Monetary policy report

Monetary policy report

Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of December 2022

The report describes economic and monetary developments in Switzerland and explains the inflation forecast. It shows how the SNB views the economic situation and the implications for monetary policy it draws from this assessment. The first section (‘Monetary policy decision of 15 December 2022’) is an excerpt from the press release published following the assessment.

This report is based on the data and information available as at 15 December 2022. Unless otherwise stated, all rates of change from the previous period are based on seasonally adjusted data and are annualised.

Key points

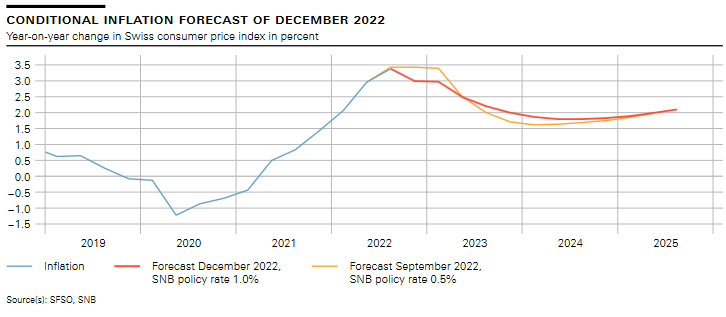

- On 15 December 2022, the SNB decided to further tighten its monetary policy. It raised the SNB policy rate by 0.5 percentage points to 1.0% to counter increased inflationary pressure and a further spread of inflation. The conditional inflation forecast was above that of September over the medium term, and would have been even higher without the rise in the SNB policy rate.

- Global growth momentum has continued to slow down. At the same time, inflation in many countries is markedly above central banks’ targets. Accordingly, numerous central banks have further tightened their monetary policy. In its baseline scenario for the global economy, the SNB expects weak economic growth in the coming quarters. Inflation will remain elevated for the time being.

- Economic momentum in Switzerland remains modest. The SNB expects GDP growth of around 2% for 2022 and around 0.5% for 2023. The level of uncertainty associated with the forecast is still high.

- Annual CPI inflation was still significantly above the range consistent with price stability, but showed a decline quarter- on-quarter and stood at 3.0% in November. The short-term inflation expectations derived from surveys stabilised at a high level. The longer-term inflation expectations remained within the range consistent with price stability.

- The Swiss franc depreciated against the euro, but appreciated against the US dollar. Bond yields fluctuated significantly, while equities posted marked gains in value. Real estate prices continued to rise. Growth in the monetary aggregates was again slow. Lending growth remained robust.

| Swiss National Bank tightens monetary policy further and raises SNB policy rate to 1.0%

The SNB is tightening its monetary policy further and is raising the SNB policy rate by 0.5 percentage points to 1.0%. In doing so, it is countering increased inflationary pressure and a further spread of inflation. It cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term. To provide appropriate monetary conditions, the SNB is also willing to be active in the foreign exchange market as necessary. The SNB policy rate change applies from 16 December 2022. Banks’ sight deposits held at the SNB will be remunerated at the SNB policy rate of 1.0% up to a certain threshold. Sight deposits above this threshold will be remunerated at an interest rate of 0.5%, and thus still at a discount of 0.5 percentage points relative to the SNB policy rate. With this tiered remuneration of sight deposits and open market operations, the SNB is ensuring that the secured short-term Swiss franc money market rates are close to the SNB policy rate. Inflation has declined somewhat in recent months, and stood at 3.0% in November. However, it is still clearly above the range the SNB equates with price stability. Inflation is likely to remain elevated for the time being. The SNB’s new conditional inflation forecast is based on the assumption that the SNB policy rate is 1.0% over the entire forecast horizon (cf. chart 1.1). Up to the beginning of 2023, the forecast is below that of September owing to the somewhat lower oil price. From mid-2023 onwards, the new forecast is higher and stands at 2.1% at the end of the forecast horizon. That the new forecast is higher over the medium term despite the raising of the SNB policy rate is attributable to stronger inflationary pressure from abroad and the fact that price increases are spreading across the various categories of goods and services in the consumer price index. The new forecast puts average annual inflation at 2.9% for 2022, 2.4% for 2023 and 1.8% for 2024 (cf. table 1.1). Without the SNB policy rate increase, the inflation forecast would be even higher over the medium term. Global growth momentum has continued to slow down. At the same time, inflation in many countries is markedly above central banks’ targets. Accordingly, numerous central banks have further tightened their monetary policy. In its baseline scenario for the global economy, the SNB expects this challenging situation to persist for now. Global economic growth is likely to be weak in the coming quarters, and inflation will remain elevated for the time being. Over the medium term, however, inflation abroad should return to more moderate levels, not least due to the increasingly tighter monetary policy in many countries. This scenario for the global economy is subject to significant risks. The energy situation in Europe could worsen again. At the same time, high inflation could become embedded and require renewed stronger monetary policy responses abroad. Finally, the coronavirus pandemic remains an important source of risk for the global economy. |

Full story here Are you the author? Previous post See more for Next post

Tags: Featured,newsletter