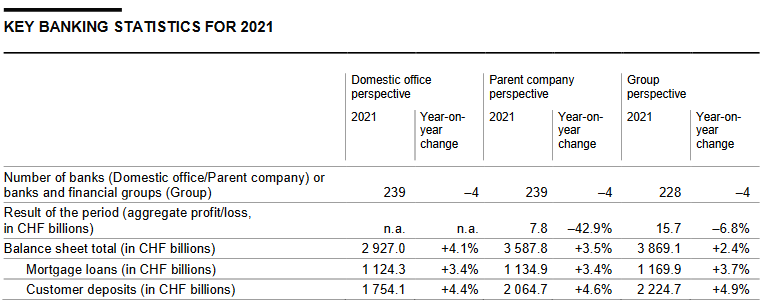

| The Swiss National Bank has today published data on the annual financial statements of banks in Switzerland for the 2021 financial year. For the first time, the published data also comprises bank office data (Domestic office perspective) in addition to the data from individual financial statements (Parent company perspective) and consolidated financial statements (Group perspective).

The Domestic office perspective shows data on the business of banks including their branches in Switzerland (cf. Explanatory video ‘Perspectives on banking statistics’). These data are particularly relevant in the context of the national accounts. For example, the SNB uses the data when compiling the balance of payments and the Swiss financial accounts. |

Further information

– Data (tables and charts), details on the methodological basis and notes as well as information on changes and revisions can be found on the SNB’s data portal at data.snb.ch.

– The list of banks and highest group entities in Switzerland contains information on banks in Switzerland including their bank category and highest domestic group entity.

Full story here Are you the author? Previous post See more for Next post

Tags: Featured,newsletter