Tag Archive: Spain

The Dollar’s Recovery has been Extended, but it may Give North American Operators a Better Selling Opportunity

Overview: The dollar's sell-off last week was

extreme and it recovered yesterday and through the European session today. The

Australian dollar has been hit the hardest. It is off more than 1% today after

the RBA lifted the cash rate by 25 bp (to 4.35%). Still, the US dollar's gains

have stretched intraday momentum indicators, suggesting the upside correction

may be nearly over. The greenback's moves appear to have been driven by

interest rate...

Read More »

Read More »

US Yields and Dollar Rise After US Government Closure Averted

Overview: The US avoided a government shutdown,

barely, and this eased one of the headwinds that were anticipated. In turn,

this is spurring new gains in US interest rates and helping underpin the dollar

at the start of the new quarter. The 10-year Treasury is holding above 4.60%

and nearing last week's high (4.68%). The two-year yield gapped higher and is

near 5.10%. The high from September 21 was almost 5.20%. The Swiss franc is the

only G10...

Read More »

Read More »

Looming US Government Shutdown Stems the Dollar’s Surge

Overview: The increasingly likely partial US federal

government shutdown has spurred a bout of liquidation of long dollar positions.

The psychologically important JPY150 level was approached, and the euro was

sold through $1.05 yesterday, and the greenback has come back better offered

today. It is lower against all the G10 currencies. It is mixed against the

emerging market currency complex, with central European currencies and South

African rand...

Read More »

Read More »

Dollar Bulls Still in Control

Overview: What may have been hoped to be a quiet

August has turned into a feeding frenzy for dollar bulls as the contrasting

economic performance has spurred persistent buying of the greenback. Even

shallow dips have been bought. Today, it is mostly trading inside yesterday's ranges

against the G10 currencies. The PBOC set the dollar's reference rate at what

appears to be a record gap below the Bloomberg average survey, and the dollar

was scooped...

Read More »

Read More »

The Dollar Regains Composure

Overview: The dollar is better bid today. It is rising against

nearly all the G10 currencies, with the Antipodeans bearing the brunt, after a

softer than expected Australian inflation report. The yen has steadied after

extending its losses to new lows for the year. Emerging market currencies are

also mostly lower, though the Mexican peso is edging higher for the fourth

consecutive session. The large Asia

Pacific bourses rallied with the exception...

Read More »

Read More »

The Dollar Reverses Early Gains

Overview: The debt ceiling drama is not over.

The agreement between the negotiating teams of President Biden and House

Speaker McCarthy sets the stage for the next act in the drama: each side must

deliver the votes. A preliminary vote today in the House of Representatives is

likely today ahead of floor vote tomorrow. Still, the market is optimistic, and

risk is favored. Asia Pacific bourses were mixed today. We note that the chip

sector helped...

Read More »

Read More »

Dollar Soft but Stretched

Overview: While bank stress seems to continue

to ease, the dollar languishes against most of the major currencies. The

Japanese yen is the notable exception. It is off about 1.5% this week. The

Dollar Index has given back the gains scored at the end of last week but

remains inside the range set last Thursday and Friday (~101.90-102.35). Perhaps

the participants are waiting for Friday. In addition to month-, quarter, and

fiscal-year ends, it is...

Read More »

Read More »

Anti-Climactic Return of China

Overview: The re-opening

of China's mainland market amid reports of strong activity during the holiday,

was relatively subdued. The CSI 300 rose less than 0.5% and the Shanghai

Composite eked out less than a 0.2% gain. The 0.5% gain in the yuan was largely

in line with the performance of the offshore yuan. Indeed, it seems like a bit

like "buy the rumor sell the fact" type of activity as Hong Kong's

Hang Seng tumbled 2.75%, to give back...

Read More »

Read More »

China Steps away from the Abyss and Animal Spirits are Rekindled

Overview: Chinese officials using the carrot and the stick have succeeded in dampening the protests and easing some anxiety and rekindled the animal spirits. Hong Kong’s Hang Seng rallied 5.25% and its index of mainland shares surged 6.20%.

Read More »

Read More »

Markets are Less on Edge as the Darkest Scenarios seem Less Likely

The situation in central Europe is still intense but it appears top US, European and Polish officials are more reluctant than some market participants to attribute the darkest of intentions and paint extreme narratives.

Read More »

Read More »

Spanish Inflation Shocks

Overview: The sharp sell-off in US equities yesterday, led by tech, is weighing on today’s activity. Most of the large Asia Pacific markets excluding Japan and India lost more than 1% today.

Read More »

Read More »

BOJ Steps-Up its Efforts, US 2-10 Curve steepens, and the Dollar Softens

Overview: A pullback in US yields yesterday and the Bank of Japan's stepped-up efforts to defend the Yield Curve Control policy helped extend the yen's recovery. This spurred profit-taking on Japanese stocks, where the Nikkei had rallied around 11% over the past two weeks.

Read More »

Read More »

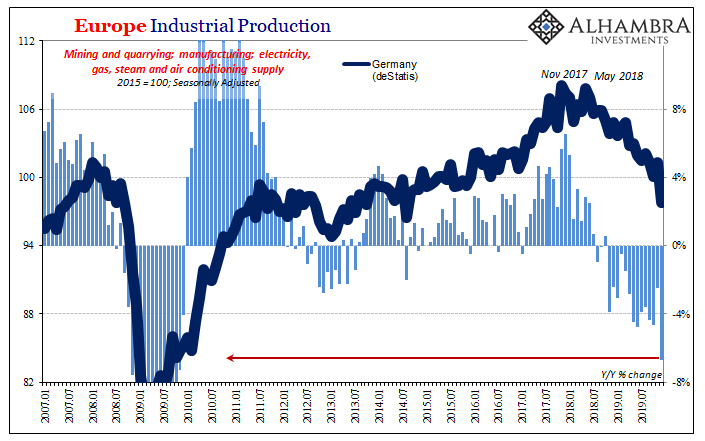

As The Fed Seeks To Justify Raising Rates, Global Growth Rates Have Been Falling Off Uniformly Around The World

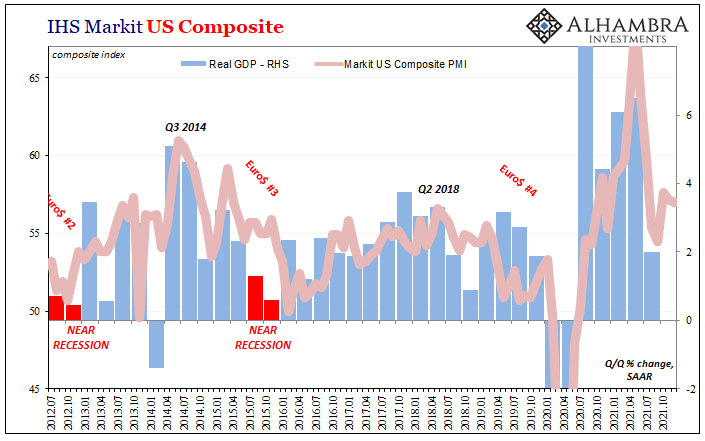

Sentiment indicators like PMI’s are nice and all, but they’re hardly top-tier data. It’s certainly not their fault, these things are made for very times than these (piggy-backing on the ISM Manufacturing’s long history without having the long history). Most of them have come out since 2008, if only because of the heightened professional interest in macroeconomics generated by a global macro economy that can never get itself going.

Read More »

Read More »

FX Daily, September 21: Risk Appetites Join Tokyo on Vacation

Global equity markets are off to a poor start to the week, and the dollar appears to be enjoying a safe-haven bid. Tokyo markets are closed until Wednesday, while Asia-Pacific stocks tumbled, and the regional index is unwinding last week's gains. The Dow Jones Stoxx 600 is off around 2.7% near midday in Europe.

Read More »

Read More »

As the Data Comes In, 2019 Really Did End Badly

The coronavirus began during December, but in its early stages no one knew a thing about it. It wasn’t until January 1 that health authorities in China closed the Huanan Seafood Wholesale Market after initially determining some wild animals sold there might have been the source of a pneumonia-like outbreak. On January 5, the Wuhan Municipal Health Commission issued a statement saying it wasn’t SARS or MERS, and that the spreading disease would be...

Read More »

Read More »

FX Daily, September 13: Bonds and the Dollar Remain Heavy Ahead of the Weekend

Overview: The markets are digesting ECB's actions and an easing in US-Chinese rhetoric. Next week features the FOMC meeting and three other major central banks (Japan, Switzerland, and Norway). The US equity rally that saw the S&P 500 edge closer to the record high set in late July spilled over to lift Asian markets. Chinese and Korean markets were closed for a mid-autumn holiday.

Read More »

Read More »

FX Daily, April 29: The Busy Week Begins Slowly

Overview: It promises to be an eventful week with the FOMC and BOE meeting, US jobs report and EMU April CPI and Q1 GDP on tap. However, the week is marked by the May Day holiday in the middle of the week. Japan's markets are closed all week, while China's markets are closed from mid-week on for an extended holiday. The week has begun on a decidedly consolidative tone.

Read More »

Read More »

FX Daily, April 26: Greenback Consolidates Ahead of Q1 GDP

Overview: The equities are finishing softly after the rally stalled in the middle of the week. The large markets in Asia fell, led by China, and the MSCI Asia Pacific Index fell for a third session, the longest losing streak in two months. Europe's Dow Jones Stoxx 600 ended an eight-day advance with a two-day loss coming into today where it is a little softer.

Read More »

Read More »

FX Weekly Preview: The Week Ahead: Don’t Skip Steps on Escalation Ladders

The drop in US yields and disappointing economic data weighed on sentiment and the dollar last week. Even weakness in equities, which had seemed to lend the greenback support, failed to do so at the end of last week. With the real Fed funds rate (adjusted for inflation) below zero, employment at 50-year lows, and some fiscal stimulus still in the pipeline, the doom and gloom cant of a recession next year seems misplaced.

Read More »

Read More »

FX Daily, May 31: Don’t Confuse Calmer Markets with Resolution

The global capital markets that were in panic mode on Tuesday stabilized yesterday, and corrective forces have carried into today's activity. However, the underlying issues in Italy and Spain are hardly clarified in the past 48 hours. Moreover, the US push on trade is intensifying again.

Read More »

Read More »