| Sentiment indicators like PMI’s are nice and all, but they’re hardly top-tier data. It’s certainly not their fault, these things are made for very times than these (piggy-backing on the ISM Manufacturing’s long history without having the long history). Most of them have come out since 2008, if only because of the heightened professional interest in macroeconomics generated by a global macro economy that can never get itself going.

What PMI’s do have going for them is that they allow us to compare – on nearly like terms – conditions across various geographical and national boundaries. The proliferation of data, thanks largely to Markit and its growing list of partners, makes this possible even if the figures themselves aren’t “hard” data like we might otherwise want. We start with the US and its “central bank” itching to hawk its hawkish stance justified mainly by a weird obsession with psychology to go along with another run of potentially misleading labor stats delivered by the BLS with their legion of inconsistencies. For our purposes here, I’ll stick to each country or region’s composite PMI. |

|

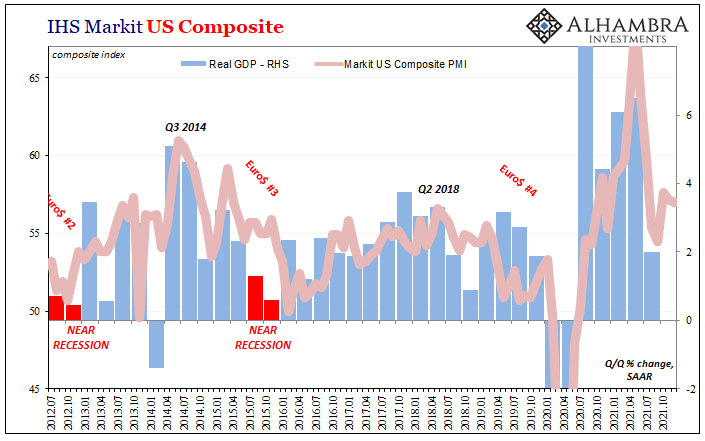

| If nothing else, it appears as if the US economy downshifted during 2021’s second half, a theme we’re going to revisit in every location. The estimates for Q3 GDP were already seriously underwhelming, and so far Q4 is anticipated to be (by analysts, FWIW) only somewhat better just as the PMI numbers project.

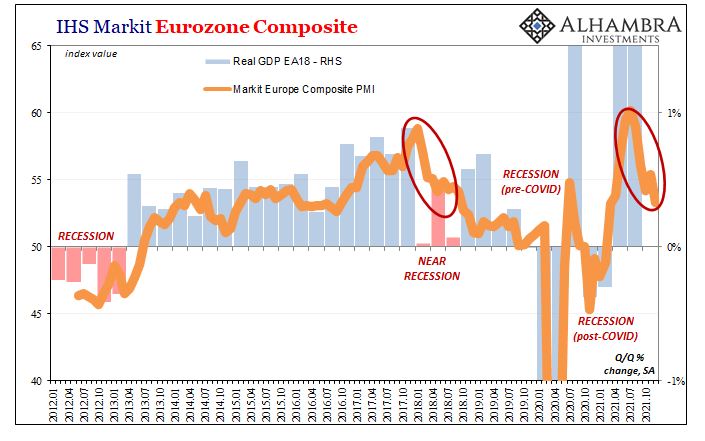

Why the slowdown? The general consensus is, of course, corona-laden. First delta now omicron, to stick with the inflationary story one has to assign anything but a macro explanation for this clear downshift. It’s basically the same over in Europe where, same timing, Markit’s Composite PMIs signal that same pattern; the second half of 2021 was very different from the first. |

|

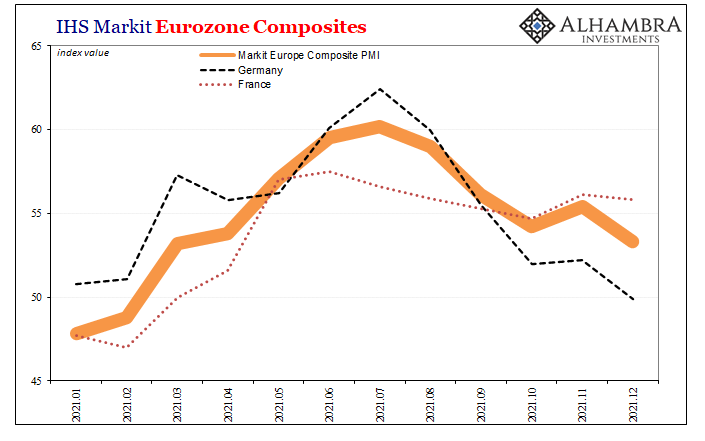

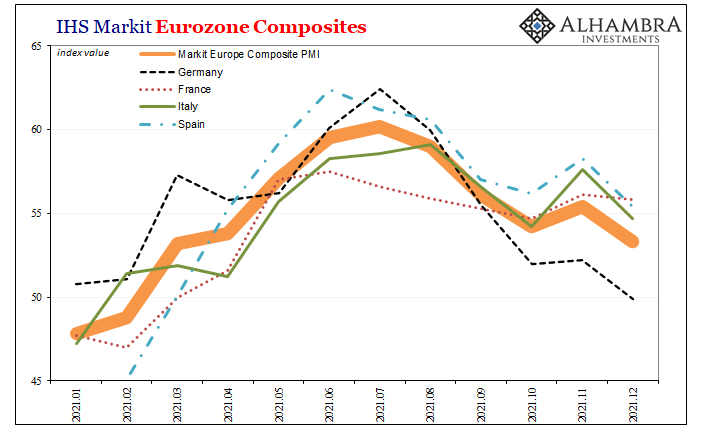

| To start last year, each economy accelerated noticeably, but here’s the thing with the year’s end: no matter what or by how much, all of them are heading lower past mid-year.

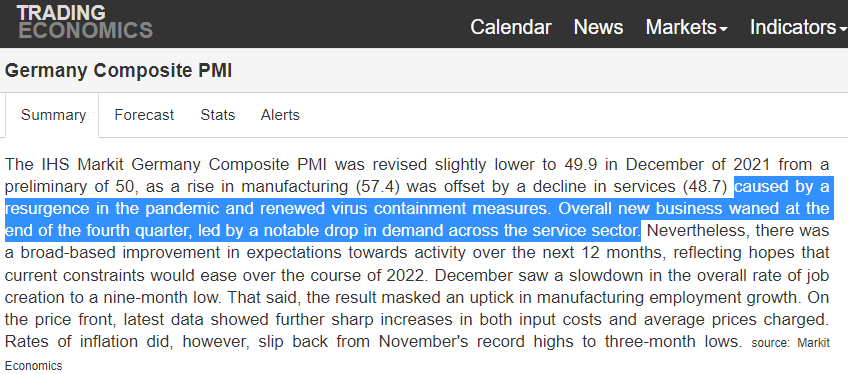

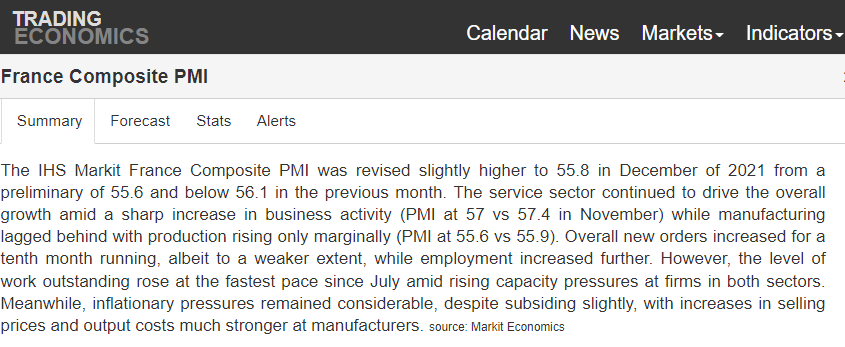

For some, like Germany, “they” blame delta and now omicron. Others such as France, where pandemic measures have been surprisingly tame by comparison, there’s no mention of the disease. Yet, both France and Germany exhibit the same trend in their composite scores if to slightly different degrees. Second half slowdown: |

|

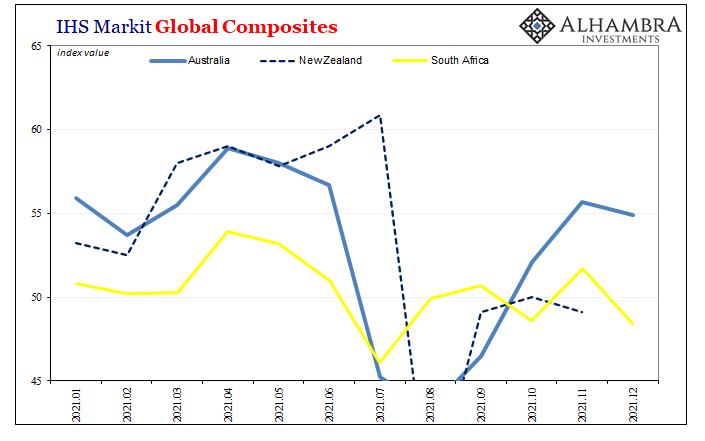

| Even in places where the corona excuse is most valid, such as the prison now known as Australia along with the incarcerated of New Zealand (I threw in South Africa, too), absolutely there’s delta’s damage but even so the second half of the year is less than the first even as each PMI comes back up from the mid-year delta demarcation.

The right side clearly less than the left side for each one: |

|

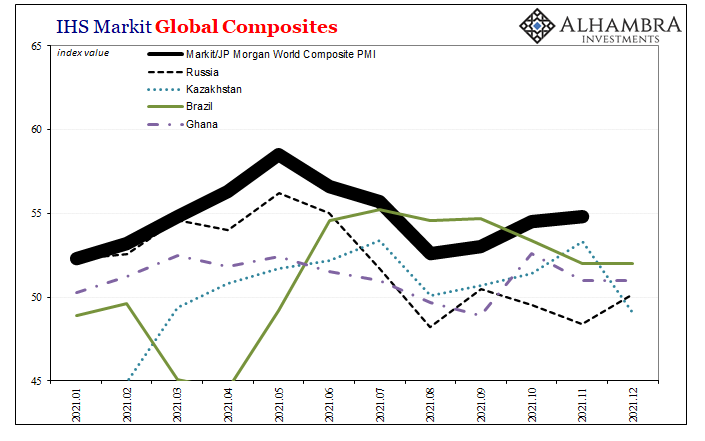

| And just to finish off the point I’m trying to make, I’ll add a basically random selection from Asia and Africa with Brazil thrown in for good measure (immediately above).

For whichever reasons, once more 2021 finished up in the opposite direction from what 2020 had handed off to it. The world economy seems almost certainly to be slowing down after having never finished, nor come close to finishing, its promised liftoff after 2020’s big recession. What that ultimately means, we’ll find out in 2022 and it could be several possibilities. If this is nothing more than what’s become the usual government overreactions to various waves and seasonal outbreaks of COVID-19 and the new strains which will visit us along the way, then, sure, Jay Powell and his inflation story might stick. But, if COVID is simply 2021’s excuse the same way “trade wars” had been 2018’s, put forward by hapless Economists, politicians, and central bankers because they didn’t know what else to say, that leads to a very different set of outcomes. |

|

| Unfortunately, we’re very familiar with those. | |

| And the latter is one Jay Powell and the FOMC should have heeded from their hawkish experience that last time. But to Economists and central bankers, each economy is an island, a national entity unto itself and left to national rather than international factors.

They called it globally synchronized for a very good reason. The problem in 2017 and 2018 was how this was confused for growth, not that it wasn’t synchronized because this is actually, sorry, Jay, a global system. And in the same way, I think we’ll see, 2021 was mistaken for a strong, red-hot recovery which we keep seeing around the parts of the world wasn’t, either; or at best wasn’t for long. |

|

| While the Fed pushes the public this year to expect and accept its US-based hawkish stuff and all that goes with it (including forecasts for an accelerating economy), like 2018 the numbers consistently indicate – as a start – instead a world-spanning slowdown of some kind.

To finish this up, China’s composite (note: which isn’t one of Markit’s). After all, that country’s dictator seems to have hit it right on the nose. |

Full story here Are you the author? Previous post See more for Next post

Tags: Australia,Composite PMI,currencies,downturn,economy,Europe,Eurozone,Featured,Federal Reserve/Monetary Policy,France,Germany,IHS Markit,Italy,Markets,New Zealand,newsletter,South Africa,Spain