Category Archive: 1.) SNB Press Releases

2024-04-09 – Martin Schlegel: Interest rates and foreign exchange interventions: Achieving price stability in challenging times

For decades, the exchange rate has played a key role for the Swiss economy and for the Swiss National Bank's monetary policy.

Read More »

Read More »

2023-11-09 – Thomas Moser: Implementing monetary policy with positive interest rates and a large balance sheet: First experiences

In September 2022, the Swiss National Bank (SNB) raised its policy rate back into positive territory. At the same time, it adopted a new approach to implementing monetary policy in the money market. This approach employs two levers: the tiered remuneration of reserves, also referred to as reserve tiering, and reserve absorption.

Read More »

Read More »

2023-11-09 – Martin Schlegel: A pillar of financial stability – The SNB’s role as lender of last resort

As part of its contribution to the stability of the financial system, the Swiss National Bank acts as lender of last resort. In this role, it makes emergency liquidity assistance available to banks when, in crisis situations, they need substantial liquid funds which they are no longer able to obtain on the market.

Read More »

Read More »

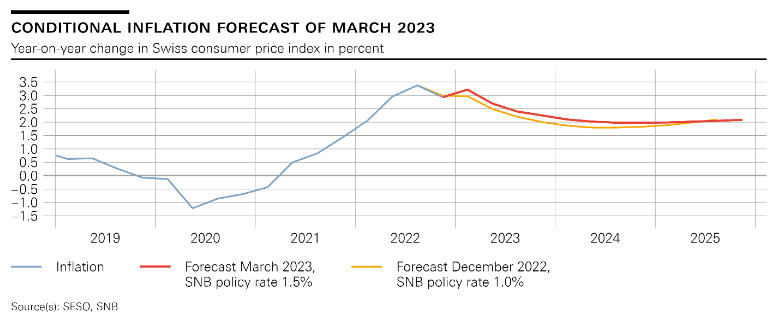

2023-03-23 – Monetary policy assessment of 23 March 2023

The SNB is tightening its monetary policy further and is raising the SNB policy rate by 0.5 percentage points to 1.5%. In doing so, it is countering the renewed increase in inflationary pressure. It cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term. To provide appropriate monetary conditions, the SNB also remains willing to be active in the foreign exchange market as...

Read More »

Read More »

Swiss National Bank provides substantial liquidity assistance to support UBS takeover of Credit Suisse

UBS today announced the takeover of Credit Suisse. This takeover was made possible with the support of the Swiss federal government, the Swiss Financial Market Supervisory Authority FINMA and the Swiss National Bank.

Read More »

Read More »

2023-02-16 – Markus K. Brunnermeier to hold the 2023 Karl Brunner Distinguished Lecture

The Swiss National Bank has named Markus K. Brunnermeier as the next speaker for its Karl Brunner Distinguished Lecture Series. Markus K. Brunnermeier is Professor of Economics at Princeton University and also Director of the Bendheim Center for Finance. His research focuses on the interaction between financial markets and the macroeconomy.

Read More »

Read More »

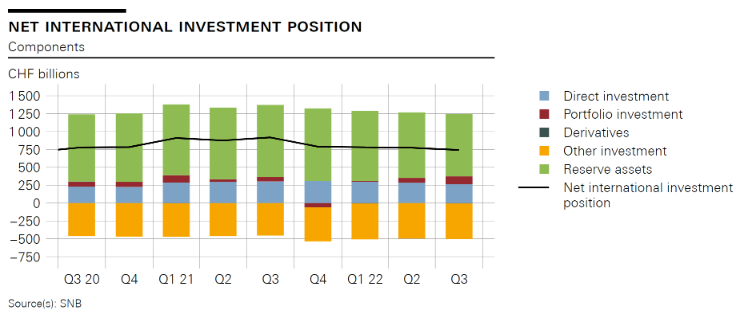

Swiss balance of payments and international investment position: Q3 2022

In the third quarter of 2022, the current account surplus amounted to CHF 24 billion – a very high figure from a long-term perspective. This was attributable to the high surplus in goods trade and the relatively low deficits in services trade and in primary income. Compared to the same quarter of 2021, however, the increase in the current account balance (CHF 2 billion) was moderate because the basis for comparison was also high.

Read More »

Read More »

Thomas Jordan: Introductory remarks, news conference

Ladies and gentlemen

It is my pleasure to welcome you to the news conference of the Swiss National Bank. I would also like to welcome all those who are joining us today online. After our introductory remarks, the members of the Governing Board will take questions from journalists as usual.

Read More »

Read More »

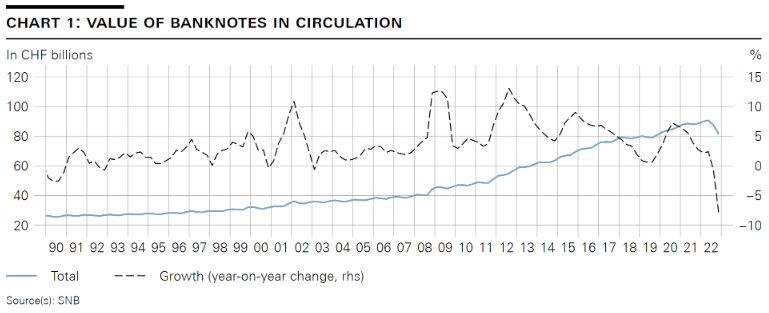

Martin Schlegel: Introductory remarks, news conference

I am pleased to give you an assessment of current developments with regard to cash. Since June, after many years of strong growth, we have seen a significant decline in banknote circulation. To contextualise this decline of approximately 10%, let me first say a few words about the above-average growth in recent years.

Read More »

Read More »

Andréa M. Maechler: Introductory remarks, news conference

In my remarks, I will talk in more detail about the implementation of today’s monetary policy decision, which Thomas Jordan has already touched on. I will start, however, by giving you an overview of how we have steered interest rates since the switch to a positive SNB policy rate in September.

Read More »

Read More »

Issuance calendar for Confederation bonds and money market debt register claims in 2023

The Swiss National Bank (SNB) and the Federal Finance Administration (FFA) advise as follows: The FFA plans to issue bonds with a face value of CHF 8 billion in 2023. Taking account of bonds maturing in 2023, the volume of bonds outstanding will increase by CHF 3.4 billion.

Read More »

Read More »

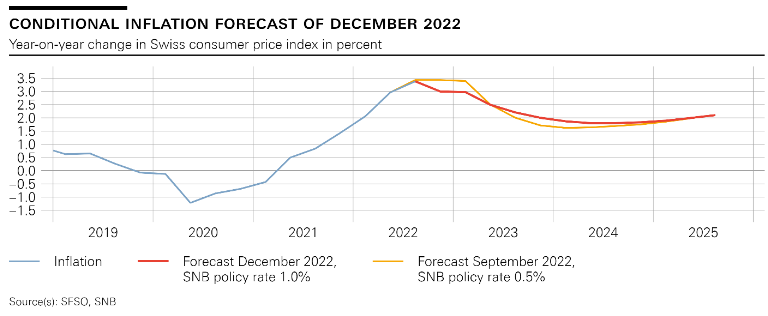

Andréa M. Maechler / Thomas Moser: Return to positive interest rates: Why reserve tiering?

It is with great pleasure that my colleague Thomas Moser and I welcome you to this year’s Swiss National Bank (SNB) Money Market Event in Geneva. We are very glad that so many of you have joined us this evening, be it on site or remotely.

Read More »

Read More »

Thomas Jordan: Decision-making under uncertainty: The importance of pragmatism, consistency and determination

It is my pleasure to welcome you to this high-level conference on global risk, uncertainty and volatility. Thank you all for accepting our invitation to join the discussions. I am very pleased to see such a distinguished group of central bank officials and academics. I would like to thank our colleagues at the Bank for International Settlements and the Federal Reserve Board for working together with us in organising this event.

Read More »

Read More »

Swiss National Bank, Banque de France, Monetary Authority of Singapore and BIS Innovation Hub to explore cross-border trading and settlement of wholesale CBDCs using DeFi protocols

Project Mariana explores automated market makers (AMM) for the cross-border exchange of hypothetical central bank digital currencies (CBDCs) in Swiss francs, euros and Singapore dollars between financial institutions to settle foreign exchange trades in financial markets.

Read More »

Read More »

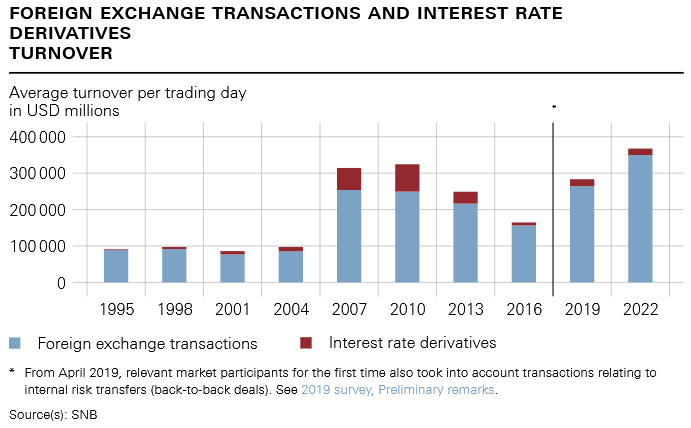

Turnover in foreign exchange and derivatives markets in Switzerland

The SNB has today published the results of the survey on turnover in foreign exchange and over-the-counter (OTC) derivatives markets in Switzerland. The data reflect the turnover in April 2022 of the banks surveyed.

Read More »

Read More »

Thomas Jordan: Current challenges to central banks’ independence

In the recent past, the political and economic backdrop has changed dramatically. Inflation is far too high almost everywhere, and central banks are raising their policy interest rates at a time when stocks of government debt are large. In some places, central bank independence is being publicly called into question.

Read More »

Read More »