Category Archive: 1) SNB and CHF

Immobilien – Remax-Schweiz-Chef Jöhl : «Die Zinserhöhung wird den Markt für privates Wohneigentum nicht in Schieflage bringen»

Wie werden sich die Preise für Schweizer Wohneigentum entwickeln, nachdem die Schweizerische Nationalbank (SNB) am Donnerstag die Zinsen erhöhte?

Read More »

Read More »

Personalbestand in der Bankbranche nimmt weiter zu

Die Zahl der bei Banken in der Schweiz beschäftigten Mitarbeitenden stieg im vergangenen Jahr gemäss der Bankenstatistik der SNB um 0,7 Prozent auf 90'577. Trotz anspruchsvollem Umfeld und der Pandemie-Situation ist das zum zweiten Mal in Folge ein leichter Anstieg.

Read More »

Read More »

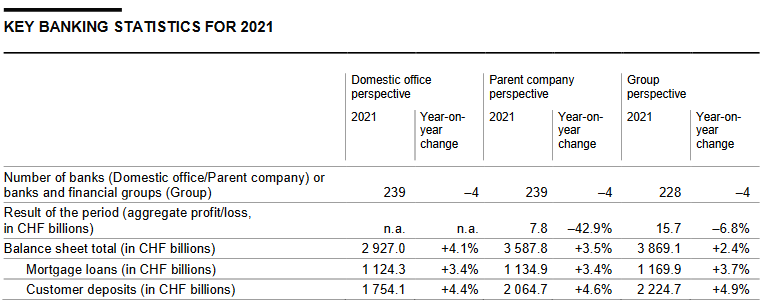

Annual banking statistics for 2021

The Swiss National Bank has today published data on the annual financial statements of banks in Switzerland for the 2021 financial year. For the first time, the published data also comprises bank office data (Domestic office perspective) in addition to the data from individual financial statements (Parent company perspective) and consolidated financial statements (Group perspective).

Read More »

Read More »

Fritz Zurbrügg: Introductory remarks, news conference

In my remarks today, I will present the key findings from the new Financial Stability Report, published this morning by the Swiss National Bank.

Read More »

Read More »

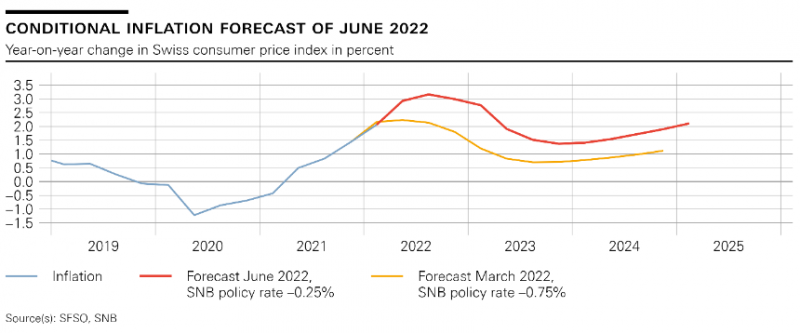

Тhomas Jordan: Introductory remarks, news conference

It is my pleasure to welcome you to the Swiss National Bank’s news conference. In my remarks, I will begin by explaining our monetary policy decision and our assessment of the

economic situation. After that, Fritz Zurbrügg will present the key messages from this year’s Financial Stability Report. Andréa Maechler will then comment on the situation on the

financial markets and the implementation of monetary policy. We will – as ever – be pleased to...

Read More »

Read More »

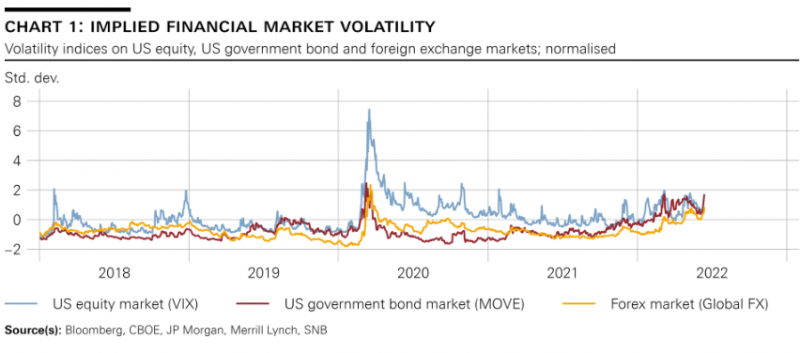

Monetary Assessment Meeting, Introduction

I will begin my remarks with a review of developments on the financial markets over the past half-year. I would then like to discuss the lowering of the threshold factor mentioned by Thomas Jordan.

Read More »

Read More »

Aktien Schweiz Schluss – SMI fällt auf tiefsten Stand seit März 2021

Am Schweizer Aktienmarkt ist es auch am Dienstag weiter abwärts gegangen. Die Angst vor einem Abgleiten der Weltwirtschaft in eine Rezession hatte die Anleger fest im Griff. Niedriger war das Barometer der 20 grössten börsennotierten Unternehmen letztmals im März vergangenen Jahres. Weiterhin litten die Börsen unter einem "Cocktail aus Inflation, steigenden Zinsen und daraus resultierender Rezessionsangst", so ein Marktanalyst.

Read More »

Read More »

Warum ist der Schweizer Franken so stark?

Nehmen Sie an unserer kostenlosen wöchentlichen online Kaffeepause und Aktiendiskussion teil: https://www.eventbrite.ch/e/kaffeepause-okonomie-und-philosophie-tickets-149113349041?aff=video

Was hinter der Stärke des Schweizer Frankens steckt - Dr. Hermann Stern erklärt es in einem unserer Online Kaffeepause Aktien Gespräche.

Datum: 10. Februar 2022

Read More »

Read More »

SNB’s Jordan: Inflation will temporarily rise above target then fall quickly

We take into account the higher inflation rates abroad when deciding monetary policy. We are ready to intervene in FX when necessary. Negative rates and currency interventions necessary for SNB to meet its mandate.

Read More »

Read More »

Swiss central bank rejects ‘creative’ demands to change course

The Swiss National Bank (SNB) continues to beat off demands to fight inflation by raising interest rates and to distribute more reserves to cantons and other causes.

Read More »

Read More »

Martin Schlegel wird neuer SNB-Vizepräsident

Schlegel (Jahrgang 1976) wird laut Mitteilung vom Mittwoch per Anfang August die Leitung des II. Departements der SNB übernehmen. Der neue Vize-Chef ist ein SNB-Urgestein. Er ist seit knapp zwanzig Jahren in verschiedenen leitenden Positionen für die SNB tätig, zuletzt seit September 2018 als stellvertretendes Mitglied des Direktoriums im I. Departement.

Read More »

Read More »

Martin Schlegel appointed to SNB

Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do not invest money that you cannot afford to lose.

Read More »

Read More »

SNB Governing Board: Federal Council appoints Martin Schlegel as Vice Chairman of the Governing Board

Petra Gerlach and Attilio Zanetti become Alternate Members of the Governing Board. At its meeting of 4 May 2022, the Federal Council appointed Martin Schlegel as Vice Chairman of the Governing Board of the Swiss National Bank with effect from 1 August 2022. He will succeed Fritz Zurbrügg on the Governing Board when the latter steps down at the end of July 2022.

Read More »

Read More »

Aktien – Wie «Amateure» sich an der Börse selber helfen können

Credit Suisse und UBS liefern uns ein schönes Lehrstück. Die UBS verspekulierte sich in den USA derart, dass die Schweizerische Nationalbank deren faule Kredite in der Finanzkrise von 2008 übernehmen und somit die Grossbank vor dem Kollaps retten musste. Derweil vermochte die Credit Suisse die Verluste selber zu stemmen und erhielt dafür Anerkennung.

Read More »

Read More »

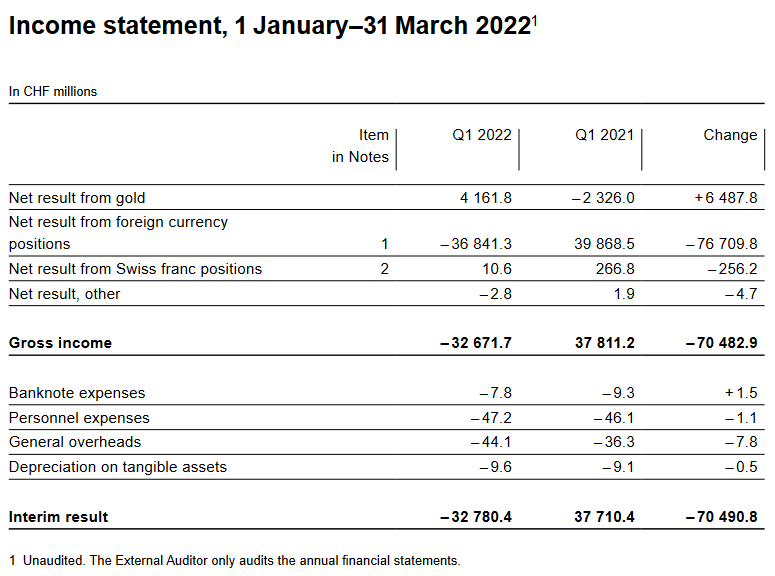

Interim results of the Swiss National Bank as at 31 March 2022

The Swiss National Bank reports a loss of CHF 32.8 billion for the first quarter of 2022. The loss on foreign currency positions amounted to CHF 36.8 billion. A valuation gain of CHF 4.2 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 10.6 million.

Read More »

Read More »

Macro Week 2022: Thomas Jordan

At this critical juncture for the global economy and monetary policy, the Peterson Institute for International Economics is convening central bankers and finance officials from around the world for our annual Macro Week—a series of speeches and onstage discussions moderated by PIIE President Adam S. Posen.

Thomas Jordan (Chairman, Swiss National Bank) speaks on April 19, 2022.

For more information, visit:...

Read More »

Read More »

What are the consequences of the war in Ukraine for the SNB’s monetary policy?

Russia's attack on Ukraine has fundamentally changed the geopolitical situation. However, it also has far-reaching economic consequences and poses the question as to whether the integration of the global economy will decrease again.

Read More »

Read More »

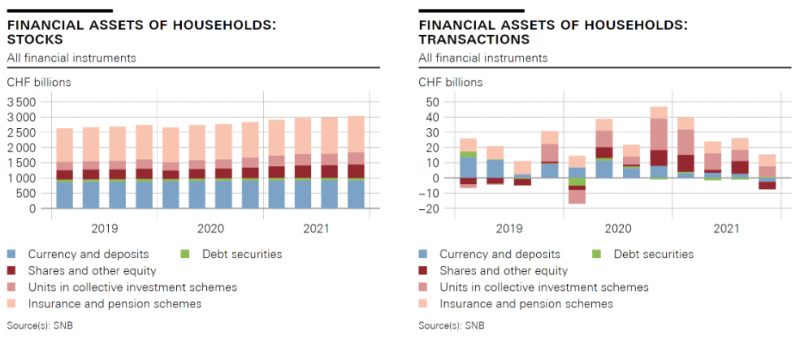

Swiss Financial Accounts: Household wealth in 2021

The Swiss National Bank is today publishing financial accounts data for Q4 2021. Data on household wealth are thus available for the whole of 2021; a commentary is provided below. This is followed by a detailed look at the development of the financial net worth of the Swiss economy’s institutional sectors since the onset of the coronavirus pandemic.

Read More »

Read More »

Geldcast update: calls for a more transparent Swiss National Bank

The Swiss National Bank (SNB) is very opaque by international standards. That has to change, says Yvan Lengwiler, professor of economics at the University of Basel. He explains his proposals in the latest Geldcast update.

Read More »

Read More »

-638453232816314704.png)