Tag Archive: Spain

FX Weekly Preview: ECB and BOJ Meetings Could be Key to Dollar Direction

The US dollar has been marked lower since the middle of last month. It flies in the face strong growth, rising inflation expectations, and greater conviction that the Fed will continue to raise interest rates this year. Moreover, an oft-cited knock on the dollar, the widening current account, may be offset this year by the impact from US corporations repatriating earnings that have been kept offshore.

Read More »

Read More »

Italian Election–Two Months and Counting

Germany does not have a government, though the election was more than three months ago. Spain, Portugal, and Ireland have minority governments. Austria is the first government since the financial crisis to include the populist right. The EU is trying to press the Visegrad group of central European countries to conform to the values of Western European members.

Read More »

Read More »

FX Weekly Preview: Thumbnail Sketch of the Week’s Big Events

Busiest week of Q4. Fed, BOJ, and BOE, only the last is expected to change policy. Flash EMU CPI and US jobs. Positive developments in Italy, less so in Spain.

Read More »

Read More »

FX Daily, October 11: Markets Looking for a New Focus

The US dollar is consolidating after retreating since reversing lower following the US jobs data at the end of last week. While the greenback has largely been confined to yesterday's ranges against the major currencies, the euro has made a marginal new high, briefly trading through the $1.1830 area noted yesterday.

Read More »

Read More »

FX Daily, October 03: Dollar Retains Firm Tone, Spanish Markets Stabilize

Firm US interest rates and a strong manufacturing ISM yesterday help support the greenback, while disappointing construction PMI in the UK weighs on sterling. The euro briefly slipped below $1.17 in Asia for the first time in six weeks. It has recovered toward the highs seen in North America yesterday (~$1.1760). There are several euro option strikes that may be in play today. In the euro, between $1.1750 and $1.1775, there are nearly 2.9 bln euros...

Read More »

Read More »

FX Daily, June 07: Markets Mark Time Ahead of Tomorrow

Tomorrow may be the most important day of the quarter for investors. The ECB meets. The UK goes to the polls. Former FBI Comey testifies. Ahead of these significant events, the global capital markets are mostly quiet, with some pockets of activity.

Read More »

Read More »

Euro Shrugs off European Banking Woes

Spain's Banco Popular is scrambling ahead of its meeting with the ECB tomorrow; shares are around 50% in three sessions. Italy has two banks that may see the same deal Monte Paschi negotiated with the EU. Portugal banks are still putting loan loss reserves and provisions aside.

Read More »

Read More »

FX Daily, December 21: Dollar Mixed in Thinning Activity, Dow 20,000 Watch Continues

The US dollar is narrowly mixed as the holiday markets make for light turnover. Global equity markets are not finding much encouragement from the new record highs by the Dow Jones Industrials. There have been a few developments to note.

Read More »

Read More »

Spain’s Political Deadlock Likely Leads to Third Election

Rajoy is hoping to form a minority government this week. It seems unlikely to succeed, which could lead to an election on Christmas. Regional elections and corruption trials may change Spain's political dynamics.

Read More »

Read More »

No Fines for Iberia, but Remedial Action Demanded and Possible Loss of Some ESI Funds

Spain and Portugal need to make some relatively small budget adjustments or will be denied some transfer payments. Spain's political situation is fluid, but another window of opportunity to break the logjam is at hand. The euro seems immune to these fiscal developments; some retracement objectives are in sight.

Read More »

Read More »

Three Developments in Spain

Favorable initial ruling for Spanish banks that overcharged on mortgages. The EC may be lenient on Spain (and Portugal) for the excessive deficits in 2015. There is a window of opportunity for Rajoy to form a minority government.

Read More »

Read More »

UK Seeks Divorce, Rajoy Needs a Shotgun Marriage

Center-right PP won the Spanish election. Anti-EU forces were setback. Rajoy needs a coalition partner.

Read More »

Read More »

European Politics Beyond the UK Referendum

Sterling is hovering around seven cents above last week’s lows as many short-term participants better position themselves for the UK to vote to say in the EU, even though many opinion polls show a statistical dead heat. The German Constitutional Court dismissed claims that the ECB’s Outright Market Transactions does not violate the German Constitution. …

Read More »

Read More »

Politics and Economics

Many people understand politics and economics to be two different disciplines. I remember in graduate school more than two decades ago, many colleagues and professors operationally defined political economy as how politics, by which they meant the state, screws up economics. I spoke at the Fixed Income Leaders Summit earlier this week and teased that many seemed …

Read More »

Read More »

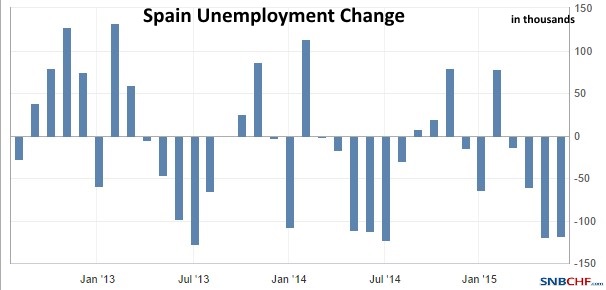

Eurocrisis, Myth and Reality, part 1: Big Job Creation in Spain

In the new series George Dorgan suggests that the euro crisis is a temporary development but not a long-lasting crisis. In the first part he shows that Spain actually created a lot of jobs in last twenty five years.

Read More »

Read More »

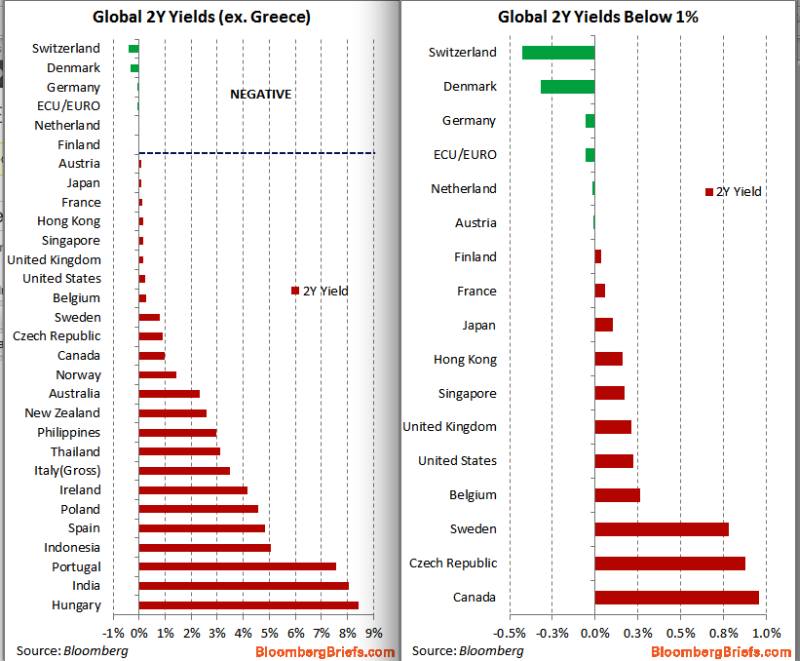

Is the Safe-Haven Government Bond Bubble Finally Bursting?

The Safe-haven government bond bubble did not pop, but Italy or Spain have become low yielders as well

Government bond yields under 10 years for safe-havens are close to zero. In April 2013, even 20 year bond yields are less than 3%, What can explain this bubble of the century?

Read More »

Read More »

Negative and Close to Zero Yields of Government Bonds and the Reasons

We judge that negative or close to zero yielding government bonds reflect three points: Risk off environment, long-run currency gains on currency with low inflation, insufficient supply of government bonds for bank refinancing purposes.

Read More »

Read More »

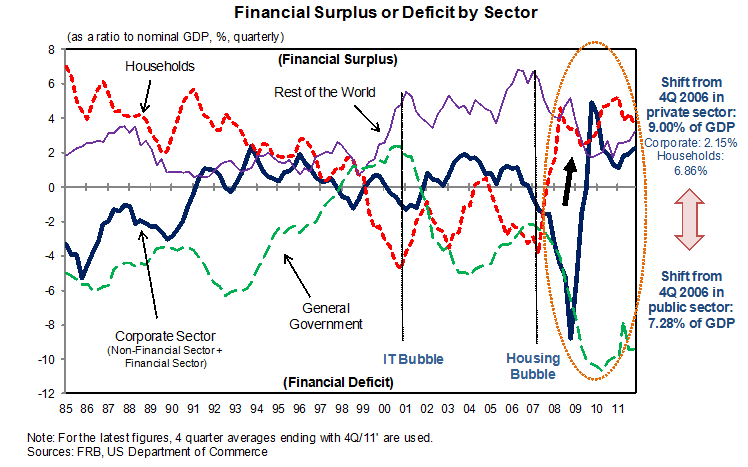

7d) Richard Koo’s and other Sector Balances

A list of long-term sector balances and related provided by Nomura's research institute and its chief economist Richard Koo.

Read More »

Read More »