Category Archive: 1.) SNB Press Releases

Andréa M. Maechler / Thomas Moser: Life after Libor: A new era of reference interest rates

A new era of reference interest rates began at the start of this year. Libor, which had been the key reference rate for several decades and several currencies, including the Swiss franc, ceased to exist in many currencies at the end of 2021. SARON has now fully replaced Swiss franc Libor.

Read More »

Read More »

Fritz Zurbrügg: Macroprudential policy beyond the pandemic: Taking stock and looking ahead

In the aftermath of the Global Financial Crisis (GFC), national regulators and international institutions joined forces to build the foundations of our current macroprudential frameworks. These comprise policies aimed at containing the build-up of vulnerabilities to which the banking sector is exposed, and at strengthening banking sector resilience.

Read More »

Read More »

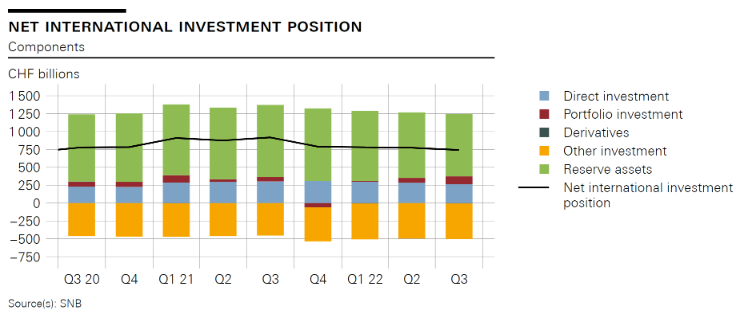

Swiss balance of payments and international investment position: 2021 and Q4 2021

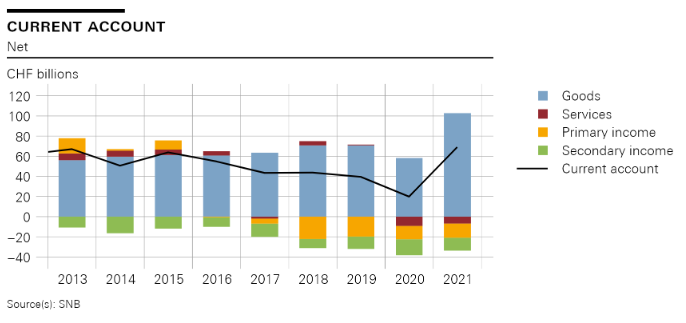

The current account surplus in 2021 was CHF 69 billion, up CHF 49 billion on the previous year, which was heavily influenced by the coronavirus pandemic. The increase in the current account surplus was almost entirely due to the higher receipts surplus in goods trade (up CHF 45 billion). Here a significantly higher receipts surplus was recorded in both traditional goods trade (foreign trade total 1) and merchanting than in the previous year....

Read More »

Read More »

„Jetzt hilft uns, dass Thomas Jordan ein Falke ist“

Der SNB-Chef wurde wegen seiner harten Anti-Inflations-Haltung gescholten, sagt Fabio Canetg, Journalist mit "Geldcast"-Sendung. Nun profitiere die Schweiz davon, weil hier die Preise mit plus 2 Prozent im Vergleich zum Euro-Raum und den USA moderat stiegen. Das wiederum ziehe Vermögen aus dem Ausland an, was den Franken stärke und die Inflation zusätzlich dämpfe.

Read More »

Read More »

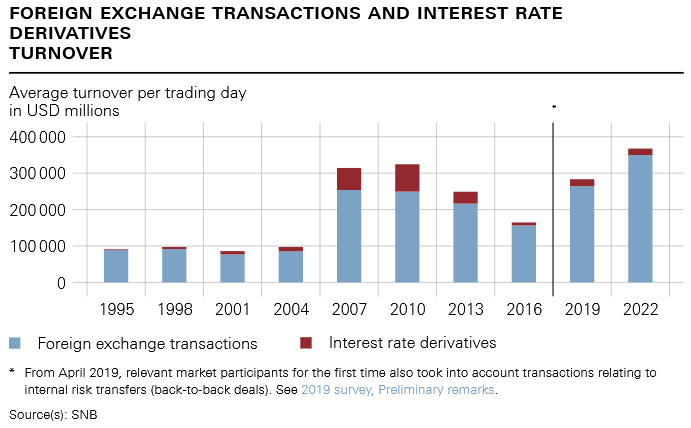

Swiss National Bank renews its commitment to adhere to the FX Global Code

The Swiss National Bank (SNB) has renewed the Statement of Commitment to the FX Global Code based on the revised version of the Code dated July 2021. By signing this Statement, the SNB attests that its internal processes are consistent with the principles of the FX Global Code. The SNB also expects its regular counterparties to comply with the agreed rules of conduct.

Read More »

Read More »

Swiss National Bank proposes reactivation of sectoral countercyclical capital buffer at 2.5%

After consultation with the Swiss Financial Market Supervisory Authority (FINMA), the Swiss National Bank has submitted a proposal to the Federal Council requesting that the sectoral countercyclical capital buffer (CCyB) be reactivated. The buffer is to be set at 2.5% of risk-weighted exposures secured by residential property in Switzerland (cf. appendix).

Read More »

Read More »

BIS, SNB and SIX successfully test integration of wholesale CBDC settlement with commercial banks

Project Helvetia looks toward a future with more tokenised financial assets based on distributed ledger technology coexisting with today’s systems.

Read More »

Read More »

Swiss National Bank expects annual profit of around CHF 26 billion for 2021

According to provisional calculations, the Swiss National Bank will report a profit in the order of around CHF 26 billion for the 2021 financial year. The profit on foreign currency positions amounted to just under CHF 26 billion. A valuation loss of CHF 0.1 billion was recorded on gold holdings. The net result on Swiss franc positions amounted to over CHF 1 billion.

Read More »

Read More »

Swiss balance of payments and international investment position: Q3 2021

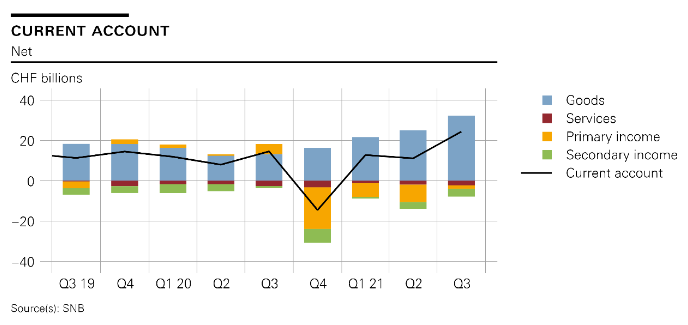

In the third quarter of 2021, the current account surplus amounted to CHF 24 billion, CHF 10 billion more than in the same quarter of 2020. The increase was mainly attributable to the significantly higher receipts surplus in goods trade. This surplus was due to traditional goods trade (foreign trade total 1), non-monetary gold trading, as well as to merchanting.

Read More »

Read More »

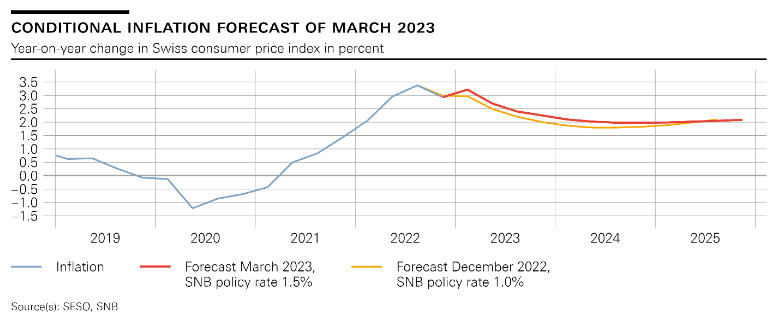

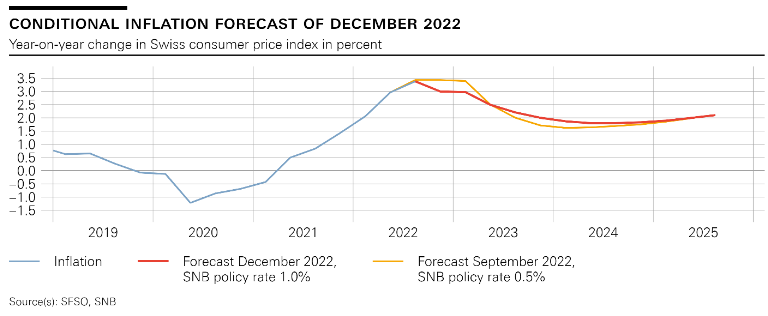

Monetary policy assessment of 16 December 2021: Swiss National Bank maintains expansionary monetary policy

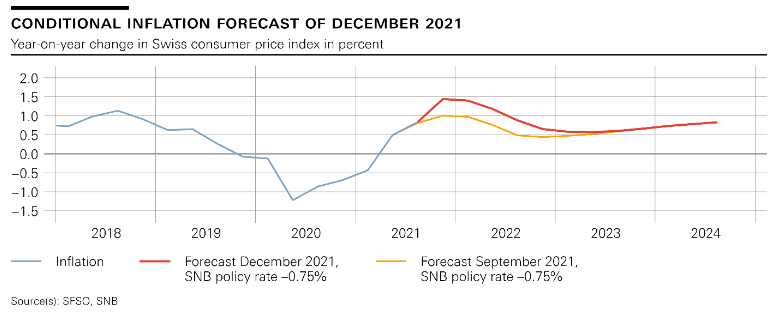

The SNB is maintaining its expansionary monetary policy. It is thus ensuring price stability and supporting the Swiss economy in its recovery from the impact of the coronavirus pandemic. It is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%, and remains willing to intervene in the foreign exchange market as necessary, in order to counter upward pressure on the Swiss franc.

Read More »

Read More »

Swiss National Bank, Banque de France and BIS conclude successful cross-border wholesale CBDC experiment

Central bank digital currencies (CBDCs) can be used effectively for international settlements between financial institutions, as shown in the newest wholesale CBDC experiment concluded by the Swiss National Bank (SNB), the Banque de France (BdF) and the Bank for International Settlements (BIS).

Read More »

Read More »

Interim results of the Swiss National Bank as at 30 September 2021

The Swiss National Bank reports a profit of CHF 41.4 billion for the first three quarters of 2021. The profit on foreign currency positions amounted to CHF 42.2 billion. A valuation loss of CHF 1.3 billion was recorded on gold holdings. The profit on Swiss franc positions amountedto CHF 0.8 billion.

Read More »

Read More »

Swiss balance of payments and international investment position: Q2 2021

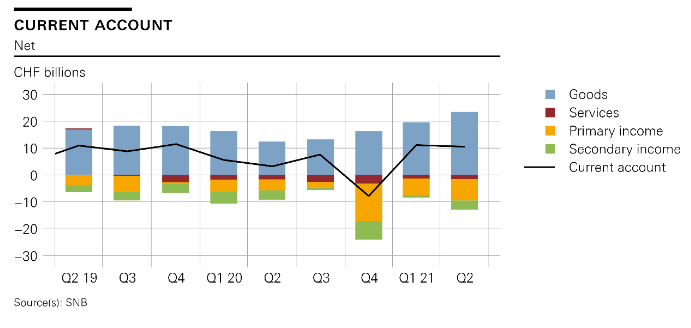

In the second quarter of 2021, the current account surplus amounted to almost CHF 11 billion, CHF 7 billion higher than in the same quarter of 2020. The rise was mainly attributable to a higher receipts surplus in goods trade.

Read More »

Read More »

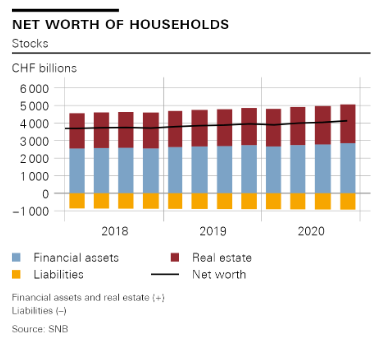

Swiss Financial Accounts: Household wealth in 2020 and focus article

Financial and real estate wealth of households increases. The Swiss National Bank is today publishing data on Q4 2020 as part of the financial accounts. Thus, household wealth data are now also available for the full year.

Read More »

Read More »

Astrid Frey appointed new SNB delegate for regional economic relations for Central Switzerland

With effect from 1 May 2021, Astrid Frey will take on the function of Swiss National Bank delegate for regional economic relations for the Central Switzerland region. She succeedsGregor Bäurle, who assumed the posit ion of Head of the SNB’s Regional Economic Relations unit on 1 January 2021.

Read More »

Read More »

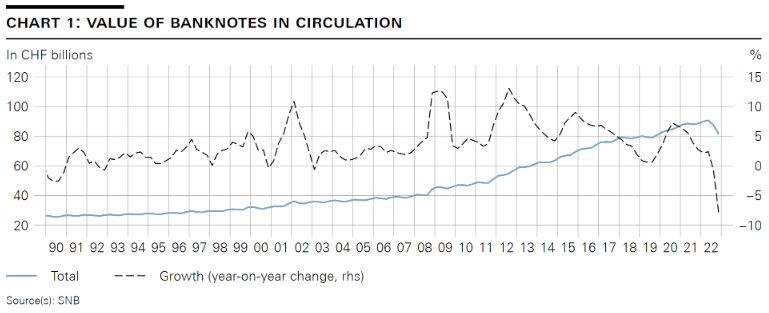

Recall of banknotes from eighth series

The Swiss National Bank is recalling its eighth-series banknotes as of 30 April 2021. From this date on, the banknotes from the eighth series lose their status as legal tender and can no longer be used for payment purposes.

Read More »

Read More »

2021-04-23 – U.S. dollar liquidity-providing operations from 1 July 2021

In view of the sustained improvements in U.S. dollar funding conditions and low demand at recent U.S. dollar liquidity-providing operations, the Bank of England, the Bank of Japan, the European Central Bank and the Swiss National Bank, in consultation with the Federal Reserve, have jointly decided to discontinue offering dollar liquidity at the 84-day maturity.

Read More »

Read More »

COVID-19, financial markets and digital transformation

In many ways, the coronavirus (COVID-19) pandemic is unprecedented. The economic shock has been global and massive, affecting both economic supply and demand simultaneously. To mitigate the economic impact, the crisis response has had to be swift and innovative - including in Switzerland.

Read More »

Read More »

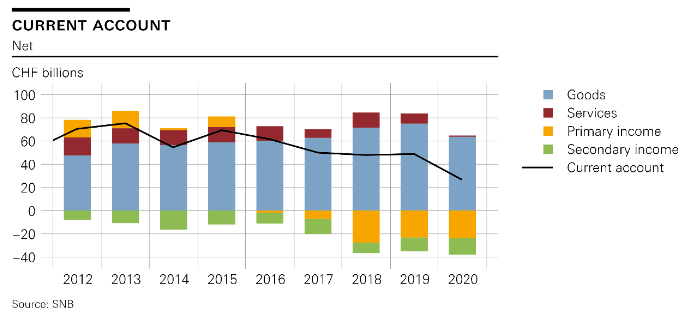

Swiss balance of payments and international investment position: 2020 and Q4 2020

The current account surplus in 2020 was CHF 27 billion, down CHF 22 billion on the previous year. This decline was particularly due to the lower receipts surpluses in trade in goods and services. In the case of goods, the decline in receipts – with expenses remaining unchanged – caused the balance to decrease by CHF 11 billion to CHF 64 billion.

Read More »

Read More »

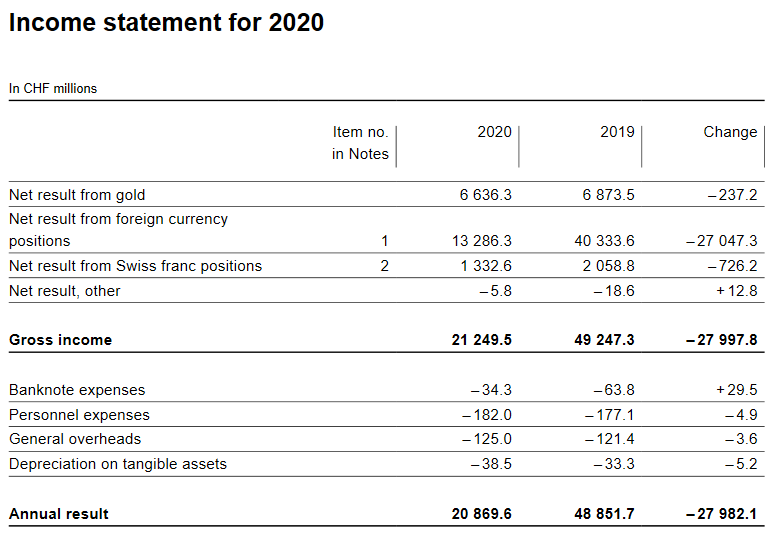

The Swiss National Bank reports a profit of CHF 20.9 billion for 2020 (2019: CHF 48.9 billion).

The Swiss National Bank reports a profit of CHF 20.9 billion for 2020 (2019: CHF 48.9 billion). The profit on foreign currency positions amounted to CHF 13.3 billion. A valuation gain of CHF 6.6 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.3 billion.

Read More »

Read More »