The SNB is maintaining its expansionary monetary policy. It is thus ensuring price stability and supporting the Swiss economy in its recovery from the impact of the coronavirus pandemic. It is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%, and remains willing to intervene in the foreign exchange market as necessary, in order to counter upward pressure on the Swiss franc. In so doing, it takes the overall currency situation into consideration. The Swiss franc remains highly valued.

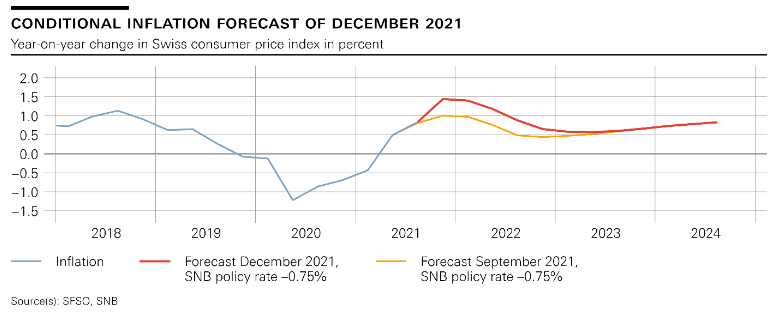

The SNB’s new conditional inflation forecast for 2021 and 2022 is slightly above that of September (cf. chart 1). This is primarily due to higher import prices, above all for oil products and for goods affected by global supply bottlenecks. In the longer term, the inflation forecast is virtually unchanged compared with September. The new forecast stands at 0.6% for 2021, 1.0% for 2022, and 0.6% for 2023 (cf. table 1). The conditional inflation forecast is based on the assumption that the SNB policy rate remains at − 0.75% over the entire forecast horizon.

| The coronavirus pandemic is continuing to shape the global economic situation. The economic recovery worldwide weakened somewhat in the third quarter due to waves of infection in certain areas and supply bottlenecks in various industries in the manufacturing sector. At the same time, inflation was unusually high in both the US and the euro area. In addition to supply chain problems, higher energy prices also played an important role in this respect.

In its baseline scenario for the global economy, the SNB assumes that extensive containment measures will not have to be introduced again, this despite the adverse developments regarding the pandemic at present. The economic recovery should thus continue, albeit somewhat subdued. Supply bottlenecks are likely to persist for some time yet, leading to price increases for the goods concerned. This situation is likely to ease over the medium term, however, with inflation abroad dropping back to more moderate levels. |

In Switzerland, the economic recovery has continued. There was a further robust increase in gross domestic product (GDP) in the third quarter, thus lifting it above its pre-crisis level for the first time. The situation on the labour market also continued to improve. GDP is likely to grow by around 3.5% this year. This is slightly stronger than the SNB had expected in September, the reason being that activity in certain service industries – such as hospitality – was more dynamic than was assumed at that time. That said, the economy has lost momentum again somewhat of late.

In its baseline scenario for Switzerland, the SNB anticipates a continuation of the economic recovery next year. This is based on the assumption that no measures will have to be introduced that would additionally impair economic activity. Against this backdrop, the SNB expects GDP growth of around 3% for 2022. Unemployment is likely to decline again somewhat, and the utilisation of production capacity should continue to return to normal. The recent worsening of the pandemic situation has again increased the uncertainty with regard to the forecasts, both for Switzerland and abroad. Economic developments over the coming quarters will hinge on which additional containment measures are taken in the countries affected.

Mortgage lending and residential property prices have risen strongly in recent quarters. Overall, the vulnerability of the mortgage and real estate markets has increased further. The SNB regularly reassesses the need for the countercyclical capital buffer to be reactivated. More detailed information on the monetary policy decision can be found in Thomas Jordan’s introductory remarks, available from 10 am. Fritz Zurbrügg’s remarks focus on developments in the area of financial stability, while Andréa Maechler’s remarks address the situation on the financial markets.

Full story here Are you the author? Previous post See more for Next post

Tags: Featured,newsletter