Key developments in 2021

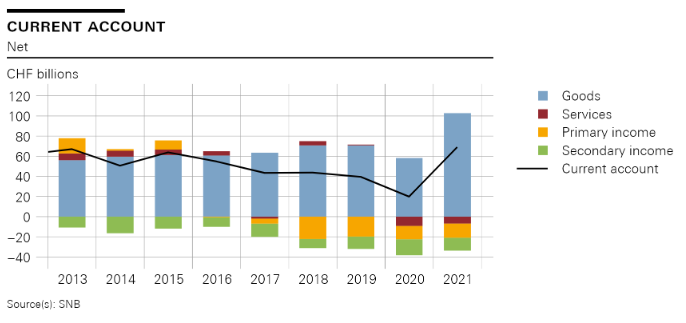

The current account surplus in 2021 was CHF 69 billion, up CHF 49 billion on the previous year, which was heavily influenced by the coronavirus pandemic. The increase in the current account surplus was almost entirely due to the higher receipts surplus in goods trade (up CHF 45 billion). Here a significantly higher receipts surplus was recorded in both traditional goods trade (foreign trade total 1) and merchanting than in the previous year. Furthermore, there was a reduction in the expenses surplus in non-monetary gold trading. |

Current Account 2013-2021 |

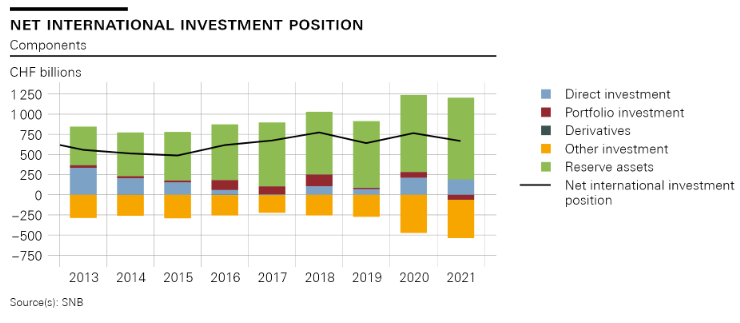

| In the financial account, reported transactions for 2021 showed a net acquisition of financial assets (CHF 119 billion) and a net incurrence of liabilities (CHF 92 billion). On the assets side, three components in particular contributed to the net acquisition: first, the SNB conducted foreign currency purchases, which was reflected in a net acquisition under reserve assets; second, resident commercial banks increased their claims on non-resident banks (interbank business), leading to a net acquisition under other investment; and finally, resident investors acquired more equity securities and debt securities issued by non-residents than they sold (portfolio investment). On the liabilities side, the net incurrence was largely attributable to other investment, with the liabilities of resident commercial banks towards non-resident customers predominating. Including derivatives, the financial account balance totalled CHF 28 billion. In 2021, the net international investment position decreased by CHF 98 billion to CHF 667 billion year-on-year, as liabilities increased more strongly than assets; stocks of assets were up by CHF 317 billion to CHF 5,594 billion, while stocks of liabilities increased by CHF 415 billion to CHF 4,927 billion. The rise in stocks on both the assets and the liabilities side was based on very substantial price-related valuation gains due to higher stock market prices in Switzerland and abroad. These valuation gains were bigger on the liabilities side, as this contains larger holdings of listed shares. Price effects dominated all other factors, including the transactions recorded in the financial account. |

Net international investment position, 2013-2021 |

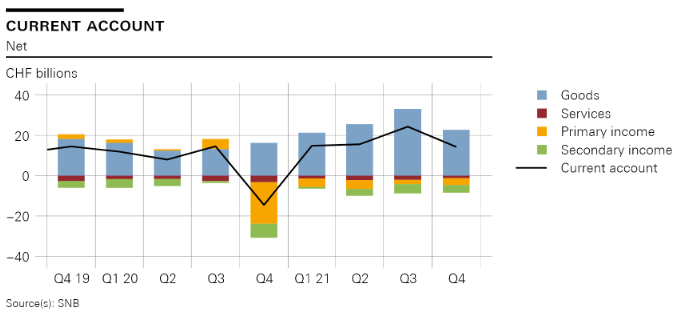

Key developments in Q4 2021In Q4 2021, the current account surplus was CHF 14 billion. The current account balance was higher than in Q4 2020, with all components contributing to the increase. When comparing with the same quarter a year ago, it should be noted that the current account balance in Q4 2020 was exceptionally low (CHF –15 billion). This was due to companies’ unusually low receipts from their participating interests abroad (primary income). In the financial account, reported transactions for Q4 2021 showed a net acquisition of financial assets (CHF 41 billion) and a net incurrence of liabilities (CHF 37 billion). The SNB’s foreign currency purchases (reserve assets) contributed to the net acquisition of financial assets, as did other investment where resident commercial banks increased their claims on non-residents. On the liabilities side, the net incurrence was attributable to other investment: the SNB, commercial banks and finance companies increased their liabilities towards non-residents. The financial account balance totalled CHF 4 billion. |

Current Account Q4 2019-Q4 2021 |

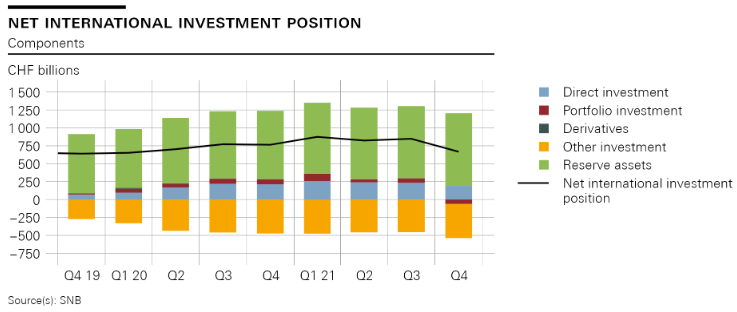

| In Q4 2021, the international investment position declined by CHF 182 billion to CHF 667 billion quarter-on-quarter, due to a decrease in financial assets and an increase in liabilities. The different effects of exchange rate and price changes on financial assets and liabilities, which are due to their differing structure in terms of currencies and financial instruments, played a critical role here. Financial assets declined by CHF 54 billion to CHF 5,594 billion. Since they contain a large share of foreign currencies, they recorded high exchange rate-related valuation losses as a result of the weaker US dollar and the weaker euro. This was counteracted by transactions and price-related valuation gains. Liabilities on the other hand increased by CHF 128 billion to CHF 4,927 billion. These contain a large proportion of listed shares and recorded high price-related valuation gains due to the strong rise in prices on the Swiss stock exchange at the end of Q4 2021. Financial account transactions also contributed to the rise in stocks. As only a small proportion of the liabilities is held in foreign currencies, exchange rate effects did not play a major role on the liabilities side. |

Net international investment position, Q4 2019-Q4 2021 |

New datasets on international economic affairs

The SNB is expanding the range of data it provides on its data portal. With these new datasets, the SNB is increasing the number of published time series on international economic affairs from around 4,500 to 69,000. The supplementary time series include, in particular, information on countries and country groups under other investment (interbank business) and direct investment. More information is available here.

Further information

Comprehensive charts and tables covering Switzerland’s balance of payments and international investment position can be found on the SNB’s data portal.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter