Category Archive: 1) SNB and CHF

Swiss central bank can cut rates further if needed, says bank president Jordan

The Swiss National Bank can cut interest rates further into negative territory if needed, President Thomas Jordan said. “We have still some room to go further if necessary,” Jordan said Saturday in an interview in Washington with Bloomberg Television’s Francine Lacqua. Jordan, who is attending the annual meetings of the International Monetary Fund and the World Bank, noted that the bank has already pushed rates quite far.

Read More »

Read More »

Switzerland’s central bank offers a glimpse behind the curtain

The Swiss National Bank is offering a rare look into how it sets monetary policy. A video of SNB President Thomas Jordan and fellow members of the governing board shows them beginning their quarterly policy assessment discussing the state of the economy with about 30 people.

Read More »

Read More »

Is Someone Trying To Buy The Swiss National Bank?

By now it is well-known that as we profiled previously, one of the most ravenous buyers of US stocks in recent years, has been a central bank: the Swiss National Bank... However, it is far less known that not only is the Swiss National Bank also a publicly traded stock, but is also one of the best performing stocks in the world this year.

Read More »

Read More »

The Swiss National Bank – what it does and how it works

The SNB film takes a behind-the-scenes look at the Swiss National Bank (SNB) and its monetary policy. It explains why the SNB has a mandate to ensure price stability, describes how it implements this mandate, and demonstrates what impact this has on our everyday lives.

Read More »

Read More »

La Banque Nationale Suisse – son action et son fonctionnement

Le film sur la Banque nationale suisse (BNS) donne un aperçu de l’institution et de la conduite de la politique monétaire. Il explique pourquoi la BNS a reçu le mandat d’assurer la stabilité des prix, comment elle remplit cette mission et quelles répercussions a son action sur notre quotidien.

Read More »

Read More »

La Banca Nazionale Svizzera – cosa fa e come opera

Il filmato sulla Banca nazionale svizzera si propone di presentare nelle linee essenziali la Banca nazionale e la sua politica monetaria. Vi si spiega perché essa ha il mandato di assicurare la stabilità dei prezzi, di quali strumenti dispone a tal fine e quali sono le conseguenze del suo operato sulla nostra vita quotidiana.

Read More »

Read More »

Die Schweizerische Nationalbank – was sie tut und wie sie handelt

Der SNB-Film gibt einen Einblick in die Nationalbank und ihre Geldpolitik. Er zeigt, weshalb die Nationalbank den Auftrag hat, die Preisstabilität zu gewährleisten, wie sie diesen Auftrag umsetzt und welche Auswirkungen dies auf unseren Alltag hat.

Read More »

Read More »

Negativzinsen: Unsere Schweiz als Versuchskaninchen

In der gestrigen Ausgabe der NZZ am Sonntag wird Nobelpreisträger Paul Krugman zitiert, wie er den Mindestkurs der SNB und deren Negativzinsen lobt. Die Negativzinsen seien ein „wertvolles Experiment“ meint er und „bedankt“ sich dafür sogar bei der SNB. „Die Schweiz eruiert neues Territorium. Aus akademischer Sicht liebe ich das.“

Read More »

Read More »

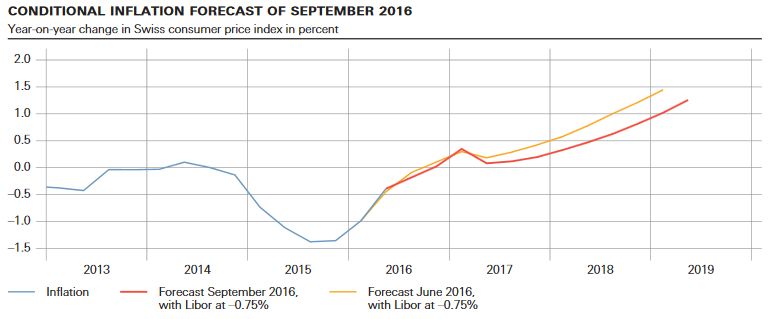

SNB Monetary policy assessment September 2016 and Comments

The SNB inflation forecast showed a strange diversion of conditional inflation forecasts: Draghi expected inflation to rebound to 1.2% next year and 1.6% in 2018.

The SNB, however, predicts 2017 inflation at 0.2% and 2018 at 0.6%. For us, one of the two is wrong.

Read More »

Read More »

Seven years of inaction on SNB rates day won’t end this week

Anyone feeling let down that the European Central Bank didn’t do much last week might just want to skip the Swiss rate decision on Thursday to avoid more disappointment. While the Swiss National Bank may be infamous for some seismic policy changes in the last few years, those bombshells weren’t dropped at scheduled meetings. In fact, the last time the institution altered interest rates at a decision in its public calendar was more than seven years...

Read More »

Read More »

Strong Swiss growth lessens chance SNB will act

Swiss real GDP growth data surprised on the upside in Q2, expanding by 0.6% q-o-q (and 2.5% q-o-q annualised). In addition, growth in the three previous quarters was revised significantly higher. As a result, our GDP growth forecast for growth in Switzerland rises mechanically from 0.9% to 1.5% for 2016.

Read More »

Read More »

Swiss trains the most expensive in Europe

A study by GoEuro, compares the cost of travelling 100km by train. Switzerland led the ranking with the most costly train trips in Europe. Travelling 100km in Switzerland cost CHF 52.

Read More »

Read More »

Swiss National Bank: Carl Menger Prize

Despite her incredible money printing and FX purchases, the SNB has many roots in the Austrian School of Economics, a school that maintains that money printing leads to price inflation. One of the major Austrian economists was Carl Menger.

Read More »

Read More »

Cash in a box catches on as Swiss negative rates bite

It’s a sign the world is getting used to negative interest rates when what once seemed bizarre starts looking like the norm. Consider Switzerland, where more and more companies are taking out insurance policies to protect their cash hoards from theft or damage.

Read More »

Read More »

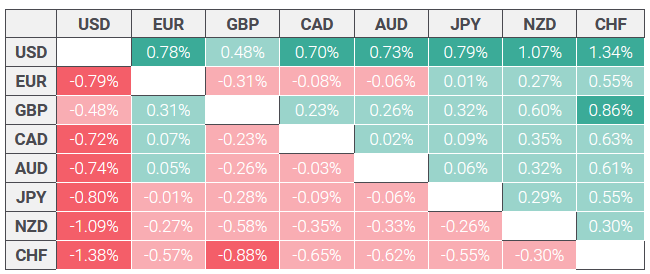

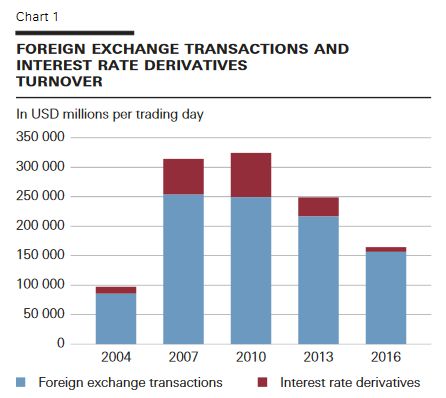

SNB Survey: 2016 Foreign Exchange Turnover

This press release presents the results for a Swiss National Bank (SNB) survey on turnover in foreign exchange and derivatives markets. The request for data was sent to 30 banks that operate in Switzerland and have a sizeable share in the foreign exchange and over-the-counter (OTC) derivatives markets. These banks reported the turnover of their domestic offices.

Read More »

Read More »

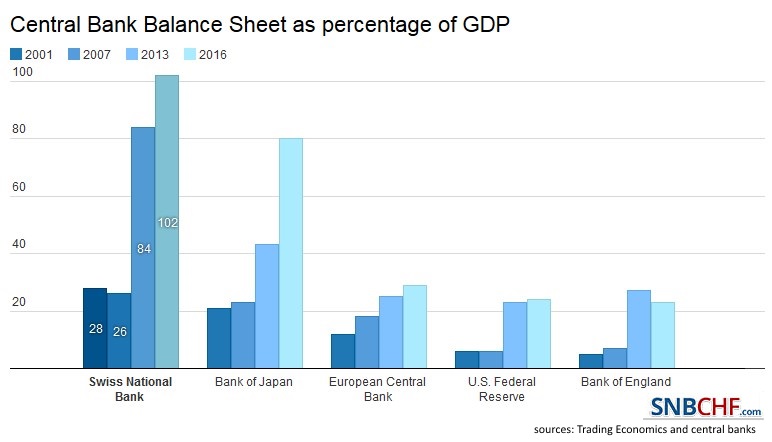

SNB Balance Sheet Now Over 100 percent GDP

Since 2008 the balance sheet of the Swiss National Bank has risen from 28% to 102% of Swiss GDP. Balance sheets of other central banks have strongly risen, too. But there is one big difference: The risk for the SNB is far higher, the SNB nearly exclusively possesses assets denominated in volatile foreign currency.

Read More »

Read More »

Wir wollen nicht in die EU. Stoppt diese SNB!

Politischen Druck auf die SNB hält Wirtschaftsprofessor Aymo Brunetti für „fatal in einer derart schwierigen Situation“. Dabei macht die SNB Politik, sie führt die Schweiz in den Euro.

Read More »

Read More »

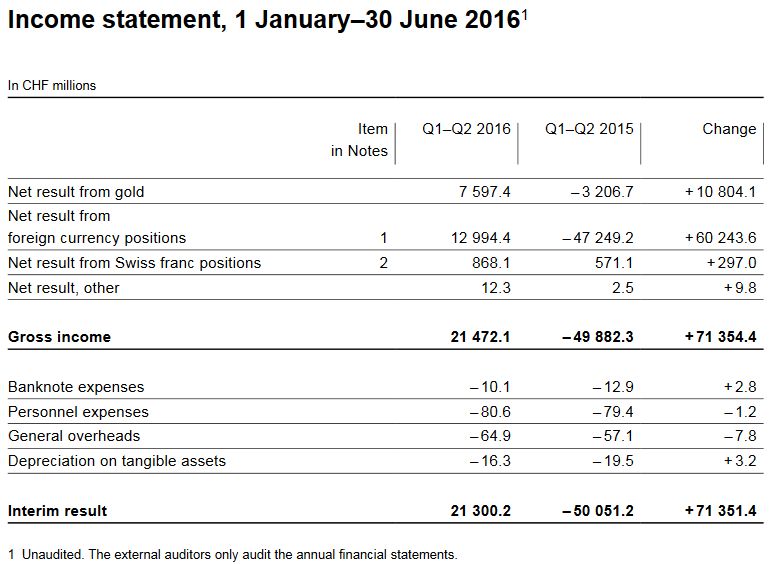

Interim results of the Swiss National Bank as at 30 June 2016

The Swiss National Bank (SNB) reports a profit of CHF 21.3 billion for the first half of 2016. A valuation gain of CHF 7.6 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 13.0 billion.

Read More »

Read More »

-638453232816314704.png)