Tag Archive: Italy

Dollar Jumps

Overview: A less hawkish Reserve Bank of New Zealand and a slightly softer than expected January CPI from Australia appears to have sparked a broad US dollar rally.

Read More »

Read More »

The Greenback is in Narrow Ranges to Start the Week

Overview: The foreign exchange market is quiet. The

Lunar New Year holiday shut most Asian markets. That, coupled with the light

news in Europe, have served to keep the dollar in narrow ranges against the G10

currencies. The Swedish krona, Norwegian krone, and Japanese yen are posting

minor gains against the greenback. The New Zealand dollar, which was strongest

major currency last week (1.4%) is off by almost 0.5% today, making it the

weakest...

Read More »

Read More »

Dollar Retreat Extended, but Turn Around Tuesday may have Already Begun

Overview: Last week's dollar losses have been

extended today. The yen is leading the move, encouraged by talk of a buying by

a large US real money fund. The Dollar Index is off about 0.35% after sliding

1.8% last week. It is below the 200-day moving average for the first time since

late August. As was the case last week, the Canadian dollar is the laggard. Emerging

market currencies are also mostly higher. The Chinese yuan's 0.67% rise is the

most...

Read More »

Read More »

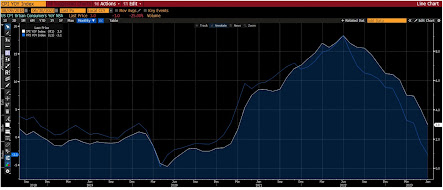

Dollar Consolidates Amid Rate Volatility

Overview: The dollar is consolidating its

recent moves as interest rate swings continue. The US two-year yield has traded

in a nearly 28 bp range in the first two sessions this week, and near 4.88%

now, it is 18 bp lower since last Friday's close. The 10-year yield is slipping

below 4.50%. It reached almost 4.70% on Monday and had fallen to almost 4.40%

yesterday. Part of this reflects the shift in overnight rate expectations. The

implied yield of...

Read More »

Read More »

The Dollar Continues to Press Against JPY150; Risk Off Ahead of the Weekend

Overview: True to the market's penchant, it heard a

dovish Fed Chair Powell yesterday. He seemed to suggest that the bar to another

hike was high. This helped cap the 10-year yield just in front of 5.00% and

allowed foreign currencies to recover against the dollar. The US two-year yield

reversed lower after rising above 5.25%. It is now around 5.15%. Still, Powell

appeared to cover similar ground as several other officials, including Fed

governors...

Read More »

Read More »

Sharp Fall in US Yields ahead of Large Supply

Overview: The market continues to monitor

developments in Israel and the Middle East. The economic calendar is light

today and the market is showing a strong appetite for risk. Except for China

and South Korea, large bourses in the Asia Pacific rallied. Japan's indices

jumped more than 2% and Australia by 1% to lead the region. Europe's Stoxx 600

is up 1.5% near midday, which, if sustained would be the largest in nearly a

month. US index futures...

Read More »

Read More »

The Greenback is Softer Ahead of CPI but Key Chart Points Remain Intact

Overview: The deluge of Treasury supply is nearly

over for this week. On tap today are 4- and 8-week T-bills and $23 bln 30-year

bonds to finish the quarterly refunding. The sales will come after the July CPI

print that is expected to see the first year-over-year increase since last June.

The market is going into the report with about a 15% chance of a Fed hike next

month discounted. Meanwhile, September crude oil extended its recover from $80

seen...

Read More »

Read More »

Fitch Roils Markets

Overview: Late yesterday, on the eve of the

quarterly refunding announcement, Fitch cut the US rating to AA+ from AAA,

citing project fiscal deterioration over the next few years and "the

erosion of governance". S&P also has the US as an AA+ credit. Ironically,

many observers who have been critical of the US monetary and fiscal policies,

like former Treasury Secretary Summers and El-Erian, were also critical of Fitch's

decision. The...

Read More »

Read More »

The Dollar Regains Composure

Overview: The dollar is better bid today. It is rising against

nearly all the G10 currencies, with the Antipodeans bearing the brunt, after a

softer than expected Australian inflation report. The yen has steadied after

extending its losses to new lows for the year. Emerging market currencies are

also mostly lower, though the Mexican peso is edging higher for the fourth

consecutive session. The large Asia

Pacific bourses rallied with the exception...

Read More »

Read More »

PBOC Sends Signal in Lower Dollar Fix, while the Canadian Dollar makes a 9-Month High

Overview: Hawkish comments by ECB President Lagarde

at the central bank symposium in Sintra and the PBOC's weaker dollar fix have weighed on the greenback today. It is lower against most of the G10 currencies,

but the Japanese yen and Norwegian krone. It also slipped to a new nine-month

low against the Canadian dollar. Emerging market currencies are also mostly firmer,

with the notable exceptions of the Russian rouble and beleaguered Turkish lira....

Read More »

Read More »

The Dollar Consolidates after Powell Sapped its Mojo

Overview: Federal Reserve Chair Powell's offered a

stronger case for a pause in the monetary tightening before the weekend and

this sapped the dollar's mojo. The greenback is mostly consolidating through

the European morning in quiet turnover. The JP Morgan Emerging Market Currency

Index is trying to snap a four-day decline. The South African rand is

recovering from its recent slide and is up nearly 1%. The South Korea won is

benefitting from...

Read More »

Read More »

Narrow Ranges in FX: Calm before the Storm?

Overview: Equity markets are mostly weaker, and

benchmark 10-year yields are a little softer. The foreign exchange market is subdued

ahead of today’s US CPI. The large bourses in Asia Pacific region with the

exception of India worked lower and Europe’s Stoxx 600 is off for the second consecutive

session. US futures have a heavier bias. Yesterday the US bank share indices

filled the gap created at the end of last week but recovered. Today’s price...

Read More »

Read More »

Dollar Comes Back Bid, as First Republic Taken Over (Mostly) by JP Morgan

Overview: Most markets are closed for the May Day

holiday. News that JP Morgan will acquire most of First Republic assets will be

a relief for the markets. US equity futures are slightly firmer, and the

10-year Treasury yield is around three basis points higher, slightly above

3.45%. Recall that before the weekend, it has fallen from almost 3.55% to 3.42%.

The market has more than a 90% chance of a quarter-point hike discounted for

Wednesday. The...

Read More »

Read More »

Financial Stress Continues to Recede

Overview: Financial stress continues to recede. The

Topix bank index is up for the second consecutive session and the Stoxx 600

bank index is recovering for the third session. The AT1 ETF is trying to snap a

four-day decline. The KBW US bank index rose for the third consecutive session

yesterday. More broadly equity markets are rallying. The advance in the Asia

Pacific was led by tech companies following Alibaba's re-organization

announcement. The...

Read More »

Read More »

Investors Shaken by Rising Rates

Overview: The surge in US interest rates and sharp

losses in US stocks sent the dollar broadly higher in North America yesterday. The

$42 bln of two-year notes auctioned by the US Treasury saw the highest yield in

more than a quarter-of-a-century (4.67%) and it still produced a small tail.

Sterling, helped by its own surprisingly strong data, was the only G10 currency

to have gained against the surging dollar. Still, no important technical levels...

Read More »

Read More »

Markets Catch Collective Breath

Overview: On the

heels of a dramatic jump in US job creation and firmer than expected

year-over-year CPI, the US reported a larger than expected jump in retail sales

and a strong recovery in manufacturing output. Few think that economic momentum

that the recent data implies can be repeated, the "no landing" camp

has gained adherents. We suspect that says more about psychology than the

economy. The US two-year note is threatening to snap...

Read More »

Read More »

Yen Retreats Ahead of Formal BOJ Announcement Tomorrow and US CPI

Overview: A consolidative tone is mostly the theme of the day. The revisions to the US CPI announced before the weekend add to the uncertainty and focus on tomorrow's report. At the same time, investors watch ongoing air space activity that has led to a few objects being shot down over the US and Canadian airspace.

Read More »

Read More »

Euro Closed above $1.09 but Follow-Through Buying Limited

Overview: After

some intraday penetration, the euro finally settled above $1.09 yesterday. However,

follow-through buying has been limited and technical and option-related

resistance is seen in the $1.0940-50 area. The dollar is more broadly mixed

today, with the dollar-bloc and Norwegian krone leading the advancers. The

euro, yen, and sterling are nursing small losses near midday in Europe. The

recovery of US equity indices yesterday after gap...

Read More »

Read More »

Risk Appetites Survive China Keeping Zero Covid Policy

Overview: Chinese officials denied plans to end the zero-Covid policy

and after a brief wobble, risk assets have traded better. Asia Pacific equities

rallied, led by Hong Kong and mainland stocks that trade in Hong Kong. Europe’s

Stoxx 600 opened lower but recovered and is around 0.5% higher after the 1.8%

gain before the weekend. US futures are firm. Benchmark 10-year yields are mostly

2-4 bp softer in Europe and the US. The dollar is mixed. The...

Read More »

Read More »

RBA Hikes by 25 bp, Chinese Stocks Surge, and the Greenback Trades Heavier

Overview: Risk appetites have returned today. Bonds

and stocks are advancing, while the dollar is better offered. Unsourced claims

that Beijing has formed a committee to assess how to exit the zero-Covid policy

sent Chinese shares sharply higher. An index of mainland companies list in Hong

Kong jumped nearly 7% and closed up almost 5.5%. The Hang Seng surged 5.2%,

while all the large markets in the region advanced. Europe’s Stoxx 600

recovered...

Read More »

Read More »