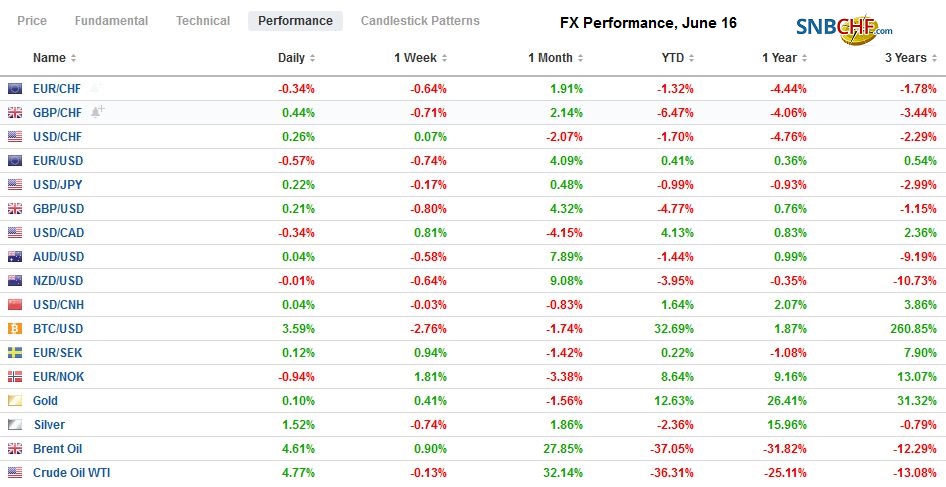

Swiss FrancThe Euro has fallen by 0.39% to 1.0704 |

EUR/CHF and USD/CHF, June 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Shortly after the US stock market opened sharply lower, the Federal Reserve announced that it’s Main Street facility was up and running. US stocks never looked back. After the S&P 500 recouped its full decline, the Fed announced it would begin buying corporate bonds. Up until now, it had been buying representative ETFs. Stocks rallied further on the news before pulling back into the close. The rally in risk assets carried into Asia. The MSCI Asia Pacific Index snapped a three-day slide and exploded higher. Despite a flare-up of tensions by North Korea, South Korea’s Kospi advanced over 5%. The Nikkei gained four percent, and Australia’s ASX rose 3.9%. Indian shares gained the least with less than a 1% gain, possibly amid concerns over a new escalation in the border dispute with China. Europe’s Dow Jones Stoxx 600 is extending yesterday’s recovery and is up around 2.5% through the European morning. US shares are firm and poised to continue yesterday’s recovery. Peripheral European bonds, led by Italy, are rallying alongside risk assets, while core bond yields are mostly edging higher. The US 10-year yield is near 73 bp. The dollar is narrowly mixed against the majors. Sterling’s 0.35% gain leads, while more the majors are +/- 0.15%. The JP Morgan Emerging Market Currency Index is struggling to extend its two-day advance. Gold held support near $1700 yesterday and is hovering around $1730, where it finished last week. Oil recovered smartly yesterday, and the July WTI contract is bid today. It appears poised to challenge $38 a barrel and then last week’s highs around $40. |

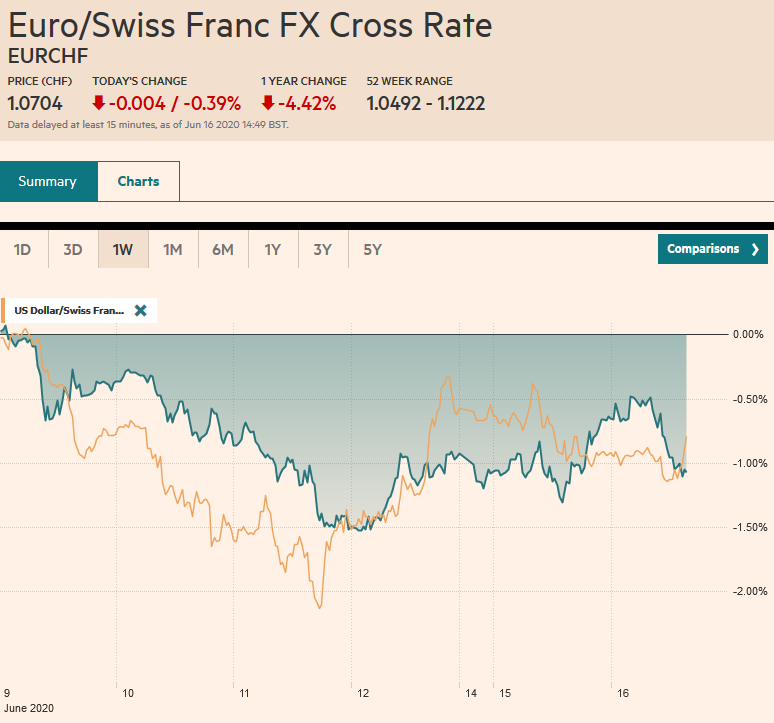

FX Performance, June 16 |

Asia Pacific

The BOJ left its rate policy unchanged, though there was a single dissent (Kataoka) who wanted an immediate cut. The BOJ did expand its corporate support by boosting the funds earmarked to JPY110 trillion (~$1 trillion) from JPY75 trillion. Last month, the BOJ announced that it would make JPY30 trillion in interest-free loans to small and medium-sized businesses and JPY25 trillion for larger firms. This was in addition to the JPY20 trillion of corporate bond and commercial paper purchase target. BOJ Governor Kuroda suggested that it would be difficult for it to raise interest rates ahead of the US. While some observers have suspected this was the case, to hear it confirmed, was surprising and raises questions about the meaning of monetary sovereignty.

Geopolitical tensions in Asia rose. North Korea destroyed a liaison office with South Korea on its territory, apparently in retaliation for South Korea’s pamphlet drop. However, North Korea is believed to be re-militarizing Kaesong industrial complex, and the destruction of the liaison office is seen as a step toward that. There was some weakening of the South Korean won in the non-deliverable forward market. India and China’s forces clashed in the Gaiwan Valley as de-escalation steps were being taken. Reports suggest that at least three Indian soldiers were killed, while some reports suggest Chinese troops also suffered casualties. India’s stocks underperformed in the regions, and the rupee retreated. It is the fourth consecutive session the rupee has eased against the US dollar.

The dollar is in about a 20 pip range around JPY107.45. Yesterday was the first session in three that the greenback held above JPY107.00. There is an option for about $430 mln at JPY107.30. A move above JPY107.85 is needed to lift the dollar’s tone. Range-trading, rather than a new trend, seems to be the most likely scenario. The Australian dollar posted an outside up day yesterday, and follow-through buying lifted it to almost $0.6980 before selling pressure in early Europe knocked it back below $0.6900. Look for initial resistance in North America in the $0.6935 area. Australia’s employment data is due early on June 18 in Sydney. The PBOC set the dollar’s reference rate ar CNY7.0755. This was a little stronger than the bank models implied. The dollar has re-entered its previous CNY7.05-CNY7.10- range.

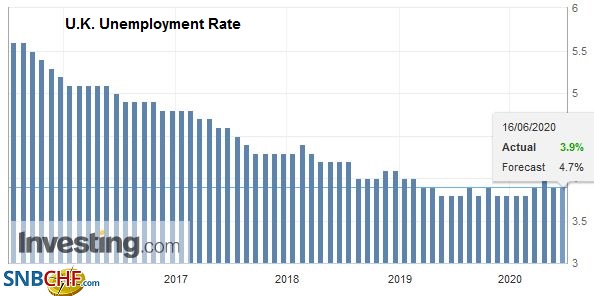

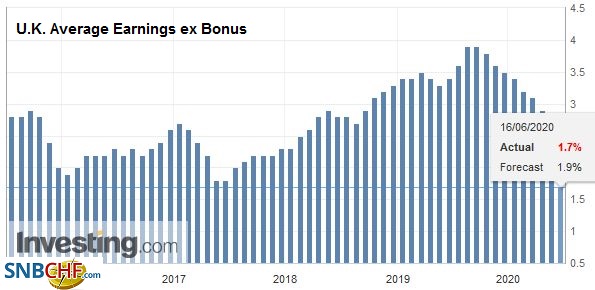

EuropeThe UK’s May employment looked bleak. Jobless claims rose by almost 529k after a revised 1.03 mln increase in April (initially ~857k). Earnings data and the unemployment rate are reported with an extra month lag. Tomorrow the UK reports May CPI and PPI ahead of the Bank of England meeting. The BOE is widely expected to boost its bond-buying program by at least GBP100 bln, a GBP200-GBP250 bln increase seems likely. |

U.K. Unemployment Rate, April 2020(see more posts on U.K. Unemployment Rate, ) Source: investing.com - Click to enlarge |

| There has also been increased talk that it may introduce yield-curve control, with some suggesting targeting the five-year rate at the same as the base rate (10 bp). Separately, the UK government and the EU seemed to soften their rhetoric about a new trade agreement, and Prime Minister Johnson said he wanted a deal by the end of next month. |

U.K. Average Earnings ex Bonus, April 2020(see more posts on U.K. Average Earnings, ) Source: investing.com - Click to enlarge |

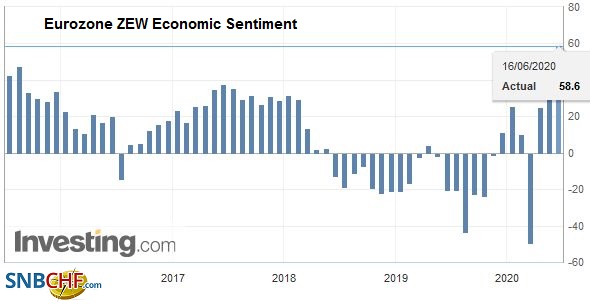

| Germany’s ZEW survey continues to improve, but the current assessment remains bleak. It rose from -93.5 to -83.1. This was slightly less than forecasts. The expectations component rose to 63.4 from 51.0. |

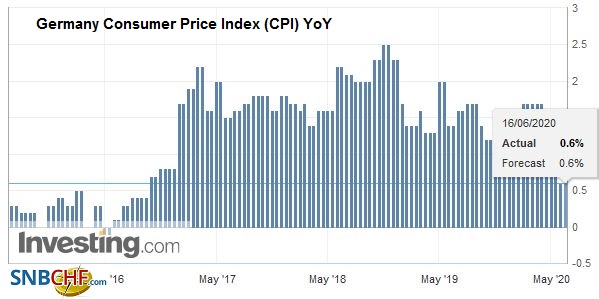

Germany Consumer Price Index (CPI) YoY, May 2020(see more posts on Germany Consumer Price Index, ) Source: investing.com - Click to enlarge |

| It was the third consecutive gain after bottoming at -49.5 in March. Separately, note the US is confirming the removal of about a third of its troops from Germany. President Trump linked it to Germany’s arrears with NATO, the gas pipeline with Russia, and unspecified trade issues. |

Eurozone ZEW Economic Sentiment, June 2020(see more posts on Eurozone ZEW Economic Sentiment, ) Source: investing.com - Click to enlarge |

Croatia and Bulgaria may be the next two members of the European Monetary Union. The first formal step would be entry into ERM-II to promote foreign exchange stability (for a couple of years to prepare for monetary union. Despite talk of its demise if some precondition, like fiscal union, or common bonds, is not met, the monetary union continues to be a work in progress. The EU Summit at the end of the week will focus on the Recovery Fund. We have long maintained more countries will join EMU before a single country leaves. That still seems right.

The euro extended yesterday’s recovery to almost $1.1355 today. It found support near $1.1225 yesterday. It frayed the (61.8%) retracement of the leg down in recent days in the $1.1340-$1.1345 area. If the downside correction is not over, the euro should close below there today. Sterling has tested a similar retracement objective near $1.2675 today and rose to almost $1.2690. However, the momentum from $1.2455 yesterday appears to be nearly exhausted. Initial support now is near $1.2600.

America

The Boston Federal Reserve will administer the Main Street lending program for small and medium-sized businesses that was finally launched after being announced in late March. The Fed will buy 95% of the loans made through the program, which really consists of three different facilities. Its design has been adjusted twice over the past two and a half months. It is the first time since the Great Depression that the Fed is aiding these firms that are too large for Small Business Administration loans and that program but too small for the corporate bond-program. The Fed has about $600 bln of buying power for this program that will lend $250,000 to $300 mln as businesses with up to 15k employees or $5 bln in 2019 revenue expand their existing debt. It is backed by $75 bln from the Treasury Dept that was earmarked in the CARES Act. The corporate bond-buying program had until now been limited to some (~$5.5 bln) ETF buying.

| Late in the afternoon (~2 pm ET), the Fed announced it would begin buying corporate bonds outright ($250 bln Secondary Market Corporate Credit Facility) based on an index it created for this purpose. The corporates are US-issuers and include non-deposit taking financial institutions, and the bonds are for a maximum of five years. Many seem critical of the Fed’s decision as corporate bond spreads do not seem to be in need of extra help, but they would likely have been just as critical if it did not make good on its promise. Moreover, a week ago, the argument was that the Fed’s actions were not in line with its own understanding of how far away it was from its policy objectives of full employment and price stability. |

U.S. Capacity Utilization Rate, May 2020(see more posts on U.S. Capacity Utilization Rate, ) Source: investing.com - Click to enlarge |

| Today’s US data will provide more evidence that the economy is on the mend. May retail sales are expected to jump by around 8.5% after a 16.4% collapse in April. The components used for GDP calculations are forecast to rise a little more than 5% after a 15.3% drop in April. |

U.S. Industrial Production YoY, May 2020(see more posts on U.S. Industrial Production, ) Source: investing.com - Click to enlarge |

| Separately, a 5% rise in manufacturing output (-13.7% in April) is expected to help lift the broader measure of industrial production by 3% (-12.2% in April). |

U.S. Retail Sales YoY, May 2020(see more posts on U.S. Retail Sales, ) Source: investing.com - Click to enlarge |

July light sweet crude oil fell to two-week lows (~$34.35) before reversing higher in the US session and rallying to close above the pre-weekend high. It seemed to have bottomed around the same time as US equities did, and the strong close amounts to a potential key reversal. The supply and demand picture is arguably supporting prices. OPEC+ has extended its cuts, and even Iraq, which had been delinquent, seems to be implementing the agreement. At the same time, demand in China, India, and Europe is gradually increasing. Our concern is that shut-in shale wells can be brought on-line quickly, and the high debt burdens provide a powerful incentive to do so.

The US dollar found support near CAD1.3500, which corresponds to a (50%) retracement of the bounce that took it from around CAD1.3315 on June 10 to a high yesterday near CAD1.3685. The greenback has turned better bid in the European morning. Initial resistance is now pegged near CAD1.3600 and then CAD1.3650. The US dollar has retraced a bit more of its recent gains against the Mexican peso. Near MXN22.00, it retraced (6.18%) of its bounce and found support before the North American open. Resistance is seen near MXN22.20, and a break of it could signal MXN22.40.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Bank of England,Bank of Japan,EUR/CHF,Eurozone ZEW Economic Sentiment,federal-reserve,FX Daily,Germany Consumer Price Index,newsletter,U.K. Average Earnings,U.K. Unemployment Rate,U.S. Capacity Utilization Rate,U.S. Industrial Production,U.S. Retail Sales,USD/CHF