Swiss FrancThe euro is higher at 1.0854 CHF (+0.06%). |

EUR/CHF - Euro Swiss Franc, June 07(see more posts on EUR/CHF, ) |

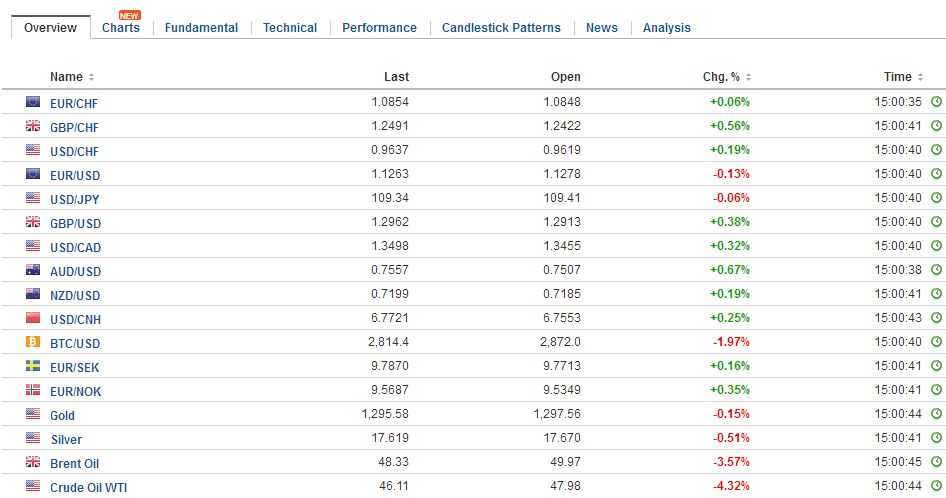

FX RatesTomorrow may be the most important day of the quarter for investors. The ECB meets. The UK goes to the polls. Former FBI Comey testifies. Ahead of these significant events, the global capital markets are mostly quiet, with some pockets of activity. The US dollar is narrowly mixed. The Australian dollar is the strongest currency today, gaining nearly 0.7% against the dollar to edge through last month’s high on the back of news that the economy expanded 0.3% rather than contract as some feared after Tuesday’s poor trade figures. The yen remains bid. The US dollar’s losses have been extended as the JPY109 level is approached. US yields stabilized after the four basis point decline yesterday. Bloomberg cited its story that cited unnamed sources saying that, after a recent divestment, China was ready to invest in US Treasuries again, as a reason for yesterday’s rally. We are skeptical of the narrative, but the truth is that China’s reserves have begun rising again and as they do, there will be a natural demand for Treasuries. |

FX Daily Rates, June 07 |

| The euro is trading quietly, keeping to the range seen over the past two sessions. It runs into offers in front of $1.1285, perhaps as some defend the $1.13 level where large options have been struck. Dips below $1.1250 seem to draw bids. Ahead of tomorrow’s ECB meeting, the market is fairly calm with the euro near seven-month highs.

There is an extra layer of importance. It is the first (major) action taken by the Single Resolution Board that was established 2 1/2 years ago. After wiping out shareholders, additional Tier 1 debt, and conversion of Tier 2 bonds into equities, it did not have to take stronger measures. If needed, it has the authority to take over the institution and/or force senior creditors to take a hit. |

FX Performance, June 07 |

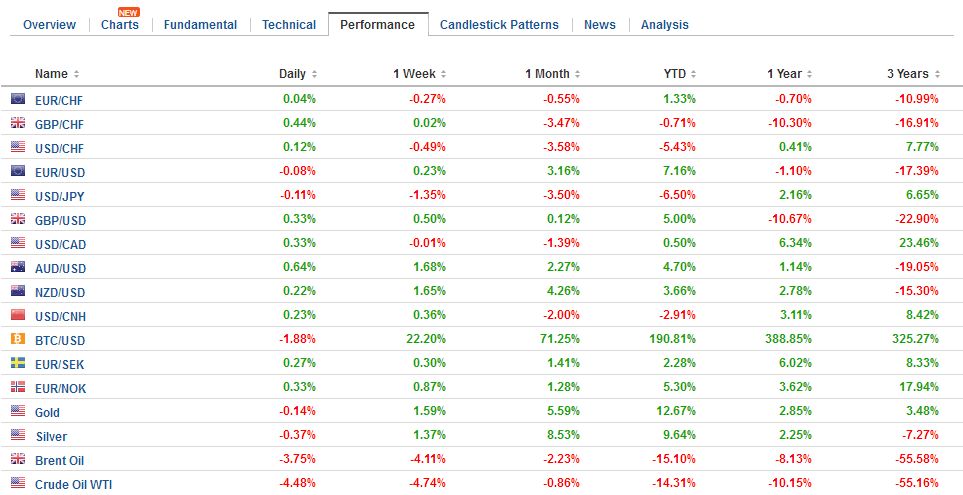

SpainSeparately, we note that Spanish industrial output was softer than expected. It rose 0.1% in April. The median forecast was for a 0.4% increase. The year-over-year rate edged up to 0.7% from a revised 0.6% (initially 0.4%).

|

Spain Industrial Production YoY, April 2017(see more posts on Spain Industrial Production, ) Source: Investing.com - Click to enlarge |

ItalyThese events in Spain may help inform the discussion of Italy’s troubled banks. One important difference is that some of the Italian bank bonds were sold to directly to retail investors. It seemed a good idea at the time, broaden the investment base, but some of the bonds were sold as having little risk. There is a precedent to compensate such investors after the resolution process. In any event, Italian bank shares are snapping a two-day decline today. |

Italy Retail Sales YoY, April 2017 Source: Investing.com - Click to enlarge |

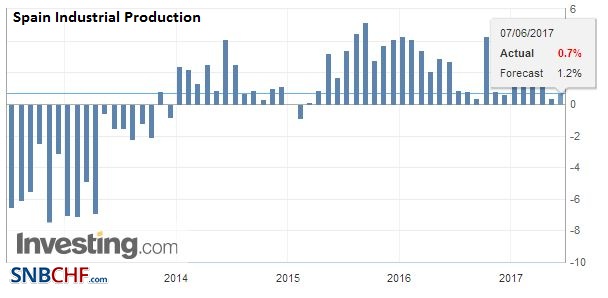

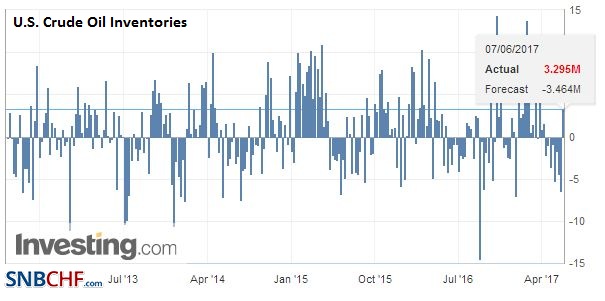

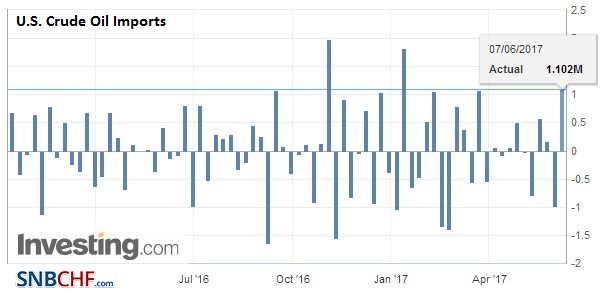

United StatesThe US Department of Energy reports the oil and gas inventories, and late in the session, consumer credit will be reported. Former FBI Director Comey testifies tomorrow, but media reports appear to steal some of the potential thunder. In particular, if the FBI thought the President was obstructing justice his behavior would have been different. Therefore, there will be no such claim. This, in turn, warns investors that the tomorrow’s testimony may have been over-hyped and that the distraction from the economic agenda, at least now, may not be as significant as feared. |

U.S. Crude Oil Inventories, May 2017(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

U.S. Crude Oil Imports, May 2017(see more posts on U.S. Crude Oil Imports, ) Source: Investing.com - Click to enlarge |

Australia

The Aussie looks constructive from a technical perspective, and the relatively high interest rates may be more salient given the pullback in US rates. However, while a contraction was avoided, Australia’s economy is not firing on all cylinders. Growth was flattered by an accumulation of inventories in mining (largest build in five years). Consumption was halved in Q1 from Q4 16, and that consumption that did take place appears to have been financed in part by a draw down in savings, which at 4.7%, is the lowest in nine years. And even then, the much of the consumption was taken up by “dwelling services,” like rent, food, and utilities.

China

Indeed earlier today, China reported that its reserves rose for a fourth consecutive month in April. The $24 bln increase was more than some economists expected, and the largest monthly increase since April 2014. They stand at $3.053 trillion, having bottomed in January a little below $3 trillion. Valuation adjustments, helped by the euro’s appreciation, complemented by the capital controls likely helped.

Eurozone

There are two European stories that are attracting interest. First, German factory orders fell sharply in April. Factory orders fell 2.1% rather than 0.3% as the Bloomberg median survey forecast indicated. There was little offset by the revision in March to 1.1% from 1.0%. Weakness was especially evident in orders for investment goods from outside the euro area. Tomorrow Germany reports April industrial output, and after the disappointing orders data, there is some risk that April output is weaker than expected (~0.5%).

Before leaving Germany, note the Constitutional Court ruling that strikes down the nuclear fuel tax has seen German utility companies rally while the DAX is little changed. An index of utility companies is up 4.3%, ostensibly in the judgment.

The other European story is in Spain. Banco Popular, which as we discussed earlier this week, was under pressure and once the Single Resolution Board was informed that it would likely fail, it marked the end. Heavy losses were inflicted on shareholders and subordinated bond holders (~3.3 bln euros). The AT1 (Alternative Tier 1) securities collapsed. The bank was sold to Santander for a euro. Santander announced a seven bln euro rights offering, which some analysts think is more than is needed for Popular and is raising extra capital. It shares are off around 3%.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$AUD,$CNY,$EUR,$JPY,EUR/CHF,FX Daily,newslettersent,Spain,Spain Industrial Production,U.S. Crude Oil Imports,U.S. Crude Oil Inventories