Category Archive: 1) SNB and CHF

SNB introduces possibility of repo rate transactions being indexed to policy rate

This will be added to the SNB's monetary policy repertoire moving forward but not before some test operations are conducted. For the time being, the central bank implements monetary policy by setting the SNB policy rate so this just adds to the tools they can play around with. However, I still see the key policy rate as being the main weapon in the armory.

Read More »

Read More »

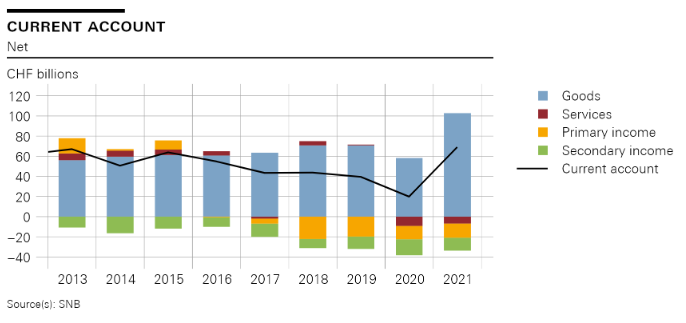

Swiss balance of payments and international investment position: 2021 and Q4 2021

The current account surplus in 2021 was CHF 69 billion, up CHF 49 billion on the previous year, which was heavily influenced by the coronavirus pandemic. The increase in the current account surplus was almost entirely due to the higher receipts surplus in goods trade (up CHF 45 billion). Here a significantly higher receipts surplus was recorded in both traditional goods trade (foreign trade total 1) and merchanting than in the previous year....

Read More »

Read More »

„Jetzt hilft uns, dass Thomas Jordan ein Falke ist“

Der SNB-Chef wurde wegen seiner harten Anti-Inflations-Haltung gescholten, sagt Fabio Canetg, Journalist mit "Geldcast"-Sendung. Nun profitiere die Schweiz davon, weil hier die Preise mit plus 2 Prozent im Vergleich zum Euro-Raum und den USA moderat stiegen. Das wiederum ziehe Vermögen aus dem Ausland an, was den Franken stärke und die Inflation zusätzlich dämpfe.

Read More »

Read More »

Devisen: Euro legt in etwas weniger trübem Umfeld zu

Auch gegenüber dem Franken hat der Euro am Montag über die erste Tageshälft angezogen. Derzeit kostet er 1,0244, am Morgen waren es noch 1,0213 und am Freitagabend 1,0200. Der US-Dollar zeigt sich bei 0,9348 Fr. relativ stabil.

In Marktkreisen gilt es als ziemlich sicher, dass die SNB zur Stützung des Euro auf Höhe der Parität zum Franken eingegriffen hat.

Read More »

Read More »

Swiss National Bank renews its commitment to adhere to the FX Global Code

The Swiss National Bank (SNB) has renewed the Statement of Commitment to the FX Global Code based on the revised version of the Code dated July 2021. By signing this Statement, the SNB attests that its internal processes are consistent with the principles of the FX Global Code. The SNB also expects its regular counterparties to comply with the agreed rules of conduct.

Read More »

Read More »

Swiss National Bank proposes reactivation of sectoral countercyclical capital buffer at 2.5%

After consultation with the Swiss Financial Market Supervisory Authority (FINMA), the Swiss National Bank has submitted a proposal to the Federal Council requesting that the sectoral countercyclical capital buffer (CCyB) be reactivated. The buffer is to be set at 2.5% of risk-weighted exposures secured by residential property in Switzerland (cf. appendix).

Read More »

Read More »

SEBA Bank Raises CHF 110 Million in Series C Fundraise

SEBA Bank, a digital assets firm with a Swiss banking license from FINMA, announced that it has raised CHF 110 million in a significantly oversubscribed Series C funding round.

Read More »

Read More »

SNB says successfully tested use of digital currency to settle transactions with top investment banks

The latest trial could see the introduction of central bank digital currency move a step closer in Switzerland. The SNB says that they integrated the digital currencies into payment systems and used them in simulated transactions involving UBS, Credit Suisse, Goldman Sachs, and Citigroup.

Read More »

Read More »

SNB erwartet für 2021 Jahresgewinn von 26 Mrd. Franken

Die Nationalbank wird für das Geschäftsjahr 2021 nach provisorischen Berechnungen einen Gewinn in der Grössenordnung von rund 26 Mrd. Franken ausweisen. Der Gewinn ist insbesondere den Fremdwährungspositionen geschuldet. Bund und Kantone erhalten eine Ausschüttung von 6 Mrd. Franken.

Read More »

Read More »

BIS, SNB and SIX successfully test integration of wholesale CBDC settlement with commercial banks

Project Helvetia looks toward a future with more tokenised financial assets based on distributed ledger technology coexisting with today’s systems.

Read More »

Read More »

Swiss National Bank expects annual profit of around CHF 26 billion for 2021

According to provisional calculations, the Swiss National Bank will report a profit in the order of around CHF 26 billion for the 2021 financial year. The profit on foreign currency positions amounted to just under CHF 26 billion. A valuation loss of CHF 0.1 billion was recorded on gold holdings. The net result on Swiss franc positions amounted to over CHF 1 billion.

Read More »

Read More »

SNB profitiert von starker Aktienmarktperformance

Die SNB dürfte laut UBS für das Gesamtjahr 2021 einen Gewinn von fast 20 Mrd. Franken ausweisen. Dieser ist einer starken Aktienmarktperformance zu verdanken trotz belastender Zins- und Währungsveränderungen. Im letzten Quartal hingegen dürfte die Nationalbank wegen der deutlichen Aufwertung des Frankens gegenüber den meisten Währungen einen Verlust von über 20 Mrd. Franken erlitten haben.

Read More »

Read More »

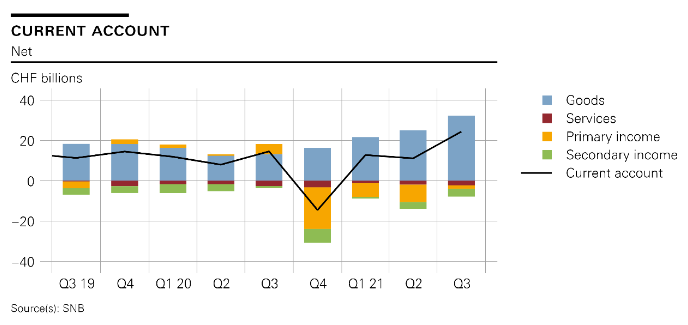

Swiss balance of payments and international investment position: Q3 2021

In the third quarter of 2021, the current account surplus amounted to CHF 24 billion, CHF 10 billion more than in the same quarter of 2020. The increase was mainly attributable to the significantly higher receipts surplus in goods trade. This surplus was due to traditional goods trade (foreign trade total 1), non-monetary gold trading, as well as to merchanting.

Read More »

Read More »

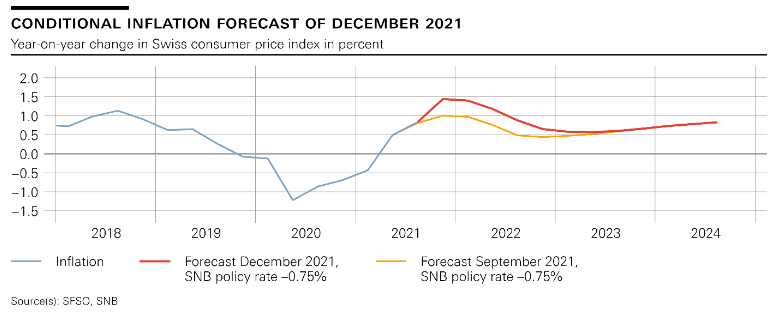

Monetary policy assessment of 16 December 2021: Swiss National Bank maintains expansionary monetary policy

The SNB is maintaining its expansionary monetary policy. It is thus ensuring price stability and supporting the Swiss economy in its recovery from the impact of the coronavirus pandemic. It is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%, and remains willing to intervene in the foreign exchange market as necessary, in order to counter upward pressure on the Swiss franc.

Read More »

Read More »

BBVA Switzerland Adds Ether to Its Crypto Trading Service

BBVA Switzerland, the Swiss franchise of Spanish multinational financial institution BBVA, has expanded its cryptocurrency custody and trading service with the addition of Ether to its investment portfolio.

Its private banking clients and new gen customers will now have access to both Bitcoin and Ether, a statement from the company said.

Read More »

Read More »

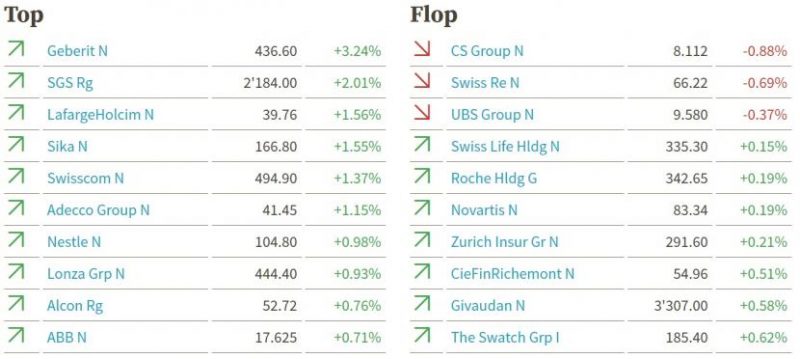

Börse – Profiteure des Tiefzinszeitalters: Die besten Aktien in der Schweiz und USA in den letzten zehn Jahren

Wer als Schweizer oder Schweizerin im Jahr 2011 im Euroraum Sommerferien machte, merkte plötzlich: Jeden Tag wird alles rasant billiger. Der Euro, der Anfang Juli noch 1,23 Franken gekostet hatte, stürzte bis zum 10. August auf 1,0070 Franken ab. Es waren dramatische Tage an den Märkten und eine Folge der sich ausweitenden Eurokrise – was die Schweizerische Nationalbank im September 2011 dazu veranlasste, die Kursuntergrenze von 1,20 Franken zum...

Read More »

Read More »

Swiss National Bank, Banque de France and BIS conclude successful cross-border wholesale CBDC experiment

Central bank digital currencies (CBDCs) can be used effectively for international settlements between financial institutions, as shown in the newest wholesale CBDC experiment concluded by the Swiss National Bank (SNB), the Banque de France (BdF) and the Bank for International Settlements (BIS).

Read More »

Read More »

“Digitales Notenbankgeld – und nun? (CBDC—What Next?),” FuW, 2021

I draw some conclusions from the CEPR eBook on CBDC, namely: Banks will change, whatever happens to CBDC. The main risk of retail CBDC is not bank disintermediation. CBDC may not be the best option even if it has net benefits. It should be for parliaments and voters, not central banks, to decide about the introduction of CBDC.

Read More »

Read More »

SNB-Vize Fritz Zurbrügg tritt Ende Juli 2022 zurück

Fritz Zurbrügg (links) tritt Ende Juli 2022 zurück. Andréa M. Maechler (rechts) dürfte ihm als Direktorin des III. ins II. Departement folgen. (Bild: PD)Fritz Zurbrügg leitete zunächst das III. Departement (Finanzmärkte, Operatives Bankgeschäft und Informatik) der Schweizerischen Nationalbank. Seit Juli 2015 führt er als Vizepräsident des Direktoriums das II. Departement (Finanzstabilität, Bargeld, Finanzen und Risiken).

Read More »

Read More »

Devisen: Euro gibt zum Dollar moderat nach – Franken etwas leichter

Der Franken neigt dagegen zum Wochenstart etwas zur Schwäche. Entsprechend legen sowohl Euro als auch Dollar zum Schweizer Franken etwas zu. So hat sich das Euro/Franken-Paar bei einem Stand von 1,0418 die 1,04er Marke zurückerobert, nachdem es am vergangenen Freitag so tief notiert hatte wie zuletzt vor sechseinhalb Jahren.

Read More »

Read More »

-638453232816314704.png)