Category Archive: 1) SNB and CHF

14R day shorting GBP and USD/CHF, oil was a setup

In this video I showcase the setups for selling into built-up longs in the NY session in cable and USD/CHF using SB strategy and an indicator template that I'm working on with rules...work in progress.

Read More »

Read More »

Rekordzahlen ZKB: Das sagt die Kantonalbank zum CS-Effekt

Die Zürcher Kantonalbank profitierte von der Krise der CS und machte im vergangenen Jahr Rekordgewinne. Das sagt die ZKB-Führung dazu.

Read More »

Read More »

The most critical questions about the Swiss central bank’s huge losses

The Swiss National Bank (SNB) booked a CHF132 billion ($143 billion) loss in 2022 and suspended profit-sharing transfers to the Confederation and cantons. What does that mean exactly? And how does the SNB fare in international comparison?

Fabio Canetg

More from this author

Last year, the SNB lost more money than ever before. And it is not alone: central banks around the world also recorded heavy losses. As a...

Read More »

Read More »

Die Schweizerische Nationalbank wird zur Devisenverkäuferin

Während die Schweizerische Nationalbank zur Schwächung des Frankens lange Zeit Fremdwährungen gekauft hatte, ist seit einigen Monaten das Gegenteil der Fall. Die Hintergründe.

Read More »

Read More »

Why can’t the Swiss National Bank go bankrupt?

The Swiss National Bank (SNB) will make a loss of CHF132 billion in 2022, and distribution of profits to the confederation and the cantons will be suspended. What does this mean for the stability of the SNB and what would happen if it faces another large loss?

Read More »

Read More »

Swiss-Life-Ökonomen erwarten nur noch wenige Zinsschritte

Das meinen die Ökonomen des Versicherungskonzerns Swiss Life und sagen deshalb für die USA, die Eurozone und die Schweiz nur noch leichte Zinserhöhungen voraus. Konkret erwartet Swiss-Life-Asset-Managers-Chefökonom Marc Brütsch von der Schweizerischen Nationalbank (SNB) im Frühling nur noch eine Erhöhung des Leitzinses um 0,25 Prozentpunkte auf 1,25 Prozent. Danach sei Schluss.

Read More »

Read More »

Swiss central bank posts record CHF132 billion loss for 2022

The Swiss National Bank (SNB) has posted an annual loss of CHF132 billion ($143 billion) for 2022, the biggest in its 115-year history. “The loss on foreign currency positions amounted to around CHF131 billion and the loss on Swiss franc positions was around CHF1 billion. A valuation gain of CHF400 million was recorded on gold holdings,” the SNB said in a statement on Monday.

Read More »

Read More »

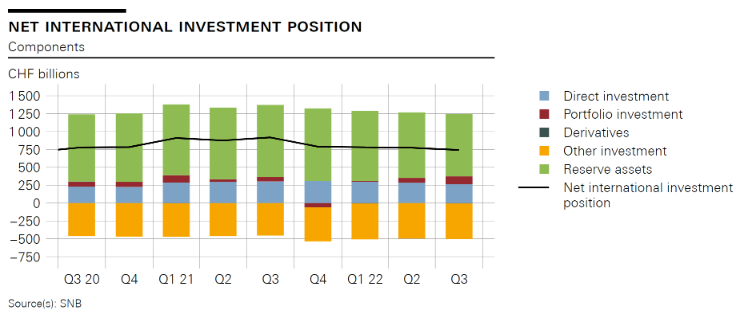

Swiss balance of payments and international investment position: Q3 2022

In the third quarter of 2022, the current account surplus amounted to CHF 24 billion – a very high figure from a long-term perspective. This was attributable to the high surplus in goods trade and the relatively low deficits in services trade and in primary income. Compared to the same quarter of 2021, however, the increase in the current account balance (CHF 2 billion) was moderate because the basis for comparison was also high.

Read More »

Read More »

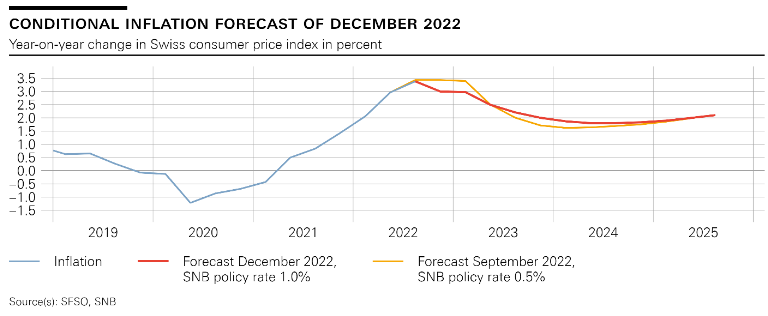

Quarterly Bulletin Q4/2022

Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of December 2022. The report describes economic and monetary developments in Switzerland and explains the inflation forecast. It shows how the SNB views the economic situation and the implications for monetary policy it draws from this assessment.

Read More »

Read More »

Thomas Jordan: Introductory remarks, news conference

Ladies and gentlemen

It is my pleasure to welcome you to the news conference of the Swiss National Bank. I would also like to welcome all those who are joining us today online. After our introductory remarks, the members of the Governing Board will take questions from journalists as usual.

Read More »

Read More »

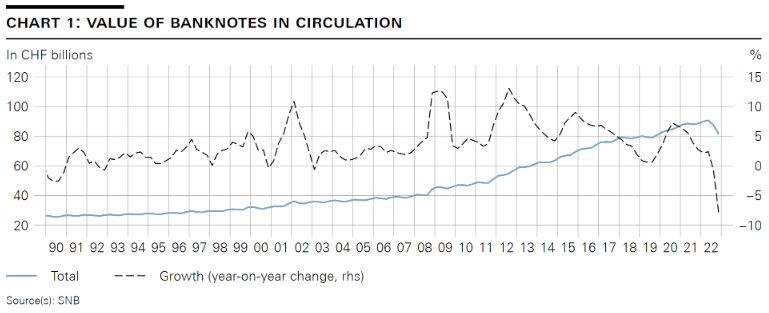

Martin Schlegel: Introductory remarks, news conference

I am pleased to give you an assessment of current developments with regard to cash. Since June, after many years of strong growth, we have seen a significant decline in banknote circulation. To contextualise this decline of approximately 10%, let me first say a few words about the above-average growth in recent years.

Read More »

Read More »

Andréa M. Maechler: Introductory remarks, news conference

In my remarks, I will talk in more detail about the implementation of today’s monetary policy decision, which Thomas Jordan has already touched on. I will start, however, by giving you an overview of how we have steered interest rates since the switch to a positive SNB policy rate in September.

Read More »

Read More »

Börsen-Ticker: Wall Street nach Fed-Zinsentscheid erneut im Minus – Schweizer Börse legt dank Indexriesen Nestlé und Novartis zu

Der SMI fällt 0,40 Prozent auf 11'091,93 Punkte. Vor der am Abend erwarteten Zinsentscheidung der US-Notenbank haben die Anleger einen Gang zurückgeschaltet. Die Freude von Vortag, als die Nachricht über den nachlassenden Inflationsdruck in den USA die Märkte angetrieben hatte, sei wieder der Vorsicht gewichen, heisst es in Börsenkreisen.

Read More »

Read More »

Week Ahead: Highlights include Fed, US CPI; ECB, BoE, SNB, Norges Bank

MON: UK GDP Estimate (Oct), Chinese M2/New Yuan Loans (Nov).TUE: OPEC MOMR; BoE Financial Stability Report; German CPI Final (Nov), UK

Unemployment Rate (Oct)/Claimant Count (Nov), EZ ZEW (Dec), US CPI (Nov),

Japanese Tankan (Q4), New Zealand Current Account (Q3).WED: FOMC Policy Announcement, IEA OMR; UK CPI (Nov), Swedish CPIF (Nov), EZ

Industrial Production (Oct), US Export/Import Prices (Nov), Japanese

Exports/Imports (Nov).THU: ECB, BoE,...

Read More »

Read More »

Issuance calendar for Confederation bonds and money market debt register claims in 2023

The Swiss National Bank (SNB) and the Federal Finance Administration (FFA) advise as follows: The FFA plans to issue bonds with a face value of CHF 8 billion in 2023. Taking account of bonds maturing in 2023, the volume of bonds outstanding will increase by CHF 3.4 billion.

Read More »

Read More »

SNB-Vize Schlegel signalisiert neuen Zinsschritt im Dezember

SNB-Vize Martin Schlegel hat angedeutet, dass die Schweizerische Nationalbank die Leitzinsen im Dezember erneut anheben wird. Er betonte die Notwendigkeit, das starke Wachstum der Konsumentenpreise zu bekämpfen.

Read More »

Read More »

Andréa M. Maechler / Thomas Moser: Return to positive interest rates: Why reserve tiering?

It is with great pleasure that my colleague Thomas Moser and I welcome you to this year’s Swiss National Bank (SNB) Money Market Event in Geneva. We are very glad that so many of you have joined us this evening, be it on site or remotely.

Read More »

Read More »

SNB-Maechler: Rückkehr zu positiven Zinsen bedingt neuen Ansatz für Geldpolitik

Die erste Leizins-Erhöhung seit 15 Jahren im Juni bezeichnet SNB-Direktoriumsmitglied Andréa Maechler als historischen Moment.

Read More »

Read More »

Barclays forecasts EURCHF trading around parity for the next few quarters

Barclays Research discusses CHF outlook and targets EUR/CHF around 0.97, 0.97, 0.98, and 1.00 by end of Q1, Q2, Q3, and Q4 of next year respectively.

Read More »

Read More »