Category Archive: 1) SNB and CHF

The new banknotes – journey to the public and back

This film shows the journey of the new Swiss banknotes, from storage and quality assurance at the Swiss National Bank to their entry into circulation. It also describes how the notes from the old banknote series are sorted and destroyed.

Read More »

Read More »

The new banknotes – security features at a glance

This film shows the five main security features that can be used to check easily and quickly if a new Swiss banknote is genuine. Additional features are shown in the film ‘The new banknotes – design and security features’.

Read More »

Read More »

The new banknotes – printing process

This film shows how the new Swiss banknotes are printed. The process uses traditional techniques such as offset, silkscreen, intaglio and letterpress printing, together with special processes such as foil application and microperforation. This gives the new Swiss banknote series a unique combination of design elements and security features.

Read More »

Read More »

The new banknotes – substrate

This film shows how the substrate for the new Swiss banknotes is produced. The issuance of these notes marks the first time that the substrate will be used for banknote production anywhere in the world. Called Durasafe®, it is a specially developed, three-layer substrate, comprising an inner polymer layer sandwiched between two outer layers of …

Read More »

Read More »

Apple Jumps After Berkshire Reveals 9.8 Million Share Stake

After three consecutive weeks of seemingly relentless bad news for Apple, moments ago the stock jumped by $2 dollars, rising from $90.5 to over $92.50. Some hope for the Swiss National Bank or will Berkshire shares sink together with Apple and the SNB?

Read More »

Read More »

As Carl Icahn Was Selling Apple, This Central Bank Was Furiously Buying

We hope for the sake of Swiss residents that equity markets never suffer a dramatic drop. The SNB has “invested” 20% of Swiss GDP in stocks. When will the ivory tower economists ultimately lose control of the most manipulated, centrally-planned market in history?

Read More »

Read More »

Grüezi, ich möchte gern eine Kuh einzahlen

Diese Filmsequenz gehört zum Thema “Alles über unser Geld” des Informationsangebots “Unsere Nationalbank”. Sie zeigt auf humorvolle Weise, was man auf ein Bankkonto einzahlen kann – und was nicht.

Read More »

Read More »

The Twilight Of The Gods (aka Central Bankers)

The current financial market volatility increasingly reflects loss of faith in policy makers. Celebrity central bankers are learning that they must constantly produce new miracles for their followers.

Read More »

Read More »

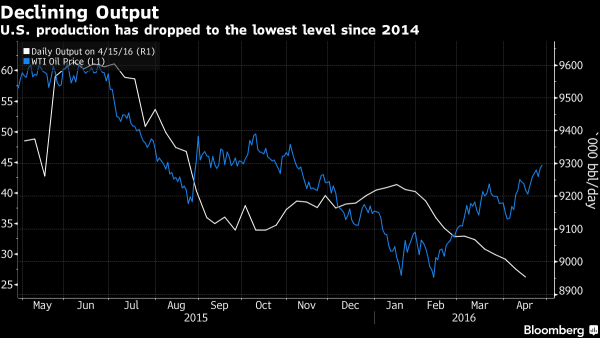

SNB Increased Equities Share to 20 percent, A High Risk Game for a Conservative Investor

A share of 20% equities is too much for a conservative investor.

- She increases the CHF debt with continuing interventions at a pace of 10% per year.

- yield on bond investments is less than 1% p.a. and equity markets might not improve a lot any more.

- Expensive dollar: she bought U.S. equities when the dollar was relatively expensive.

Read More »

Read More »

Generalversammlung 2016 (Simultanübersetzung auf Deutsch)

Generalversammlung, 29.04.2016 00:00 Jean Studer, Präsident des Bankrats der Schweizerischen Nationalbank 42:35 Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank

Read More »

Read More »

Assemblea generale 2016 (traduzione simultanea in italiano)

Assemblea generale, 29.04.2016 00:00 Jean Studer, presidente del Consiglio di banca della Banca nazionale svizzera 42:35 Thomas Jordan, presidente della Direzione generale della Banca nazionale svizzera

Read More »

Read More »

Assemblée générale 2016 (traduction simultanée en français)

Assemblée générale, 29.04.2016 00:00 Jean Studer, président du Conseil de banque de la Banque nationale suisse 42:35 Thomas Jordan, président de la Direction générale de la Banque nationale suisse

Read More »

Read More »

Generalversammlung – Assemblée générale – General Meeting of Shareholders – Assemblea generale, 2016

Generalversammlung – Assemblée générale – General Meeting of Shareholders – Assemblea generale, 29.04.2016 00:00 Jean Studer, Präsident des Bankrats der Schweizerischen Nationalbank – Jean Studer, président du Conseil de banque de la Banque nationale suisse – Jean Studer, president of the Bank Council of the Swiss National Bank – Jean Studer, presidente del Consiglio di …

Read More »

Read More »

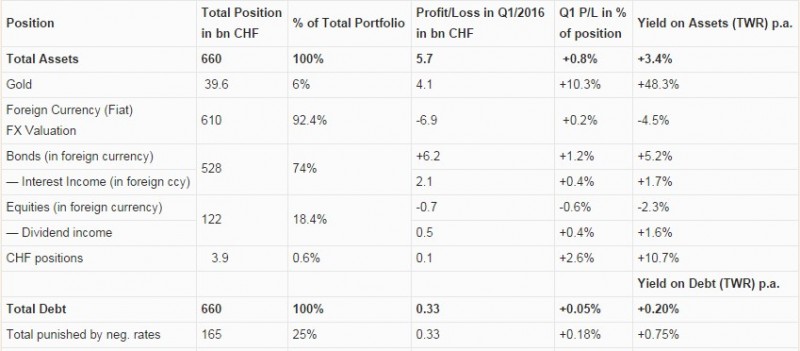

Gold, Bonds and Negative Interest Rates Give SNB a Q1 profit

SNB Results Q1 2016: Two thirds of SNB profit comes from Gold. Deflation helps with higher bonds prices and profit on negative interest rates.

Read More »

Read More »

With Tech Tanking, Can Anything Save The System?

Submitted by John Rubino via DollarCollapse.com,

First it was the banks reporting horrendous numbers — largely, we were told, because of their exposure to recently-cratered energy companies. Now it’s Big Tech, which is a much harder thing t...

Read More »

Read More »

Wall Street and SNB In Pain: 163 Hedge Funds Are Long AAPL Stock

First it was the blow up of hedge fund darling Valeant that crushed countless funds who were long the name.

Then, one month ago after the collapse of the Allergan-Pfizer deal, we showed (one of the reasons) why the hedge fund world continued to unde...

Read More »

Read More »

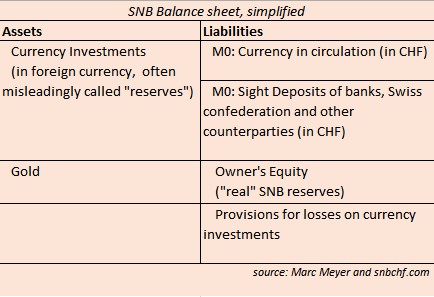

April 2016: SNB running suicide again?

Speculative position: Speculators are even longer CHF (against USD): +9410x 125K contracts.

Sight Deposits: SNB intervenes for 6.4 bln. CHF in only three weeks. Sight deposits (aka debt) are rising by nearly 1% per month, this is 10% per year. The SNB can never achieve such a yield on investment, her yield is between 1 and 2 percent. Is the bank running suicide again?

Read More »

Read More »

Izabella Kaminska: Uberisation of the Economy: Gosplan 2.0.

SERIES 2.2: POST-CAPITALISM 7 MAR – IZABELLA KAMNISKA (FINANCIAL TIMES): UBERISATION OF THE ECONOMY: GOSPLAN 2.0 The sharing economy isn’t what you think it is. Nor is the platform economy. Furthermore, we’ve been here before. Last time it was under the guise of ‘red plenty’. Could we be sleep walking our way into a technocratic …

Read More »

Read More »