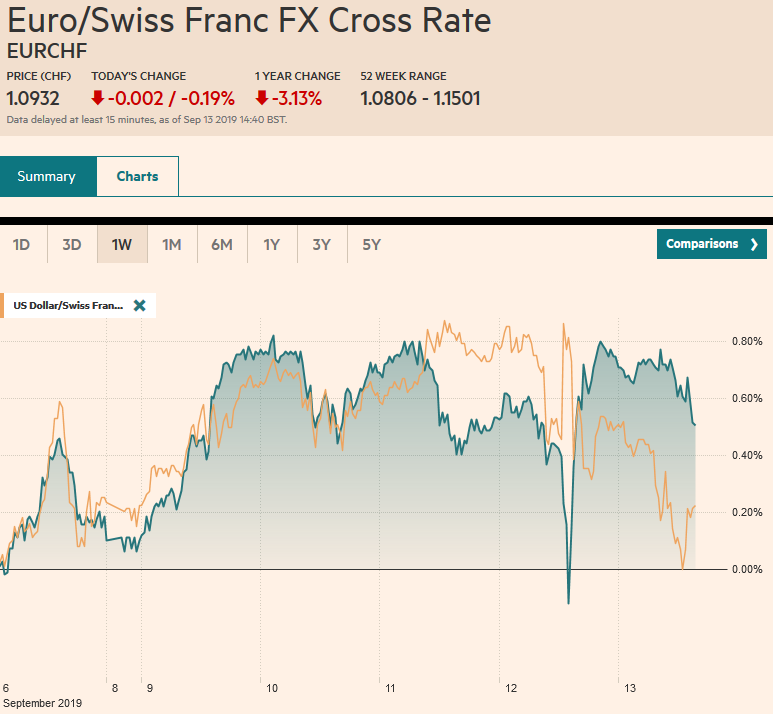

Swiss FrancThe Euro has fallen by 0.19% to 1.0932 |

EUR/CHF and USD/CHF, September 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The markets are digesting ECB’s actions and an easing in US-Chinese rhetoric. Next week features the FOMC meeting and three other major central banks (Japan, Switzerland, and Norway). The US equity rally that saw the S&P 500 edge closer to the record high set in late July spilled over to lift Asian markets. Chinese and Korean markets were closed for a mid-autumn holiday. The Nikkei rose 1% to bring the week’s gain to 3.7% on top of last week’s 2.4% rally. It is at five-month highs. European shares are edging higher, but the Dow Jones Stoxx 600 is below yesterday’s high. It is up nearly 1% on the week, which is the fourth consecutive weekly advance, and over the streak, it has gained about 5.5%. The S&P 500 is up about 1% this week coming into today. It is posied to close higher for the third week, during which time it has risen a little more than 4.5%. This month’s sharp reversal of yields continues with benchmark 10-year rates up mostly three-to-four basis points today. The immediate drivers that are widely cited include Draghi’s push for fiscal support in Europe, the acceleration in US core inflation (2.4% year-over-year, an 11-year high), a soft reception to the US 30-year auction, and speculation that the US and China could strike an interim deal. The US 10-year yield has risen 20 bp this week to test the 1.80% level. It finished last month a little below 1.50%. The US dollar is softer against most of the major and emerging market currencies today. The New Zealand and Canadian dollars are the exceptions among the majors and are a touch softer. Among the emerging market currencies is the notable exception. It is paring the gains recorded yesterday after the larger than expected rate cut. The Dollar Index looks to be headed for its second consecutive weekly decline. It would be the first back-to-back loss here in Q3. |

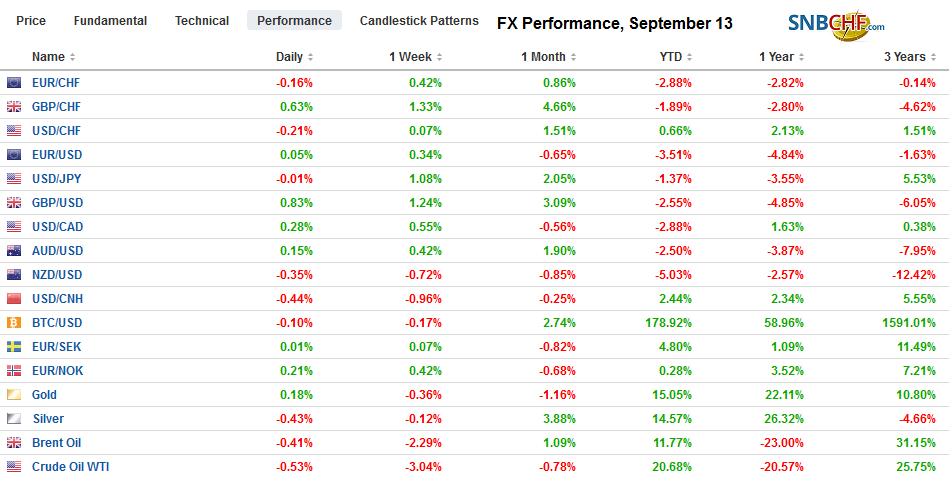

FX Performance, September 13 |

Asia Pacific

The US and China have had two tariff truces this year. Each ended with the US slapping fresh tariffs on its rival. Over the past 24-hours, talk of an interim deal has emerged. Ostensibly, the basis would be China taking steps to improve the protection of intellectual property rights and return to the market to buy US agriculture products. It is less clear what the US gives, accept to delay, and possibly rollback some tariffs. Meanwhile, reports suggest that China may have taken 15 cargoes of soy from the US yesterday and may buy as much as 600k metric tons of soy in Q4.

Part of the challenge in trying to sort out motivations and winners/losers is the extent of the “goodwill” really being expressed and the more base national interest. For example, China may have been counting on Brazilian soy (and corn), but dry weather makes this less certain. At the same time, despite the official rhetoric that China pays the tariffs, many US businesses and households cite the tariffs as a major concern. The pattern is quite clear in the markets. Escalating tensions weigh on stocks and fans speculation of more aggressive Fed easing and curve flattening or inversion. President Trump puts much emphasis on the stock market, and the weakening of the economy is thought to diminish his chances for re-election. In our analysis, we would de-emphasize the “goodwill” that many are emphasizing, and focus more on national interest. We are still of the mind that says the end goal is a disengagement between the two largest economies, not completely and not without some back and forth.

Another weekend means more demonstrations in Hong Kong. However, even here there seems to be some optimism, though a US Chamber of Commerce survey found that a quarter of the US firms in HK are thinking about leaving. Many are considering Singapore. That said, the Hang Seng market rallied for the second week is up 6.2% over the period. It is the first back-to-back gain since June. The Hong Kong dollar, which had been testing its lower band last month, is finishing the week at its best level in more than a month.

The dollar closed yesterday above JPY108 for the first time since late July. It edged a bit higher today to almost JPY108.30before pulling back a bit. The drivers have not changed. They have simply moved in the other direction. Specifically, the dollar was dragged down by the lower yields and now is rising against the yen as US yields rise. Nearby support is seen near JPY107.80. There is little resistance to the dollar until the JPY109.00 is approached. The Australian dollar is firm. It is rising for the eighth session in the past nine, but the climb has been a grind. Consider that it has risen less than 0.5% this week. It has yet to close above $0.6880, which is a retracement target, though it is poked a little above it on an intraday basis. The momentum may be fading and may need a new impetus.

EuropeDraghi delivered. The ECB’s asset purchase program and its forward guidance were open-ended. They became data-dependent and no longer date-linked. The asset purchase program of 20 bln euro a month is considerably smaller than expected, but the unlimited duration suggests the ultimate size of the ECB’s balance sheet will be larger than anticipated. The deposit rate was cut 10 bp to minus 50 bp. A tiering system was introduced that excluded some deposits from the negative rate. However, the terms were not particularly generous. Reserves in excess of six-times the amount required were exempt. The Swiss National Bank, for example, does not charge a negative rate on reserves above four-times required. German banks are the chief beneficiary. On the other hand, the terms and duration of the TLTRO were eased. No premium above the deposit rate is necessary, and the loans are for three rather two years. European bank shares and sovereign bonds pared initial gains. The euro came within 1/100 a cent of the 2.5-year low set last week ( Bloomberg: $1.0926) before staging an impressive rally to a new marginal high above a little above $1.1085. Many observers emphasized Draghi’s call for fiscal stimulus, but besides being more emphatic, it was not new ground for ECB President. |

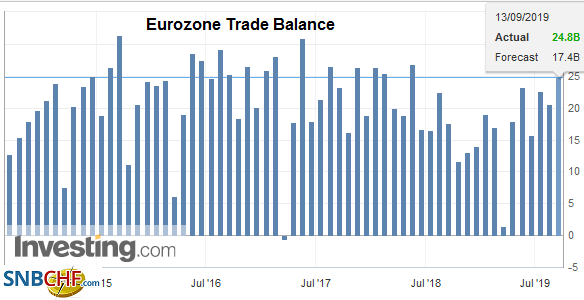

Eurozone Trade Balance, July 2019(see more posts on Eurozone Trade Balance, ) Source: investing.com - Click to enlarge |

The EC’s chief Brexit negotiator Barnier says he is still waiting for concrete proposals from the UK government. Meanwhile, Foster, the head of the Democrat Unionist Party from Northern Ireland seemed open to some compromise. However, new divisions in the UK’s internal market were rejected, which seemed to dampen hopes that as a compromise Northern Ireland would abide by EU rules longer after Brexit.

Spain has about ten days to either form a government or call for new elections, which would be the fourth in four years. Sanchez has rejected the latest offer by Podemos to form a coalition. Podemos appears to be insisting on cabinet posts, which Sanchez refuses. The King will meet with the party heads next week (September 16-17), which may offer the last opportunity to avoid a return to the polls. If there are to be elections, November 10 seems a likely timeframe, according to reports.

The euro posted an outside up day by trading on both sides of the previous day’s range and closing above the previous session high. There has been follow-through buying today that lifted the euro above $1.1100 for the first time since August 27. It has not established a foothold yet above it, and there is a 612 mln euro option struck there that expires today. A trendline drawn off the June and August highs comes in near $1.1125 today, and a close above that would lift the technical tone and set up a challenge next week on the highs from the second half of August near $1.1165. Sterling has shot through the cap at $1.24 that had been blocking the upside in recent days. The next target is near $1.25, which is where the (38.2%) retracement of the year’s decline (from the March high near $1.3380 to the recent low near $1.1965). Today’s advance may be too fast as North American dealers will inherit the books with sterling above its upper Bollinger Band (~$1.2440).

AmericaEnergy and food restrained headline US CPI but the core rose more than expected. The 0.3% rise in the core rate lifted the year-over-year rate to 2.4%. It was the third consecutive month that it rose by 0.3% and the fasted three-month period since January 2008. Weekly jobless claims fell more than expected. At 204k, they are not much above the cyclical low set this past April at 193k. Today the US reports August retail sales. It is widely recognized that consumption, helped by expanding employment and credit, has been resilient. Retail sales account for about a quarter of the consumption measured by PCE. The components used for GDP calculations has risen an average of 0.9% a month this year through July. It is the strongest seven-month period for at least a quarter of a century. It is difficult to envision the pace accelerating from here. Retail sales are expected to have increased by 0.2% at the headline level after rising 0.7% in July. Core retail sales rose 1.0% in July and maybe 0.3% in August. |

U.S. Retail Sales YoY, August 2019(see more posts on U.S. Retail Sales, ) Source: investing.com - Click to enlarge |

The implied yield of the September Fed funds futures contract has risen a quarter of a basis point this week. The implied yield of the October contract has risen two basis points this week. Bloomberg’s calculus suggests that this reflect a 1.6% chance of no change at next week’s FOMC meeting. The CME’s model sees the prices implying a little more than 13% chance the Fed stands pat. Both models say the market has given up on a 50 bp move. The implied yield on the January 2020 contract has risen 10 bp this week to 1.63%. The current effective average is 2.13%. The market now has fully priced in two more cuts this year and has given up, (for the time being) a fourth cut.

The US dollar is rising against the Canadian dollar for the third session. Recall that last week, the US dollar ended a seven-week rally against its Canadian counterpart. Near CAD1.3220, the US dollar is up this week by about 0.3%. The Canadian dollar’s weakness seems to reflect cross rate adjustment. The CAD1.3230 area is a (38.2%) retracement of the big leg down from last week’s high near CAD1.3380 to this week’s low near CAD1.3135. The next retracement objective is near CAD1.3260, which is also where the 20-day moving average is found. The US dollar also snapped a seven-week advance against the Mexican peso last week. But unlike its performance against the Canadian dollar, the greenback has fallen further against the Mexican peso, where carry-trade strategies appear to have returned. The dollar is falling through the MXN19,40 area we highlighted, for the first time in nearly a month. The next chart point is the 200-day moving average near MXN19.2950. The lower Bollinger Band is found now near MXN19.30.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brexit,Currency Movement,ECB,EUR/CHF,Eurozone Trade Balance,federal-reserve,FX Daily,newsletter,Spain,Trade,U.S. Retail Sales,USD/CHF