Tag Archive: consumer spending

Simple Economics and Money Math

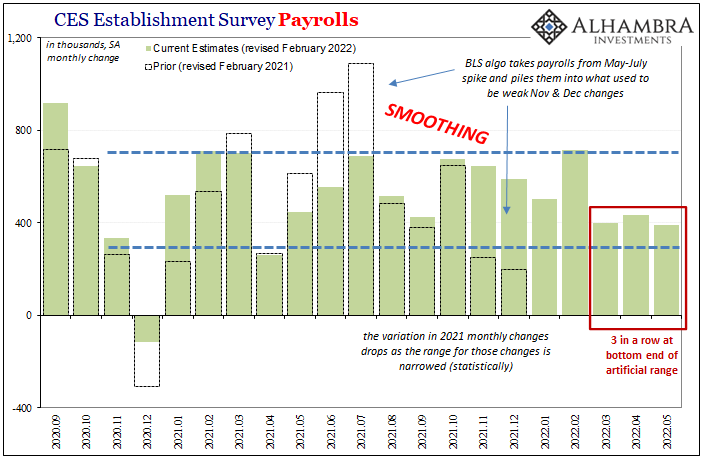

The BLS’s most recent labor market data is, well, troubling. Even the preferred if artificially-smooth Establishment Survey indicates that something has changed since around March. A slowdown at least, leaving more questions than answers (from President Phillips).

Read More »

Read More »

No Pandemic. Not Rate Hikes. Doesn’t Matter Interest Rates. Just Globally Synchronized.

The fact that German retail sales crashed so much in April 2022 is significant for a couple reasons. First, it more than suggests something is wrong with Germany, and not just some run-of-the-mill hiccup. Second, because it was this April rather than last April or last summer, you can’t blame COVID this time.

Read More »

Read More »

T-bills Targeted Target

Yesterday’s market “volatility” spilled (way) over into this morning’s trading. It ended up being a very striking example, perhaps the clearest and most alarming yet, of a scramble for collateral. The 4-week T-bill, well, the chart speaks for itself:During past scrambles, such as those last year, they didn’t look like this. They would hit, stick around for an hour, maybe a bit longer, and then clear up as collateral books get balanced in repo like...

Read More »

Read More »

Is It Recession?

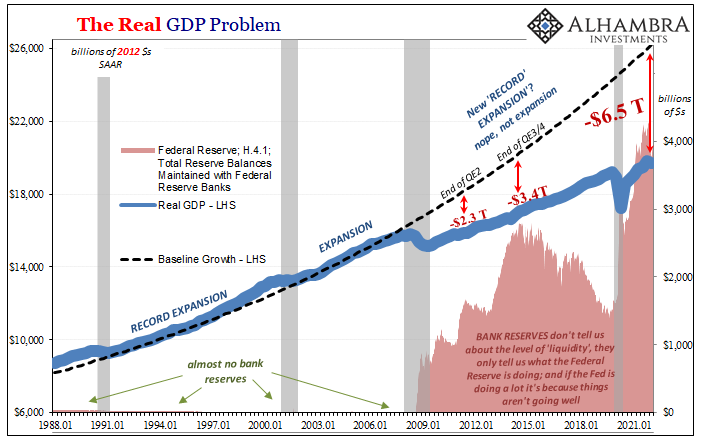

According to today’s advance estimate for first quarter 2022 US real GDP, the third highest (inflation-adjusted) inventory build on record subtracted nearly a point off the quarter-over-quarter annual rate. Yes, you read that right; deducted from growth, as in lowered it. This might seem counterintuitive since by GDP accounting inventory adds to output.

Read More »

Read More »

Not Good Goods

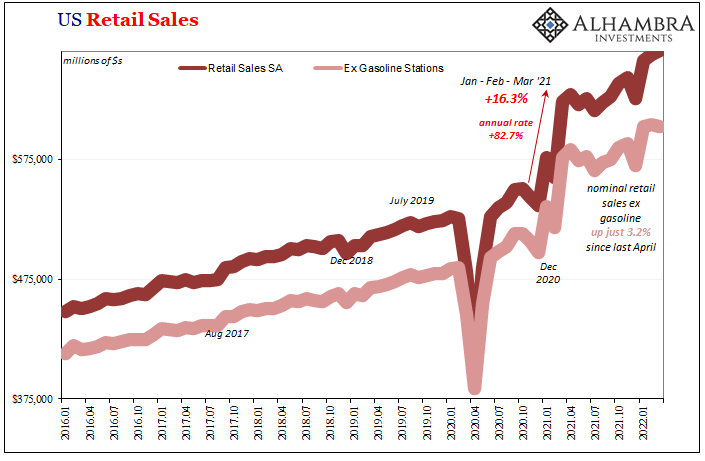

The goods economy in the United States is – maybe was – the lone economic bright spot. That in and of itself should’ve provoked more caution, instead there was the red-hot recovery to sell under the cover of supply shock pricing changes. The sheer spending on goods, and how they arrived, each unabashedly artificial from the get-go.

Read More »

Read More »

FOMC Goes With Unemployment Rate While This Huge Number Happens To Far More Relevant Economic Data

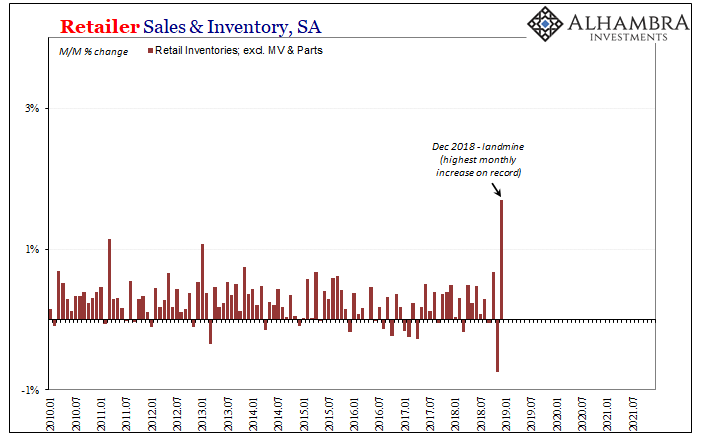

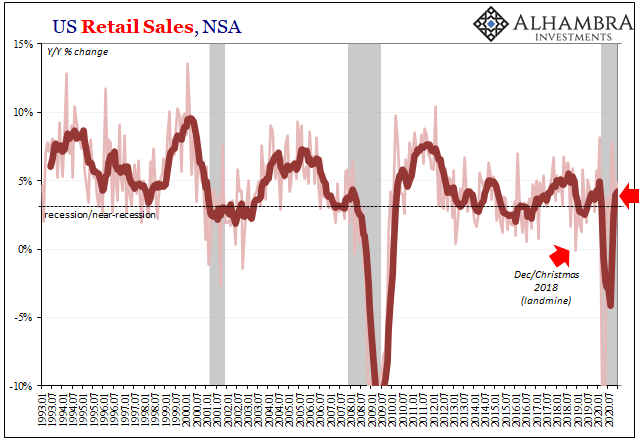

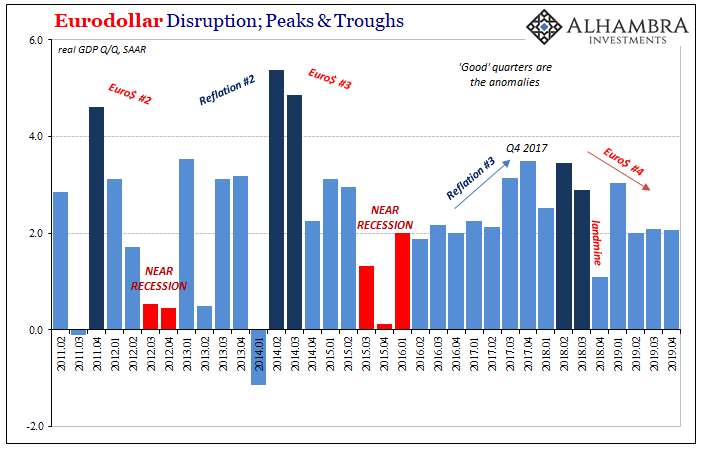

The first time I can consciously remember using the term landmine was probably here in February 2019. I had described the same process play out several times before, I had just never applied that term. There was all sorts of market chaos in the final two months of 2018, including a full-on stock market correction, believe it or not, leaving the inflation and recovery narrative in near complete tatters.

Read More »

Read More »

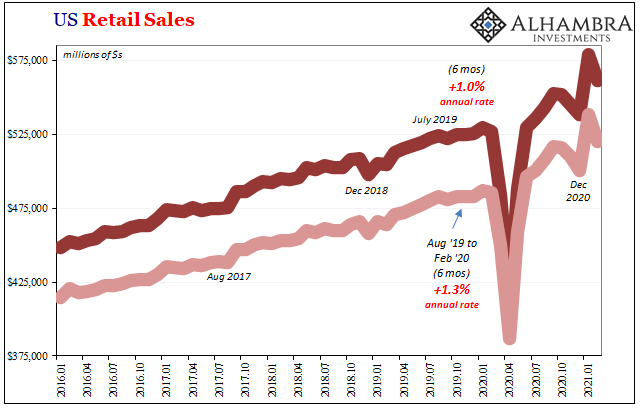

Trying To Project The Goods Trade Cycle

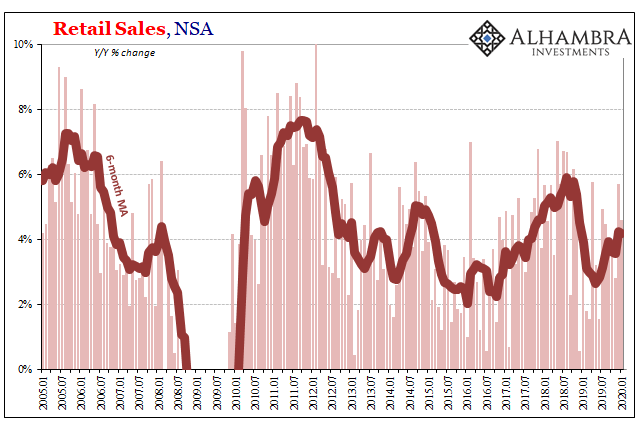

One quick note on yesterday’s retail sales estimates in the US for the month of November 2021. The increase for them was less than had been expected, but these were hardly awful by any rational measure.

Read More »

Read More »

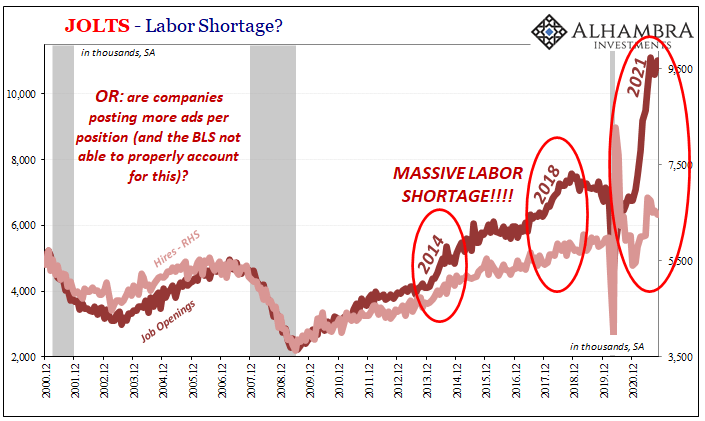

A Global JOLT(s) In July

The Bureau Labor Statistics reported today another huge month for Job Openings (JO). According to their methodology (which I still believe is flawed, but that’s not our focus this time), the level for October 2021 (JOLTS updates are for one month further back than payrolls) was a blistering 11.03 million.

Read More »

Read More »

August Retail Sales Surprise To The Upside, Because They Were Down?

According to the movie The Princess Bride, the worst classic blunder anyone can make is to get involved in a land war in Asia. No kidding. The second is something about Sicilians and death. There is also, I’ve come to learn, an unspoken third which cautions against chasing down and then trying to break down seasonal adjustments in economic data.Some things are best left just as they are published.

Read More »

Read More »

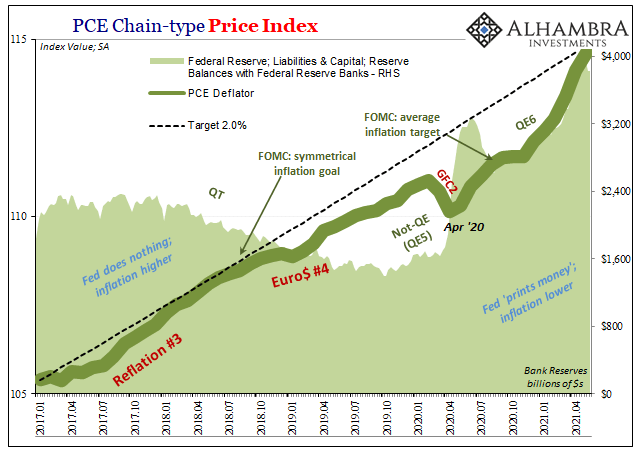

Inflation Isn’t Just The Outlier, The Inflation In It Is, Too

Following the same recent pattern as the BLS and its CPI, the Bureau of Economic Analysis’s (BEA) PCE Deflator ran up hotter in May 2021 than its already high increase during April. The latter’s headline consumer basket rose 3.91% year-over-year, its fastest pace since August 2008.

Read More »

Read More »

Spending Here, Production There, and What Autos Have To Do With It

While the global inflation picture remains fixed at firmly normal (as in, disinflationary), US retail sales by contrast have been highly abnormal. You’d think given that, the consumer price part of the economic equation would, well, equate eventually price-wise.

Read More »

Read More »

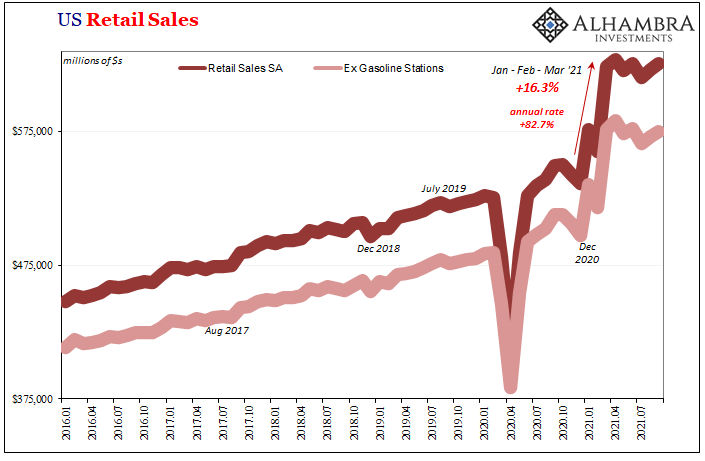

Uncle Sam Was Back Having Consumers’ Backs

American consumers were back in action in January 2021. The “unemployment cliff” along with the slowdown and contraction in the labor market during the last quarter of 2020 had left retail sales falling backward with employment. Seasonally-adjusted, total retail spending had declined for three straight months to end last year.

Read More »

Read More »

Consumers, Producers, and the Unsettled End of 2020

The months of November and December aren’t always easily comparable year to year when it comes to American shopping habits. For a retailer, these are the big ones. The Christmas shopping season and the amount of spending which takes place during it makes or breaks the typical year (though last year, there was that whole thing in March and April which has had a say in each’s final annual condition).

Read More »

Read More »

Consumers, Too; (Un)Confident To Re-engage

There is a lot of evidence which shows some basis for expectations-based monetary policy. Much of what becomes a recession or worse is due to the psychological impacts upon businesses (who invest and hire) as well as workers being consumers (who earn and then spend).

Read More »

Read More »

Extending the Summer Slowdown

A big splurge in September, and then not much more in October. While it would be consistent for many to focus on the former, instead there is much about the latter which, for once, is feeding growing concerns. Retail sales, American consumer spending on goods, has been the one (outside of economically insignificant housing) bright spot since summer

Read More »

Read More »

Personal Income and Spending: The Other Side

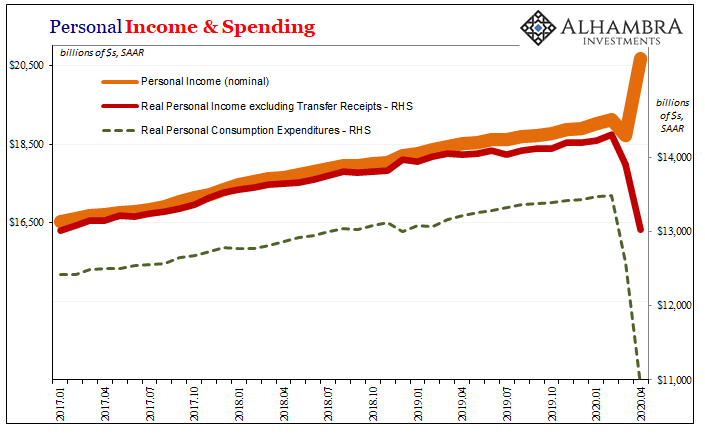

The missing piece so far is consumers. We’ve gotten a glimpse at how businesses are taking in the shock, both shocks, actually, in that corporations are battening down the liquidity hatches at all possible speed and excess. Not a good sign, especially as it provides some insight into why jobless claims (as the only employment data we have for beyond March) have kept up at a 2mm pace.These are second order effects.

Read More »

Read More »

We All Know Who’s On First, But What’s On Second?

It wasn’t entirely unexpected, though when it was announced it was still quite a lot to take in. On September 1, 2005, the Bureau of Economic Analysis (BEA) reported that the nation’s personal savings rate had turned negative during the month of July. The press release announcing the number, in trying to explain the result was reduced instead to a tautology, “The negative personal saving reflects personal outlays that exceed disposable personal...

Read More »

Read More »

US Sales and Production Remain Virus-Free, But Still Aren’t Headwind-Free

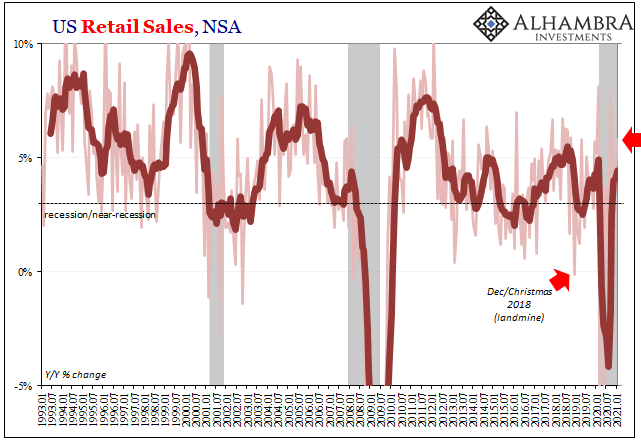

The lull in US consumer spending on goods has reached a fifth month. The annual comparisons aren’t good, yet they somewhat mask the more recent problems appearing in the figures. According to the Census Bureau, total retail sales in January rose 4.58% year-over-year (unadjusted). Not a good number, but better, seemingly, than early on in 2019 when the series was putting out 3s and 2s.

Read More »

Read More »

Three Straight Quarters of 2 percent, And Yet Each One Very Different

Headline GDP growth during the fourth quarter of 2019 was 2.05849% (continuously compounded annual rate), slightly lower than the (revised) 2.08169% during Q3. For the year, the Bureau of Economic Analysis (BEA) puts total real output at $19.07 trillion, or annual growth of 2.33% and down from 2.93% in 2018. Last year was weaker than 2017, the second lowest out of the six since 2013.

Read More »

Read More »

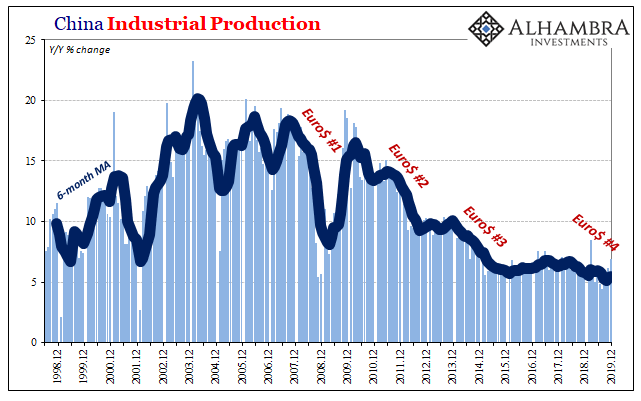

China Enters 2020 Still (Intent On) Managing Its Decline

Chinese Industrial Production accelerated further in December 2019, rising 6.9% year-over-year according to today’s estimates from China’s National Bureau of Statistics (NBS). That was a full percentage point above consensus. IP had bottomed out right in August at a record low 4.4%, and then, just as this wave of renewed optimism swept the world, it has rebounded alongside it.

Read More »

Read More »