Overview: The deluge of Treasury supply is nearly over for this week. On tap today are 4- and 8-week T-bills and $23 bln 30-year bonds to finish the quarterly refunding. The sales will come after the July CPI print that is expected to see the first year-over-year increase since last June. The market is going into the report with about a 15% chance of a Fed hike next month discounted. Meanwhile, September crude oil extended its recover from $80 seen on Tuesday to a new 12-month high near $85 before steadying. Amid strike fears, Europe's natural gas benchmark soared by more than 27% yesterday but is about 5.3% lower today. For its part, gold has stabilized after falling to four-week lows yesterday near $1914. It is pushing above $1920 in the European mornings.

The dollar is broadly softer against the G10 currencies, but the Japanese yen, which is practically flat. The Swiss franc and euro are leading the move. However, notable chart levels have not been taken out and the intraday momentum indicators caution against chasing the dollar lower in early North American turnover. Most emerging market currencies are firmer. As widely expected, the Reserve Bank of India left rates steady, and the central bank of Mexico is expected to do the same later today. Equity markets are mostly higher. In the Asia Pacific, Taiwan, South Korea, and India were notable exceptions. Europe's Stoxx 600 is extended yesterday's gains and is up around 0.4%. US index futures are also trading higher. European benchmark 10-year yields are mostly 1-3 bp higher. Core-peripheral spreads are narrower. The US 10-year yield is hovering near 4%.

Asia Pacific

In the week after the Bank of Japan doubled the upper limit on the 10-year JGB, Japanese investors were net buyers of the most foreign bonds in five weeks, according to Ministry of Finance data released earlier today. The common narrative was the with higher yields at home, Japanese investors would repatriate investment, even though they have been buyers of foreign bonds this year, after last December's surprise adjustment of the Yield Curve Control. Japanese investors bought JPY438.8 bln (~$3 bln) of foreign bonds last week. This was slightly more than the average weekly purchase this year. For their part, foreign investors dumped JPY1.97 trillion of Japanese bonds, the most in since mid-January.

US President Biden signed an executive order whose details still have to be worked out that will restrict US investment in certain sectors via specific vehicles in China. The American press framed the announcement as some kind of restraint because of the desire to mend the bilateral relationship. Opposition in Congress wants broader measures that include biotech and energy. There is a 45-day public comment period, and after two years of discussions, the order is still very much a work in progress, and from the outside seems prematurely announced. The "high fence in a small yard" spin has yet to be proven. China, of course, responded vehemently that the US broad use of national security weaponizes trade and technology. The executive order, however, it develops over the next month-and-a-half, will not be effective until next year and one suspects the US will try to get other countries to adopt similar measures, whatever the final form. Some form of Chinese retaliation would also not be surprising.

The dollar settled near session highs yesterday around JPY143.75. It pushed tentatively above JPY144 for the first time since July 7, but has not sustained the move, amid the broader US dollar pullback. Options for about $755 mln struck there expire tomorrow. If the market is unable extend the upside momentum, a risk of a bout of profit-taking increases. Key support is at the recent low near JPY141.50, and the 20-day moving average is slight lower. The Australian dollar seems content to consolidate between $0.6500 and $0.6600. The oversold momentum indicators appear to be beginning to bottom but re-establishing foothold above $0.6600 is necessary to boost the chances that a low is in place. Unless the Aussie can rise above $0.6570, it will be the fourth session of lower highs. The dollar remains firm against the Chinese yuan and the wider spread between the onshore and offshore yuan (CNY and CNH) is consistent with pressure building on the onshore yuan. The spread between the two was near 0.2 in the last two sessions was the most since a the end of June. Reports suggest that China officials have banned the word "deflation" but with negative CPI and disappointing real sector data (and more likely next week), there are heightened expectations for cut in rates and/or a reduction in reserve requirements. The PBOC set the dollar's reference rate at CNY7.1576 today. The median forecast in Bloomberg's survey was for CNY7.2030.

Europe

There have been two notable developments in Europe this week. First, amid talk of Germany de-industrializing, TSMC announced plans to jointly build a new semiconductor fabrication facility in the eastern part of Germany, joining Intel. Tesla also recently an announced plans to expand into Germany. Second, Italy is levying a surtax on banks, following the increase in full year guidance by the two largest banks. There was a dramatic adverse reaction by bank shares, as one might have expected, which wiped out $10 bln of market capitalization. The government "clarified" that the tax would not exceed 0.1% of the banks' assets and indicated that banks which have already increased deposit rates for savers, the tax "will not have a significant impact." An index of Italian bank shared plunged 7.8% on Tuesday and rose by about 3.8% yesterday. Today, the index is a little more than 1% higher.

Sterling has treaded water this week, and with one brief exception has traded with a $1.27-handle. Tomorrow's June and Q2 GDP figures and details may push it out the range. The UK economy contracted by 0.1% in May and is seen recouping it and a little bit more to rise by 0.2% in June. Industrial output is seen rebounding after contracting by 0.6% in May, while services are seen expanding by 0.2% after a flat May. Construction output, which fell by 0.2% in May is expected to be unchanged in June. The trade deficit is seen narrowing. If output rises by 0.2% in June, the sum of the monthly figures would suggest around a 0.3% expansion in Q2. However, this is a not a reliable guide. Consider that the monthly GDP figures pointed to 0.3% growth in Q1, the quarterly figure showed only a 0.1% increase. Similarly, the median forecast in Bloomberg's survey is for a flat quarter. It sees no improvement from Q1's flat consumer and a 1% increase in government spending to offset the expected weakness in business spending and investment. Net exports appear little changed from Q1.

While the euro and sterling's downside momentum has waned, today's gain are still not sufficient. The euro is trading at new highs for the week, reaching $1.1025 in the European morning. Last Friday's high was slightly above $1.1040, and resistance is seen around $1.1050 (20-day moving average is about $1.1060). There are options for almost 1.2 bln euros at $1.10 that expire today. There are more $1.10 options that expire next week. The euro's daily momentum indicators are stretched and may be poised to turn higher in the coming days after falling since mid-July. Meanwhile, sterling has found strong sellers in front of $1.28 this week. It reached $1.2770 in early European turnover but appears to be stalling. The $1.2680-$1.2700 has offered support in recent days. Sterling's daily momentum indicators are also stretched and at least one has turned higher, but the price action is not convincing. Sterling has spent hardly anytime outside of the range set last Friday (~$1.2690-$1.2790). Data that could impact BOE expectations are due next week (employment and wages, CPI, and retail sales).

America

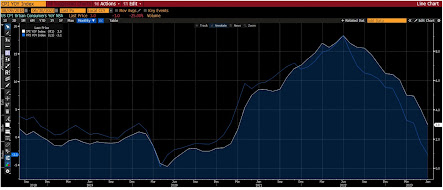

The focus is on today's July US CPI. Given the base effect, the 0.2% rise economists are largely looking for will translate into the first rise in the year-over-year rate since June 2022 when it peaked. The year-over-year rate is seen rising from 3.0% to 3.3%. Many if not most observers seem to be thinking this is a one-off fluke, but the risk is that it is not. In fact, the year-over-year may be rising this month. The year-over-year may fall against in September and October before rising again in November and December. Headline CPI rose at an annualized rate 3.6% in Q2 23 after a 4.0% rise in Q1 23. In Q3 22, headline CPI rose at an annualized pace of 2.4% and 3.2% in Q4 22. Those are the quarterly bogies that need to be beat for pace of inflation to slow.

Some observers still insist that China is an important driver of US consumer prices. It has an intuitive appear as some many American consumer products come from China. However, there are numerous problems with this conceptualization. First, the US CPI basket is weighted heavily toward services not goods. And prices of those services, like housing, medical care, education, and recreation are of a domestic nature. Second, imagine a consumer good that is imported into the US. By the time the final end-user buys the item, consider that the costs for storage, transportation, insurance, and marketing are incurred and each middle step has its own mark-up. The final cost of the good may double by the time we buy it. Thirdly, the goods that we do buy seem to be considerably less commodity intensive. The cost of electronics is hardly a function of their traditional raw materials, for example. We would argue that the reduced commodity intensity (commodity use for each unit of GDP) has fallen sharply over the last few decades is a key development. According to the World Bank since 1990, the US commodity intensity has fallen from 0.17 to 0.11, meaning it takes 11-cents of commodities to produce $1 GDP, down by about a third. The comparable eurozone numbers are 0.22 and 0.15. China's commodity-intensity has fallen from 0.3 to 0.2 and Japan's has eased from 0.18 to 0.13.

The US dollar remains with Tuesday's broad range against the Canadian dollar (~CAD1.3365-CAD1.3500). It slipped below CAD1.3400 for the first time since the high was seen and fray the five-day moving average (just below CAD1.3400), which it has not closed below this month. The daily momentum indicators are stretched, and like sterling, at least one has turned, while the price action is not wholly convincing. A close below CAD1.3400 would boost confidence in our suspicion that the greenback is exhausted after spiking to CAD1.35 on Tuesday. For its part, the Mexican peso is consolidating the big moves in both directions seen at the end of last week. The US dollar continues to hold above MXN17.00. The central bank meets later today. Confirmation that it intends on keeping the cash target at 11.25% may encourage a push lower. The dollar's momentum indicators are stretched and at least one has turned down.

Tags: #USD,capital flows,China,Currency Movement,Featured,Germany,inflation,Italy,newsletter,US