Tag Archive: U.S. Retail Sales

Retail sales are an aggregated measure of the sales of retail goods over a stated time period, typically based on a data sampling that is extrapolated to model an entire country. Measuring consumer demand for finished goods, retail sales help gauge the pulse of an economy and its projected path toward expansion or contraction. As a leading macroeconomic indicator, healthy retail sales figures typically elicit positive movements in equity markets.

FX Daily, July 16: BOJ Tweaks Forecasts

The markets head into the weekend with little fanfare. Most large equity markets in the Asia Pacific region slipped earlier today. Hong Kong, which will be exempt from the need to secure mainland's cybersecurity approval for foreign IPOs, and Australia were notable exceptions. European bourses are edging higher, while US futures are oscillating around unchanged levels.

Read More »

Read More »

FX Daily, August 14: Consolidation Featured Ahead of the Weekend

The equity rally is stalling ahead of the weekend. Most markets in the Asia Pacific region eased, though China and Australia advanced. Japanese shares were mixed. The Nikkei, though advanced for the fourth consecutive session, while the Topis slipped.

Read More »

Read More »

FX Daily, June 16: Correction Scenario Tested

Overview: Shortly after the US stock market opened sharply lower, the Federal Reserve announced that it's Main Street facility was up and running. US stocks never looked back. After the S&P 500 recouped its full decline, the Fed announced it would begin buying corporate bonds. Up until now, it had been buying representative ETFs. Stocks rallied further on the news before pulling back into the close. The rally in risk assets carried into Asia.

Read More »

Read More »

FX Daily, May 15: Much Talk but Little Action

Overview: The S&P 500 staged an impressive recovery yesterday, a sell-off that took it to its lowest level since April 21, to close more than 1% higher on the day, helped set the tone in the Far East and Europe today. Gains in most Asia Pacific markets, but Hong Kong, Shanghai, and India, trimmed this week's losses. Australia's 1.4% rally today managed to turn ASX positive for the week, extending leg up for a third consecutive week.

Read More »

Read More »

FX Daily, April 15: Dollar Rises as Equities Slump

Overview: The recovery in equities stalled, and the risk-off mood has helped lift the US dollar, which had been trending lower. Taiwan and Malaysia were notable exceptions in the Asia Pacific regions to the heavier equity tone. The Nikkei gave back almost 0.5% after surging more than 3% on Tuesday. Europe's Dow Jones Stoxx 600 is ending a five-day rally.

Read More »

Read More »

FX Daily, March 17: Even Turn Around Tuesday is Flat

Overview: While the markets are not as disorderly as they have been, the tone is fragile, and the animal spirits have been crushed. Australian stocks fell more than 10% last week and dropped another 9.7% yesterday before rebounding by almost 6% today to be one of the few Asia Pacific equity markets to rise. The Nikkei eked out a small gain, but the broader Topix rose 2.6%.

Read More »

Read More »

FX Daily, February 14: Investors Continue to Look Past the Coronavirus

Overview: The capital markets are heading into the weekend, still trying to look past the coronavirus despite the new cases in Hubei. Tokyo was a notable exception in the Asia Pacific region, as the other major equity markets, like in Hong Kong, China, Taiwan, South Korea, and Australia, advanced. The MSCI Asia Pacific Index rose for the second week.

Read More »

Read More »

FX Daily, January 16: Markets Look for New Cues with US-China Trade Pact Signed

Overview: The global capital markets are calm today as investors await fresh trading incentives. New record highs in the US equity indices gave Asia Pacific stocks a lift, though China and Taiwan were notable exceptions. Europe's Dow Jones Stoxx 600 is firm new record highs set last week. US equities are edging higher in Europe. Benchmark bond yields are little changed.

Read More »

Read More »

FX Daily, December 13: Stunning Tory Victory and US-China Trade Boosts Risk Assets

Overview: The combination of a US-China trade deal and exit polls showing the Tories securing a majority in the House of Commons boosted risk assets, sent sterling flying, and the euro sharply higher. Separately, the Fed stepped up its efforts to make as smooth as possible funding over the turn of the year.

Read More »

Read More »

FX Daily, November 15: Market Runs with US Line that US-China Deal is Close

Comments by US presidential adviser Kudlow playing up the prospects of a trade agreement between the US and China, with other reports suggesting a key call be held today, is helping to underpin sentiment into the weekend. The MSCI Asia Pacific Index pared this week's loss today, with China the only main market not participating, despite the PBOC's unexpected injection of CNY200 bln of the Medium-Term Lending Facility.

Read More »

Read More »

FX Daily, October 16: Fickle Market Tempers Enthusiasm

Overview: Fading hopes that a Brexit agreement can be struck is seeing sterling trade broadly lower, while China's demand that US tariffs be rescinded in exchange for a commitment to buy $40-$50 bln of US agriculture goods over two years, makes the handshake agreement less secure. At the same time, Hong Kong is becoming another front in the US-Sino confrontation.

Read More »

Read More »

FX Daily, September 13: Bonds and the Dollar Remain Heavy Ahead of the Weekend

Overview: The markets are digesting ECB's actions and an easing in US-Chinese rhetoric. Next week features the FOMC meeting and three other major central banks (Japan, Switzerland, and Norway). The US equity rally that saw the S&P 500 edge closer to the record high set in late July spilled over to lift Asian markets. Chinese and Korean markets were closed for a mid-autumn holiday.

Read More »

Read More »

FX Daily, August 15: Animal Spirits Lick Wounds

Overview: It took some time for investors to recognize that the scaling back of US tariff plans was not part of a de-escalation agreement. There was an explicit acknowledgment by US Commerce Secretary Ross that there was no quid pro quo. The US tariff split was more about the US than an overture to China.

Read More »

Read More »

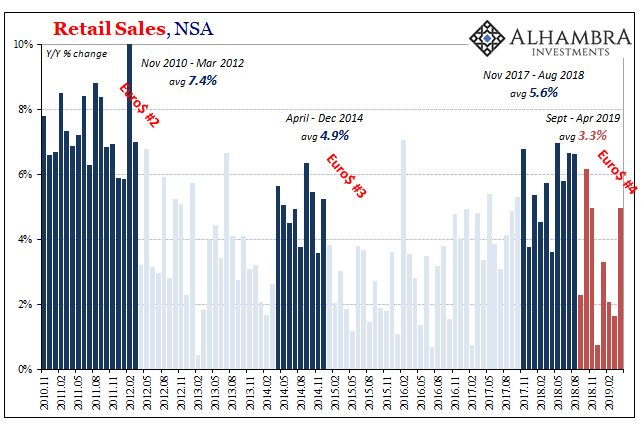

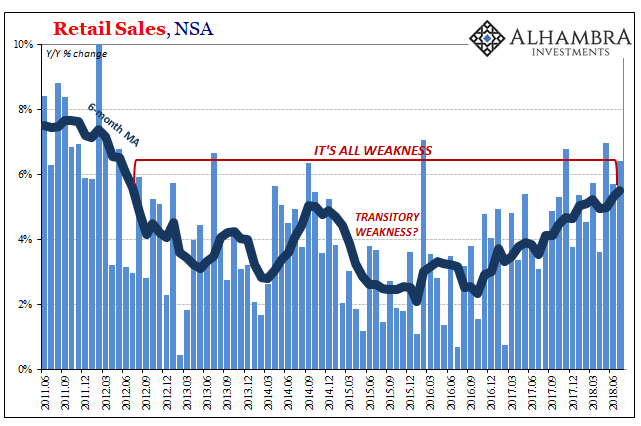

Globally Synchronized, After All

For there to be a second half rebound, there has to be some established baseline growth. Whatever might have happened, if it was due to “transitory” factors temporarily interrupting the economic track then once those dissipate the economy easily gets back on track because the track itself was never bothered.

Read More »

Read More »

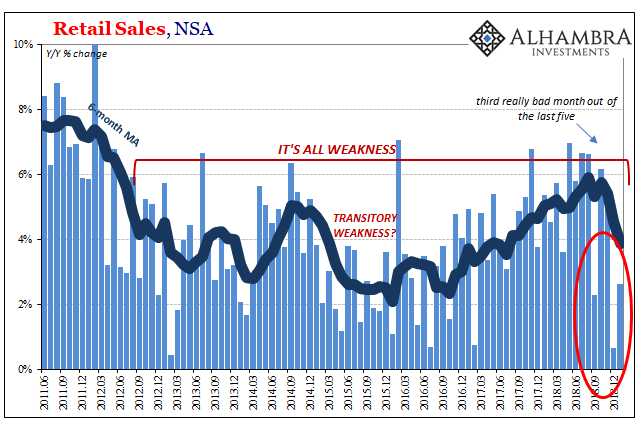

Global Doves Expire: Fed Pause Fizzles (US Retail Sales)

Before the stock market’s slide beginning in early October, for most people they heard the economy was booming, the labor market was unbelievably good, an inflationary breakout just over the horizon. Jay Powell did as much as anyone to foster this belief, chief caretaker to the narrative. He and his fellow central bankers couldn’t use the word “strong” enough.

Read More »

Read More »

Downturn Rising, No ‘Glitch’ In Retail Sales

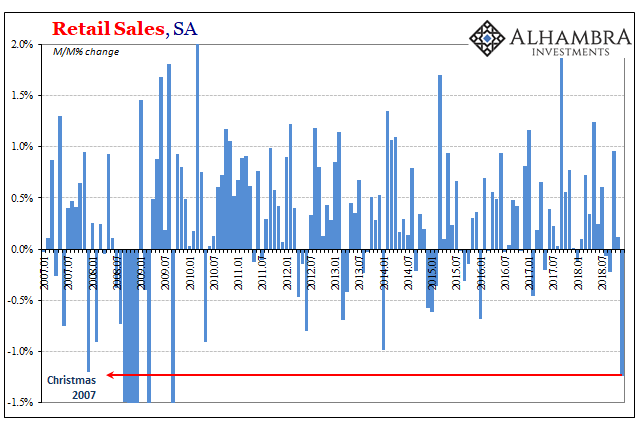

You just don’t see $4 billion monthly retail sales revisions, in either direction. Advance estimates are changed all the time, each monthly figure will be recalculated twice after its initial release. Typically, though, the subsequent revisions are minor rarely amounting to a billion. Four times that?

Read More »

Read More »

Labor Shortage America has been Canceled

The holiday season was shaping up to be a good one, perhaps a very good one. All the signs seemed to be pointing in that direction, especially if you were a worker. All throughout last year, beginning partway through 2017, there wasn’t a day that went by without some mainstream story “reporting” on America’s labor shortage.

Read More »

Read More »

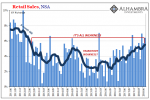

Retail Sales Marked By Revisions

Retail sales rebounded 0.8% in October 2018 from September 2018, but it’s the downward revisions to the prior months that are cause for attention. The estimates for particularly September were moved sharply lower. Total retail sales two months ago had been figured last month at $485.8 billion (unadjusted) originally, but are now believed to have been just $483.0 billion.

Read More »

Read More »

No Such Thing As An 80 percent Boom

Many attribute the saying “a rising tide lifts all boats” to President John Kennedy. He may have been the man who brought it into the mainstream but as his former speechwriter Ted Sorenson long ago admitted it didn’t originate from his or the President’s imagination. Instead, according to Sorenson, it was a phrase borrowed from the New England Chamber of Commerce or some such.

Read More »

Read More »

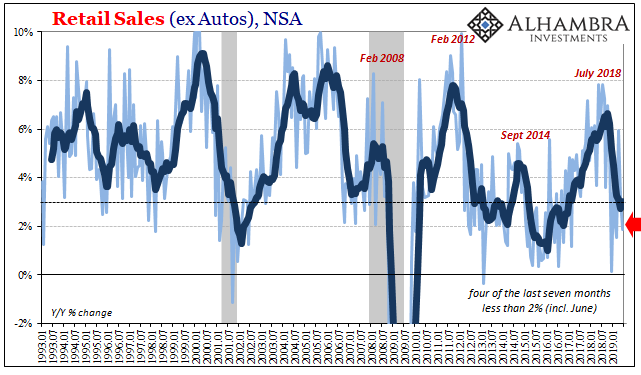

What’s Hot Isn’t Retail Sales Growth

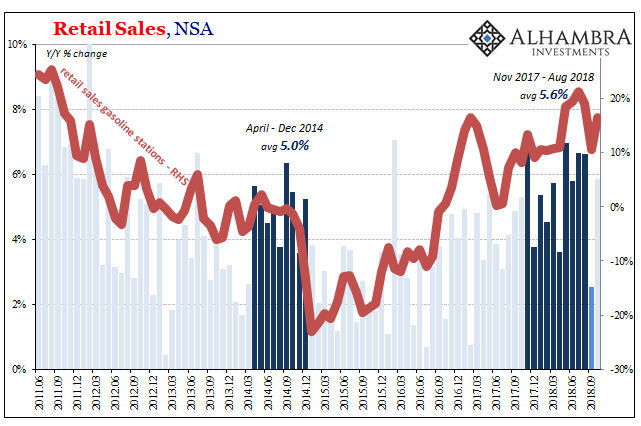

Americans are spending more on filling up. A lot more. According the Census Bureau, retail sales at gasoline stations had increased by nearly 20% year-over-year (unadjusted) in both May and June 2018. In the latest figures for July, released today, gasoline station sales were up by more than 21%.

Read More »

Read More »