| You just don’t see $4 billion monthly retail sales revisions, in either direction. Advance estimates are changed all the time, each monthly figure will be recalculated twice after its initial release. Typically, though, the subsequent revisions are minor rarely amounting to a billion. Four times that?

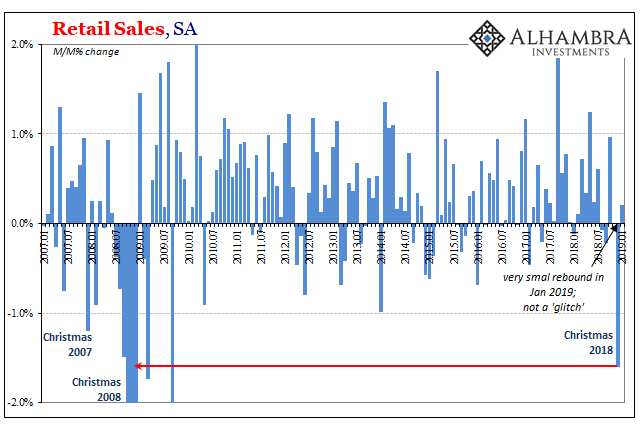

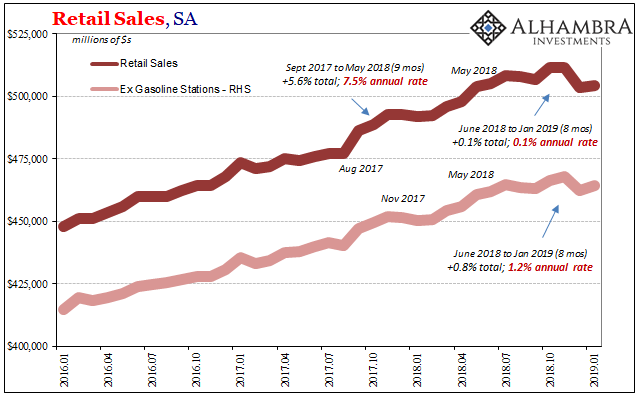

Last month, the Census Bureau reported that retail sales during the Christmas holiday were a disaster. It was Christmas 2007 bad. For people thinking the US economy was booming, this was a shock. So much so, some like the President’s chief economic advisor Larry Kudlow stated it had to have been a “glitch” in the data. The BEA proved that wasn’t the case when it released its data on Personal Spending. Now the Census Bureau reports retail sales for January 2019, at the same time revising them for December (and November). Not only wasn’t the drop a glitch, it was far worse than first guessed. If it had been anything like a mistake, revisions would be positive not more than $4 billion further downward. |

U.S. Retail Sales, Jun 2011 - Dec 2018(see more posts on U.S. Retail Sales, ) |

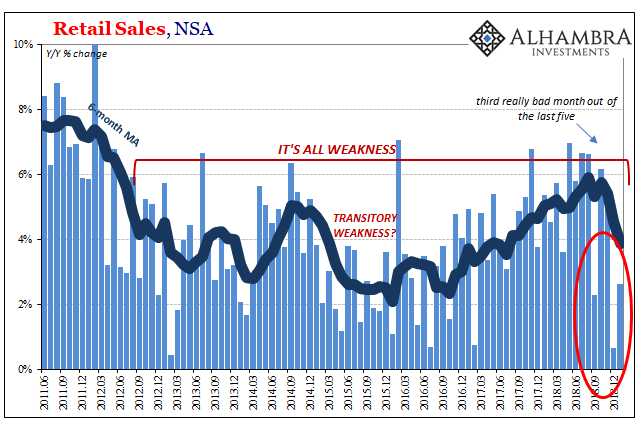

| Unadjusted, the advance estimate put December 2018 retail sales at $569.5 billion. That worked out to a year-over-year increase of just 1.44%, one of the worst monthly results in the series. Having obtained more comprehensive sample data in the meantime, the Census Bureau now estimates retail sales during December were just $565.1 billion, or 0.66%.

What’s worse, the advance January 2019 total was (unadjusted) $456.4 billion. That’s just 2.63% more than January 2018. In other words, not one isolated suspiciously bad month, rather one very bad month confirmed by another. Validation that what’s going on isn’t just numbers. |

U.S. Retail Sales, Euro/Dollar, Nov 2010 - Feb 2019(see more posts on U.S. Retail Sales, ) |

| Seasonally-adjusted, the advance monthly change from November 2018 to December 2018 was first put at -1.2%. This was about equal to December 2007, the rough holiday start to what would become the Great “Recession.” Revised, the monthly change is now closer to something like December 2008. |

U.S. Retail Sales, Jan 2007 - 2019(see more posts on U.S. Retail Sales, ) |

| This doesn’t suggest another huge recession is lining up as I write. What it says is that, balance of probabilities, “whatever” is going on in the US economy right now is a substantial issue already. The chances of this being a statistical problem are now close to zero (leaving only benchmark revisions to rescue the “boom”, not likely).

There is “something” going on and its impacts are, obviously, to the downside. While December’s estimate sticks out, this really isn’t a new development. As I’ve written for several months, it really does appear as if the global economy (including the US) struck a landmine during October-December. |

U.S. Retail Sales, Jan 2016 - 2019(see more posts on U.S. Retail Sales, ) |

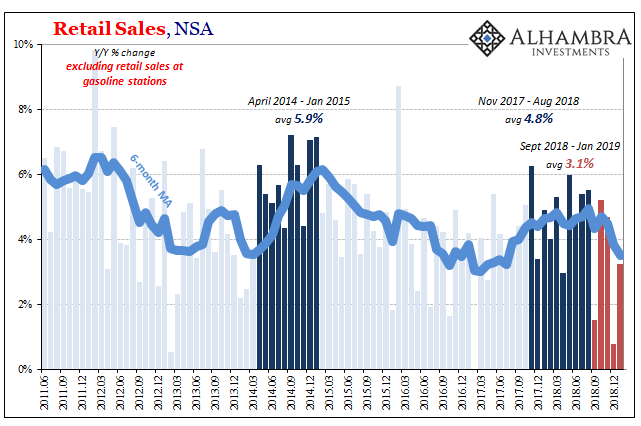

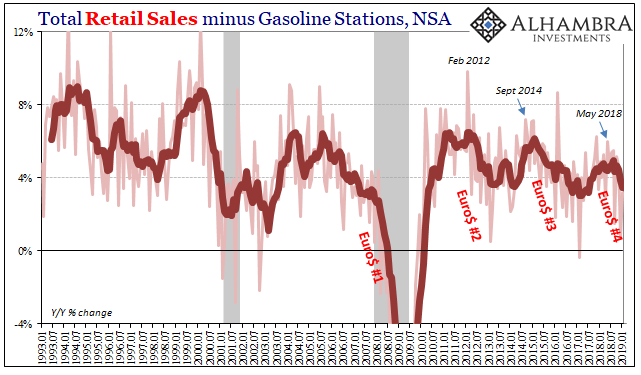

| This goes well beyond the price of oil. Retail sales recorded at gasoline stations are now falling by about 4% year-over-year. If we leave them out of the total, however, retail sales are suggesting broad-based consumer weakness – just as the BEA figured in Personal Spending.

In a matter of a few months, the average growth (ex gasoline) is down to just 3.5%. That’s the lowest since the middle of 2017, the (lagged) bottom of the last downturn. |

U.S. Retail Sales ex Gas, Jun 2011 - Mar 2019(see more posts on U.S. Retail Sales, ) |

| To begin last year, the US economy was together with the rest of the world supposedly booming. That was globally synchronized growth. Then “overseas turmoil” showed up around April and May, leaving the US to “decouple” from growing weakness elsewhere. To end last year, even that much was in doubt.

As we finally begin to catch up with 2019 data, more and more it appears that’s not what happened nor what it is happening. Instead, what was called a boom was a weak Reflation #3. Being stuck in this uninspired baseline meant that everything was susceptible to eurodollar reverse; just as has occurred on three previous occasions. |

U.S. Retail Sales Stagnation, Jan 1992 - 2019(see more posts on U.S. Retail Sales, ) |

| It also would’ve meant there wouldn’t be any decoupling. There is always variability as far as timing and intensity in these downturns, but given enough time there really is harmony in the global economic direction. Reflation #3 worldwide became Euro$ #4 at some point last year likely around April and May. There is no going it alone in this globalized framework.

This is ultimately what matters most about the January 2019 retail sales estimates. Even if you didn’t quite go as far as Larry Kudlow in denial, it wasn’t as far-fetched to think the US economy in particular was the cleanest dirty shirt (since we’re using 2015 terminology). Maybe a small, transitory soft patch for growth, no more than a few months (October to December), and then right back to booming again. |

U.S. Retail Sales Total minus Gasoline Stations, Jan 1993 - 2019(see more posts on U.S. Retail Sales, ) |

Nothing is impossible, of course, but the chances of that much variation in downturn have just been cut significantly. The US economy before 2018 even finished had exhibited the same unnerving symptoms as we find elsewhere around the world. It’s more than just one bad month being revised to a worse month.

In short, yeah, almost certainly downturn ahead if not already.

Does that mean full-blown recession? Maybe as bad as 2008? There isn’t nearly enough here to determine all that, nor, I would add, is there enough in market indications, either. Though curves are inverted and retail sales have been unsurprisingly (and relatedly) awful, these merely tell us that we are on the right track giving up on the upside and thinking more exclusively about the downside – if not yet having drawn any conclusions about how far down things might become.

Another really bad month like December, though, and the probabilities really start to skew.

Full story here Are you the author? Previous post See more for Next postTags: consumer spending,currencies,economy,EuroDollar,Federal Reserve/Monetary Policy,gasoline,Markets,newsletter,oil prices,Retail sales,U.S. Retail Sales