conclusions have led Zhiwei to revise down the probability of a large RMB devaluation to 10% from 15%. Perhaps as a statement of intent from the PBoC, the CNY fix was set +0.3% stronger this morning and is currently trading over 1% firmer which, as it stands, is the biggest strengthening for the onshore currency since July 2005 (although it's clearly playing some catch up with the weakness in the US Dollar last week).

There’s also been some important data out of China for us to digest over the last couple of days. The first was the retail sales numbers where according to the Ministry of Commerce, sales were said to have risen +11.2% yoy over the Spring Festival Period, boosted in particular by a strong increase in box-office sales. While those numbers were seen as positive, the January trade numbers, released this morning, are less so. In Dollar terms exports were down a sharp 11.2% yoy in January (vs. -1.8% expected) from -1.4% in December. That was the biggest plunge since March. Imports also tumbled a lot more than expected (-18.8% yoy vs. -3.6% expected) with the trade surplus a shade higher as a result at $63.3bn (from $60.1bn). In CNY terms exports were also sharply lower (-6.6% yoy vs. +3.6% expected) although also outdone by a huge decline in CNY imports.

Open for the first time in ten days, bourses are trading lower in China this morning although the moves are more than likely reflecting the catch-up from markets elsewhere last week. The Shanghai Comp (-0.77%), CSI 300 (-0.65%) and Shenzhen (-0.41%) are all lower just after the midday break, although in fairness have pared earlier steeper falls (of up to 3%). The most eye catching moves have come in Japan again where the Nikkei and Topix have rallied +7.16% and +8.32% respectively. This has come despite a softer than expected Q4 GDP report for the economy (-0.4% qoq vs. -0.2% expected), adding some weight perhaps to the argument for further easing from the BoJ. Elsewhere the Hang Seng (+2.94%), Kospi (+1.48%) and ASX (+1.64%) are up, while credit markets in Asia have ripped tighter with iTraxx Aus and Asia indices 8-9bps lower.

The moves this morning follow an epic week for markets with some savage volatility and a major rebound on Friday. Just to put things in perspective though, the following list of asset performance shows Friday's rally first and then the overall performance in the week. Looking firstly at the sharp moves in equity markets: S&P 500 (+1.95%/-0.81%), Dow (+2.00%/-1.43%), Stoxx 600 (+2.91%/-4.41%), DAX (+2.45%/-3.43%), IBEX (+2.25%/-6.81%), Stoxx 600 Banks (+5.60%/-5.86%), S&P 500 Banks (+6.24%/-2.91%). Credit indices were subject to huge day-to-day swings also: iTraxx Senior Fins (-13.5bps/+6bps), iTraxx Sub Fins (-31bps/+18bps), Main (-7.5bps/+8bps), CDX IG (-2.6bps/+7bps). Meanwhile US HY energy spreads finished 26bps tighter on Friday but were +193bps wider on the week.

Moves were as equally impressive in commodity markets and highlighted by Gold (-0.70%/+5.50%) which had its strongest week since 2011. In Oil markets, despite the massive rally on Friday (the biggest since February 2009) following those WSJ headlines concerning potential production cuts on Thursday evening, WTI (+12.32%/-4.69%) still failed to stem a decline over the full five-days. Not to be outdone, there were some wild swings in rates markets too. 10y Bunds (+7.5bps/-3.4bps) actually traded to as low as 13bps on an intraday basis last week, while 10y Treasuries (+8.9bps/-8.8bps) were as low as 1.529% and traded within a 34bps range over the five-days.

It was that huge rally for Oil along with a rebound for financials which combined for what was a markedly better day all round for risk assets on Friday. With regards to the latter, a lot was made of the much better than expected results from Commerzbank, while news of JP Morgan’s Jamie Dimon purchasing $26m of his own bank’s stock also contributed to the better sentiment. Some chatter around the ECB also potentially being in talks with the Italian government about purchasing bad loans also gained some headlines, however as we highlighted on Friday this has the potential to open moral hazard, political, legal and logistical questions.

Also in focus on Friday was the latest US retail sales data. January sales were up a better than expected +0.2% mom (vs. +0.1%) last month while there was also beats for the ex auto (+0.1% mom vs. 0.0% expected) and ex auto and gas (+0.4% mom vs. +0.3% expected) prints. Meanwhile a strong gain for the GDP sensitive retail control component (+0.6% mom vs. +0.3% expected) resulted in the Atlanta Fed revising up their estimate for Q1 GDP growth to 2.7% from 2.5% - there’s quite the divergence now starting to emerge between this and economist forecasts.

The rest of the data was something of a mixed bag. The January import price index reading declined less than expected last month (-1.1% mom vs. -1.5% expected). Business inventories printed in line for December at +0.1% mom. Finally the first estimate for the University of Michigan consumer sentiment print showed a 1.3pt decline from January to 90.7 (vs. 92.3 expected) with both current conditions and expectations indices edging lower. Notably the 1y inflation expectation index was unchanged at 2.5% but 5-10y inflation expectations edged three-tenths lower to 2.4%, which is the lowest on record. In Europe the main data of note had been in the Q4 GDP numbers. The flash estimate for the Euro area showed no surprises however at +0.3% qoq (in-line) which was also the same for Germany (+0.3% qoq). Meanwhile the soft regional prints that we had witnessed result in a much softer than expected Euro area IP report for December (-1.0% mom vs. +0.3% expected).

Away from the data, the NY Fed President Dudley became the latest Fed official to acknowledge that ‘inflation is probably going to take a little bit longer to get back to our 2% objective’. On the much talked about negative-rates topic, Dudley was of the view that it is ‘extraordinarily premature’ to talk about such a move for the US right now and that ‘there are a lot of things that we would do long before we would really think about moving to negative interest rates’.

A quick recap on earnings where the season is beginning to wind down in the US. 381 S&P 500 companies have now reported their latest quarterly numbers with earnings beats standing at a robust 76% which is a tad better than the 74%, 75% and 73% we had seen for the prior 3 quarters, albeit with expectations beaten down in advance. There has been a bit of improvement in the top line numbers in recent reports too, putting the overall trend back in line with prior quarters. 48% have beaten revenue estimates which compares to 44%, 49% and 48% in the previous three quarters.

Full story here Are you the author? Previous post See more for Next postTags: Bond yield,central banks,China,Consumer Sentiment,Copper,Deutsche Bank,Equity Markets,Greece,headlines,Iran,Italy,Jamie Dimon,Japan,Japanese yen,Jim Reid,Markit,Michigan,Nikkei,Trade Balance,U.S. Consumer Confidence,U.S. Retail Sales,University Of Michigan,Volatility,yuan